I tidied up my portfolio a bit today. This has partly to do with the fact that I think the stock market is currently running a bit hot, but it's not the decisive factor; it's simply a time when it seems wise to sell some stocks that were no longer at the top of my want list anyway.

First of all, some of you may have noticed that I have switched most of the growth portfolio to ETFs. I've also tidied up a bit there, but it's not worth mentioning.

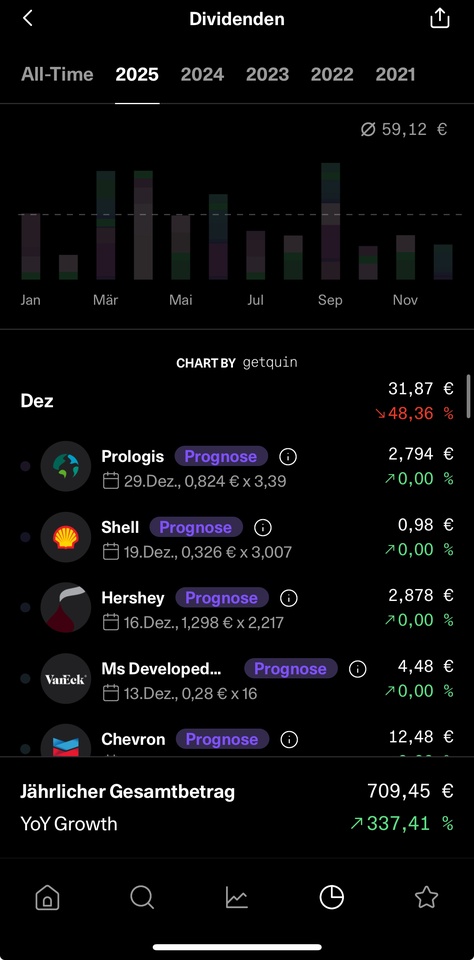

In the dividend portfolio, I shifted a little more back and forth; although initially I only shifted to the cash portfolio and not yet shifted :D Some of you may remember that I took over some of my grandparents' shares, some of which are also old tax holdings. This is also the case here. But there's no doubt that I also had to pay a lot of tax on the non-old stock. However, I also wanted to tidy up a bit, even though the dividend portfolio was actually intended for buy and hold (forever), so sometimes it turns out that you should perhaps sell after all.

$SBUX (+3.28%) I had started to build up a position at around 85. Then came the Starbucks "crash". This forced me to buy some more. However, the position has become far too large for my dividend portfolio, so I reduced it by a little more than 1/2.

$SAP (+0.8%)

@Karl_ <- Following on from Karl's post. I have a similar view and think that the valuation is no longer really justified. I am also unsure about the German market as a whole at the moment. But after all, SAP also does a lot of business in America. 100% out

$JPM (+2.25%) Perhaps a controversial decision. But I'm not entirely convinced by JPM's return on capital, even for a bank. It is certainly a good investment, but not for me at the moment. But that's more of a gut decision. 100% out

$DHL (+1.33%)

$7974 (-0.28%) were mini positions. Question: Continue to build up or get out? The latter was the answer. I don't see an absolute reason to buy at the moment. 100% liquidated

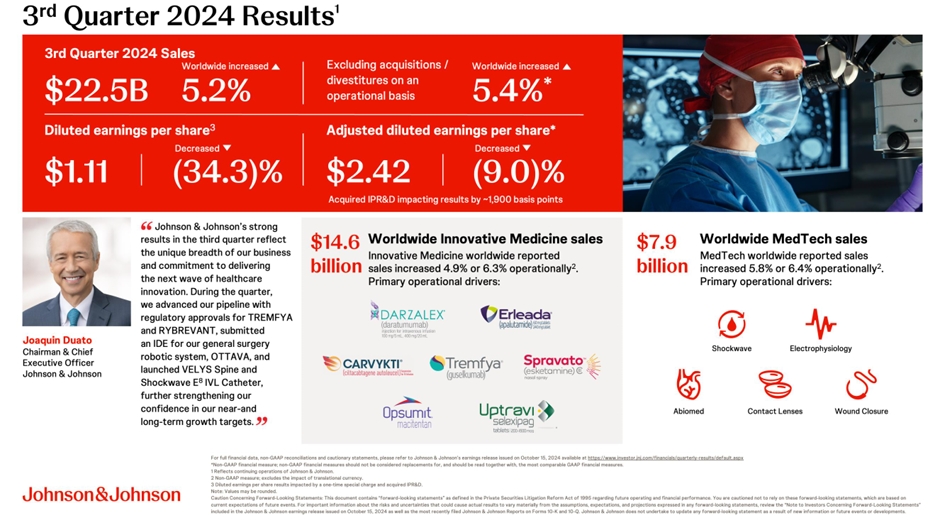

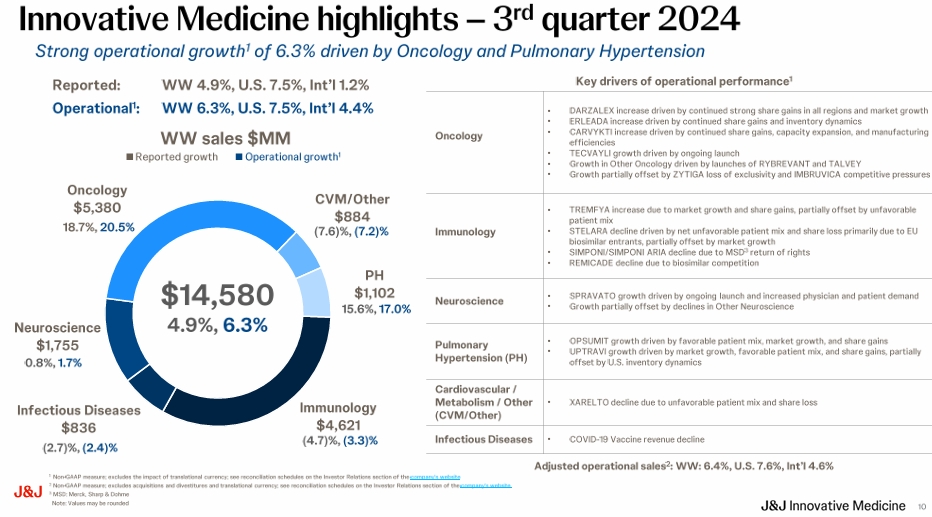

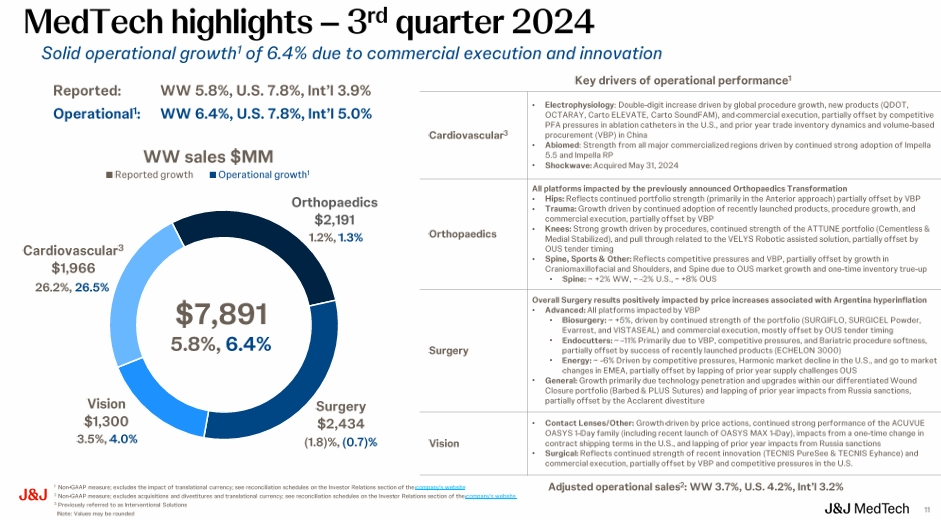

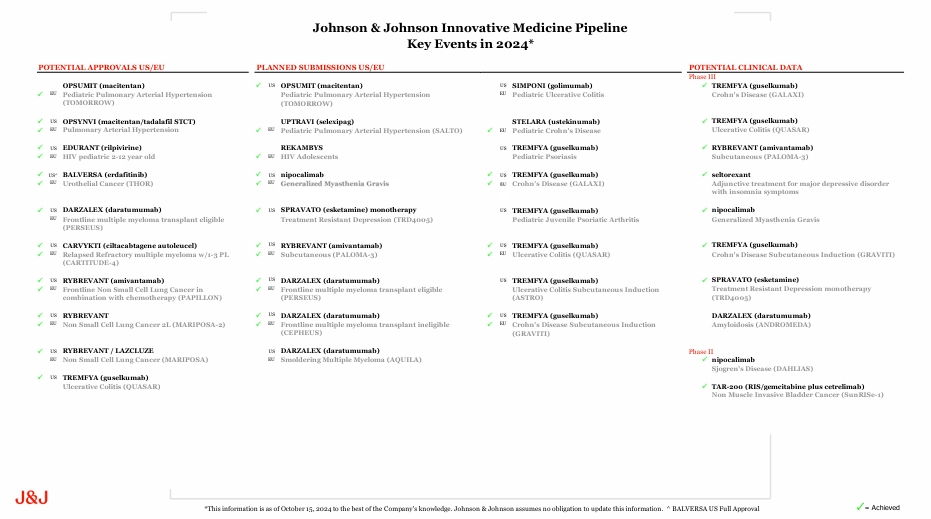

$JNJ (+0.25%) certainly also a controversial decision. However, I am not convinced by either the performance or the fundamentals. 100% out.

$AZN (+3.35%) Bought Corona for a good reason (vaccination). Now took profits. 100% out.

That's it for now. I now have a cash ratio of almost 50%, which is of course far too much. The cash will flow partly into ETFs in the former growth portfolio and partly into dividend stocks. The main focus will be on consumer staples, industrials and healthcare - if better opportunities arise there. I will gradually build up positions there and post my reasons accordingly.

Edit: I am always grateful for ideas in consumer staples/industrials/healthcare + dividend paying.