$GPN (-5,41 %) . Paul Singer has now entered the market with his Elliot Management. A shark as he is written in the book. $GPN (-5,41 %) has put quite a lot of money (24.3 billion dollars) on the table for the takeover of Worldpay. After that it went down sharply. But what is perhaps being disregarded by the stock market is the now strongly promoted stablecoin sector.

Worldpay already processes over 50 billion transactions per year in 146 countries. But now it's about more: Worldpay will be working with BVNK's multi-rail infrastructure in the future. The aim is to enable companies around the world to pay out in stablecoins - almost in real time.

John McNaught, SVP at Worldpay, explains: "We want to give companies the opportunity to pay people with stablecoins anywhere in the world - faster, cheaper and more efficiently than ever before."

Stablecoins: the next trillion-dollar game

This opens up Global Payments a gigantic market. Stablecoins such as USDC, USDT & Co. already have a market capitalization of around 250 billion dollars. But experts are certain that this is just the beginning.

Especially in international business - where traditional bank transfers often take days and cost horrendous fees - stablecoins could trigger the next revolution. Retailers, influencers, suppliers, freelancers: in future, everyone should be able to be paid in digital dollars at lightning speed.

"This is the real game changer," says industry insiders. "Those who scale this first will dominate payment transactions in the future."

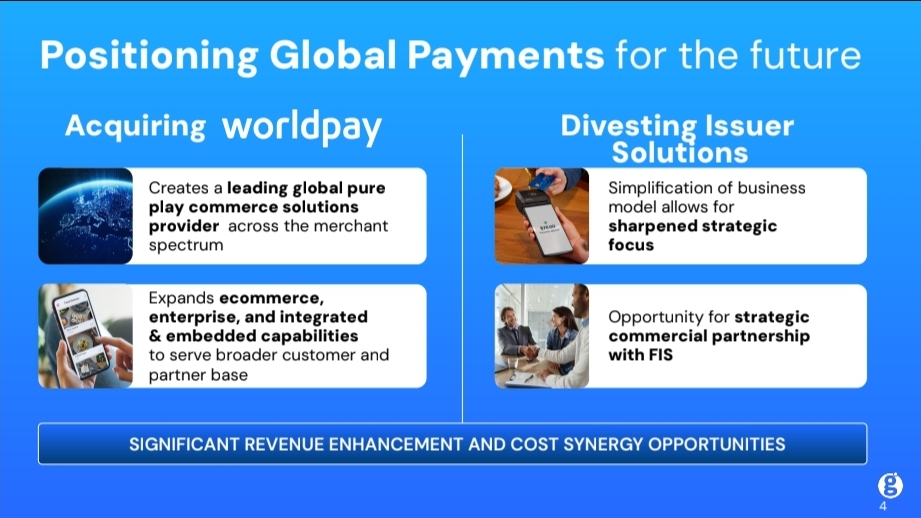

Global Payments: On the way to a commerce empire

Parallel is expanding Global Payments is expanding its "Genius" platform. The aim is no longer just to process payments, but to become the digital nerve center for the entire retail sector. Whether table reservations, loyalty programs or invoice automation - everything is to be merged into a single platform in future.

CEO Cameron Bready calls it a "groundbreaking day" for the industry. The merged company will soon serve over 6 million customers in 175 countries and process around 94 billion transactions per year.

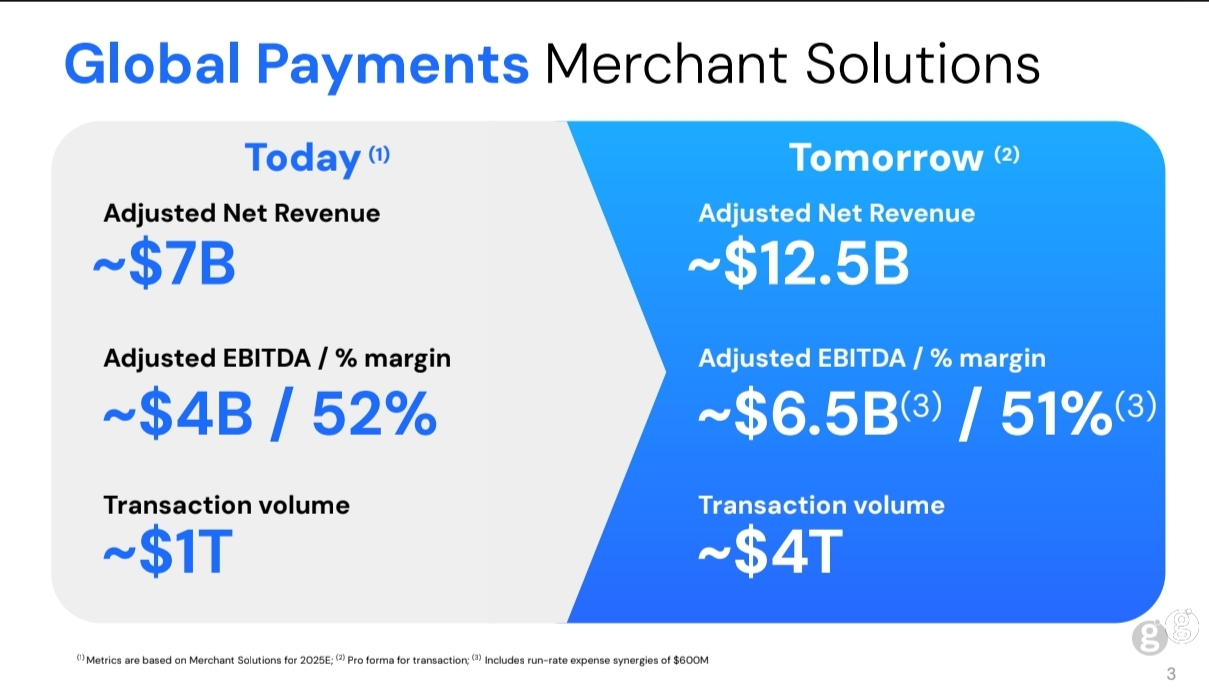

The forecasts are gigantic: Global Payments expects adjusted net sales of 12.5 billion dollars and EBITDA of 6.5 billion dollars in 2025.

I am currently considering an entry for the medium/long term.