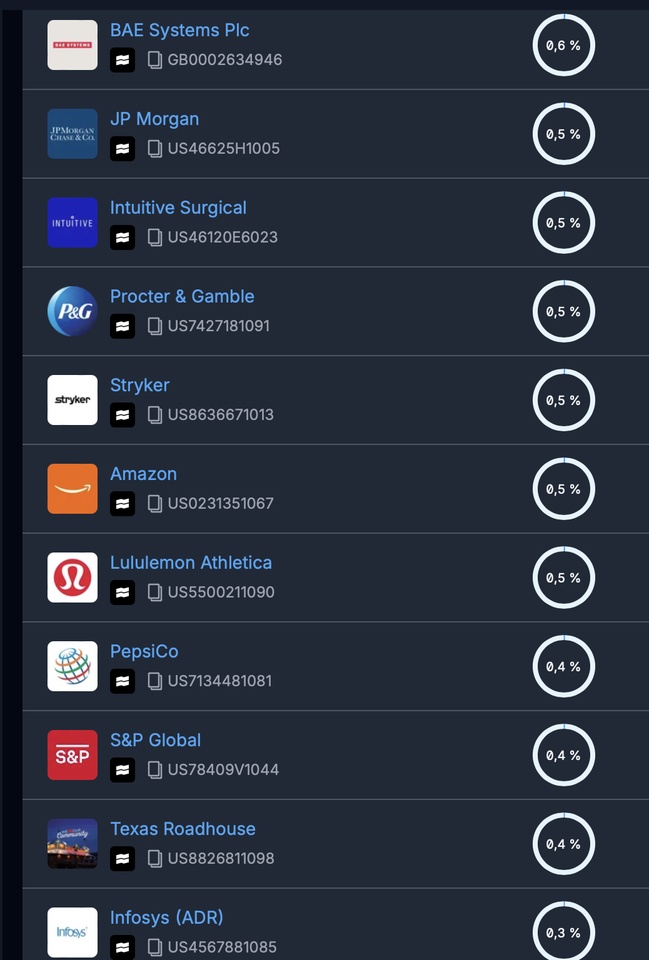

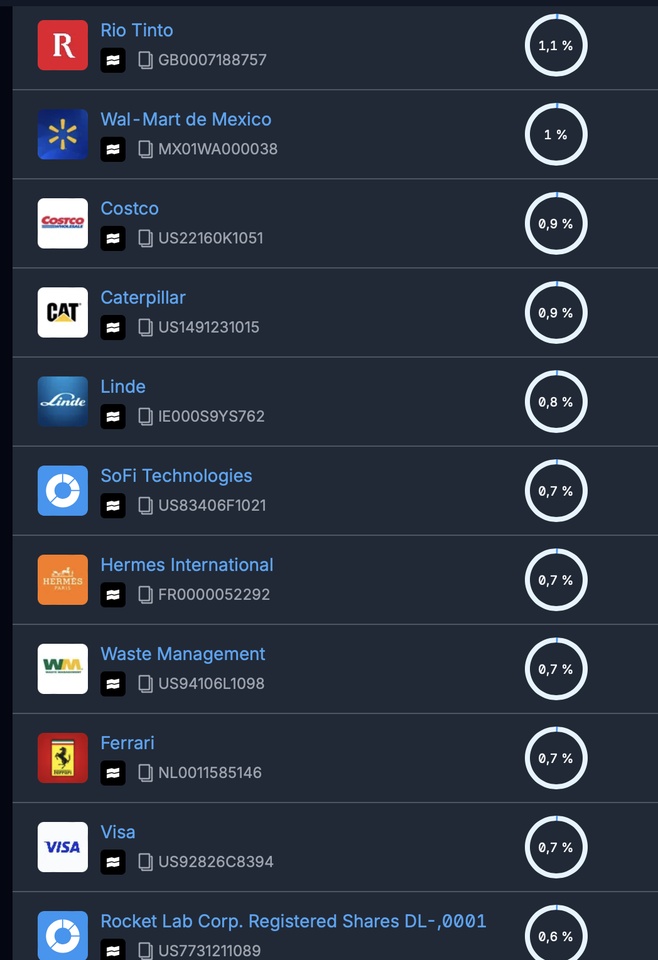

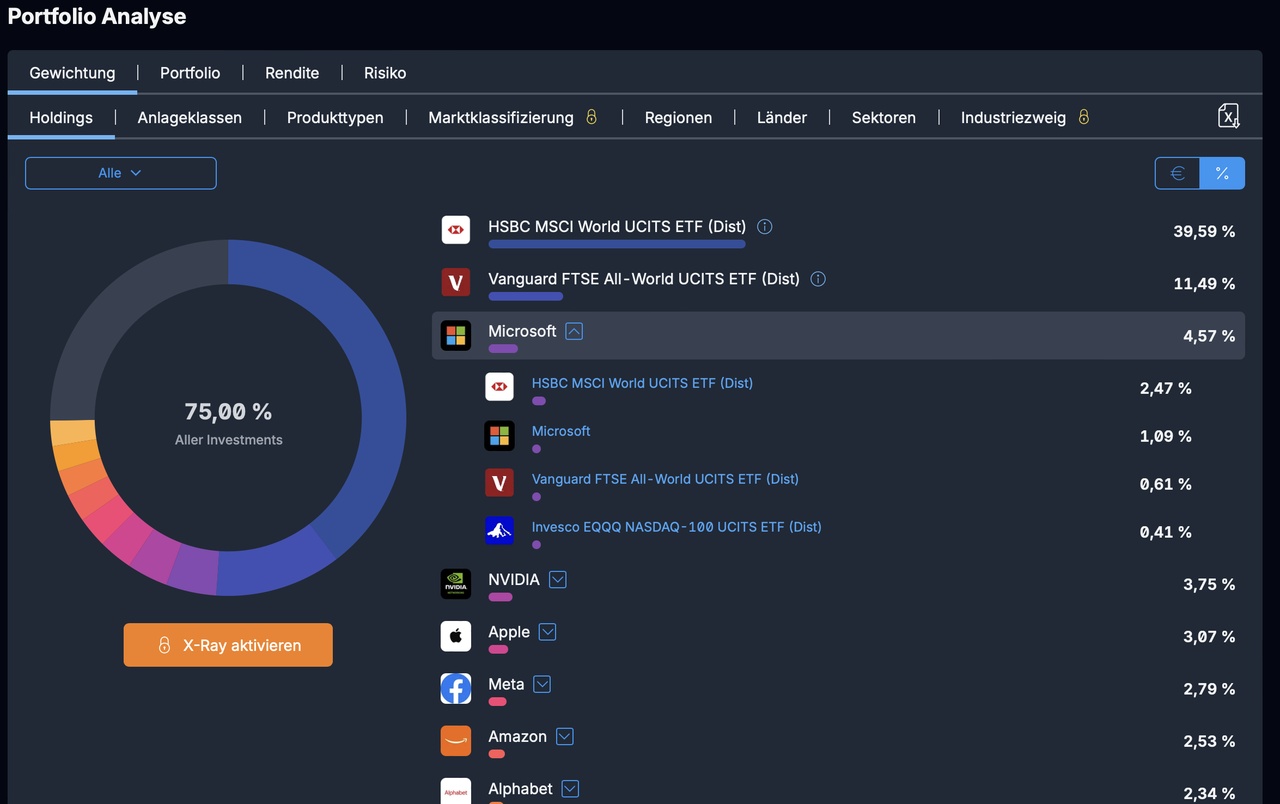

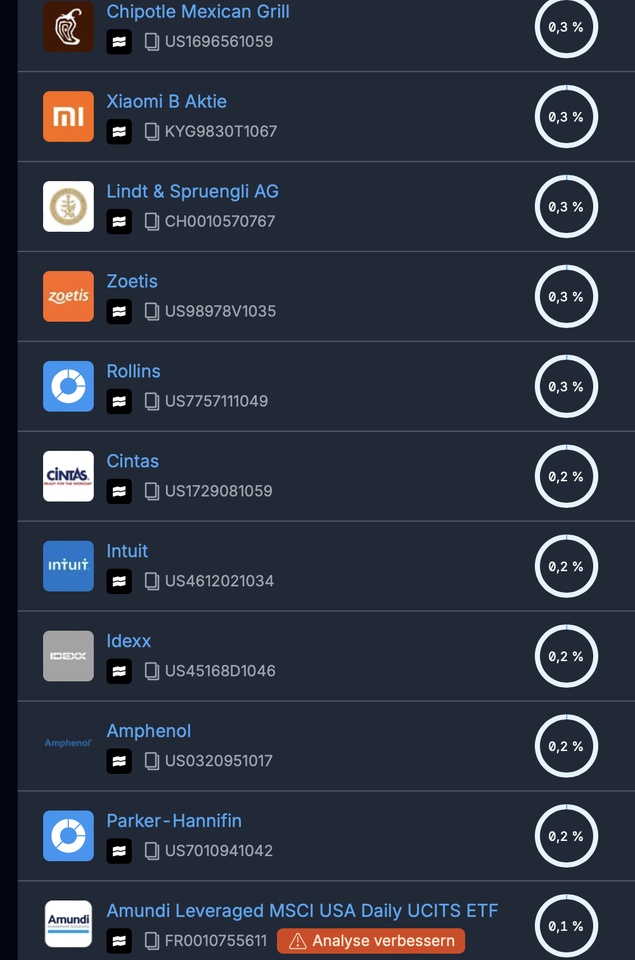

A lot has happened in my portfolio again in recent weeks. In addition to a few sales (including $GOOGL (+0.02%) and $NVDA (+0.32%)) from hot sectors, I have built up cash and diversified further ($CMG (-0.75%)

$SNPS, (-3.14%)

$BRO (-0.71%)

$AMGN (-2.02%)

$LSEG (+0%)). Further acquisitions and new entries (e.g. $INTU (-2.35%)

$ADP (-1.43%)

$WM (-1.07%)

$CTAS (-1.59%)

$RMS (-0.62%)) are planned. As short- to medium-term trades, I have invested in $Adobe (-3.55%) and $TTD (-0.23%) as short to medium-term trades. I mainly invest for the long term, but a correction (technology, cloud) including sector rotation (consumer, pharma, software) seems inevitable to me. I am therefore taking a wait-and-see approach and, if necessary, I will reenter $GOOGL (+0.02%) and $NVDA (+0.32%) again at the appropriate time.

Please let me know what you think.

I will probably share future updates with you every two months at the beginning of the month (November, January,...).

I wish you all a successful time.