The flock’s flying high again — with the top 7 positions now making up ~40% of the portfolio! That’s 6 points over last month showing how conviction is compounding 📈🪶

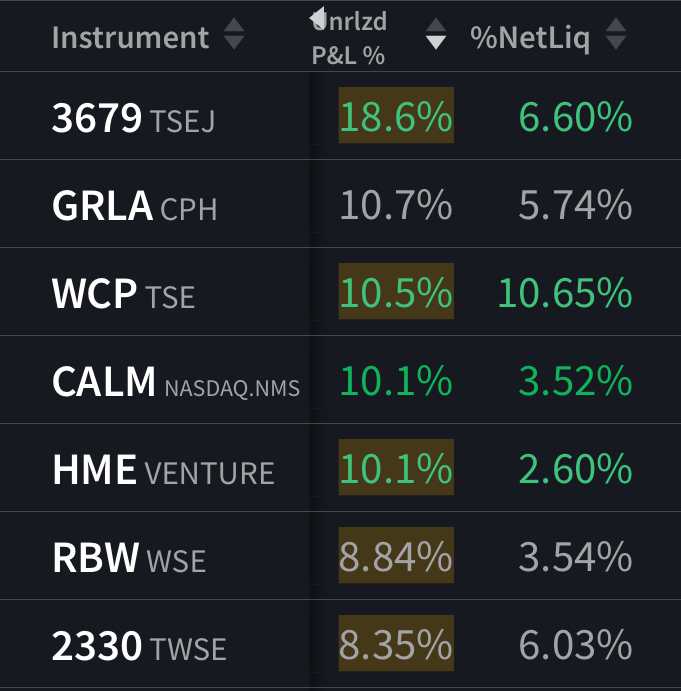

🏆 Top 7 Gainers August 2025:

$3679 (-1.71%) — Japan's quiet beast Zigexn is back on top with +18.6%, still among Patito's favorite conviction plays (6.60% of the nest).

$GRLA — Groenlandsbanken holds strong with +10.7%, proof you don’t need hype to win.

$WCP (-0.78%) — Our favorite dividend dripper slows slightly but keeps marching with +10.5%, and making up for largest holding (10.65%) as we have progressively added to the position. It doesn't show there but we have already received another full 1% in dividends since our start in February that have been fully reinvested to the portfolio. Did we mention it's a monthly dividend payer?

$CALM (+0.42%) — A new protein-powered entry: Cal-Maine cracks into the top 7 with +10.1%. 🍳

$HME (+1.45%) — Small Canadian energy keeps climbing, also +10.1% and currently holding the title for our top dividend score in our scoring system

$RBW (-0.21%) — Polish pick surprises with +8.84%, diversifying with promise.

$2330 — Taiwan Semi still making chips and making gains: +8.35%, and holding 6.03%.

🔁 Returning Leaders:

✅ $3679, $GRLA, $WCP, $HME, $2330

💪 These are not one-hit quacks — they’re holding their spots through volatility and growing stronger.

Our stronghold gold ETF $4GLD (-1.22%) has been pushed down the top ladder which is good news!

🍳 New Cracks in the Shell:

- Welcome to $CALM (Cal-Maine) and $RBW! Both breaking into the leaderboard with solid performance and strong fundamentals.

🎯 Strategy Update:

Patito's top 7 holdings now represent nearly half the portfolio — a clear sign of rising conviction and performance concentration.

We continue to prioritize:

- 🏅 High Patito Score picks (Elite + Excellent)

- 🧠 High WB Score conviction

- 🌍 Global diversification from Japan to Canada to Poland

- 🧈 Stable dividends and strong capital efficiency

🐣 Patito's holding steady, sleeping well, and reinvesting smart. August was golden.

Onward to September — let’s fluff up more feathers and hope for our other half of the portfolio to wake up (yes we're looking at you $BRK.B (+0.14%) , $SIGA , and $WRB (+0.98%) ).