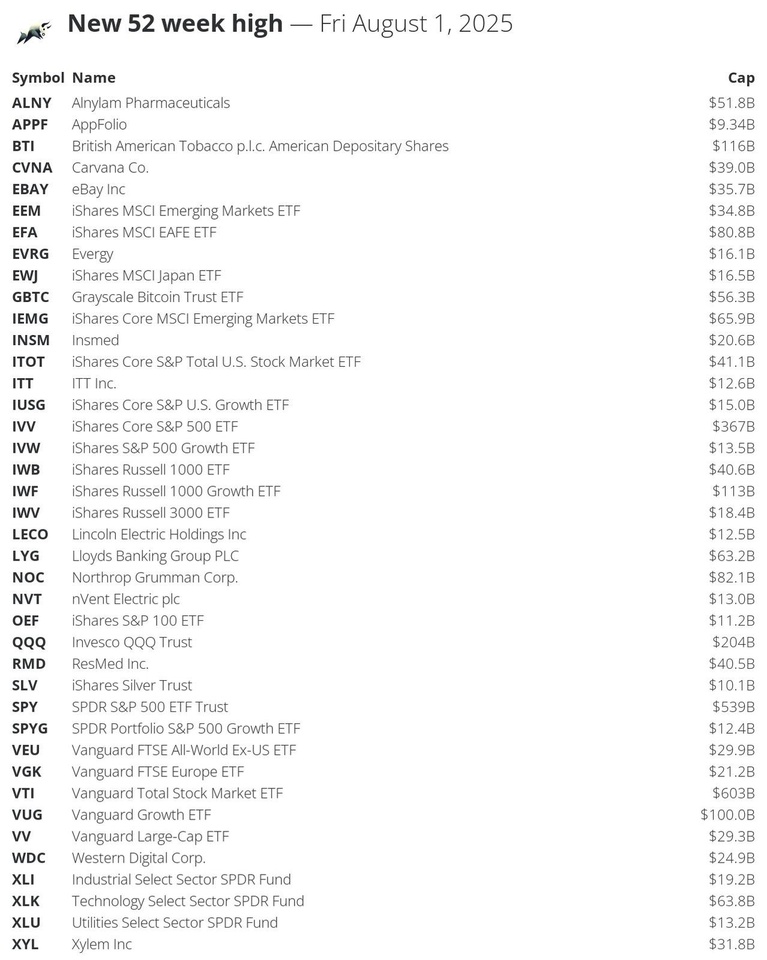

🔝 Stocks that made a new 52-week high today: $VTI (+0,68 %)

$SPY (+0,67 %)

$IVV (+0,69 %)

$QQQ

$BTI (+0 %)

$IWF (+0,77 %)

$VUG (+0,85 %)

$NOC (-0,1 %)

$EFA

$IEMG (+0,52 %)

$XLK

$LYG

$GBTC

$ALNY (-0,18 %)

$ITOT (+0,71 %)

$IWB (+0,65 %)

$RMD (-2,32 %)

$CVNA (+3,03 %)

$EBAY (+1,83 %)

$EEM

$XYL (+0,1 %)

$VEU (+0,29 %)

$VV (+0,7 %)

$WDC (+3,12 %)

$VGK (+0 %)

$INSM (-0,36 %)

$XLI

$IWV (+0,68 %)

$EWJ (+0,25 %)

$EVRG (+0,94 %)

$IUSG

$IVW

$XLU

$NVT

$ITT (+0,33 %)

$LECO (+0 %)

$SPYG

$OEF (+0,83 %)

$SLV

$APPF (+1,26 %)

#52weekHigh

Vanguard Growth Index Fund;ETF

Price

Debate sobre VUG

Puestos

5Market News

Tested and simply put the cheaper broker

I briefly looked into the setup and trading, and you can say: It's just another broker with advantages and disadvantages. One advantage is the 24/5 trading and at 3 a.m. many shares can be traded with a spread of just 2 cents.

That's not even the prime-time ask/bid spread in Germany, at least for stocks like Amazon, Robinhood and co. So they are modern and cheap.

Potential disadvantages: The shares are stored and cleared in the USA and are therefore not bound by European rules. In addition, tokenized shares are not tax-simple, like almost everything in crypto. However, this can also be an advantage for some people. With tax apps, you pay your taxes a little later and at the same time the tax situation there is still pretty gray. On the one hand, tokenized shares should be treated like shares, but at the same time they are crypto-derivatives and therefore also valid for the one-year tax-free sale. For some people, there are also US ETFs to trade there, such as $SCHD or $VUG (+0,85 %) . Maybe for people like @GoDividend what or @ScorpionfromBW .

Robin hood

Today was $HOOD (+4,02 %) EU event and it's cool what they are launching. They don't seem to want to go away from brokers but want to go straight for crypto. Pretty bullish in the long term, but it remains to be seen how customers will react. Hopefully the neobrokers in the EU won't lose too many customers.

I am brutally curious to see how blockchain and shares will develop in the future. Perhaps we will see the first official IPO via blockchain in the next few years. I signed up for the rewards and to check out how it works.

Insider Trading!!!

Today ain't my day. I discuss my background as well as add another diary entry to my YouTube channel.

I am trying to grow this portfolio WITHOUT selling, and I do not know how realistic this goal is. All in all, I know that the recent increases in the prices for $VOO (+0,68 %) , $SCHD , $SCHY , $SCHG , $VYMI , $VUG (+0,85 %) , $DGRO , $QQQ , and $TQQQ have increased a good amount.

However, out benevolent tech dictatorial oligarchs have really not released any positive news. Therefore, I am quite hesitant to invest in big tech at the moment. Maybe in the near future, big tech will be selling at more palatable prices.

I am trying to manage my money as best as I can. I see the underlying shifts etc but who knows exactly how much the US can lose while the rest of the planet gains???

Follow me for unbiased and straight to the blood commentary as well as information. I am a type of devil, but at least I am predictable...

Dear fellow investors,

This month I will reach another milestone in my investment journey, breaking 800$ in monthly dividend payments for the very first time. I couldn't be more excited....

Wooohooo 💲💲💲

This is due to receiving payouts for the following assets:

641 x $SCHD

281 x $O (-0,39 %)

311 x $JEPI

211 x $JEPQ

179 x $SPLG

89 x $MAIN (-0,58 %) (two payouts this month!)

137 x $EFC (-1,46 %)

67 x $EPR (-0,96 %)

67 x $SPYI

13 x $QQQI

Looking ahead, it seems like September might be my first 1k$ dividend month 🤪🤪🤪.

Fingers crossed 🤞🤞🤞

For those among you who follow my story, know that I just started (again) in Dec 2023 and already had to upgrade my goals to 150k$ invested and average dividends of >500$/month. Both goals are within reach and very likely to be achieved before 2024 comes to an end.

I am very happy with sticking to the plan (DCA-ing into a selected few ETFs and stocks) in hopes for #fire (Financial Independence Retire Early).🔥🔥🔥

I am planning on making some adjustments to the portfolio over the next couple of weeks and months and hopefully later this summer I will share my whole portfolio with more information about my investment strategy as well as the (as of recent) popular Sankey diagram of monthly money flow here on getquin for scrutiny and further constructive feedback. So stay tunes for that.

The list of updated key take-aways are as follows:

1. Select your ETFs and stick with them

- Core:

$SPLG (alternatives are $SPY (+0,67 %) and $VOO (+0,68 %) ), chosen because of slightly lower expense ratio and lower prices (hope for more inflow), trading volume is not a concern as this was bought for the looooong "buy and hold"

- Dividend 💸:

$SCHD (alternatives are $VIG (+0,46 %) and $VYM (+0,4 %) ), chosen because seemed undervalued at the time of purchase, great dividend and decent dividend growth

- Growth 📈:

Still not chosen, open to suggestions

I maintain that it will probably be $QQQM (alternatives are $VGT (+1,34 %) , $SCHG , $SPGP , $DGRW , $VUG (+0,85 %) )

- REITs 🏠:

Not yet chosen, as here I am not even sure any longer if I actually want to invest in REIT ETFs or not just keep my exposure to the few REITS I already own ($O (-0,39 %) , $VICI (+0 %) , $MAIN (-0,58 %) , $EPR (-0,96 %) , $EPRT (-2,33 %) ...)

If I decide to venture into this field, it will probably be $SCHH (alternatives are $XLRE and $VNQ (+0,16 %) )

- Misc 🗠:

$O (-0,39 %) The Monthly Dividend Stock

$JEPI / $JEPQ for monthly dividends in the covered call space

$SPYI / $QQQI to potentially replace $JEPI and $JEPQ

$VICI (+0 %) / $MAIN (-0,58 %) for additional monthly dividends in the REIT / finance space

I might also entertain the idea of investing in some individual stocks like $AMZN (+1,56 %) . $NVDA (+2,31 %) , $MSFT (+0,63 %) , but that will depend on the constitution of the growth ETF I will buy.

2. Learn 🎓

Educate yourself and don't simply "trust" Youtubers. Read investment books (e.g. 'The Intelligent Investor' by Ben Graham, 'The Little Book Of Common Sense Investing' by John C. Bogle, 'Patient Capital' by Victoria Ivashina and Josh Lerner) and listen to many different voices in the investment arena. Be curious, but cautious... If it says: "100% win rate guaranteed!", it's probably best to stay away from it.

3. Don't try to time the market ⌚️

As one youtuber says: "Time in the market beats timing the market." I am sure we are all guilty of trying to buy at the best price on a particular day/week... If you are in for the long haul, it doesn't matter. DCA (Dollar Cost Averaging) for the win. 🏆

4. ETF over stock picking

Of course you can have huge winners if you pick individual stocks and if you have some insights that allow you to buy before the hype, great, I am very happy for you. Who wouldn't want to have invested in $KO (-0,37 %) , $TSLA (-3,07 %) , $AMZN (+1,56 %) , $GOOG (+1,83 %) or $NVDA (+2,31 %) in their early days?! But that doesn't happen very often. If you invest in solid ETFs covering a wide array of markets, you will do just fine (especially with a long investment horizon). I have certainly tried to "pick' some stocks that looked promising for their upward potential, but only two have given me solid returns ($NEP and $CFLT (-0,51 %) ), whereas so far there are many losers (e.g. $IONQ (+1,39 %) , $OTLK , $SACH , $EPR (-0,96 %) ).

That being said, I am not against holding individual stocks and I am sure that the likes of $NVDA (+2,31 %) , $MSFT (+0,63 %) , and $AMZN (+1,56 %) will continue to deliver amazing returns, but these are also top of the list in weighted S&P500 or Nasdaq ETFs... ($SPLG , $VOO (+0,68 %) or $QQQM , $SPGP etc.). Just saying!😉

5. Tailored investing

We are all different and our your time horizon, risk appetite, age, income and other factors most likely vary massively. My life, 47yo, being single without kids, being in a somewhat safe and well-paid job, having paid off properties that generate a decent income stream, wanting to retire in 3-5 years and not needing much is very different to someone who just starts their investment career and/or have a family or are already retired or or or.

Make a plan of what you want the investment to do for you and work towards it. In my case, I want to achieve #fire (Financial Independence Retire Early) as soon as possible, being able to live off dividends entirely. I recon I will need about 50k/ year (lots of safety built in). So building a strong dividend portfolio is my main goal. Sprinkle in some growth opportunities and we have a party. 🥳

Let me know what your goals are and how you plan to achieve those. Also if you have some input on which other ETFs and/or stocks to pick, I am all ears 👂👂.

In the best case scenario I never need the extra money (apart from a home) and I have just more money when I get old.

After calculating what payout I could get, if I kept investing till retirement age and what payout rate I could achieve, I it’s a nobrainer.

Even though I know that I need to up my spending on some point (family etc) and have a lower monthly amount to invest, it’s even more motivation for me to have a kickoff start.

I reached 100k$ invested on 2024-03-15 which was one of the milestones for 2024 (the new one is now 150k$).

Also March was very good to me with dividend payouts exceeding 600$ for the month, which made me revise my initial goal of 400$/month (avg.) by the end of 2024 up to >500$/month. 💲💲💲

Since this account is very new (Dec. 2023), I am very happy with sticking to the plan (so far) in hopes for #fire (Financial Independence Retire Early).🔥🔥🔥

Key take-aways so far are as follows:

1. Select your ETFs and stick with them

- Core:

$SPLG (alternatives are $SPY (+0,67 %) and $VOO (+0,68 %) ), chosen because of slightly lower expense ratio and lower prices (hope for more inflow), trading volume is not a concern as this was bought for looooong

- Dividend 💸:

$SCHD (alternatives are $VIG (+0,46 %) and $VYM (+0,4 %) ), chosen because seemed undervalued at the time of purchase, great dividend

- Growth 📈:

Not yet chosen, open to suggestions

Will probably be $QQQM (alternatives are $VGT (+1,34 %) , $SCHG , $SPGP , $DGRW , $VUG (+0,85 %) )

- REITs 🏠:

Not yet chosen, open to suggestions

Will probably be $SCHH (alternatives are $XLRE and $VNQ (+0,16 %) )

- Misc 🗠:

$O (-0,39 %) The Monthly Dividend Stock

$JEPI / $JEPQ for monthly dividends in the covered call space

$VICI (+0 %) / $MAIN (-0,58 %) for additional monthly dividends in the REIT space

2. Learn 🎓

Educate yourself and don't simply "trust" Youtubers. Read investment books, listen to many different voices in the investment arena. Be curious, but cautious... If it says: "100% win rate guaranteed!", it's probably best to stay away from it.

3. Don't try to time the market

As one youtuber says: "Time in the market beats timing the market." I am sure we are all guilty of trying to buy at the best price on a particular day/week... If you are in for the long haul, it doesn't matter.

4. ETF over stock picking

Of course you can have huge winners if you pick individual stocks and if you have some insights that allow you to buy before the hype, great, I am very happy for you. But that doesn't happen very often. If you invest in solid ETFs covering a wide array of markets, you will do just fine.

5. Tailored investing

We are all different and our your time horizon, risk appetite, age, income and other factors most likely vary massively. My life, 47yo, being single without kids, being in a somewhat safe and well-paid job, having paid off properties that generate a decent income stream, wanting to retire in 3-5 years and not needing much is very different to someone who just starts their investment career and/or have a family or are already retired or or or.

Make a plan of what you want the investment to do for you and work towards it. In my case, I want to achieve #fire (Financial Independence Retire Early) as soon as possible, being able to live off dividends entirely. I recon I will need about 50k/ year (lots of safety built in). So building a strong dividend portfolio is my main goal. Sprinkle in some growth opportunities and we have a party. 🥳

Let me know what your goals are and how you plan to achieve those. Also if you have some input on which other ETFs and/or stocks to pick, I am all ears.

When you mentioned your age of 47, my first thought was: is that still considered early retirement? 😅

I take it you are on a very good path, considering you also got real estate.

I think the most important thing for you is to decide what to do with your free time soon! That might be your biggest concern soon.

Valores en tendencia

Principales creadores de la semana