From crypto to AI: Galaxy transforms Helios with USD 1.4 billion in project financing

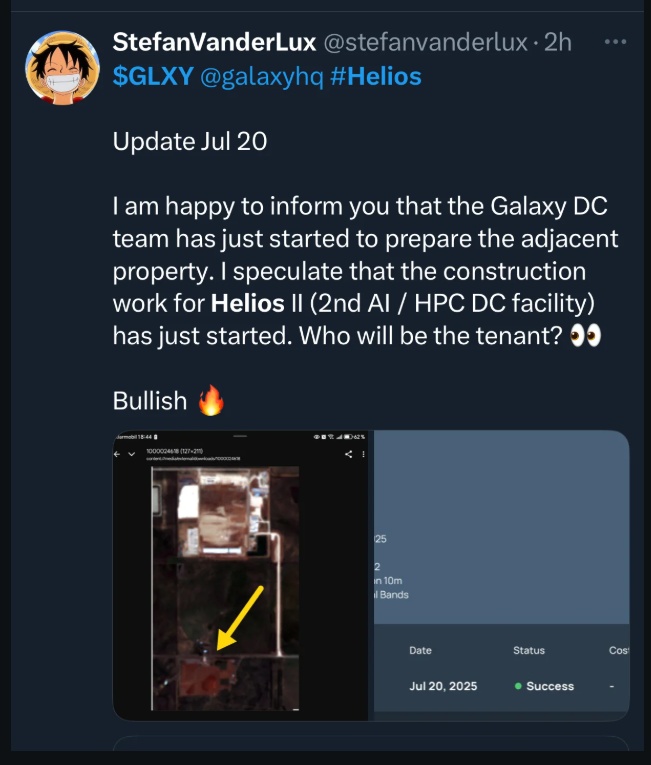

It was assumed that $GLXY (-1.29%) the adjacent areas of Helios are being prepared for additional AI data centers - this assessment is confirmed by new information.

"They have delayed the quarterly report to August 5 - a very positive sign that they are beating expectations and/or making big announcements."

this assessment is now confirmed:

Satellite images (Credit: u/stefanvanderlux) show initial development work on the neighboring property; in parallel, Galaxy has secured binding, secured project financing in the amount of 1.4 billion USD (80 % loan-to-cost, 36 months), whereby USD 350 million in equity equity has already been contributed and the loan is secured by the assets of Galaxy Helios I.

The financing is for the conversion and expansion of the Helios campus in West Texas into a large-scale AI/HPC infrastructureinfrastructure, the first phase of which will 2026 phase is scheduled to start in early 2026; the maturity date of the current facility is August 15, 2028 dated August 15, 2028.

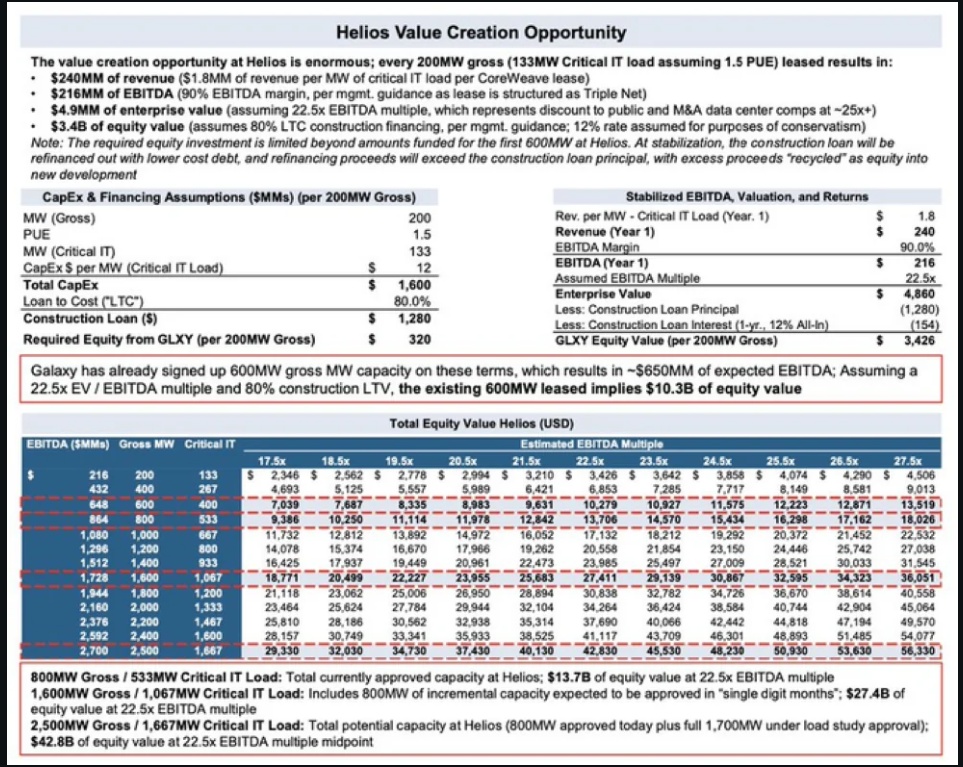

At the same time, the GPU cloud provider $CRWV (-2.34%) has drawn its final option and secured a total of 800 MW of approved IT capacity at the site; the agreements include long-term terms of use (15 years) and are the basis for Galaxy estimates of >1 billion USD annual revenue from this deal.

Technically, the facility is designed for high-density AI workloads: planned equipment with $NVDA (-0.86%)

H100 GPUs, the use of liquid cooling (with up to 40% lower energy requirements compared to conventional systems) and the use of 100 % carbon-free, "onsite" renewable energy are emphasized in the announcements.

The potential of the site is considerable: Helios can generate up to 3.5 GW scalable; 2.7 GW are the subject of load studies and an additional 1.7 GW under construction - making Helios one of the largest AI data center campuses in the USA. In addition to Phase I (already contracted capacity), there is an additional leasing agreement for Phase II for a further 260 MW IT load.

At the same time, a €1.2 billion expansion initiative was announced, in which $GLXY (-1.29%) with USD 750 million and $CRWV (-2.34%) with USD 450 million are to be involved - a signal for planned regional expansion beyond Texas and Nevada.

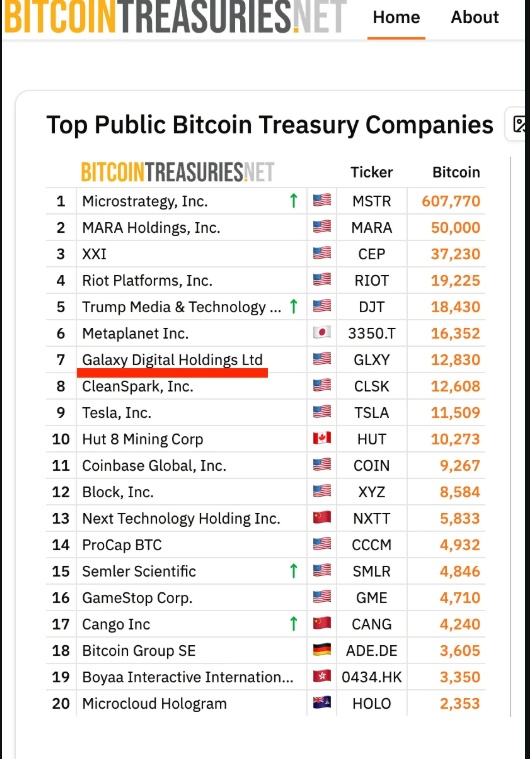

At the governance and management level, Galaxy and CoreWeave are apparently working on a common framework for AI governance (transparency, data protection), which underlines the regulatory maturity of the project. Operationally and financially, Galaxy is underpinning the transformation: the latest quarterly report shows a gross profit of USD 299 million gross profit and a 12-month turnover of approximately USD 3.2 billion;

in addition Matt Friedrich was appointed Chief Legal Officer (taking office on September 8, 2025), which complements the strength of the management board.

To summarize:

The combination of concrete construction activities on adjacent sites, the secured project financing, the full CoreWeave commitment to 800 MW as well as technical and energy alignment makes the earlier assumption about a significant expansion of Helios plausible and verifiable.

For Galaxy, this means a clear strategic realignment from a predominantly crypto-oriented business model to a capital-intensive but contract-based AI infrastructure platform with potentially stable, recurring cash flows.

Important:

The development is promising, but not free of risks

- Construction and schedule risk

- Implementation of the power supply

- Market and demand development for GPU compute

This is not investment advice - just a summary of the facts and what they mean for the Helios transformation.

Sources: