After Ottobock $DE000BCK2223 (-0,16 %) successfully went public in October 2025, we take a look at the hard facts in January 2026. Is the global market leader in human bionics a must-have for your portfolio?

🏢 Company profile & market position

Ottobock is no longer just a supplier to medical supply stores. With approx. 30 % market share in prosthetics, they are the global player. Particularly exciting: Through their network of 400 Patient Care Centers they control the entire value chain - from the high-tech knee joint right through to the patient.

📈 Key financial figures (as at Jan. 2026)

The figures show a clear direction: Profitability.

- Growth: The core business is growing at a double-digit rate (approx. 13% p.a.).

- Margin turbo: The EBITDA margin climbed from 21% to just under 26 %. Why? Focus on margin instead of sheer size.

- Cash flow: Free cash flow has improved massively in 2025 (approx. EUR 173m), paving the way for the first dividend (payout approx. 30-40%) in in the year 2026.

🌟 Opportunities: more than just demographics

- Innovation: 3D printing and AI-controlled prostheses reduce costs and increase patient satisfaction.

- Crisis management & humanitarian aid: A sad but factual growth driver is the increasing global demand in conflict areas (e.g. Ukraine). Ottobock $DE000BCK2223 (-0,16 %) not only provides humanitarian aid here, but also secures long-term market share in regions with enormous pent-up demand through its local presence and training of technicians.

- Dividend play: Starting this year, Ottobock $DE000BCK2223 (-0,16 %) will also become interesting for income investors.

⚠️ Risks: What you need to have on your radar

- Debt: Even if the IPO proceeds were used to redeem, leverage remains to be kept in mind.

- Governance: The Näder family has a firm grip on the reins - this means stability, but little say for small investors.

- Regulation: Cost pressure in healthcare systems can squeeze margins on standard products.

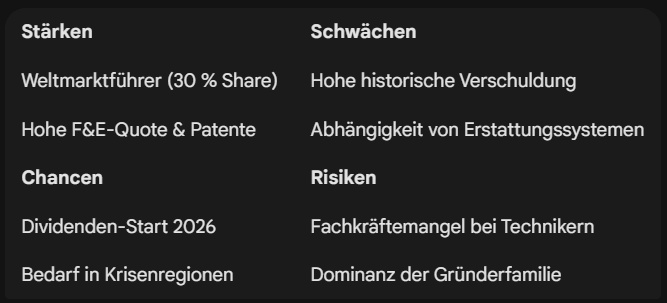

📊 SWOT analysis at a glance

🎯 Evaluation

The share price is currently hovering around 65.00 - 67.00 EUR (close to the IPO price). While UBS remains rather neutral, banks such as Deutsche Bank or Jefferies see price targets of up to 81.00 EUR.

My conclusion: Ottobock $DE000BCK2223 (-0,16 %) is a quality compounder. Anyone who wants to bet on medical technology with a "moat" will find a solid stock here, which is now also capable of paying dividends.

What do you think of Ottobock $DE000BCK2223 (-0,16 %)

?

Have you held them in your portfolio since the IPO or are you waiting for a significant dip below EUR 65?

Let me know your opinion in the comments! 👇💬

#Ottobock

#Aktienanalyse

#MedTech

#Börse

#Investieren

#GetQuin

#Dividende

#HumanBionics