Wereldhave

Price

Debate sobre WHA

Puestos

19Today I bought NNN Reit

Today I bought $NNN (+0,51 %) reit, 8 shares at an average price of €35,955 each (including transaction costs).

I currently own 48 shares, which currently yields +- €98,99 per year in dividends.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

$NNN (+0,51 %)

$O (+0,36 %)

$ADC (+0,19 %)

$MAA (-1,27 %)

$WHA (-2,53 %)

$ECMPA (-2,91 %)

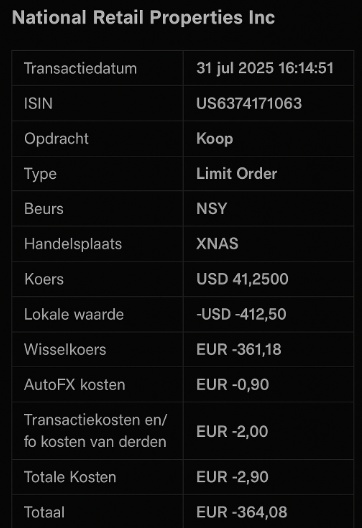

Today I bought NNN reit

Today I bought $NNN reit, 10 shares at an average price of €36,408 each (including transaction costs).

I currently own 40 shares, which currently yields +- €82,492 per year in dividends.

#dividend

#dividends

#dividende

#invest

#investing

#etf

#etfs

#nationalretailproperties

$NNN (+0,51 %)

$O (+0,36 %)

$ADC (+0,19 %)

$MAA (-1,27 %)

$WHA (-2,53 %)

$ECMPA (-2,91 %)

First goal almost reached

Sold $WHA (-2,53 %) and swapped it for $JEGP (-0,32 %) . First goal almost reached: €100 avg div per month

New position opened

$WHA (-2,53 %) is my latest position, I was hesitating about this purchase for a while, especially with the higher share price. It is a wonderful company with great future plans, also they pay a great dividend.

Wereldhave update

$WHA (-2,53 %) has done very nice, it is one that has done like clockwork:

Fundamental has $WHA (-2,53 %) this year changed in a good way in my opinion. If you want to know, I recomand the part over Wereldhave of "De Aandeelhouder" podcast on YouTube https://youtu.be/L11_N9eQ9FE?si=vSIc9e6F_iKeciKr&t=962

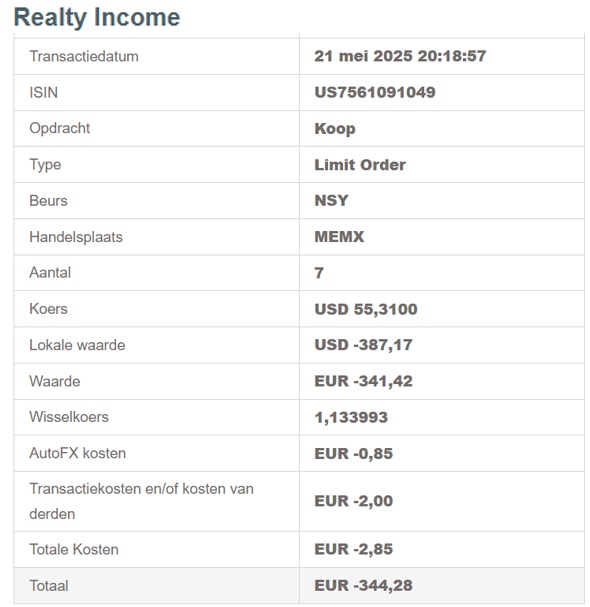

Bought 7 shares of Realty Income today

Bought 7 shares of Realty Income $O (+0,36 %) today at an average price of €49,182 including transaction costs.

I currently own 73 shares.

This gives me an annual dividend of approximately €214 per year.

$O (+0,36 %)

$ADC (+0,19 %)

$NNN (+0,51 %)

$MAA (-1,27 %)

$WHA (-2,53 %)

$ECMPA (-2,91 %)

#dividend

#dividende

#dividends

#invest

#investing

#realestate

Valores en tendencia

Principales creadores de la semana