Already available in the depot:

Are there any of these that you would still add to now or just hold?

Unfortunately, I sold too early:

On my watchlist:

Puestos

79Already available in the depot:

Are there any of these that you would still add to now or just hold?

Unfortunately, I sold too early:

On my watchlist:

Shares of $APP (+5,16 %) climb 8.2% to $634.18, recouping nearly half of their losses from the previous day ** APP plunged 14% on Monday after Bloomberg News reported that the U.S. Securities and Exchange Commission is investigating the company's data collection practices ** Oppenheimer does not expect the SEC investigation to have a material impact on the company ** Oppenheimer maintains its long-term bull thesis, but warns that the stock could be volatile in the near term ** Citi Research sees it as a positive that the company did not file an 8K report, suggesting that the company does not necessarily view this investigation as a "material" risk ** We would be buyers on any weakness - Citi ** The SEC is looking into allegations that APP may have violated service agreements with its platform partners to deliver more targeted advertising to users, according to the report, which cited insiders familiar with the matter ** The company, which was recently added to the S&P 500, said it does not comment on potential regulatory matters; the SEC declined to comment due to the ongoing government shutdown ** Shares initially fell in premarket trading Tuesday, but then opened higher ** YTD shares up 94%

After the first half of my derivative left my portfolio 1.5 weeks ago at $APLD (-1,37 %) left my portfolio with 200%, I have now also sold the second half as part of a small risk minimization.

Since I was also asked yesterday after my post on the bubble which stocks I see as most at risk in the event of a downturn and could speculate on short, I have to say that $APLD (-1,37 %) would certainly be one of them, like everything in the data center sector.

So also

But also companies like

$QBTS (+3,39 %) and all the other small quantum players

and also

$APP (+5,16 %) I see a good short opportunity in the event of a strong correction.

But it's not that far yet and who knows if and above all when it will happen.

In my humble estimation, it will not happen before the 2nd quarter.

That's why this list is not exhaustive and cannot be changed.

But you have to be prepared.

Subscribe to the podcast to keep AI rolling.

00:00:00 Market environment

00:18:14 AMD, AI bubble

00:46:00 Gold

01:21:30 Silver

01:41:00 AppLovin, Palantir, Robinhood, Crowdstrike, Uber

Spotify

https://open.spotify.com/episode/7ikqEWGJPS0GUOGeyDz1sL?si=YRcXJc8PQ5GcOow-gX8MyA

YouTube

Apple Podcast

$AMD (+6,32 %)

#gold

#siöber

#silver

$APP (+5,16 %)

$UBER (-0,67 %)

$PLTR (+2,29 %)

$CRWD (+0,86 %)

#podcast

#apotify

The trend-following project I mentioned entered its first round today with the following ten stocks:

AeroVironment $AVAV (+3,24 %) , AppLovin $APP (+5,16 %) , Innodata $INOD (+2,8 %) , IREN $IREN (+11,25 %) , Kraken Robotics $PNG (-2,35 %) , Micron Technology $MU (+5,61 %) , Oklo $OKLO , Ondas $ONDS (+3,62 %) , Nebius $NBIS (+9,49 %) and Robinhood $HOOD (+4,02 %) . Each equally weighted, in a Trading212 Pie.

In my opinion, these companies had solid ratios and met the desired technical metrics (mostly beta > 1.5 ; 1M performance > 20% ; price > 50EMA).

Hopes / forecasts:

The model is designed to avoid the severe drawdowns that normally accompany high risk high reward stocks. The stocks have been selected so that all have a distance of about 15% from their 50d EMA.

To explain: the EMA is a moving average that reacts more strongly to trends or trend changes. In my experience, it often serves as support and a downward break may indicate a trend reversal.

This is theoretically perfect for this model: as long as the share is trading above its EMA, it is in a sustained uptrend (which the model wants to "surf" 🏄♂️); if it falls below it, it is sold. This mechanism therefore acts more or less like a dynamic trailing stop loss.

However, this should not happen immediately, as all shares are still above this average.

No investment advice, this is still an experiment. Updates to follow.

I would like to start a little experiment: I normally avoid individual stocks as I don't have the expertise to successfully deal with fundamental analysis.

However, as I still want to profit from stocks with strong momentum, I have come up with the following rule:

As a hedge:

Fundamental data is deliberately ignored here, only momentum is taken into account in order to keep the whole thing as simple as possible. What do you think? Especially @Tenbagger2024 from whose posts I got the inspiration for this.

Grateful for the >50% overall return from my Interactive Brokers stock portfolio (>90% gain for holdings held since Q3/Q4 2024, excluding new stocks added this 2025). Hoping for higher returns in the longer term 🙏

Top fave holdings $NBIS (+9,49 %)

$AMSC (+5,32 %)

$AVGO (+1,78 %)

$GEV (-1,56 %)

$SOUN

$ACHR

$SPOT (-4,02 %)

$APP (+5,16 %)

$RDDT (-0,02 %)

$SNOW (+2,02 %)

Selling a small part (7,5% aprox) of my $APP (+5,16 %) position.

After a spectacular run of more than 1.500% since I added it, i’m letting go a bit due to rebalancing of my portfolio (it was more than 9% at this point). It is the second time I sell a small portion of Applovin.

To be clear, its still my biggest position and I still think it is a great company, but valuation is not so great (78 P/E TTM, 52 P/E FW1, 41 P/E FW2) and although we’re used to see them beating earnings with ease, any small underperformance on the ernings would possibly trigger a big dip on the price… and we have yet to see the real new revenue in their expansion to retail and e-commerce (specially DTC brands).

I’ll keep selling more if it keeps going up at this path, and I would probably repurchase if an important dip happens (unless that dip is due something really concerning).

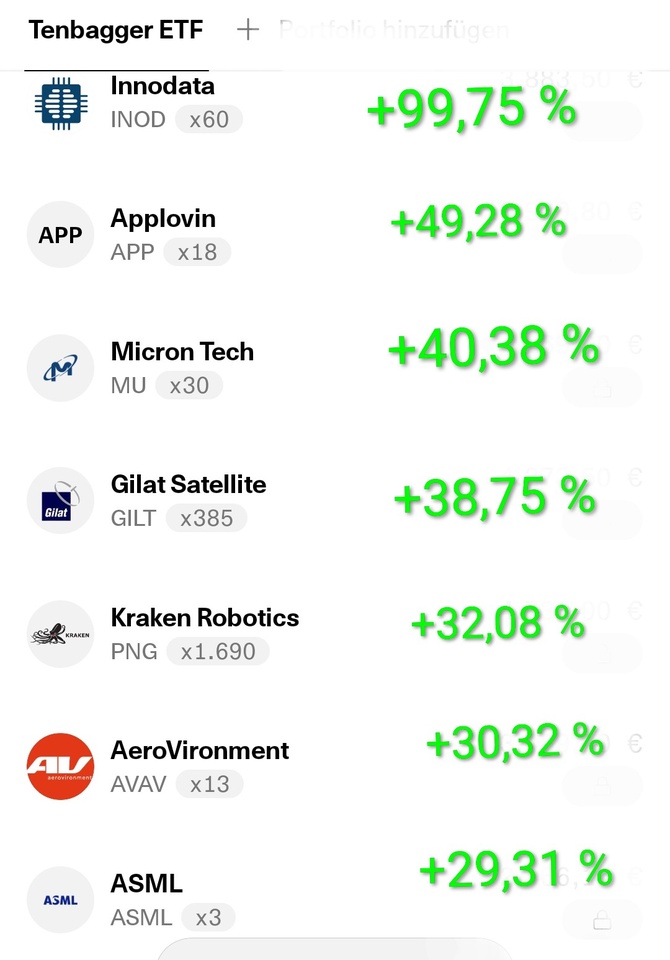

Hello my dears,

September is over.

That's why I'd like to give you a little overview of the month.

Tops: 📉

$INOD (+2,8 %)

$APP (+5,16 %)

$MU (+5,61 %)

$GILT (+4,07 %)

$PNG (-2,35 %)

$AVAV (+3,24 %)

$ASML (-0,02 %)

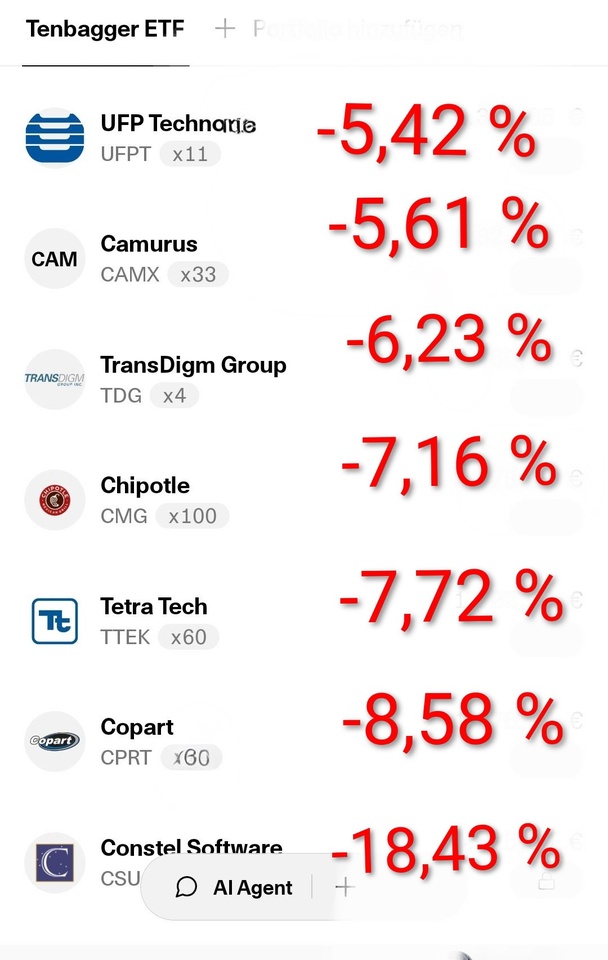

Flops: 📈

$UFPT (+0,32 %)

$CAMX (-4,2 %)

$TDG (+0,62 %)

$CMG (-1,83 %)

$TTEK (+0 %)

$CPRT (-0,8 %)

$CSU (+1,2 %)

It was noticeable in September that there were a lot of long runners and compounders among the flops. For this reason, I am relaxed for the time being and will stick to the values.

📉

My overall portfolio closed the month up 8.64 %.

$EQQQ (+0,87 %) NASDAQ 100. +4.81 %

$IWDA (+0,51 %) MSCI World. +2,62 %

My dears, we @Semos25 , @SemiGrowth remain invested.

AppLovin (APP) is at a historic turning point. With its inclusion in the S&P 500, a wave of bullish analysts' voices and the launch of the self-service tool Axon Ads Manager and Axon.ai on October 1, the company has opened up the billion-dollar market in global e-commerce advertising. After a brilliant share price rally and fending off a short-seller attack, CEO Adam Foroughi is now focusing on growth through AI. Analysts are confident that the share will continue to soar.

Business model and market position

AppLovin began its corporate history as a developer and publisher of mobile games, but has undergone a fundamental transformation in recent years. Today, the company sees itself primarily as a provider of AdTech and performance marketing solutions. Advertisers can use its platform to reach target groups worldwide, monetize their reach and scale the growth of their apps or online stores. With tools such as AppDiscovery, which relies on AI-supported advertising optimization, and MAX, a monetization solution for publishers, AppLovin is positioning itself as a leading provider in the field of digital advertising. While the gaming segment has long been the foundation of the business, expansion into the non-gaming and, in particular, the e-commerce sector is now coming to the fore.

Launch on October 1 - Axon Ads Manager as a scaling turbo

On October 1, 2025, AppLovin will launch its self-service tool Axon Ads Manager for non-gaming advertisers, replacing the manual onboarding that was previously required. The portal enables e-commerce and other advertisers to plan, manage and optimize campaigns directly. This makes access much simpler, more global and more scalable. For AppLovin, this is the first step towards directly addressing international customers and massively expanding its reach. While the customer base was previously limited to a few hundred advertisers, potentially thousands can now sign up independently and use the AI-supported performance advertising. Analysts such as Morgan Stanley see the launch as decisive proof of the scalability of the non-gaming advertising model and expect the customer base to multiply and the segment to make a significant contribution to revenue growth in future.

Axon.ai - The AI engine behind AppLovin

Axon.ai is the AI-powered recommendation engine behind AppDiscovery and uses predictive algorithms to evaluate advertising impressions in real time in order to optimize customers' return targets. Advertisers set targets, Axon.ai analyzes device and interaction data as well as feedback from the bidding process and controls automated bids based on this, without processing sensitive personal data. As usage grows, the model improves continuously as more data enables more precise predictions, creating a self-reinforcing scaling effect. With Axon 2.0, this technology is now set to unfold its impact beyond the gaming segment in global e-commerce.

Short seller attack in March 2025

In March 2025, AppLovin was targeted by aggressive short sellers who pushed the share price down from over USD 530 to USD 200. They questioned the sustainability of the e-commerce business, criticized the attribution and questioned the pixel technology. CEO Adam Foroughi reacted openly and emphasized that Pixel fulfilled the same standard functions as Google or Meta. He also referred to the rapid growth of the e-commerce segment, which had reached a billion-dollar level within a few months, and emphasized AppLovin's ability to achieve in quarters what others achieve in a decade. The markets followed this view. The share has recovered impressively since then.

(My dears, this is where I kept my cool and remained loyal to the company).

Seal of quality through S&P 500 inclusion and analyst praise

On September 22, 2025, AppLovin was included in the prestigious S&P 500 Index, a seal of quality that confirms the company's compliance with strict criteria on market capitalization, liquidity and profitability and at the same time ensures greater visibility and capital inflows from index funds. At the same time, analyst firms are outdoing each other with optimistic assessments. Morgan Stanley raised its price target to USD 750, UBS even to USD 810, Piper Sandler sees USD 740 and Phillip Securities USD 725, while Wells Fargo, Bank of America, Oppenheimer and Benchmark also issued clear buy recommendations. Expectations thus range between USD 500 and USD 800 and underpin the assessment that AppLovin not only offers short-term price potential, but can also achieve annual earnings growth of around 34% in the long term.

AppLovin on the verge of the next growth spurt

AppLovin has made the transition from gaming publisher to AI-driven AdTech specialist and is clearly focusing on the e-commerce market, which is significantly larger than the original gaming segment. The launch of the self-service tool and the further development of Axon.ai open up enormous scaling potential. The inclusion in the S&P 500 and numerous positive analyst opinions confirm the strategic strength. This gives AppLovin the opportunity to establish itself as a leading player in global e-commerce advertising, even if the path remains highly dynamic and volatile.

By A. Wimbauer - Updated on 30.09.25

Principales creadores de la semana