German machine builder for semiconductor equipment - key player in SiC/GaN and optoelectronics. Aixtron ($AIXA (+6,48 %) ) supplies the equipment on which the next generation of energy-efficient chips is manufactured - indispensable for AI data centers, electromobility and datacom.

⚙️ What does Aixtron do?

➡️ Specialist for MOCVD and CVD systems for the production of III-V semiconductors (e.g. GaN, SiC).

➡️ Core markets: Power electronics (SiC/GaN), optoelectronics (laser, datacom) and special applications (LEDs, micro-optics).

➡️ Sales basis: 78% equipment, 22% after sales - clear focus on AI & e-mobility growth markets.

➡️ Regions: 60% Asia, 17% Europe, 23% Americas.

➡️ Location: Herzogenrath (NRW), globally active with a focus on Asia, Europe & USA.

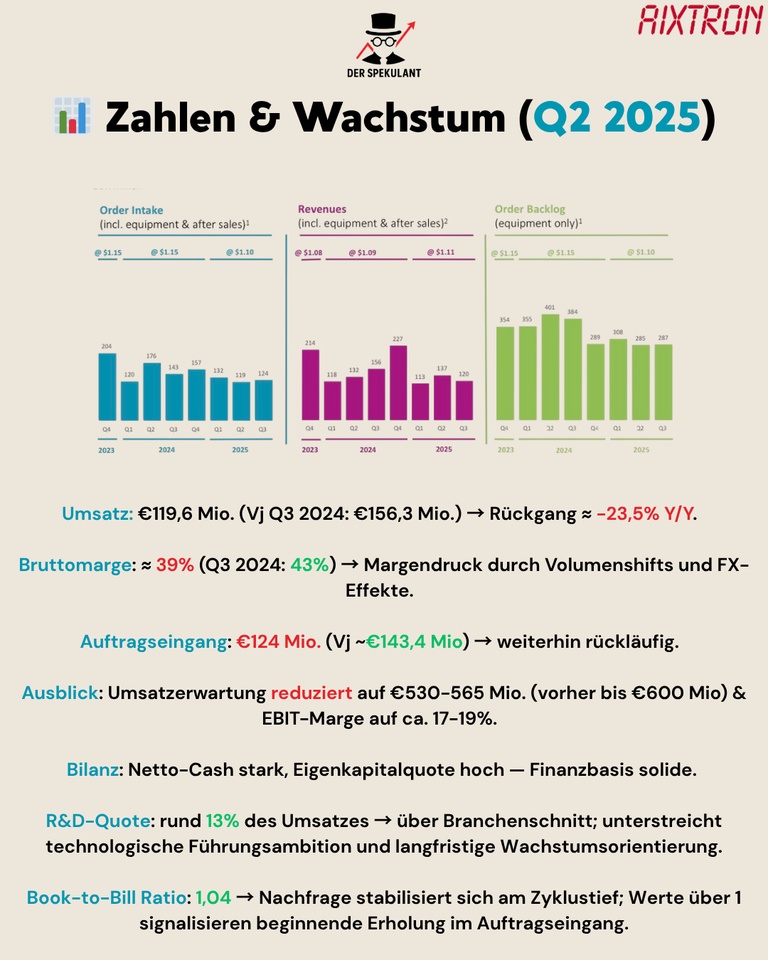

📊 Figures & growth (Q3 2025)

📉 Turnover: € 119.6 million (previous year € 156.3 million) → Decline ≈ -23.5 % Y/Y.

📉 Gross margin: ≈ 39% (Q3 2024: 43%) → Margin pressure due to volume shifts & FX effects.

📉 Incoming orders: € 124 million (previous year € 143.4 million) → further decline.

📊 Outlook for 2025: Sales € 530-565 million (previously up to € 600 million), EBIT margin 17-19%.

💰 Balance sheet: Net cash strong, equity ratio high - solid financial base.

🧩 R&D ratio: ~13% - above industry average, underlines technological leadership ambition.

📈 Book-to-bill ratio: 1.04 - shows start of recovery in incoming orders.

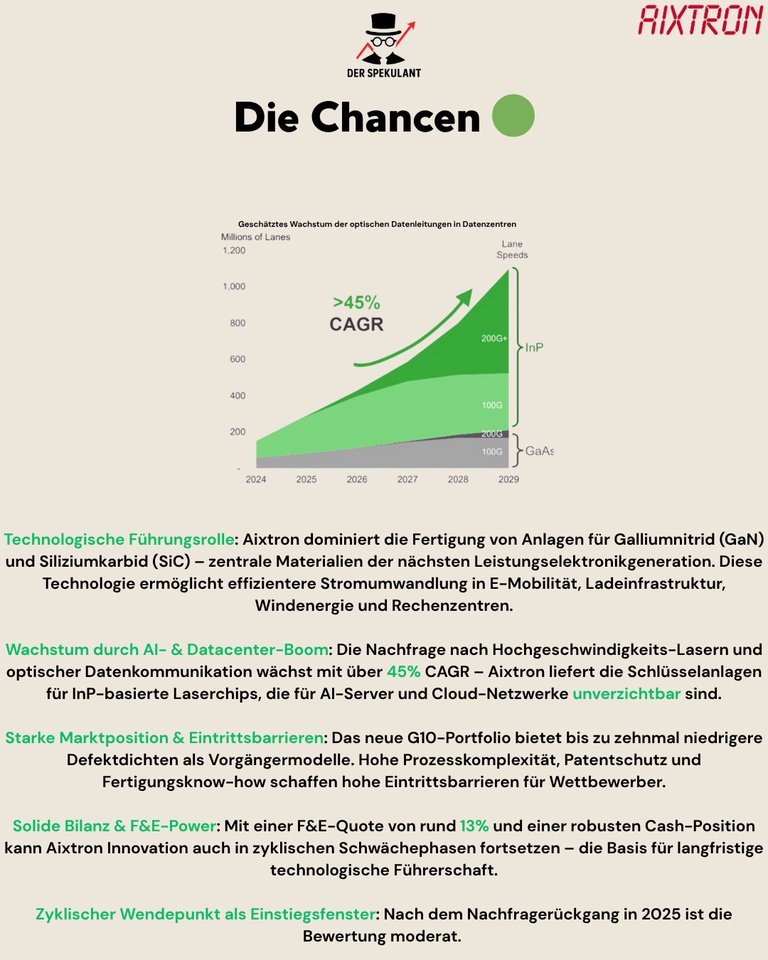

🟢 The opportunities

🧠 Technological leadership: Aixtron dominates the production of systems for GaN and SiC - key materials for the next generation of power electronics. This technology enables more efficient power conversion in e-mobility, charging infrastructure, wind energy and data centers.

🌐 Growth through AI & data center boom: Demand for high-speed lasers and optical data communication is growing at > 45% CAGR. Aixtron supplies the key equipment for InP-based laser chips, which are essential for AI servers and cloud networks.

🧱 Strong market position & barriers to entry: The new G10 portfolio offers up to ten times lower defect densities than previous models. High process complexity, patent protection and manufacturing expertise create high barriers for competitors such as Veeco or AMEC.

💸 Solid balance sheet & R&D power: With a 13% R&D share and robust cash position, Aixtron can continue to invest even in periods of weakness - the basis for long-term technological leadership.

📈 Cyclical turning point as an entry window: After the decline in demand in 2025, the valuation is moderate. Rising investments in SiC/GaN from 2026 could usher in the next cycle.

🔴 The risks

⚠️ Cyclicality & timing: Aixtron operates in a highly cyclical market environment. Demand for SiC and GaN equipment is currently declining as customers postpone their investments. A delayed upturn in power electronics could further dampen sales in 2025.

⚠️ High expectations: The market is already pricing in a turnaround for 2026. If this fails to materialize, there is a risk of valuation markdowns. Investors are currently expecting a rapid rebound - any delay will be disproportionately penalized.

⚠️ Currency and volume effectsPostponement of major orders to the fourth quarter and unfavorable exchange rates (especially USD/EUR) are putting pressure on margins and earnings. Short-term forecast deviations are therefore more likely than upside surprises.

⚠️ Technological competitionThe semiconductor equipment market is driven by innovation. Competitors such as Veeco and AMEC are investing heavily in GaN and SiC technologies. AIXTRON must consistently defend its technological leadership position - any lag in innovation could cost market share.

💡 Conclusion & outlook

Aixtron remains a strategically important player in energy efficiency and optoelectronics.

In the short term, the cycle is a burden, but in the long term the technology leadership offers a clear investment story.

🎯 Long-term goal:

Growth phase after 2026 with accelerated SiC/GaN investments.

💬 Community question:

Do you think Aixtron is a "turnaround entry" or the risky cyclical with high uncertainty?