Part 5 of 5

/ Review of the year 2024: In the first 4 parts

of my investment story, I looked at the years 2013 to 2023.

A mixture of highs and lows. While there was a lot of learning at the beginning, the last few years are finally bearing fruit!

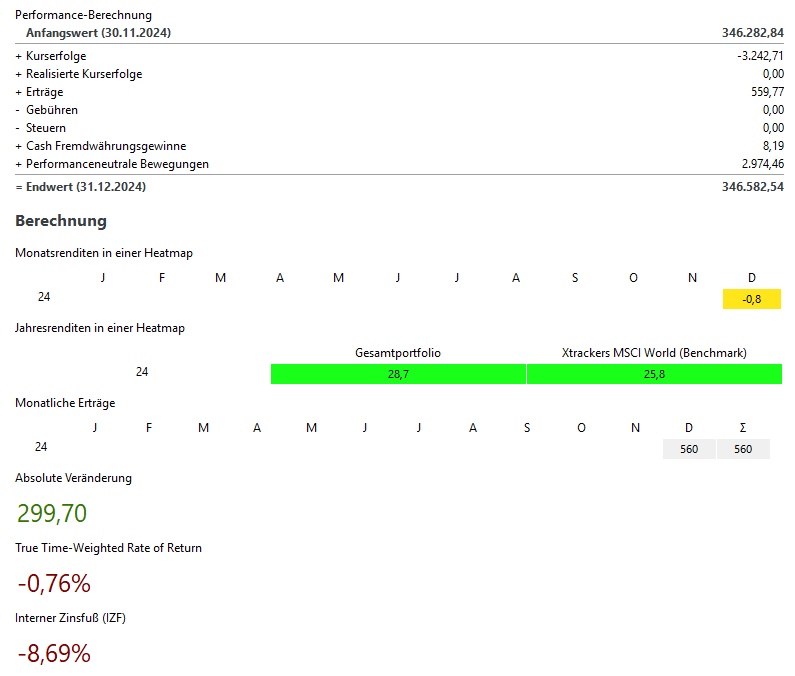

Monthly view:

2024 was another very positive year, although December again resulted in a slight loss in the portfolio.

In total, December was -0,8%. This corresponds to price losses of -3.200€.

The MSCI World (benchmark) was -0.9% and the S&P500 -2.5%.

In the following, however, I would like to look primarily at the whole of 2024 and not

just December.

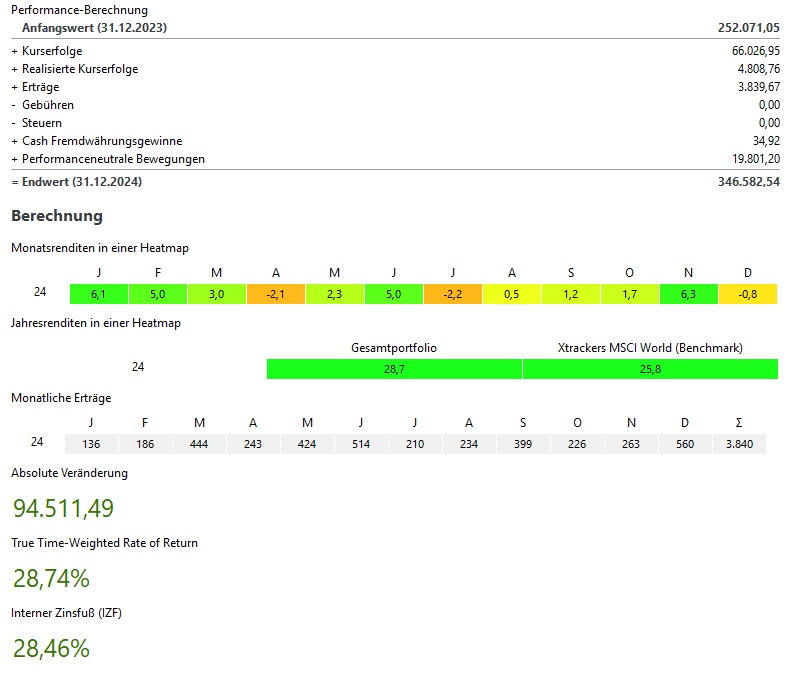

Year as a whole:

Winners & losers:

The winner par excellence is hardly surprising NVIDIA $NVDA (-0.96%) with

almost €20,000 in share price gains! And this despite the fact that I took my entire stake of ~€4,000 off the table in March.

In 2nd place follows Bitcoin

$BTC (-2.96%) with approx. 6,000€ price gains. 3rd-5th place

are shared by TSMC $TSM (-4.99%)

Alphabet $GOOG (-1.43%) and Meta

$META (-0.47%) with gains of ~€5,000 each.

On the loser side it looks very relaxed all in all.

Sartorius $SRT (-3.2%)

Nike $NKE (-2.66%)

and Bechtle $BC8 (-1%) have each caused share price losses of ~€1,000. They are followed by LVMH $MC (-3.93%) with share price losses of €500 and Amgen $AMGN (-1.71%) with €200.

All in all, share price losses that are not really worth mentioning.

The performance-neutral movements in 2024 were just under €20,000. This is a significant decline compared to the almost €30,000 from previous years. This was due to some private issues and the upcoming house construction.

My performance for the year as a whole was +28,8% and therefore outperformed my benchmark, the MSCI World, by 25.8%.

In total, my portfolio currently stands at ~347.000€. This

corresponds to an absolute growth of ~95,000€ in the current

year 2023. ~71.000€ of which comes from price gains, ~3.800€ from

dividends / interest and ~20.000€ from additional investments.

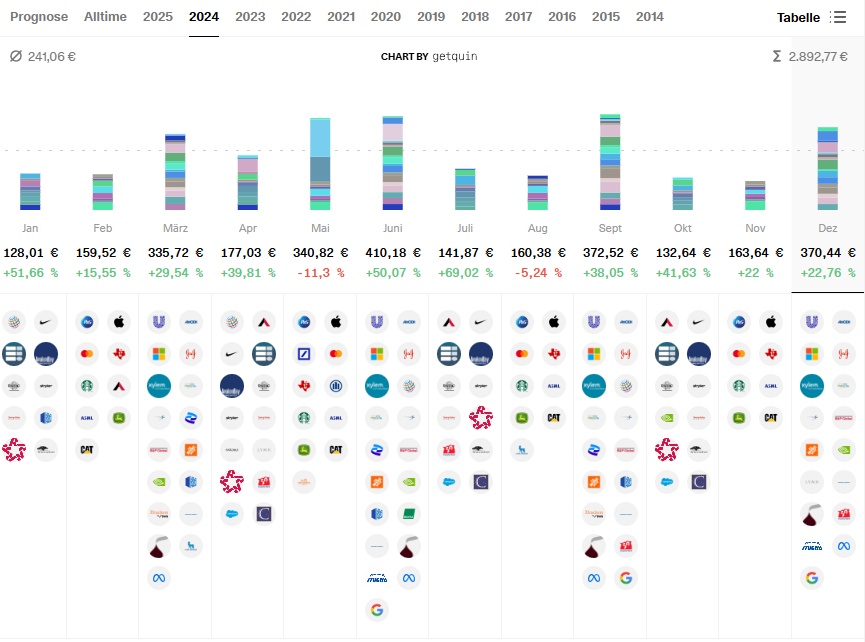

Dividend:

- The dividends in December were 17% above the previous year at ~€370

- Amgen is in the lead with over 50€ (gross) dividend every 3 months

- For the year as a whole, my dividends amounted to ~2.900€ and thus almost 25% over 2023

Buys & sells:

- I bought in December for a significantly reduced ~500€

- As always, my savings plans were executed:

- Blue chips: Lockheed Martin $LMT (-1.52%) Republic Services $RSG (+1.04%) Thermo Fisher $TMO (-1.07%) ASML $ASML (-4.78%) Northrop Grumman $NOC (-1.09%) Itochu $8001 (-6.28%) Constellation Software $CSU (-1.18%) Hermes $RMS Salesforce $CRM (+0.02%) MasterCard $MA (-0.26%) Deere $DE (-2.01%)

- Growth: -

- ETFs: MSCI World $XDWD (-1.98%) and the WisdomTree Global Quality Dividend Growth $GGRP (-2.26%)

- Crypto: Bitcoin $BTC (-2.96%) and Ethereum $ETH (-4.37%)

- There were no further sales in December

Target 2024 & outlook 2025:

My goal for 2024 was to reach €300,000 in the portfolio. Due to the

extremely positive market performance in the current year, my portfolio stands at ~€ 350,000 at the end of the year. I was therefore able to significantly exceed my target.

What will happen in 2025? The logical target, of course, would be 400.000€ to be achieved. However, due to the upcoming house construction, part of the assets will be invested in the house construction. If I include the property in my statement of assets, the target of €400,000 would of course not change.

However, as I am more likely to be tracking my liquid assets here, I will probably

probably refrain from doing so.

Therefore, my year-end target for 2025 will probably be closer to the final balance for 2024. So around €350,000 at the end of 2025.

How are things looking for you? Have you already thought about your plans for 2025?

Finally, I wanted to say thank you again for all the positive reactions to my investment story!

https://linktr.ee/mister.ultra

#dividends

#dividende

#rückblick

#depotupdate

#aktie

#stocks

#etfs

#crypto

#personalstrategy