$KDP (-1.09%)

$7751 (-0.9%)

$NXPI (-1.03%)

$WM (+0.46%)

$CDNS (-0.53%)

$BN (-0.57%)

$SOFI (-0.99%)

$UNH (-1.21%)

$AMT (+0.44%)

$UPS (-0.55%)

$BNP (+0.5%)

$NVS (+1.72%)

$DB1 (+1.22%)

$MSCI (+1.63%)

$ENPH (-4.42%)

$BKNG (+0.2%)

$LOGN (+0.64%)

$V (+0.54%)

$MDLZ (-0.5%)

$PYPL (-1.08%)

$000660

$MBG (-0.06%)

$BAS (+0%)

$UBSG (+0.51%)

$SAN (+0.11%)

$CVS (-0.36%)

$OTLY (-0.96%)

$GSK (-0.41%)

$ETSY (-1.68%)

$CAT (+0.81%)

$KHC (-2.21%)

$ADYEN (-0.66%)

$ADS (-1.32%)

$AIR (+0.19%)

$SBUX (-2.84%)

$CMG (-0.4%)

$META (+0.28%)

$KLAC (-0.26%)

$MELI (-0.24%)

$WOLF (-0.32%)

$GOOGL (+1.6%)

$EQIX (-0.19%)

$MSFT (-0.43%)

$CVNA (+0.37%)

$EBAY (-0.49%)

$005930

$6752 (-0.57%)

$KOG (+0.97%)

$VOW3 (-0.5%)

$GLE (-0.28%)

$LHA (-1.13%)

$STLAM (-0.39%)

$SPGI (+0.52%)

$MA (+0.04%)

$PUM (-0.66%)

$AIXA (+0.44%)

$FSLR (-5.98%)

$AAPL (-0.98%)

$REDDIT (+0%)

$AMZN (+1.13%)

$NET (+0.08%)

$MSTR (-4.12%)

$GDDY (-0.93%)

$TWLO (-0.85%)

$COIN (-2.68%)

$066570

$CL (+1.26%)

$ABBV (+0.52%)

$XOM (+1.68%)

- Markets

- Stocks

- Kongsberg Gruppe

- Forum Discussion

Kongsberg Gruppe

Price

Discussion about KOG

Posts

13Quarterly figures 27.10-31.10.25

Military stock picks

Like it or not, this is my stock pick for the military sector long term. No hypes, just pure core well diversified industries, free from all the junk that NATO and other ETFs have in them.

$LMT (+1.32%)

$RTX (-0.75%)

$NOC (-0.77%)

$BA. (-1.16%)

Check out the pie here:

https://www.trading212.com/pies/lua2LbG5mCkbey2atfkE807rM83oY

The Military Core 2040 Pack is a four-company portfolio designed to capture the full architecture of 21st-century defense capability.

Each company plays a distinct and complementary role in a layered global security model.

No redundancy: Each firm operates in a unique domain with minimal overlap.

Not financial advice.

Additional notes:

If I had to add any company at all to this, it would only be $PLTR (-0.13%) for the AI military play, but I already have it in my future of tech pack, not duplicating

If you wish more companies to include, you can consider satelite positons on $SAAB B (+2.62%) and $KOG (+0.97%) , both are pretty solid choices too, not as main choices though, not using them on my core DCA.

These were the ten most successful CEOs for shareholders in 2024

Hello my dears,

The CEO makes a major contribution to how successful a company is.

A CEO plays a crucial role in the success of a company. According to studies, a CEO's performance has a significant impact on company performance, with estimates ranging up to 45%. An effective CEO can increase company value through strategic direction, leadership and decision-making, while poor leadership can lead to stagnation or even decline.

Here are some aspects of how a CEO contributes to a company's success:

Strategic direction:

The CEO sets the long-term vision and strategy of the company and ensures that resources are utilized efficiently.

Leadership and motivation:

A good CEO motivates and leads employees, creates a positive corporate culture and promotes collaboration.

Decision-making:

The CEO makes important decisions that drive the company forward, whether in terms of products, markets or investments.

Communication:

The CEO is the mouthpiece of the company and communicates both internally and externally to create trust and transparency.

Crisis management:

A capable CEO can react quickly and effectively in crisis situations to avert damage to the company.

A CEO change can have a significant impact on a company, both positive and negative. If a new CEO comes in with a clear vision and effective leadership style, this can lead to a significant upturn, whereas a change to a less capable leader can lead to problems.

The role of the CEO is therefore of great importance for the success or failure of a company. A good CEO is more than just a manager; he or she is a visionary, a leader and a crisis manager who leads the company through all the ups and downs.

Dear ones, which are your favorite CEOs?

And do you even know the CEOs of your investments?

I have to admit I don't know all 59 🙈🙈

But maybe one of your CEOs is one of the 10 from 2024.

To determine the ten most successful CEOs of the year for shareholders, the business medium "The Economist" has compiled a list of CEOs whose total shareholder returns were particularly high compared to the average of listed companies in the S&P Global 1200. The S&P Global 1200 comprises the most valuable companies outside China and India. The information is based on data from "Bloomberg" and was collected between January and December 19, 2024.

10 John-Christophe Tellier (UCB) $UCB (+1.26%)

Jean-Christophe Tellier is the CEO of UCB, a global biopharmaceutical company based in Brussels. UCB specializes in the development of therapies for people with serious diseases, particularly in the fields of neurology and immunology.

In 2024, the launch of the anti-inflammatory drug Bimzelx in the US led to a sharp rise in the share price. UCB thus achieved a total shareholder return 133 percent higher than the average of the companies in the S&P 1200 over the period under review.

9 Rick Smith (Axon Enterprise). $AXON (-2.1%)

Rick Smith is the founder and CEO of Axon Enterprise, a technology company that develops public safety solutions. Originally founded in 1993 as Taser International, the company made a name for itself with the development of stun guns used by law enforcement agencies worldwide.

Despite repeated reports of a toxic workplace culture at Axon, the company has had a successful year. The rise in the share price was spurred on by the comments of the newly elected US President Donald Trump, who wants to further militarize the US federal police force. Axon Enterprise generated a 149% higher total shareholder return in 2024 than the average company in the S&P 1200.

8th Tyler Glover (Texas Pacific Land). $TPL (-1.65%)

Tyler Glover is the CEO of Texas Pacific Land Corporation (TPL), one of the largest private landowners in Texas and an influential company in the energy and real estate industries. TPL owns millions of acres of land in West Texas, particularly in the Permian Basin, one of the most productive oil and gas regions. In 2024, the company's share price rose on expectations that the high energy consumption of AI data centers will boost the business. Texas Pacific Land delivered a 158% higher total shareholder return than the average company in the S&P 1200 over the period.

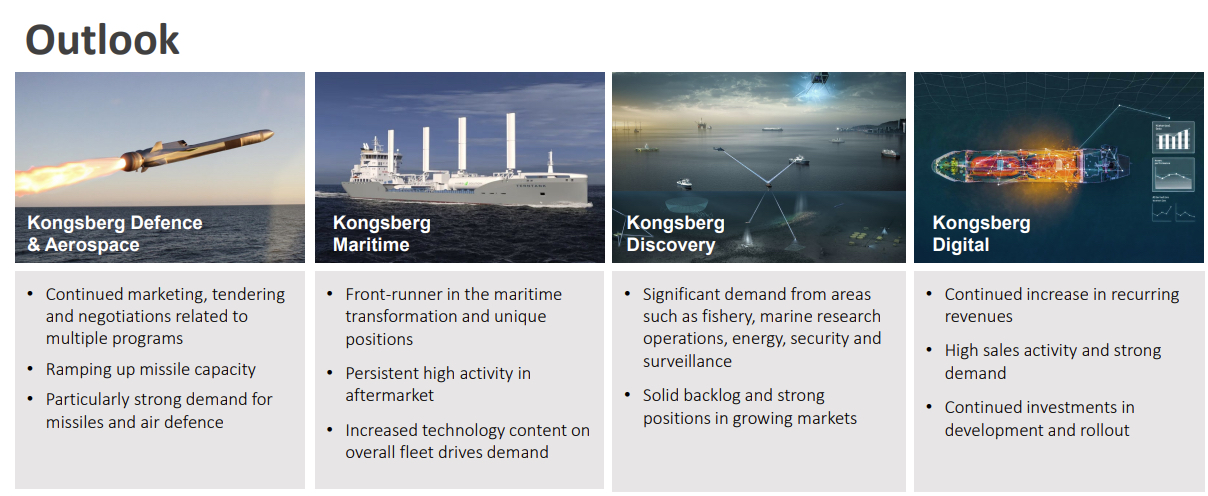

7 Geir Haoy (Kongsberg). $KOG (+0.97%)

Geir Haoy is the CEO of Kongsberg Gruppen, a Norwegian technology company operating in various industries, including defense, space, shipping, oil and gas, and digital solutions. In 2024, the company benefited from increasing orders for weapon systems. CEO Haoy achieved a 174 percent higher total return for his shareholders in 2024. 174 percent higher total return than the S&P 1200 average.

6. Yasuhito Hirota (Asics). $7936 (-1.25%)

Yasuhito Hirota is the CEO of Asics, one of the world's leading sportswear and footwear companies, which is particularly well known for its running and training shoes. This year, one model in particular has been a success for the company: Onitsuka Tiger.

The shoe is trending thanks to posts on social media and has recorded high sales figures. Asics thus achieved a 176% higher total shareholder return than the S&P 1200 average in the period under review.

5 Seiji Izumisawa (Mitsubishi Heavy Industries)

Seiji Izumisawa is the CEO of Mitsubishi Heavy Industries (MHI), a Japanese industrial conglomerate that operates in a variety of sectors, including aerospace, power generation, shipbuilding, engineering and defense. Izumisawa has bundled the company's strengths - and focused primarily on the energy and defense sectors. This year, he delivered a 177 percent higher total return to shareholders than the average company in the S&P 1200.

4. Jensen Huang (Nvidia). $NVDA (+2.51%)

Jensen Huang is the co-founder and CEO of Nvidia, a leader in graphics processing units (GPUs) and artificial intelligence (AI). Under his leadership, Nvidia has evolved from a manufacturer of graphics chips for computers to a global technology giant that also offers solutions for AI, deep learning, cloud computing and self-driving cars.

The rapid growth resulting from the AI hype slowed down this year. The high expectations of analysts were not quite met. Nevertheless, Huang was able to achieve a 180% higher total return for its shareholders in 2024 than the S&P 1200 average.

3rd Jim Burke (Vistra). $VST (+0%)

Jim Burke is the CEO of Vistra, an energy supply company based in Irving, Texas. Vistra is engaged in the generation and distribution of electricity and operates a broad portfolio of energy assets, including gas, coal, wind and solar power plants.

Similar to Texas Pacific Land, his company benefited from increasing energy consumption due to AI data centers. In 2024, it generated a 288% higher total return than the S&P 1200 average.

2nd Christian Bruch (Siemens Energy). $ENR (+0.84%)

Christian Bruch is the CEO of Siemens Energy, a global company specializing in the development, manufacture and maintenance of technologies for power generation, transmission and distribution. Siemens Energy was created in 2020 as an independent company from the spin-off of the Siemens Energy Division.

In 2024, the company recovered after Siemens Energy posted a loss of more than 4.5 billion euros in 2023. The German government provided billions in guarantees for the troubled company. In 2024, Siemens Energy achieved a total return 312 percent higher than the S&P 1200 average due to the recovery of the share price.

1 Alex Karp (Palantir). $PLTR (-0.13%)

Alex Karp is the co-founder and CEO of Palantir, a company specializing in data analytics and software solutions. Founded in 2003, Palantir provides big data analytics platforms that are mainly used by government agencies but also by companies in various sectors - and are controversial.

By 2024, the company's market capitalization had risen from USD 36 billion to over USD 180 billion. In September, Palantir was included in the S&P 500 Index of the most valuable companies in the USA. In 2024, Palantir thus achieved a total return 322 percent higher than the S&P 1200 average.

I would have expected some of the CEOs here, but there are also a few that I would not have expected.

I am invested in Siemens Energy, Vistra and NVIDIA

Unfortunately, UCB didn't make it from the Watch into my portfolio.

I hope you enjoyed the presentation of the CEOs.

Please let me know in the comments.

https://www.businessinsider.de/wirtschaft/ranking-die-besten-ceos-fuer-aktionaere-im-jahr-2024/

MilDef to deliver robust hardware worth 225 million Swedish kronor to Kongsberg Defence & Aerospace

The MilDef share has corrected sharply in recent weeks. A major insider sale by company director Daniel Ljunggren drove investors out of the Scandinavian second-tier stock, which had previously performed strongly. In the meantime, a technical stabilization is emerging on the chart, underpinned by an order placed last Friday.

MilDef is to supply robust hardware worth 225 million Swedish kronor (equivalent to 20.1 million euros) to Kongsberg Defense & Aerospace. The customer is a long-standing partner and customer of the Swedes. The products that MilDef is supplying to Kongsberg include solutions such as computers, switches, servers and displays for various platforms.

"This is MilDef's largest single order in the Norwegian market and we are honored to be part of an important and cutting-edge defense system manufactured in Norway. This is proof of how Nordic defense companies work together and take responsibility for European defense," says Daniel Ljunggren about the latest order.

Even though the news only hit the stock market ticker last Friday (July 4), the Scandinavian company has included the order from Kongsberg in its order backlog for the second quarter, which ended a few days earlier. MilDef is aiming to deliver the hardware from next year.

This is MilDef - We armor IT.

Great momentum!

Share of the day

MilDef is a global systems integrator and full-service provider specializing in rugged IT for defense and security sectors. MilDef provides hardware, software and services to protect critical information flows and systems - whenever and wherever the risks are greatest.

WE ARMOR IT.

MilDef is a systems integrator and full-service provider specializing in rugged IT for the defense and security sector. We provide hardware, software and services that enable the digitization of critical information flows under the toughest conditions and in the most demanding environments.

We protect key information flows and systems wherever and whenever the stakes are high. We provide secure, robust and reliable IT that ultimately protects not only human lives, but also our common way of life, freedom and democracy. The very foundation of our society.

Working closely with our customers and partners, we integrate durable, reliable and customized hardware into highly flexible and adaptable systems and solutions. Solutions that undergo rigorous testing - not only in our laboratories and environmental testing facilities, but also in real-world applications.

MilDef products are sold to more than 200 customers through subsidiaries in Sweden, Norway, Finland, Denmark, the UK, Germany, Switzerland, the USA and Australia. MilDef was founded in 1997 in Helsingborg, Sweden. The MilDef Group has been listed on Nasdaq Stockholm since 2021.

Germany wants to buy Joint Strike Missiles for F-35 from Kongsberg

The German government has decided to purchase the Joint Strike Missile (JSM) air-to-ground missile for its F-35 fighter jets. The agreement is expected to be worth around NOK 6.5 billion for the Norwegian defense company Kongsberg Defence & Aerospace as the supplier, as the company writes in a press release. The corresponding 25 million euro bill was discussed in the Bundestag yesterday.

As stated in the budget committee's submission, it concerned the procurement of the missile as part of a cooperation with the Kingdom of Norway and the granting of an over-scheduled commitment authorization totaling 478.656 million euros.

The Joint Strike Missile is an air-to-ground missile weighing around 400 kg that can also be carried in the internal weapon bays of the F-35. The manufacturer gives the range as more than 350 km.

According to the Kongsberg announcement, the planned procurement is a government deal between Norway and Germany as part of the cooperation between the two nations in the field of naval defense equipment. According to the agreement, the Norwegian Defense Materiel Agency (NDMA) will act as the contracting party.

The intergovernmental agreement for the German procurement of the JSM was approved by the Bundestag on June 4. According to the press release, negotiations are still ongoing. It is expected that the contract will be signed by the end of the first half of 2025.

Alongside Norway, Japan, Australia and the USA, Germany will be the fifth country to opt for the JSM.

"We are delighted that Germany has become the fifth nation to select the JSM for its F-35 fleet," said Eirik Lie, President of Kongsberg Defense & Aerospace, in the press release. "The JSM's navigation system, flight profile and automatic target recognition technology make it an excellent addition to the F-35."

Lars Hoffmann

https://www.hartpunkt.de/deutschland-will-joint-strike-missiles-fuer-f-35-bei-kongsberg-kaufen/

Podcast episode 81 "Buy High. Sell Low."

Subscribe to the podcast so that AI doesn't kill us like Skynet in Terminator with Arnold.

00:00:00 Market overview

00:05:00 Eli Lilly & Novo Nordisk

00:24:30 Walmart, Costco, Target

00:42:20 Trend following models, FED, outlook

00:55:00 Gold, Gold 3x Factor ETF A1VBKP

01:11:20 Bitcoin

01:27:20 WisdomTree Europe Defense ETF A40Y9K

01:31:20 AI lies

Spotify

https://open.spotify.com/episode/6tYBjXQRNO1oZYrR2Yuwec?si=R6Vl3hd4Rk2LX80UeugNhw

YouTube

ApplePodcast

$BTC (-0.35%)

#bitcoin

#gold

$LLY (-0.65%)

$TGT (-1.38%)

$COST (+0.29%)

$WMT (-3.83%)

$RHM (-0.18%)

$SAAB B (+2.62%)

$THALES (-1%)

$SAF (-1.47%)

$KOG (+0.97%)

I would be interested in your current performance next episode

The first quarter is now over ✌️

Kongsberg puts its first satellite into operation

The Norwegian defense company Kongsberg Defence & Aerospace has launched its first microsatellite into space and has thus entered the space industry as a satellite operator and service provider.

The satellite, called ARVAKER 1 N3X, was launched from Vandenberg Space Force Base in California as part of SpaceX's Transporter 13 launch service, according to a Kongsberg press release.

Kongsberg's companies and subsidiaries reportedly cover the entire value chain to provide next-generation satellite services, from providing its own microsatellites and ground stations to data processing and analysis. Kongsberg is positioned to deliver complete system solutions that combine the space segment with ground systems to improve data transmission and reduce latency. A key capability of Kongsberg is to integrate and test satellites with sensitive and government-controlled payloads in its own facilities.

In 2024, Kongsberg was awarded a contract by the Norwegian Armed Forces to provide maritime surveillance data to cover Norwegian areas of interest. Under the five-year contract, Kongsberg will launch three satellites, the company writes.

According to the announcement, the data will be used by the Norwegian Armed Forces and other Norwegian government institutions involved in maritime security.

The MP42H satellites are manufactured by Kongsberg NanoAvionics and are equipped with Automatic Identification System (AIS) receivers and detector systems supplied by Kongsberg Discovery. This includes a navigation radar detector developed by the Norwegian Defense Research Institute (FFI). According to the press release, Kongsberg NanoAvionics has manufactured and launched 40 satellites to date.

The satellites are operated by Kongsberg Satellite Services (KSAT), which intends to use its international network of download stations to provide high-frequency, low-latency surveillance data for both the Norwegian government and international customers.

lah

https://www.hartpunkt.de/kongsberg-nimmt-seinen-ersten-satelliten-in-betrieb/

At last! A European Defense ETF

$IE0002Y8CX98 (+0.12%) - WisdomTree Europe Defense UCITS ETF - EUR Acc

TOP 10

"The index was developed by WisdomTree, Inc. ("WT"). The selection of European

companies in the index is based on their share of sales from the defense sector. The Index also seeks to exclude companies associated with weapons that are banned under international law, such as cluster munitions, anti-personnel mines, and biological and chemical weapons. The index also seeks to exclude companies that violate certain generally accepted international norms and standards, such as the principles of the United Nations Global Compact.

At least 20 stocks that meet the revenue share criteria as well as additional minimum requirements regarding market capitalization and liquidity are selected for inclusion. The selected companies in the index are weighted according to free float-adjusted market capitalization - adjusted by the exposure score - while complying with the upper limits and criteria defined in the index methodology.

The index is rebalanced every six months."

#wisdomtree

#europe

#defense

#etf

#defenseetf

#rheinmetall

#leonardo

#saab

#baesystems

#thales

Kongsberg receives major order to supply Naval Strike Missiles to the U.S. Navy and the U.S. Marine Corps. $KOG (+0.97%)

Norwegian defense contractor Kongsberg Defence & Aerospace has signed a multi-year procurement contract to supply Naval Strike Missile (NSM) missiles to the U.S. Navy and Fleet Marine Force over a five-year period. The fixed-price contract awarded yesterday is worth NOK 10 billion (around 900 million US dollars), Kongsberg announced. The contract includes options that, if exercised, would increase the cumulative value of the contract to approximately NOK 12 billion, the statement added.

"This contract is the largest defense contract in Kongsberg's history and an important milestone for us," said Geir Håøy, President and CEO of Kongsberg.

The NSM missile is reportedly the centerpiece of the U.S. Navy's Over-the-Horizon Weapons System (OTH-WS) program and will be installed on Littoral Combat Ships and Constellation-class frigates. Kongsberg also supplies NSM to the U.S. Marine Corps as a key component of the Navy Marine Expeditionary Ship Interdiction System (NMESIS) program.

According to Eirik Lie, President of Kongsberg Defense & Aerospace, the multi-year procurement contract provides stability along the entire supply chain for the company and its subcontractors. In response to strong demand, Kongsberg recently announced the construction of a new factory in James City County, Virginia, to meet the growing demand for the Joint Strike Missile (JSM) and NSM. In addition, Kongsberg has opened a production line in Norway this year and announced the construction of a plant in Australia.

The NSM was developed by Kongsberg and first deployed by the Norwegian Navy in 2012. NSM is the main weapon of the Norwegian frigates and corvettes and has been selected by the U.S. Navy, the U.S. Marine Corps, Poland, Romania, Canada, Germany, Australia, Malaysia, Spain, the United Kingdom, the Netherlands, Belgium and Latvia, according to the manufacturer.

New addition: Kongsberg Gruppen ASA

- Norwegian company in the fields of defense, security and energy transition

- Kongsberg Maritime and Kongsberg Defense & Aerospace have shown considerable growth recently

- Third largest company on Oslo Børs by market capitalization (according to Equnior(Statoil) and DNB (Den Norske Banken))

Due to the tense political situation in the world, the investment was considered precisely because it is 'crisis-proof' and benefits from conflicts.

Another reason for my investment is that a strong defense industry contributes to national security and thus ultimately ensures the protection of the population.

Sources and other interesting articles:

https://e24.no/boers-og-finans/i/Oo8V5q/kongsberg-aksjen-har-gitt-937-prosent-avkastning-paa-fem-aar

https://de.marketscreener.com/kurs/aktie/KONGSBERG-GRUPPEN-ASA-1413189/

Trending Securities

Top creators this week