UK REITs have experienced quite a turbulent period over the past three years, influenced by a number of factors, including the Brexit, the COVID-19 pandemic, and the recent turmoil in the financial markets in relation to interest rates and inflation.

Brexit-related uncertainty has weighed on REITs, particularly those with strong exposure to the commercial sector.

The pandemic hit sectors such as retail and hospitality hard, negatively affecting REITs that invest in these sectors.

However, residential and logistics REITs have generally shown greater resilience.

In my view, the future outlook for UK REITs is largely tied to interest rate developments as REITs often finance themselves through debt. Higher rates increase financing costs, reducing profitability.

Inflation is also playing a role by pushing up REITs' operating costs, such as maintenance expenses, utilities, and wages. This can erode profit margins if these costs cannot be passed on to tenants.

As European investors then we have the foreign exchange risk that has a major impact in the GBP vs. EURO ratio

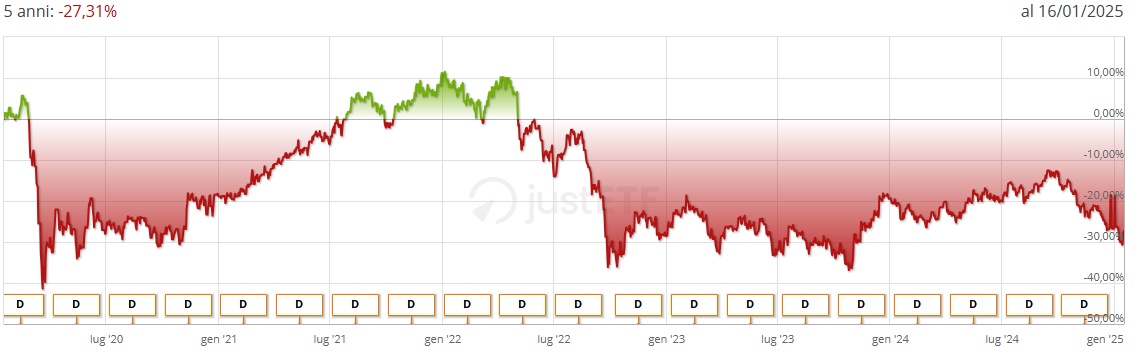

Analyzing an ETF that tracks this market example iShares UK Property UCITS ETF $IUKP (-0,78 %) we see that in the last 3 years it has lost -32%, if we analyze the last 5 years a -27% and only in the last 3 months a -14.65%, with a current return of 4.48%.

Particular is its composition only SEGRO $SGRO (-1,4 %) weighs almost 20% of the ETF.

In my opinion the outlook for the next 3 years is positive.

I expect uncertainty in the short term on interest rates, but I think a decline in rates and an adjustment of rents to inflation with a large increase in dividends in the next few years at current prices can be expected.

What do you guys think ?