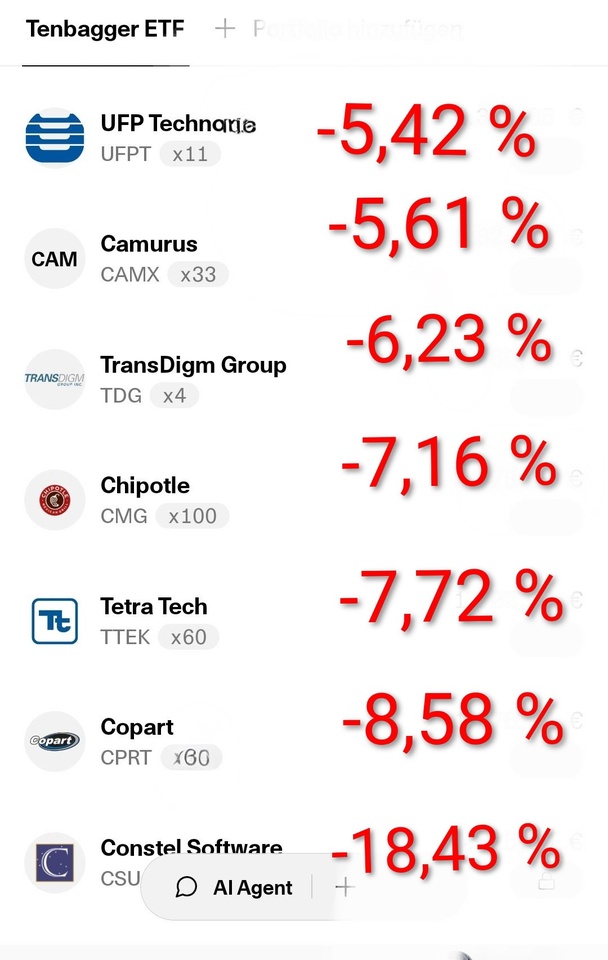

Who would have thought that damaged cars could be such a profitable business? Copart has taken the trade in damaged vehicles to a new level

The figures speak for themselves

In the last 10 years, turnover has risen from USD 12.7 billion to USD 4.65 billion.

At the same time, the operating margin has improved from 32% to around 36%. Earnings have climbed from USD 0.26 to USD 1.59 per share in the same period.

In the financial year just ended, which ran until the end of July, profits jumped by 14% to USD 1.59 per share.

Nevertheless, the share price has taken a massive hit. The trigger for this is likely to have been the "disappointing" sales performance.

In each of the last two quarters, sales were below consensus estimates. In Q3, turnover of USD 1.21 billion was achieved, but USD 1.23 billion was expected.

In the fourth quarter, sales of USD 1.13 billion were below the estimates of USD 1.14 billion

Disappointing

It is perfectly legitimate to criticize this. However, the fact that profits exceeded expectations in each case was clearly ignored. Moreover, the "disappointing" sales performance does not change the fact that profits rose by 14% in the financial year just ended.

On top of this, the growth momentum has recently accelerated and Copart has once again demonstrated the strong impact of its operational Hebel impact.

Turnover climbed by 5.2 % in the final quarter. However, this led to a 12.4 % increase in gross profit and a 22.9 % jump in profit.

Earnings per share even increased by 24.2%. This is an example of the leaps in profit that Copart is capable of, even if the underlying market is barely growing.

All this suggests that the cost estimates may be too low. At present, earnings are expected to rise by only 7% to USD 1.70 per share in the current financial year.

Copart therefore has a forward P/E of 26.1, while the long-term average is 31.3. If the business figures turn out better than expected, this could lead to a revaluation of the shares

Copart share: Chart from 07.10.2025, price: USD 44.30 - abbreviation: CPRT | Source: TWS

The long-term Aufwärtstrend and the support zone at USD 39 - 42.50 have come within reach. This could be an opportunity for anti-cyclical investors. Copart's valuation has fallen to its lowest level since the beginning of 2023, when I last analyzed the stock (13.01.2023).

From the bulls' point of view, prices below USD 39 would be unpleasant. On the other hand, a rise above USD 45 could trigger a recovery towards USD 46.70 or USD 49 - 50.

The chart picture would brighten sustainably above this level

Source and complete article