Hello my dears,

This morning I received a question from dear @THE-ROCK-SAAR

It was about "Buy the Dip" at Constellation Software.

Since I didn't want to write him any nonsense, I got straight to work.

And took a new look at the compounder.

Although I'm invested myself, I haven't done a proper analysis for some time.

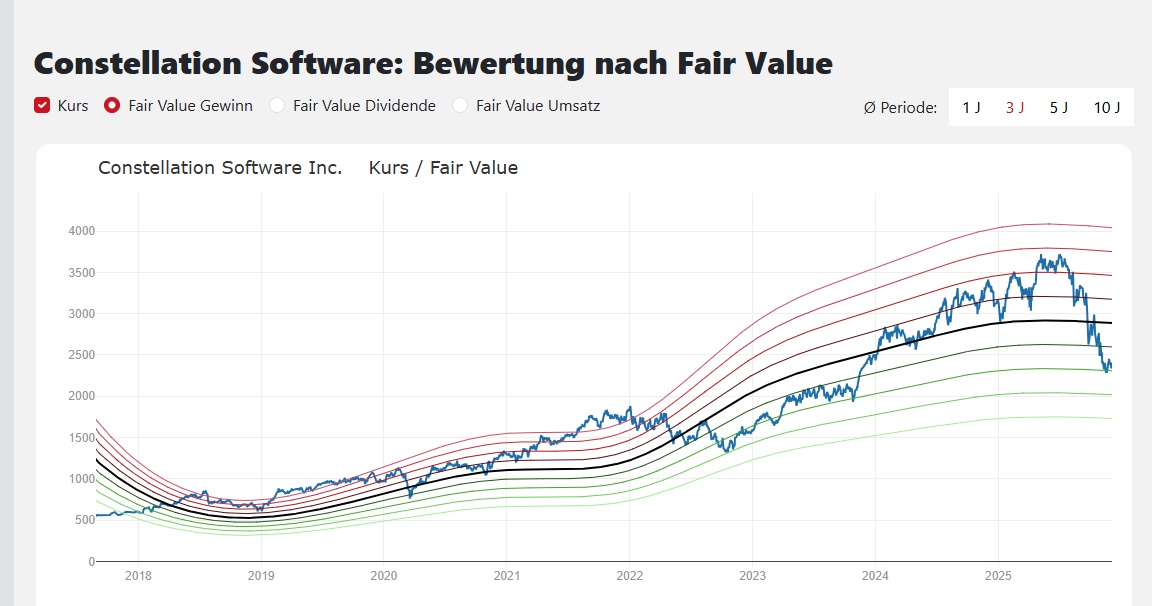

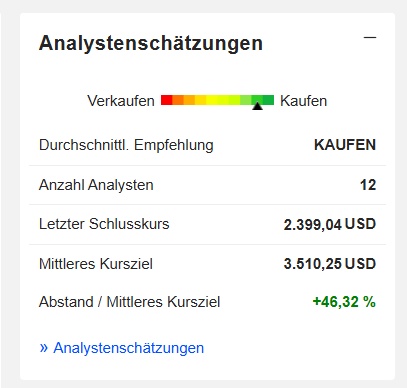

Because analysts lowered their price targets due to AI concerns and the founder Mark Leonard had to step down for health reasons. The share now only knows the downward direction.

This is an absolute novelty for the share. Because the compounder has only known the upward direction in recent years.

Despite the fact that the last quarterly figures published by Constellation Software (Q3 2025, as at September 30) showed solid results, with further sales growth and a dividend payment. Previously in Q2 2025, the company also reported rising sales and declared a dividend of USD 1.00 per share.

My dears,

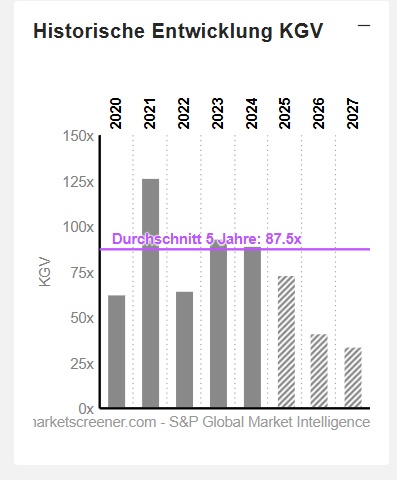

It is always said that the stock market is already pricing in the future. But when I wrote out the key figures, I asked myself.

" is there still so much uncertainty on the part of investors "

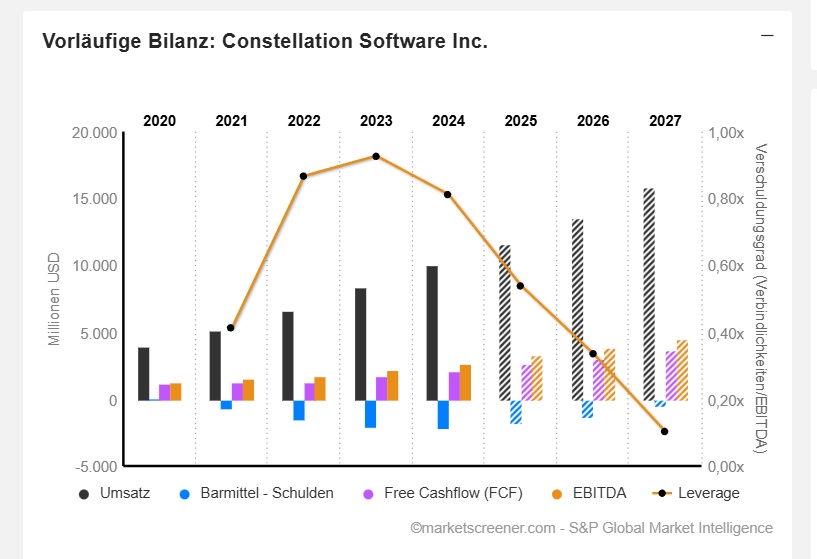

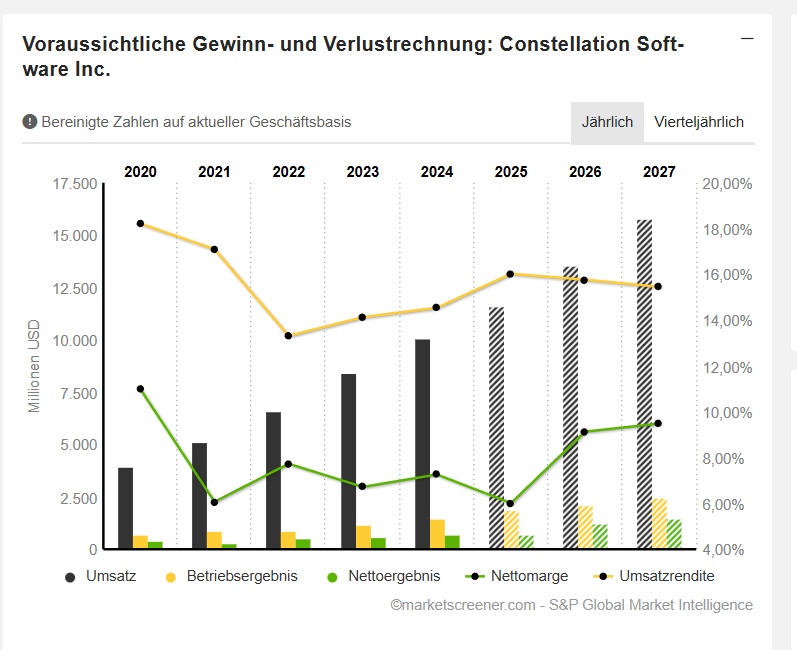

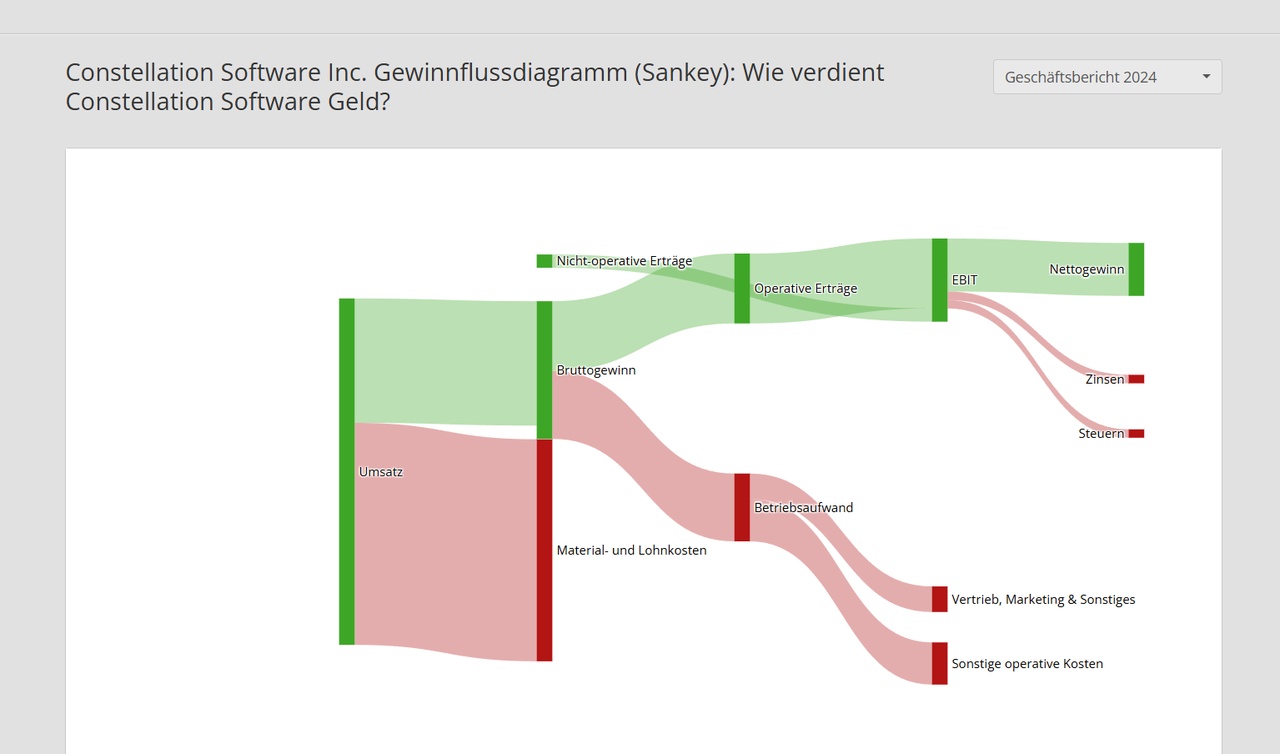

because the 77% increase in net profit, with a nice even increase in sales and free cash flow. With an exemplary reduction in debt, despite an increase in CAPEX, no investor can overlook this.

The company continues to expand into the right acquisitions.

Ladies and gentlemen, let's discuss.

Are we retail investors seeing something here earlier than the investors?

In terms of chart technology, I would perhaps wait for a bottom to form first.

(Perhaps our dear friend @TomTurboInvest can give a brief assessment)

But fundamentally I think Constellation Software is still well positioned.

I would be happy to hear your assessment in the comments.

Constellation Software Inc. is a provider of software and services to a select group of markets in the public and private sectors. The company acquires, manages and builds vertical market software companies (VMS) that provide specialized, mission-critical software solutions to meet the specific needs of its customers. The company's principal activity is the development, installation and customization of software and the provision of related professional services and support to customers around the world. The company sells software licenses for on-site use on both a perpetual and fixed-term basis. The company has six business units serving customers in over 100 different markets around the world. The six operating groups include Volaris, Harris, Topicus, Vela, Jonas and the Perseus Group. The company has offices in North America, Europe, Australia, South America and Africa.

Number of employees: 45,000

Performance

15 years

+7.577,33 %

10 years

+525,55 %

5 years

+129,50 %

1 year

-29,36 %

Current year

-25,18 %

What was the performance of the Constellation Software share?

Current year-23,26 %

2024

+26,24 %

2023

+57,02 %

2022

-14,94 %

2021

+43,20 %

2020

+33,52 %

2019

+50,02 %

2018

+7,20 %

2017

+32,27 %

2016

+9,76 %

2015

+40,05 %

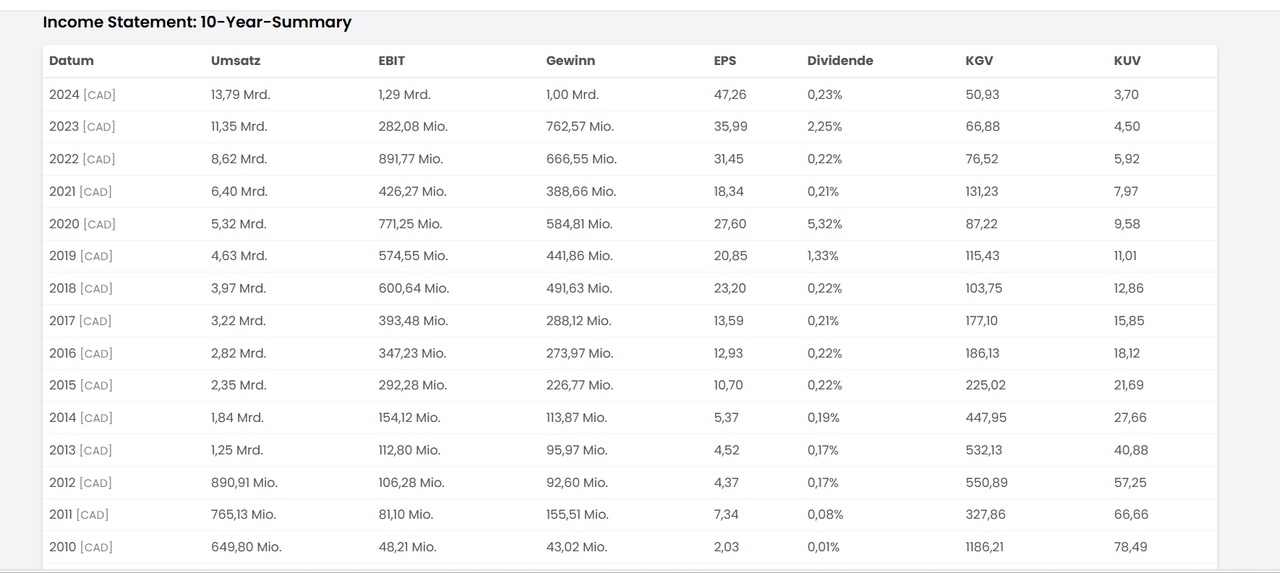

1USD in millions

Estimates

year

Turnover

Change in

2025 11.601 15,25 %

2026 13.536 16,68 %

2027 15.821 16,88 %

Year

Ebit

Change in

2025 1.859 27 %

2026 2.134 14,79 %

2027 2.446 14,58 %

Year

Net result

Change in

2025 697,6 -4,58 %

2026 1.236 77,23 %

2027 1.501 21,4 %

Year

Net debt

CAPEX

2025 1.778 64,33

2026 1.311 81,25

2027 467 92,75

Year

Free cash flow

Change in

2025 2.624 23,23 %

2026 3.061 16,68 %

2027 3.657 19,47 %

Year

EBITDA margin (%)

Net profit (%)

2025 28,35 % 6,01 %

2026 28,73 % 9,13 %

2027 28,63 % 9,49 %

Year

ROE

Earnings per share

2025 19,38 % 32,74

2026 25,28 % 58,13

2027 22,28 % 70,62

Year

P/E RATIO

PEG

2025 73.3x -14.5x

2026 41.3x 0.5x

2027 34x 1.6x

Lumine Group to acquire Synchronoss Technologies

December 04, 2025 10:26 ET | Source: Constellation Software Inc.

(The Lumine Group is part of Constellation Software Inc. )

Lumine Group wird Synchronoss Technologies übernehmen

Constellation Software's Harris Operating Group enters into agreement to acquire TECVIA Holding GmbH

November 17, 2025 17:06 ET | Source: Constellation Software Inc.

(The Harris Operating Group belongs - just like the Lumine Group - to Constellation Software )