Hello dear community,

Without further ado I decided to collect a few reasons why I think regenerative hydrogen is too overproportional on the stock market.

In the future I will write more articles behind technical aspects and processes, because it should be better for an investment to understand the business model, if the interest would be there of course ...

5 selected reasons why the potential of "green" hydrogen is overestimated on the stock market.

1. occurrence:

Hydrogen does not occur on earth in pure form. I hope critics will forgive the assumed 0.03% in the atmosphere. It is always bound. Currently, hydrogen is produced primarily from the process of "steam reforming". A relatively simple and portable process developed in the early 1920's and nearly perfected since then. The efficiency here is about 60-70%. Advantage and disadvantage at the same time: The price of hydrogen is directly linked to the price of natural gas.

2. political will:

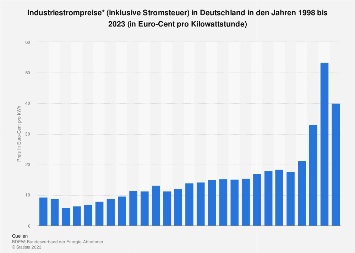

"Germany has the energy for the turnaround!": is the advertising slogan of a good dividend payer. Realistically, this is not the case! Why? Quite simply: the price of electricity. According to official data, the industrial electricity price in Germany is about 40ct gross. That is far too much to make "sustainable" technologies attractive in the future, because it is well known that these are extremely energy-intensive. Just think of the electrolysis of water to hydrogen.

Other European countries are much more favorable in this respect. Just think of Norway, which is why they will be lucky enough to become a net-zero state within Europe. Of course, one can also remain naive and think that the future import from Norway will not be carried off with maximum profits.

3.price:

Ultimately, the end user will always consume according to the lowest price. This applies equally to commercial and private customers.

The following price ranges result per kg:

"Green" hydrogen: 4-6€/kg

"Grey" hydrogen: 1-3€/kg

These are net prices. So don't be surprised at the next H2 filling station when prices between 9€ and 12,50€ are called.

4. industry battle of the future:

Accordingly, the hype around hydrogen arises precisely because of the newcomers around Nel $NEL (+0,99 %) , Plug $PLUG (-5,5 %) , Ballard $BLDP (-0,42 %) and Co.

But it is astonishing how it is assumed that the big players are inactive. In the field of industrial gases, the dominant players are Linde $LIN , Air Liquide $AI (+1,45 %) , Air Products $APD (+1,74 %) and many more.

But here, too, major new players are entering the field. Total $TTE (+0,31 %) , Shell $SHEL (+0,99 %) BP $BP. (+0,97 %) and other oil companies also have the knowledge. Why? Hydrogen already plays an enormously important role in the refinery process. Naturally, they want to become independent of the gas giants and also move into new segments. So what do such small fish want in this shark tank? They will not be able to assert themselves. Their activities will be watched, of course, but at the right moment a giant will dare to make a takeover bid.

5. every investor overestimates himself here, because FOMO "kicks in." Major stock magazines have been advertising the industry for years, but reality always catches up with the dreamers. Many underestimate the amount of material, planning, cost and price pressure in the industry, because after all, it serves a vision that is politically promoted and serves to save humanity.

To the investors: Are you that naive? Hydrogen has its irreplaceable justification and will continue to gain in importance in the future, but not the importance that corresponds to the stock market values.

Here Nel is valued at about €2.5 billion, although they are burning money. Plug already has a valuation of about €8 billion, but is still unprofitable. Eventually, someone will pay for it. But one thing is for sure: big investors are pulling out the money and taking profits or minimizing losses. You don't have these opportunities for inside information!

Do you want a sequel?

What is your personal interest in hydrogen? Would you also like to know more about the technologies of the individual applicants?