On Friday, 12.09.2025, it fell $BNTX (+0,22 %) briefly by 10%, closing the day at just over € 82.

The background was an article in the Washington Post (owner Jeff Bezos), which referred several times to insiders / anonymous sources.

Next week, CDC's Advisory Committee on Immunization Practices (ACIP) will decide on the future vaccination recommendations regarding Covid-19.

The FDA approved the latest coronavirus vaccines in August for people aged 65 and older or with risk factors. However, the CDC may narrow or broaden this recommendation. Approximately 43% of all people in the 65-74 age group received a vaccination from the 2024-2025 vaccine in the US, according to CDC estimates.

According to insiders, next week the committee may only recommend vaccination for people aged 75 and over or with pre-existing conditions.

The situation is similar with regard to the recommendation for vaccination in children. Around 13% of all children received the 2024-2025 vaccine.

As argumentative support, the Trump administration intends to submit documents to the Commission next week linking 25 deaths in children to the vaccine. The basis of this information appears to be the federal Vaccine Adverse Event Reporting System (VAERS), where anyone can report vaccine-related adverse events without verification/confirmation.

Why is this relevant to BioNTech?

A recommendation from the CDC means that insurance will pay for the vaccine and doctors will offer it. Accordingly, a lack of recommendation would $BNTX (+0,22 %) would lead to a significant loss of sales. The number of people over the age of 65 will reach a new high of approx. 18.4 % or approx. 63.8 million people in the USA in 2025. I was unable to find any information on how many of these people are under 75.

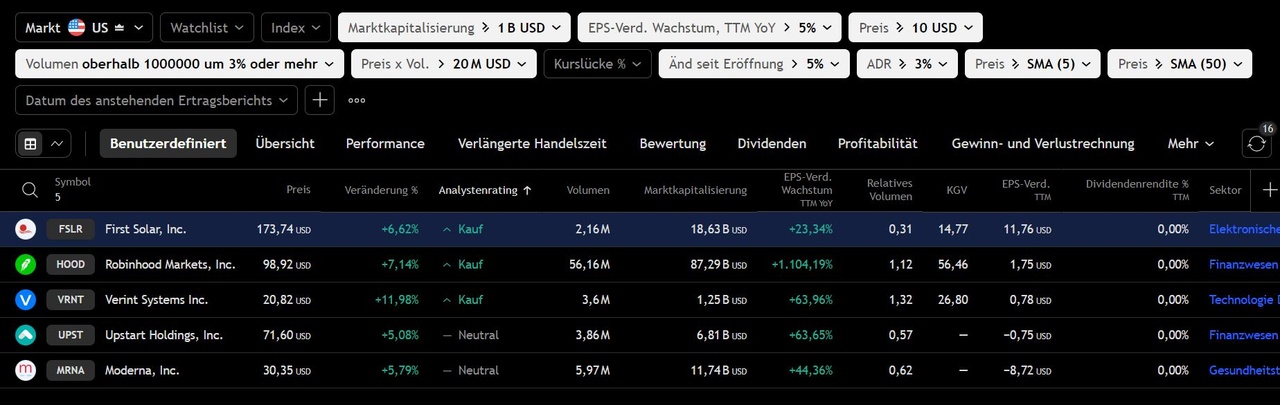

Besides $BNTX (+0,22 %) has also $MRNA (+0,7 %) also saw its share price plummet on Friday as a result of this article. The latter have already reacted with a statement that there are no new negative findings.

The article also quotes other experts who share this view, including Noel Brewer, a vaccine consultant dismissed by Kennedy:

"They are leveraging this platform to share untruths about vaccines to scare people," Brewer said. "The U.S. government is now in the business of vaccine misinformation."

In my view, it is quite likely that the recommendations will be adjusted, as Kennedy dismissed the members of this commission at the beginning of the year and replaced them with his own people, most of whom are critical of the corona vaccinations.

In the short term, I would therefore expect another decline, as BioNTech is currently the only company on the market with the coronavirus vaccine. In the medium term, it will be crucial that other drugs/vaccines can be placed on the market. For example, the precision medicine BNT323 (trastuzumab pamirtecan) for HER2-positive breast cancer looks positive. See the articles from about 1 week ago with the positive results of the phase III trial.

I remain invested despite the likely ongoing decline in sales of the corona vaccine. In addition to the high liquid funds and the massive investments in research & development, BioNTech has already shown that they "can" do mRNA. I may take advantage of the potential share price declines to expand my position.

How do you assess the situation?

How high do you see the short-term share price risk in the absence of a vaccination recommendation for children and especially for people aged 65-74 in the USA?

Are you / will you remain invested? Are you increasing your position?

Sources:

https://www.washingtonpost.com/health/2025/09/12/covid-vaccine-child-death-cdc/