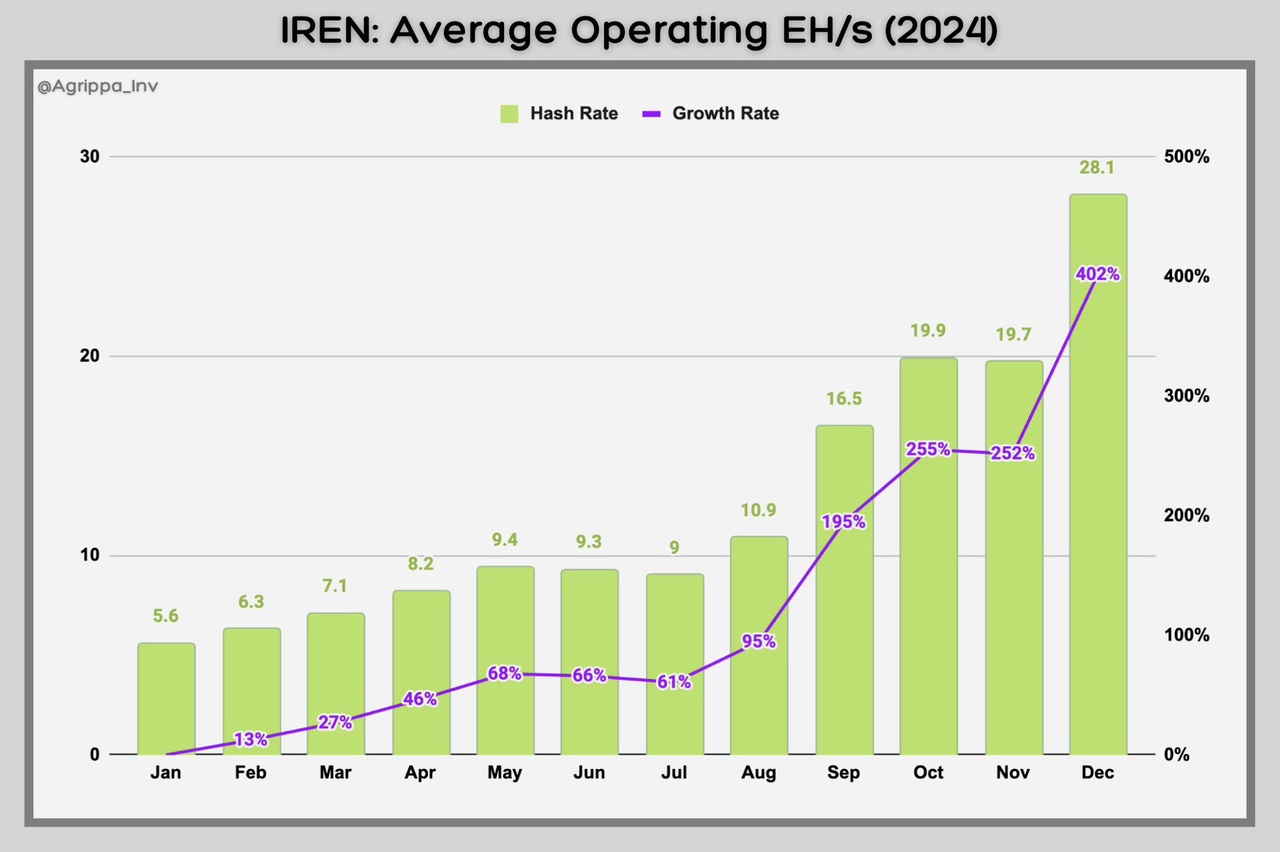

$IREN (+7.59%) started earlier than its competitors. The potential is incredible in the truest sense of the word.

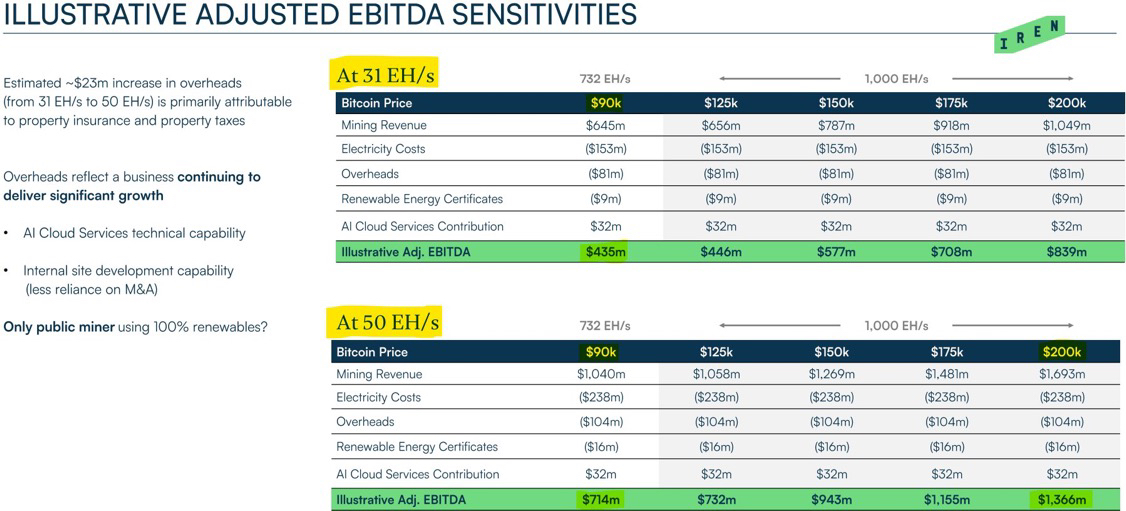

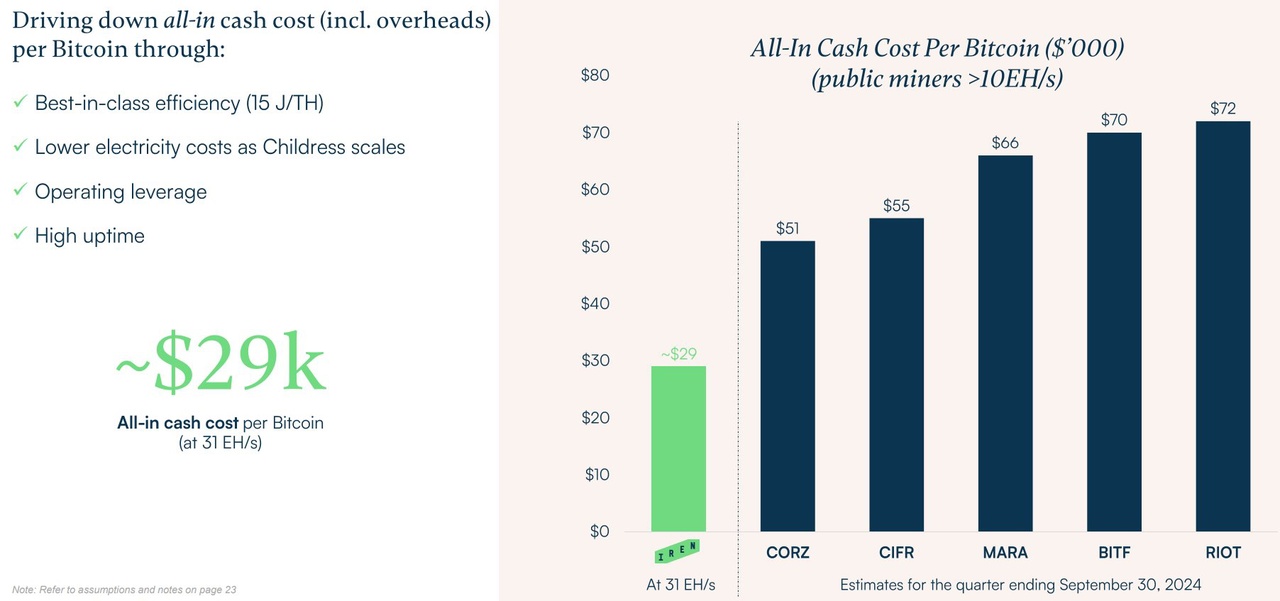

"We own the entire stack - land, electricity, substations, data centers and computers. We don't lease anything. This means lower costs, higher performance and long-term reliability. Currently, GPUs consume less than 2% of our total energy portfolio."

CEO & Founder Daniel Roberts

$IREN (+7.59%) Vertical DC integration

What does the vertical integration of data centers mean for $IREN (+7.59%) ? We take a look at this article from DataXConnect: " $NBIS (+2.8%) will be a DataOne tenant for the next 10 years" (1). $NBIS (+2.8%) provides the designs for the construction by DataOne. DataOne owns power, land, substations, transmission infrastructure, backup power generation and facility operations!

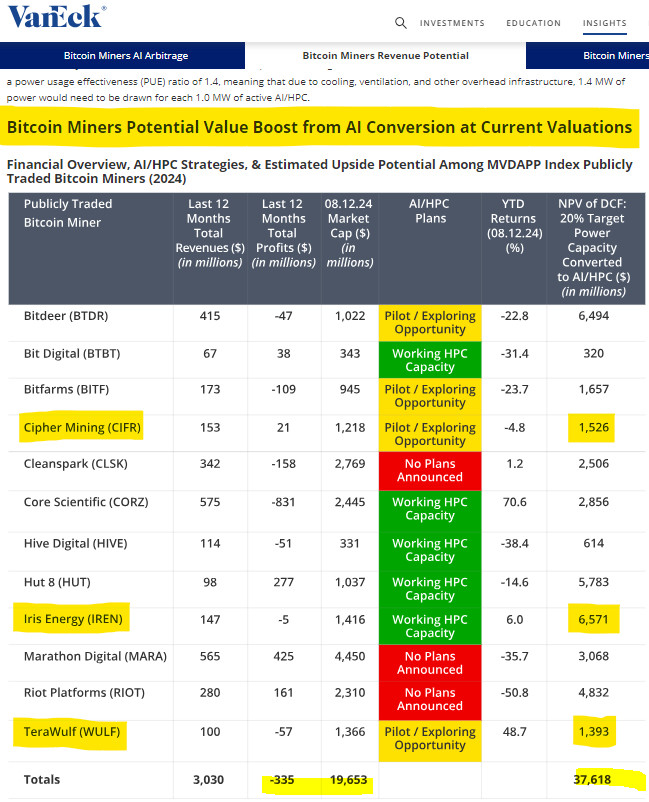

$NBIS (+2.8%) pays colocation to DataOne! The 3.7 billion that Google/Fluidstack $WULF (+2.07%) pays for 200 MW (2)? The 3 billion that Google/Fluidstack pays $CIFR (+5.78%) pays for 168 MW (3)?

$NBIS (+2.8%) DataOne is paying around 5.45 billion for their 300 MW. It is probably more, as DataOne has significantly more influence than $WULF (+2.07%) / $CIFR (+5.78%) as DataOne/BSO operates 240 data centers worldwide; for comparison: $EQIX (+1.24%) (75 billion mcap) has 270 data centers. In addition, DataOne has additional capital expenditures for gas turbines behind the meter and will likely pass at least some of the costs on to $NBIS (+2.8%) pass on. For $IREN (+7.59%) which has already paid most of these costs at lower prices, this is largely pure margin!

From the Neoclouds $ORCL (-1.41%) , $CRWV (-2.77%) , $NBIS (+2.8%) , $IREN (+7.59%) . Is $IREN (+7.59%) the only ones who own their own land, power, data centers and electrical infrastructure! $CRWV (-2.77%) was lucky and signed a contract with $CORZ (-2.28%) when $CORZ (-2.28%) was on the verge of bankruptcy. He also secured $ORCL (-1.41%) Crusoe's electricity when Crusoe failed at Bitcoin mining. $CRWV (-2.77%) at least recognizes the weakness and tries to $CORZ (-2.28%) to buy up.

$CIFR (+5.78%)

$CRWV (-2.77%)

$NBIS (+2.8%)

$GOOGL (-0.67%)

$GOOG (-0.5%)

$MSFT (-0.15%)

$META (-2.33%)

$ORCL (-1.41%)

$NVDA (-0.8%)

$WULF (+2.07%)