🔹 Revenue: $4.60B (Est. $4.47B) 🟢; UP +12.3% YoY

🔹 Adj EPS: $0.77 (Est. $0.40) 🟢; includes ~$0.20 timing benefit from tariffs

Guidance (FY26):

🔹 Revenue: $19.3B–$19.5B (Est. $19.15B) 🟢

🔹 Adj EPS: $5.32–$5.72 (Est. $5.47) 🟡

🔹 Same-Store Sales Growth: 4%–6%

Other Q2 Metrics:

🔹 Same-Store Sales: +6.5% (Traffic +3.0%, Ticket +3.4%)

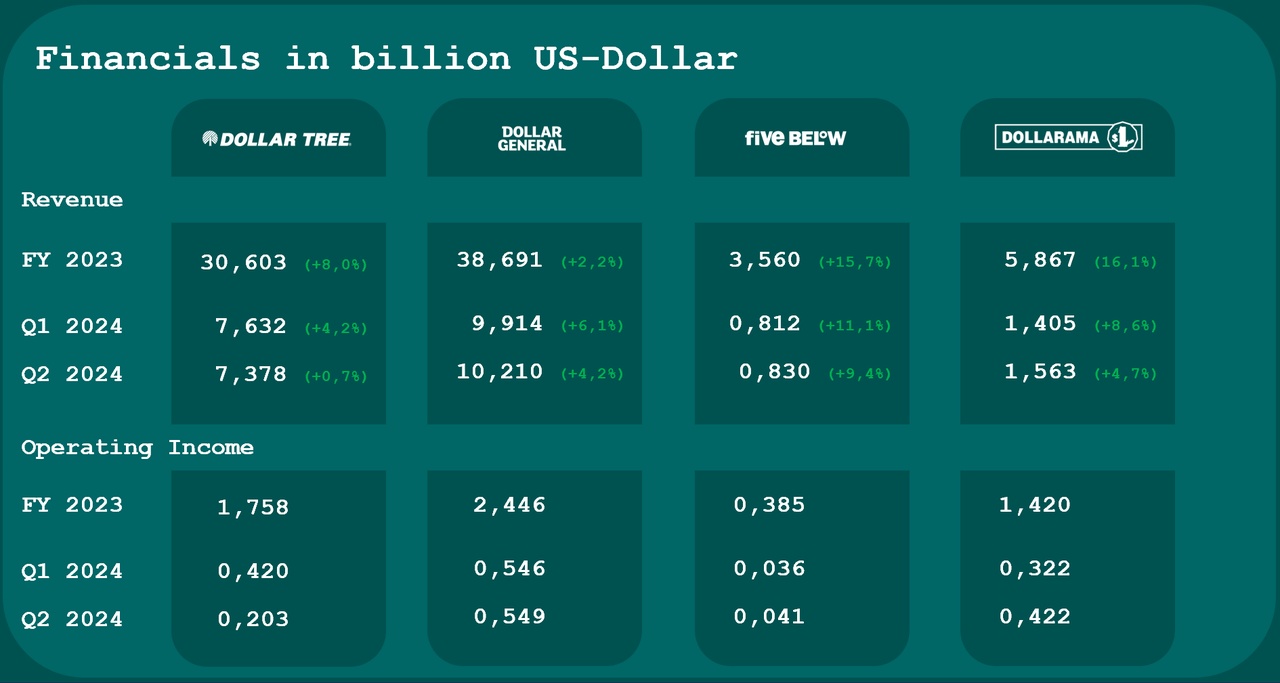

🔹 Operating Income: $231M (Adj: $236M); Margin 5.1% (Adj: 5.2%)

🔹 Net Income: $156M; Diluted EPS: $0.75

🔹 Gross Margin: 34.4% (UP +20 bps YoY)

Other Highlights:

🔹 Completed sale of Family Dollar (July 2025); now a Dollar Tree-only business

🔹 Repurchased >$1B shares YTD (11M shares; $938M + $71M post-Q2)

🔹 Opened 106 new stores; 585 stores converted to “3.0” multi-price format

🔹 Cash & Equivalents: $666M; $2.4B remaining repurchase authorization

🔹 Net cash from ops YTD: $639M; Free cash flow YTD: $145M

Management Commentary:

🔸 CEO Mike Creedon: “With Family Dollar sold, we are now fully focused on strengthening Dollar Tree. Strong sales, margin expansion, and share gains reinforce our unique positioning in a tougher consumer backdrop.”

🔸 Company flagged ~$0.20 EPS boost from tariff timing in Q2, expected to reverse in Q3.