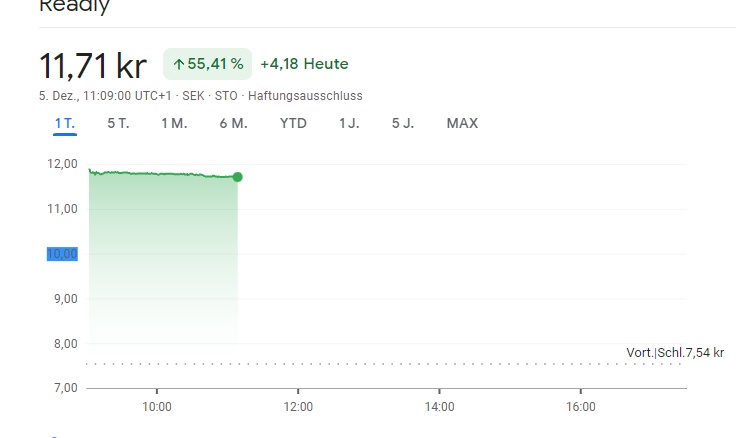

Readly Intl

Price

Debate sobre READ

Puestos

43To conclude this post, I would also like to share my decision.

TR's support team was also unable to answer my question as to whether the $READ is still tradable after the change of stock exchange and referred to L & S as the stock exchange operator. One of the prerequisites for the shares to be tradable via TR is that the shares can be traded on several German stock exchanges and that they are liquid.

I am afraid that after the switch to over-the-counter trading in Sweden, trading will $READ will no longer be tradable on many German stock exchanges, possibly only in direct trading. The trading volume in Sweden is already $READ more than thin.

Conclusion: I sold today $READ sold today as the trading situation is too confusing for me. A re-entry and a further gamble on a squeeze-out may be played if trading is secured after all.

The sale will be posted if available.

VG your GordonGekko😜

Now it's up to the experts among you! Off the top of my head @BloombergT comes to mind.

How do you see the situation at $READ (Readly international)?

My main concern here is the imminent delisting from NASDAQ Stockholm. Will the share still be tradable on L & S? I personally can't find any information on this.

Many thanks in advance :-)

Now it's up to the experts among you! Off the top of my head @BloombergT comes to mind.

How do you see the situation at $READ (Readly international)?

My main concern here is the imminent delisting from NASDAQ Stockholm. Will the share still be tradable on L & S? I personally can't find any information on this.

Many thanks in advance :-)

To $READ get back into the game and get one or two opinions;-)

The extended acceptance period and takeover of Readly by Bonnier is through and Bonnier holds 75.4% of the shares in Readly.

Which I think has confirmed my suspicion that Bonnier has slyly bought itself time to buy up additional shares from the market peu a peu and has thus certainly achieved an interim goal, since Bonnier is now the majority owner and does not have to fear a blocking minority.

Bonnier's other goals are to divest Readly's international business and to buy up more than 90% of the shares in order to delist Readly.

I think that the sale of the international business will benefit all remaining shareholders and possibly yield a good payout. The effort to grab 90% of the shares will further boost the price of Readly shares, if not everyone throws their shares on the market right away.It is possible that Bonnier will make a higher or further takeover bid in order to grab the remaining 15% of the shares as quickly as possible.

To cut a long story short, I think the Readly shares will be fun in the near future and I'm thinking about buying more now. What's your opinion on this?!

I come back to the topic $READ and the takeover or attempted takeover by Bonnier.

Now it is a fact that the takeover is going through after all, despite the significantly lower acceptance rate, and Bonnier holds 65.8% plus of the shares. Plus, as again the offer period has been extended. However, I do not believe that Bonnier will be able to get hold of many more shares and that it may be a tactical move on Bonnier's part to get hold of shares "cheaply" from the market. I am also convinced that there is a lot of potential in $READ and that Bonnier has made a move for this reason anyway. What is your opinion on $READ and Bonnier's behavior despite clearly missed takeover targets? At least I'm not giving up any of my shares 😎.

I would like to hear your opinion on a takeover offer from $READ a takeover bid. The offer was recently increased to the equivalent of 1.29 euros. The acceptance threshold is at least 90% of the shares. With the increased offer, approximately 32% of the shares have been safely taken over.

Do you think that the takeover offer is final? I don't think that the limit has been reached yet, since the share price has really crashed and many shareholders would have to sell with heavy losses. Would you still hold or sell? I am curious to hear your arguments.

Before the question comes: Yes I have shares and am still slightly in the minus ;-) Purchase price just under 1.37 euros.

Sale. Great app, but I'm using the takeover bid to get out. Overall, I made a small loss and my idea didn't work out...

Comparison:

Mercedes also has great cars, but I still don't have to have the shares! 😉

"Readly International received a cash tender offer of 12 kronor per share from a subsidiary of Sweden's Bonnier News Group."

Source: https://www.handelsblatt.com/dpa/aktie-im-fokus-readly-legen-nach-bonnier-uebernahmegebot-mehr-als-haelfte-zu/28848232.html (05.12.2022)

Good morning everyone,

I would like to ask you today how you $READ (Readly) find?

For one thing, do you use it? And if yes, which magazines you find in the category "Economy & Finance" ? (filtered by language ? "german", otherwise the list would be too long) are really worth reading read? You can see them all in the screenshots. Feel free to name English-language magazines as well.

On the other hand, what do you think of the publicly traded company "Readly"?

Are you invested? Do you see opportunities in this subscription/business model?

Readly is now raising its prices considerably. Let's see what effect this will have on subscriber numbers, since there is already a lot of talk about "mass instead of class" in the magazine and newspaper offering...

Looking forward to your assessment

I wish you a nice weekend.

Best regards

Heiko

Valores en tendencia

Principales creadores de la semana