Already available in the depot:

Are there any of these that you would still add to now or just hold?

Unfortunately, I sold too early:

On my watchlist:

Puestos

127Already available in the depot:

Are there any of these that you would still add to now or just hold?

Unfortunately, I sold too early:

On my watchlist:

The trend-following project I mentioned entered its first round today with the following ten stocks:

AeroVironment $AVAV (-2,07 %) , AppLovin $APP (-0,8 %) , Innodata $INOD (-7,36 %) , IREN $IREN (+6,64 %) , Kraken Robotics $PNG (-3,71 %) , Micron Technology $MU (-2,57 %) , Oklo $OKLO , Ondas $ONDS (-5,71 %) , Nebius $NBIS (-5,13 %) and Robinhood $HOOD (-4,49 %) . Each equally weighted, in a Trading212 Pie.

In my opinion, these companies had solid ratios and met the desired technical metrics (mostly beta > 1.5 ; 1M performance > 20% ; price > 50EMA).

Hopes / forecasts:

The model is designed to avoid the severe drawdowns that normally accompany high risk high reward stocks. The stocks have been selected so that all have a distance of about 15% from their 50d EMA.

To explain: the EMA is a moving average that reacts more strongly to trends or trend changes. In my experience, it often serves as support and a downward break may indicate a trend reversal.

This is theoretically perfect for this model: as long as the share is trading above its EMA, it is in a sustained uptrend (which the model wants to "surf" 🏄♂️); if it falls below it, it is sold. This mechanism therefore acts more or less like a dynamic trailing stop loss.

However, this should not happen immediately, as all shares are still above this average.

No investment advice, this is still an experiment. Updates to follow.

I would like to start a little experiment: I normally avoid individual stocks as I don't have the expertise to successfully deal with fundamental analysis.

However, as I still want to profit from stocks with strong momentum, I have come up with the following rule:

As a hedge:

Fundamental data is deliberately ignored here, only momentum is taken into account in order to keep the whole thing as simple as possible. What do you think? Especially @Tenbagger2024 from whose posts I got the inspiration for this.

Hello my dears,

September is over.

That's why I'd like to give you a little overview of the month.

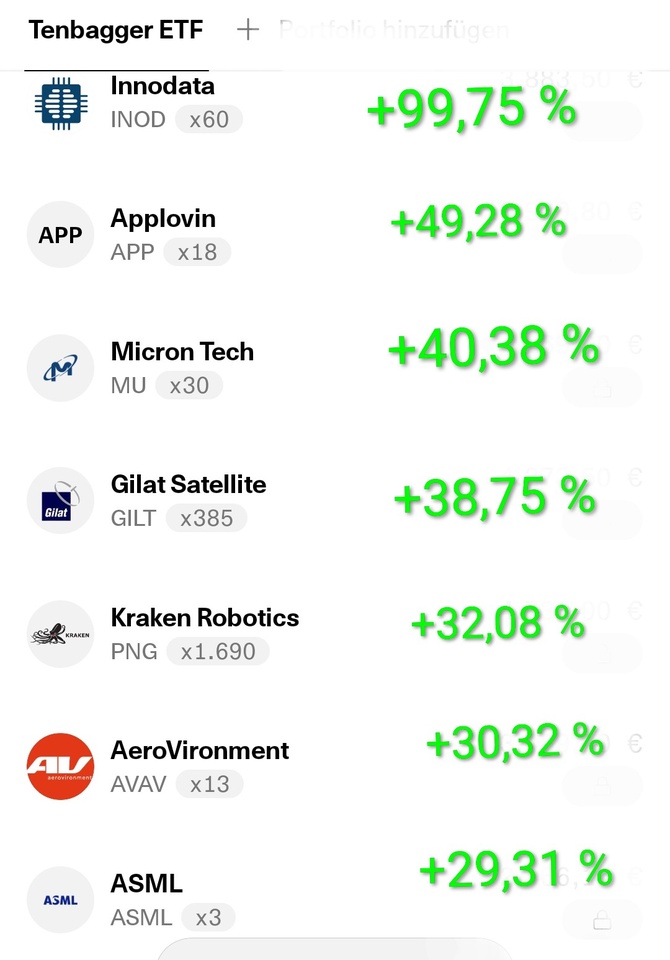

Tops: 📉

$INOD (-7,36 %)

$APP (-0,8 %)

$MU (-2,57 %)

$GILT (+0 %)

$PNG (-3,71 %)

$AVAV (-2,07 %)

$ASML (-0,96 %)

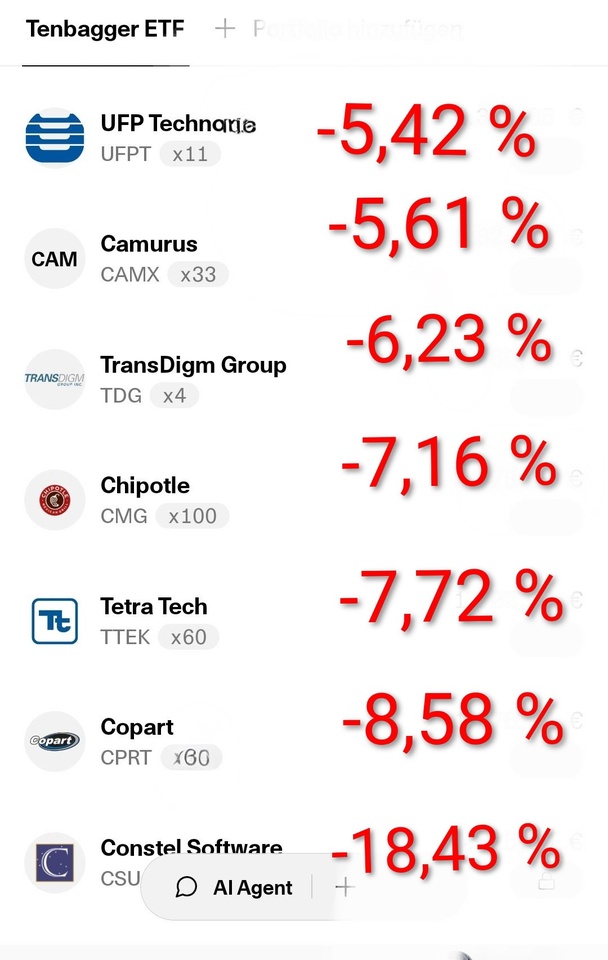

Flops: 📈

$UFPT (+1,54 %)

$CAMX (-4,49 %)

$TDG (+0,63 %)

$CMG (+2,66 %)

$TTEK (-4,01 %)

$CPRT (+0,68 %)

$CSU (-3,95 %)

It was noticeable in September that there were a lot of long runners and compounders among the flops. For this reason, I am relaxed for the time being and will stick to the values.

📉

My overall portfolio closed the month up 8.64 %.

$EQQQ (-0,99 %) NASDAQ 100. +4.81 %

$IWDA (-0,28 %) MSCI World. +2,62 %

Good evening everyone,

I now have the plan to take a total of 5 shares, as each additional share would mean higher diversification, which would most likely lead to lower returns.

Current portfolio idea:

Nvidia $NVDA (-4,18 %) 20%

Amazon $AMZN (-1,87 %) 20%

Palantir $PLTR (+1,09 %) 15%

Coinbase $COIN (-4,3 %) 15%

Micron Technology $MU (-2,57 %) 15%

And the remaining 15% to buy/rebalance when a stock is down 5% or more.

I realize that many of these stocks are already very expensive, but who says that the hype is over right now?

I think the hype can definitely go on for the next 4 months and who knows what else is coming with AI etc.

It's about getting as much potential return as possible, so I have to take a high risk.

I am open to tips and criticism and am still thinking back and forth about what can be changed.

I look forward to your opinions.

Good morning everyone,

Tomorrow I'm starting a project called Planspiel Börse, where the aim is to generate as much return as possible in groups of 4 in just under 4 months with a fictitious share/etf portfolio of €50,000.

Unfortunately, I have already noticed a few problems, there are almost no small-mid caps, which means it will be difficult to achieve a particularly good return.

In addition, you can only weight each position by 20%, there is an order fee of €15 + 0.3% and there is no leverage or similar.

Now I would like to know how you would approach this.

What would be your weighting?

What strategy would you use?

Would you invest everything straight away?

Or do you already have ideas for stocks?

I look forward to your answers and am grateful for any help.

Addendum: Here is a list of all tradable stocks etc. PB25_Wertpapierliste.pdf

$HY9H (-4,36 %)

$ASML (-0,96 %)

$INTC (-3,77 %) . $MU (-2,57 %)

SK Hynix is now the market leader in memory, also thanks to greater use of EUV than its competitors. According to current expansion plans, this is set to continue: Within just two years, around 20 more EUV systems are to be purchased to equip new factories and are intended for HBM and the latest memory solutions.

Number of EUV systems to double

SK Hynix already uses around 20 EUV systems from ASML in the Netherlands in its production. According to South Korean media today, this number is set to double by 2027, which could make SK Hynix one of the three largest customers.

According to analyses, SK Hynix would then have as many or even more EUV systems in use than Intel, which is rather atypical for a memory manufacturer. The number 1 in EUV is of course TSMC, which is unbeaten, while Samsung is number 2 as the world's second largest foundry, because it was here, in the logic sector, that EUV established itself many years earlier.

Intel completely missed the boat and is now having to pay for its failure with extensive problems including mass redundancies and new partnerships for financial injections.

SK Hynix, on the other hand, is extremely active in the new EUV systems. The manufacturer has been using EUV since 2021, and the South Koreans have already taken delivery of their first high-NA EUV system. This is now being used to test when it will be worth using in series production.

Micron is taking exactly the opposite approach: Here, EUV has only just been ramped up and is now slowly being integrated. However, the difference of four years does not seem to make as much of a difference in memory production as it does in the logic sector, as Micron also continues to make a lot of sales and high profits. After four years without EUV, Intel had once again fallen behind TSMC in terms of processor production.

The new EUV and later also high-NA EUV systems should help SK Hynix to bring new products to market faster and with good yields. The advantage of the newer equipment is always that the number of exposure steps can be reduced, resulting in fewer errors. Ultimately, this saves time and costs, even though the initial investment of several hundred million euros per exposure system is huge. The scanners are to be used in both the M15X factory extension in Cheongju and the M16 factory in Icheon.

🔹 Revenue: $11.32B (Est. $11.15B) 🟢; UP +46% YoY

🔹 Adj. EPS: $3.03 (Est. $2.84) 🟢; UP +156.8% YoY

🔹 Adj. Gross Margin: 45.7% (Est. 44.3%) 🟢; UP +920 bps YoY

🔹 Adj. Operating Income: $3.96B (Est. $3.67B) 🟢; UP +126.6% YoY

🔹 Adj. Operating Margin: 35.0% (Est. 33.2%) 🟢; UP +1,250 bps YoY

🔹 Adj. OpEx: $1.21B (Est. $1.22B) 🟢; UP +12% YoY

Q1 Guidance

🔹 Adj. Revenue: $12.2B–$12.8B (Mid: $12.5B; Est. $11.91B) 🟢

🔹 Adj. EPS: $3.60–$3.90 (Mid: $3.75; Est. $3.05) 🟢

🔹 Adj. Gross Margin: 50.5%–52.5% (Mid: 51.5%; Est. 45.7%) 🟢

🔹 Adj. OpEx: $1.34B ± $20M

Q4 Business Unit

🔹 Cloud Memory BU Revenue: $4.543B; UP +213.6% YoY

🔹 Core Data Center BU Revenue: $1.577B; DOWN -23.0% YoY

🔹 Mobile & Client BU Revenue: $3.760B; UP +24.5% YoY

🔹 Automotive & Embedded BU Revenue: $1.434B; UP +16.6% YoY

Other Metrics

🔹 Operating Cash Flow (Q4): $5.73B; UP +68.0% YoY

🔹 Operating Cash Flow (FY25): $17.53B; UP +106.0% YoY

🔹 CapEx (Q4 / FY25): $4.93B / $13.80B

🔹 Adj. Free Cash Flow (Q4 / FY25): $803M / $3.72B

🔹 Cash, Marketable Investments & Restricted Cash (YE): $11.94B

🔹 Dividend: $0.115/share (payable Oct 21, 2025; record Oct 3, 2025)

CEO Commentary

🔸 “Micron closed out a record-breaking fiscal year with exceptional Q4 performance, underscoring our leadership in technology, products, and operational execution.”

🔸 “We achieved all-time highs across our data center business and are entering fiscal 2026 with strong momentum and our most competitive portfolio to date.”

🔸 “As the only U.S.-based memory manufacturer, Micron is uniquely positioned to capitalize on the AI opportunity ahead.”

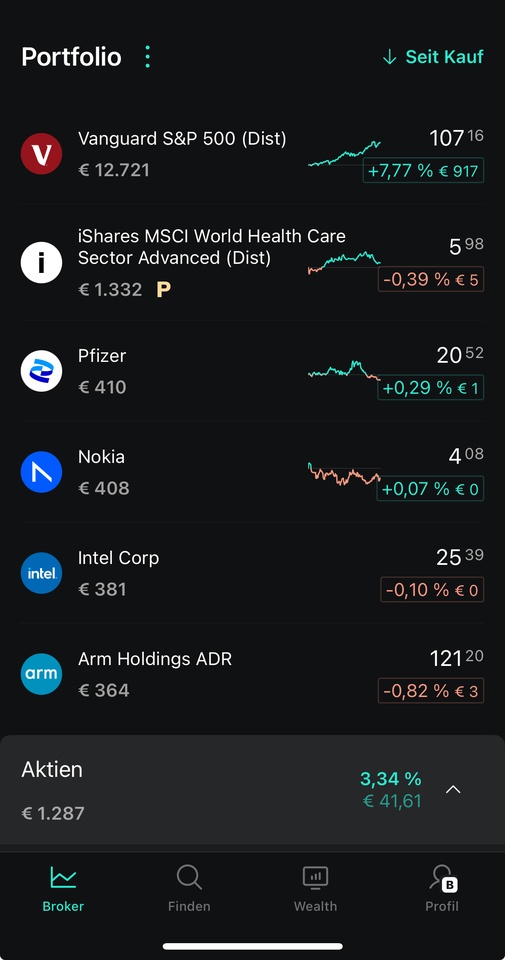

Good morning,

Today I actually bought the first tranche of the following shares:

Intel - Arm Holding - Nokia - Pfizer

---------------------------------------------------------------------------------------------

$INTC (-3,77 %) Nobody believes me, but I actually wanted to buy Intel last week before the significant rise, after the rise I speculated on a setback, which didn't turn out to be so strong and today I simply bought.

Why Intel? What distinguishes Intel from AMD and NVIDIA?

Intel is the only one that develops and also produces itself. Of course, this also entails risks, but it is also the case that Intel is the only non $MU (-2,57 %) is the only non-Asian chip manufacturer that has the latest ASML machines. Is that not one of the reasons why even Nvidia is now investing in Intel... By the way, I actually bought Micron today, simply to increase the size of the position.

In my opinion, anyone investing in Intel today should have a lot of patience. As you know, I don't have much of that, so maybe this will be my gym.

--------------------------------------------------------------------------------------------------------

$ARM (-2,68 %) Arm develops the Arm architecture for processors, which are particularly efficient and do not require cooling, which is why you find them as standard in smartphones, tablets and other devices, and sells the licenses to Qualcomm, Apple, Samsung and Nvidia, for example.

They are involved in almost all smartphone chips, earning money from the license without having to bear any production costs themselves.

The risks are a very high valuation, in which a lot of growth is already priced in. Strong dependence on the smartphone market, competitors could contest market shares and the company is very dependent on the Asian market.

--------------------------------------------------------------------------------------------------------

$NOKIA (+3,18 %) is quite well positioned and a leader in 5G network technology. For example, it controls over 29% of the 5G market outside China and is already in the lead in 6G... The business model is quite cyclical, investment intensive and the technological change is very fast.

--------------------------------------------------------------------------------------------------------

$PFE (-0,98 %) has made many strategic acquisitions in recent years. The acquisitions of Seagen and currently Metsera, among others, show that Pfizer is making targeted investments in growing and lucrative therapeutic areas. Whether the pipeline will be successful remains to be seen and is probably one of the greater risks.

--------------------------------------------------------------------------------------------------------

I have mentioned some of the risks, there are probably countless. The stocks fit into my portfolio quite well, as I mainly invest in boring ETFs and the weighting of these individual stocks is too low to significantly jeopardize my basic investment. If things go really badly, the money is gone, if things go reasonably badly, I have dividend stocks 🤪

Hello dear Getquin Community,

After $ORCL (-3,35 %) Oracle caused quite a stir after the last quarterly figures and the market reacted extremely positively with a 40 percent increase in the share price, so much so that CEO Larry Ellison briefly became the richest person in the world overnight, I wanted to unravel the magic and find out exactly which division caused this tremor.

The answer is Cloud Infrastructure, or OCI for short. In this area, the demand for data centers for artificial intelligence has exploded, which has brought Oracle long-term orders worth 455 billion US dollars. However, it is not only Oracle that is benefiting, but also other hyperscalers, regional challengers and, above all, the so-called shovel manufacturers that provide the basic infrastructure.

I have taken the trouble to look for potential competitors and up-and-coming challengers so that you have a complete overview of this sector. I have divided the whole thing into the following segments: 🌍 Big players (hyperscalers), 💡 Hidden champions (selection by region), ⚒️ Shovel manufacturers (infrastructure suppliers) and, as always, my favorite.

If I have overlooked any important aspects or a classification was not entirely precise, I look forward to your comments and exciting additions. Together we can understand this topic even better and learn from each other.

Feel free to leave a 👍. I wish you every success with your investments 🚀

🌍 Big Player (Hyperscaler)

Amazon Web Services - $AMZN (-1,87 %) (USA, Nasdaq) → World market leader with >30 % market share, huge data centers & own AI chips (Trainium, Inferentia)

Microsoft Azure - $MSFT (-0,42 %) (USA, Nasdaq) → second largest provider, strong AI focus through OpenAI partnership

Google Cloud - $GOOGL (+0,07 %) (USA, Nasdaq) → third largest provider, specialized in AI workloads & big data

Oracle Cloud Infrastructure (OCI) - $ORCL (-3,35 %) (USA, NYSE) → Number 4 worldwide, currently fastest growth (+70-80 %), RPO USD 455 bn

Alibaba Cloud - $BABA (-2,63 %) , $9988 (-2,31 %) (China, NYSE/HKEX) → Market leader in Asia, complete cloud suite from IaaS to AI

Favorite: Oracle - $ORCL (-3,35 %)

Oracle impresses with its cloud infrastructure OCI, which recently collected orders worth 455 billion US dollars. The moat lies in the close integration of the database business and cloud services as well as the multi-cloud partnerships with Microsoft and Google. The compounder property is the result of long-term contracts and economies of scale in data center construction.

Alternative favorite: Alibaba Cloud - $BABA (-2,63 %) , $9988 (-2,31 %)

Alibaba is number one in Asia and number four worldwide. The moat lies in the close integration with Alibaba's e-commerce and fintech ecosystem. The compounder property stems from the enormous growth in emerging markets and the increasing demand for cloud services in China. While the stock is valued significantly cheaper than Oracle, there are geopolitical and regulatory risks.

💡 Hidden champions (selection by region)

🇪🇺 Europe

OVHcloud - $OVH (-2,9 %) PA (France) → largest European cloud provider, GDPR- and Gaia-X-focused

Scaleway - private (France, part of the Iliad Group) → Developer and AI cloud platform

T-Systems - part of $DTE (+0,31 %) DE (Deutsche Telekom, Germany) → Hybrid & Sovereign Cloud for Public Sector

IONOS - $IOS (+1,66 %) DE (Germany, Xetra)

Largest European web hosting and SME cloud provider. Burggraben: strong brand and high customer loyalty in the SME sector.

Aruba Cloud - private (Italy) → regionally strong in SMEs & hosting

Outscale - private (France, subsidiary of Dassault $DSY.PA) → Industrial Cloud & Simulation

Favorite: OVHcloud - $OVH (-2,9 %)

Burggraben: strong position as a GDPR-compliant sovereign cloud with Gaia-X. Compounder: increasing trust from authorities and companies ensures growing recurring revenues.

🇨🇳 China

Baidu AI Cloud - part of $BIDU (-4,79 %) , $9888 (-5,07 %) (Nasdaq, China/USA) → AI workloads, autonomous driving, language models

JD Cloud - part of $JD (-1,91 %) , $9618 (-2,21 %) (Nasdaq, China/USA) → Cloud for e-commerce & retail

Kingsoft Cloud - $KC (-4,29 %) , $3896 (-3,85 %) (Nasdaq, China/USA) → Gaming, streaming and app cloud

China Telecom Cloud - part of $728 HK (HKEX) → Infrastructure cloud, state-supported

China Mobile Cloud - part of $941 HK (HKEX) → 5G edge cloud with telecom backbone

Favorite: Kingsoft Cloud - $KC (-4,29 %) , $3896 (-3,85 %)

Moat: Specializing in gaming, streaming and mobile apps with deep integrations into ecosystems. Compounder: benefits from China's growing online consumption and strong embedding in the Tencent environment.

🇯🇵 Japan

NTT Communications - part of $9432 (-1,2 %) T (Tokyo) → Enterprise cloud with global network

NEC Cloud - $6701 (-0,71 %) T (Tokyo) → Government & security solutions

Fujitsu Cloud K5 - $6702 (-0,19 %) T (Tokyo) → Hybrid cloud for large companies

Rakuten Symphony Cloud - part of $4755 (-1,52 %) T (Tokyo) → 5G & telecom cloud

IIJ Cloud - $3774 (+3,5 %) T (Tokyo) → Cloud pioneer for enterprise IT

Favorite: NTT - $9432 (-1,2 %)

Moat: global telecom backbone and huge enterprise customer base. Compounder: expansion of data centers in Asia and Europe with stable recurring revenues.

🇮🇳 India

Reliance Jio Cloud - part of $RELIANCE NS (NSE India) → Telecom Cloud, partnership with Azure

Tata Communications IZO - $TATACOMM NS (NSE India) → Hybrid cloud & global backbone

Infosys Cobalt - $INFY (NYSE/NSE India) → Cloud migration platform & consulting

HCLTech Cloud - $HCLTECH NS (NSE India) → AI-powered hybrid cloud

Wipro Cloud Studio - $WIPRO NS (NSE India) → MultiCloud service provider

Favorite: Tata Communications - $TATACOMM

Moat: global fiber optic network and deep networking in hybrid cloud. Compounder: growing international expansion and increasing demand for multi-cloud solutions.

🌏 Asia / Oceania

Naver Cloud - part of $035420 KQ (Korea KOSDAQ) → AI & gaming cloud

Samsung SDS Cloud - $018260 , $SMSN (-1,6 %) KQ (Korea KOSDAQ) → Enterprise & IoT Cloud

KT Cloud - part of $030200 KQ (Korea KOSDAQ) → Telecom & Edge Cloud with 5G

Telstra Cloud - $TLS (-1,52 %) AX (Australia) → Telecom Cloud, Asia-Pacific focus

Macquarie Telecom Cloud - $MAQ AX (Australia) → Public Sector & Compliance

Favorite: Naver Cloud - $035420

Moat: strong integration of AI and gaming in Korea. Compounder: rapid scaling due to growing demand for AI and ML applications.

🌍 Latin America

UOL Diveo (Compasso UOL) - private (Brazil) → Cloud + Managed Services

Tivit Cloud - private (Brazil) → MultiCloud for industry & banks

Locaweb Cloud - $LWSA3 SA (Brazil) → SME Hosting & Cloud

Claro Cloud - part of $AMX (-3,23 %) (Mexico, NYSE/HKEX) → Telecom Cloud in Latin America

DesireCloud - private (Chile/Peru) → Local provider for companies

Favorite: Locaweb - $LWSA3

moat: Market leader for SME cloud and hosting in Brazil. Compounder: enormous scalability through the digitalization of small and medium-sized enterprises throughout Latin America.

🇨🇦 Canada

OVHcloud Canada - part of $OVH (-2,9 %) PA (France) → Data centers for North America

SherWeb - private (Quebec) → Cloud and MSP services for SMEs

HostPapa - private (Canada) → SME cloud solutions

Canadian Web Hosting - private (Canada) → Cloud & hosting with a focus on data protection

Beanfield Cloud - private (Toronto) → Cloud combined with fiber optic infrastructure

Favorite: SherWeb - private

Moat: close ties to SMEs via managed services. Compounder: fast-growing cloud ecosystem for small businesses in North America, high customer loyalty.

⚒️ Blade manufacturers (infrastructure suppliers)

🖥️ Semiconductors & Chips

Nvidia - $NVDA (-4,18 %) (USA, Nasdaq) → GPUs for AI training & cloud

AMD - $AMD (+0,89 %) (USA, Nasdaq) → CPUs/GPUs for Data Center

Intel - $INTC (-3,77 %) (USA, Nasdaq) → Server CPUs & AI accelerators (Gaudi)

TSMC - $TSM (-2,19 %) (Taiwan, NYSE/TWSE) → largest chip manufacturer, produces for NVIDIA/AMD

Samsung Electronics - $SMSN (-1,6 %) KQ (Korea) → Memory, foundry, GPUs/CPUs

Favorite: Nvidia - $NVDA (-4,18 %)

Moat: near monopoly in high-end GPUs for AI. Compounder: Ecosystem and network effects through CUDA and developer community.

📦 Data center hardware & servers

Supermicro - $SMCI (-2,35 %) (USA, Nasdaq) → GPU clusters & AI servers

Dell Technologies - $DELL (-2,81 %) (USA, NYSE) → Enterprise Servers & Storage

Hewlett Packard Enterprise - $HPE (+0,28 %) (USA, NYSE) → Hybrid Cloud & Edge

Inspur - private (China) → AI & Cloud Server

Lenovo - $LNVGY (-3,45 %) (China/ADR) → HPC and AI servers

Favorite: Supermicro - $SMCI (-2,35 %)

Moat: Specialization in GPU clusters and AI servers. Compounder: benefits from every expansion of the hyperscalers, extremely high scalability.

⚡ Memory & network chips

Micron - $MU (-2,57 %) (USA, Nasdaq) → DRAM & HBM memory

SK Hynix - $HY9H (-4,36 %) KQ (Korea) → Memory chips, HBM for NVIDIA

Broadcom - $AVGO (-3,39 %) (USA, Nasdaq) → Network Chips & Switches

Marvell - $MRVL (-3,43 %) (USA, Nasdaq) → Network & 5G chips

ASE Technology - $ASX (-4,42 %) (Taiwan, NYSE) → Packaging for high-end chips

Favorite: Broadcom - $AVGO (-3,39 %)

Moat: deep roots in network infrastructure of hyperscalers. Compounder: benefits from rising demand for switches and custom chips for the cloud.

🏭 Data centers / colocation

Equinix - $EQIX (+1,03 %) (USA, Nasdaq) → largest colocation provider worldwide

Digital Realty - $DLR (-0,13 %) (USA, NYSE) → Data centers worldwide, strong in Europe/USA

China Telecom DC - part of $728 HK (HKEX) → Data center infrastructure in China

NTT Data Centers - part of $9432 (-1,2 %) T (Tokyo) → Data centers in Asia/Europe

NEXTDC - $NXT (+0,56 %) AX (Australia) → Growing data centers in the APAC region

Favorite: Equinix - $EQIX (+1,03 %)

Moat: global networking and extremely high switching costs for customers. Compounder: continuous expansion and cross-selling potential through platform structure.

🔋 Energy & cooling

Schneider Electric - $SU (-0,16 %) PA (France, Euronext) → Power & Cooling for Data Center

ABB - $ABBN (-0,28 %) (Switzerland, SIX/NYSE ADR) → Energy & Automation

Siemens Energy - $ENR (-2,09 %) (Germany, Xetra) → Power Grids & Data Center Technology

Vertiv - $VRT (-2,71 %) (USA, NYSE) → Cooling, Racks & UPSs

Eaton - $ETN (-0,19 %) (Ireland/USA, NYSE) → Power Management

Favorite: Schneider Electric - $SU (-0,16 %)

Burggraben: market-leading energy and cooling systems for data centers. Compounder: long-term growth due to increasing demand for efficient data centers.

🌐 Network & Connectivity

Cisco - $CSCO (+1,04 %) (USA, Nasdaq) → Router & Network Hardware

Arista Networks - $ANET (-6,19 %) (USA, NYSE) → High-speed switches for hyperscalers

Juniper Networks - Acquisition by $HPE (+0,28 %) Hewlett Packard HP (USA, NYSE) → Routing & Network Security

Ciena - $CIEN (-1,05 %) (USA, NYSE) → Fiber Optics & Optical Networks

Nokia - $NOK (+4,19 %) (Finland, NYSE/Helsinki) → 5G & Core Networks

Favorite: Arista Networks - $ANET (-6,19 %)

Moat: technological leadership in high-speed switches in hyperscaler data centers. Compounder: enormous growth opportunities due to exponential data traffic in AI workloads.

✨ Takeaway

The Oracle quake shows: Cloud & AI are the growth drivers of the coming years. While hyperscalers are in the spotlight, hidden champions are growing in their niches in the background and blade manufacturers are making money from every expansion of the infrastructure.

👉 Question for you: Do you prefer to focus on hyperscalers in your strategy? hyperscalersthe hidden champions or directly on the shovel manufacturers?

I look forward to your opinions!

Source: own analysis

Image - Image credit: Getty Images

I will remain invested here too. 🚀

Citi expects Micron Technology ( NASDAQ: MU ) to issue guidance that is well above expectations when the memory maker releases its financial results for the fourth quarter of fiscal 2025 later this month.

Micron shares rose 5% in early trading on Thursday.

"We expect the company to remain in line and well ahead of expectations due to higher DRAM and NAND sales and pricing," Citi analysts led by Christopher Danely said in an investor note Thursday. "We believe the continued uptick in the memory market is due to limited production and better-than-expected demand, particularly from the data center end-user market (55% of Micron revenue)."

Citi raised its revenue forecast for fiscal 2026 from $54.5 billion to $56 billion and its earnings per share from $14.62 to $15.02. The full-year earnings forecast is 26% above consensus. Citi expects revenue of USD 13 billion and earnings per share of USD 3.23 for the first quarter.

"We believe the DRAM recovery is intact, and our checks show that demand from the AI sector has increased sharply as C25 CSP capital spending increased by $18 billion during the reporting season. We believe this will lead to a potential upside for Micron," Danely added.

Citi reiterated its Buy rating and raised its price target from $140 to $175.

Micron plans to release its fourth-quarter results after the market on Tuesday, September 23. A consensus estimate is for adjusted earnings per share of $2.85 on revenue of $11.09 billion.

Principales creadores de la semana