Following the Israeli attack on Iranian nuclear facilities on June 13, 2025, oil prices skyrocketed. $IOIL00 (+0.03%) rose to USD 77 per barrel, the sharpest increase since the coronavirus crisis in 2020. The market reacted with price losses, and shifts into $965515 (+0.66%) the US dollar and bonds.

Chapter overview:

I: Key facts

II: Strait of Hormuz

III: Oil Infrastructure

IV: Oil in connection with CPI data

V: Scenarios for this conflict

Let's take a sober look at the situation, is the oil price overreacting?

I: Key Facts

Iran currently produces around 3.3 to 4 million barrels of oil per day and exports around 1.5 to 1.7 million barrels, with the majority of these exports going to China. Should there be a shortfall in Iranian exports, for example due to attacks on production facilities or sanctions, this would be manageable for the commodities market in the short term. The daily volume corresponds to only a small part of the global oil demand of over 100 million barrels per day. This means that although the market will react to a shortfall, other producers such as the USA, Brazil or Saudi Arabia will be able to close part of the gap. The actual market reaction is therefore not primarily driven by a real supply shortfall, but by the fear of further escalation.

If we look at the status quo from a market psychology perspective, then the main cause of the price jumps is uncertainty about a possible spread of the conflict to the entire Gulf region. After all, this region is responsible for around a fifth of global oil shipments, as it is home to key oil-producing countries such as Saudi Arabia, Iraq, the United Arab Emirates and Kuwait. The mere possibility that the conflict could spread and other countries or production facilities could be affected leads to risk premiums on the futures market. Traders are therefore buying oil futures as a hedge against possible supply chain issues, which is also driving up prices. The fear of a blockade of the Strait of Hormuz, one of the world's most important oil transport routes, is a particularly strong price driver.

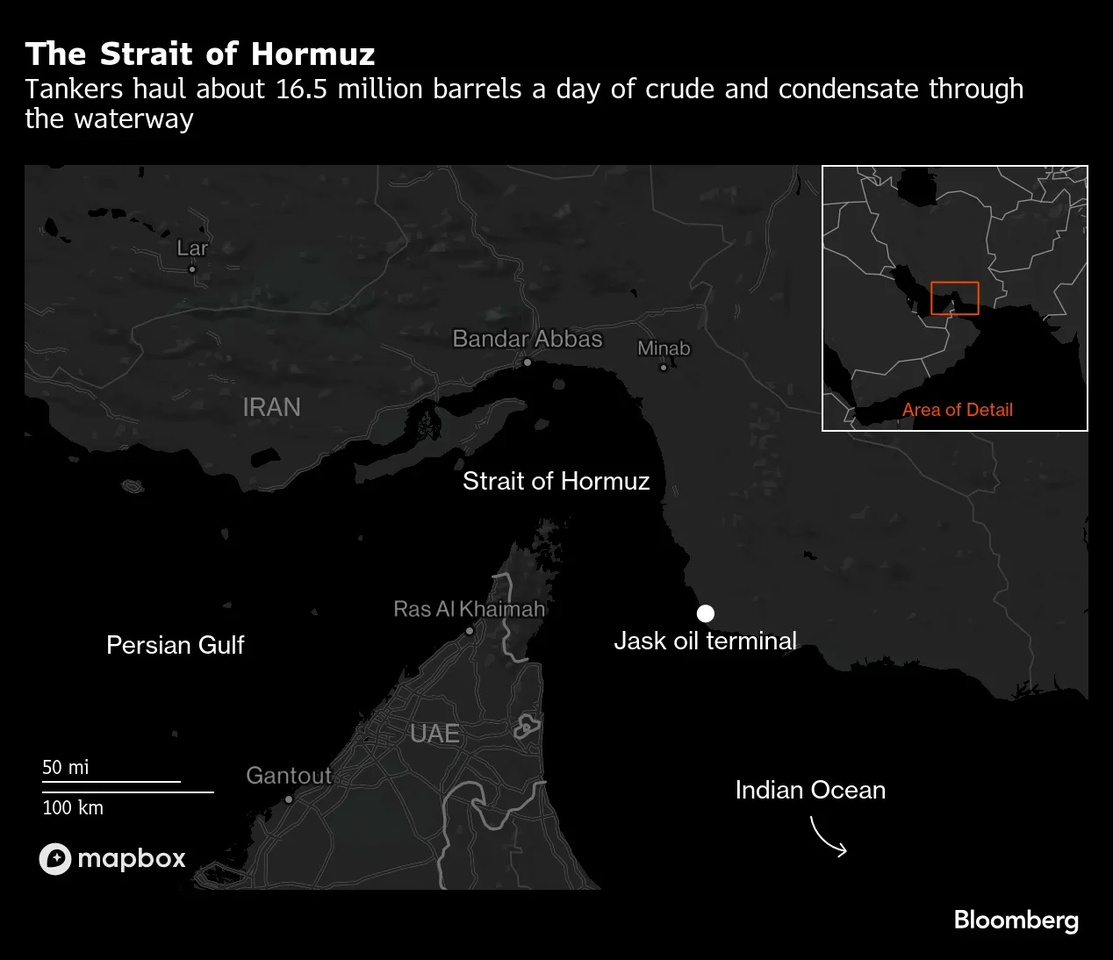

II: Strait of Hormuz

𝖣𝗂𝖾𝖾 𝖲𝗍𝗋𝖺ß𝖾 𝗏𝗈𝗇 𝖧𝗈𝗋𝗆𝗎𝗌 𝗏𝖾𝗋𝖻𝗂𝗇𝖽𝖾𝗍 𝖽𝖾𝗇 𝖯𝖾𝗋𝗌𝗂𝗌𝖼𝗁𝖾𝗇 𝖦𝗈𝗅𝖿 𝗆𝗂𝗍 𝖽𝖾𝗆 𝖦𝗈𝗅𝖿 𝗏𝗈𝗇 𝖮𝗆𝖺𝗇 𝗎𝗇𝖽 𝖽𝖾𝗆 𝖠𝗋𝖺𝖻𝗂𝗌𝖼𝗁𝖾𝗇 𝖬𝖾𝖾𝗋. 𝖳ä𝗀𝗅𝗂𝖼𝗁 𝗉𝖺𝗌𝗌𝗂𝖾𝗋𝖾𝗇 𝖽𝗈𝗋𝗍 𝗋𝗎𝗇𝖽 20 𝖬𝗂𝗅𝗅𝗂𝗈𝗇𝖾𝗇 𝖡𝖺𝗋𝗋𝖾𝗅 𝖱𝗈𝗁ö𝗅, 𝖾𝗍𝗐𝖺 𝖾𝗂𝗇 𝖥ü𝗇𝖿𝗍𝖾𝗅 𝖽𝖾𝗌 𝗐𝖾𝗅𝗍𝗐𝖾𝗂𝗍𝖾𝗇 𝖡𝖾𝖽𝖺𝗋𝖿𝗌. 𝖲𝗂𝖾 𝗂𝗌𝗍 𝖽𝖺𝗆𝗂𝗍 𝖽𝗂𝖾 𝗐𝗂𝖼𝗁𝗍𝗂𝗀𝗌𝗍𝖾 Ö𝗅𝗍𝗋𝖺𝗇𝗌𝗉𝗈𝗋𝗍𝗋𝗈𝗎𝗍𝖾 𝖽𝖾𝗋 𝖶𝖾𝗅𝗍.

But a spear of the road is small at the moment. It has to be said that a closure in the future is also very low, because it has never been closed. Bear in mind that there was much more conflict in the region at the time. During the Iraq-Iran war, also known as the tanker war, numerous oil tankers were attacked, but the road remained open despite heavy fighting. Iran has also repeatedly threatened to block the strait in recent decades, particularly in response to sanctions or military pressure. However, the threats were never carried out. From a game theory perspective, this is called an empty threat.

There are several reasons for not closing the straits. First, the US and allies have a strong naval presence in the region to ensure freedom of navigation. Secondly, Iran is also dependent on the revenue from oil exports via the Strait of Hormuz. A blockade would have a massive economic impact on its own country.

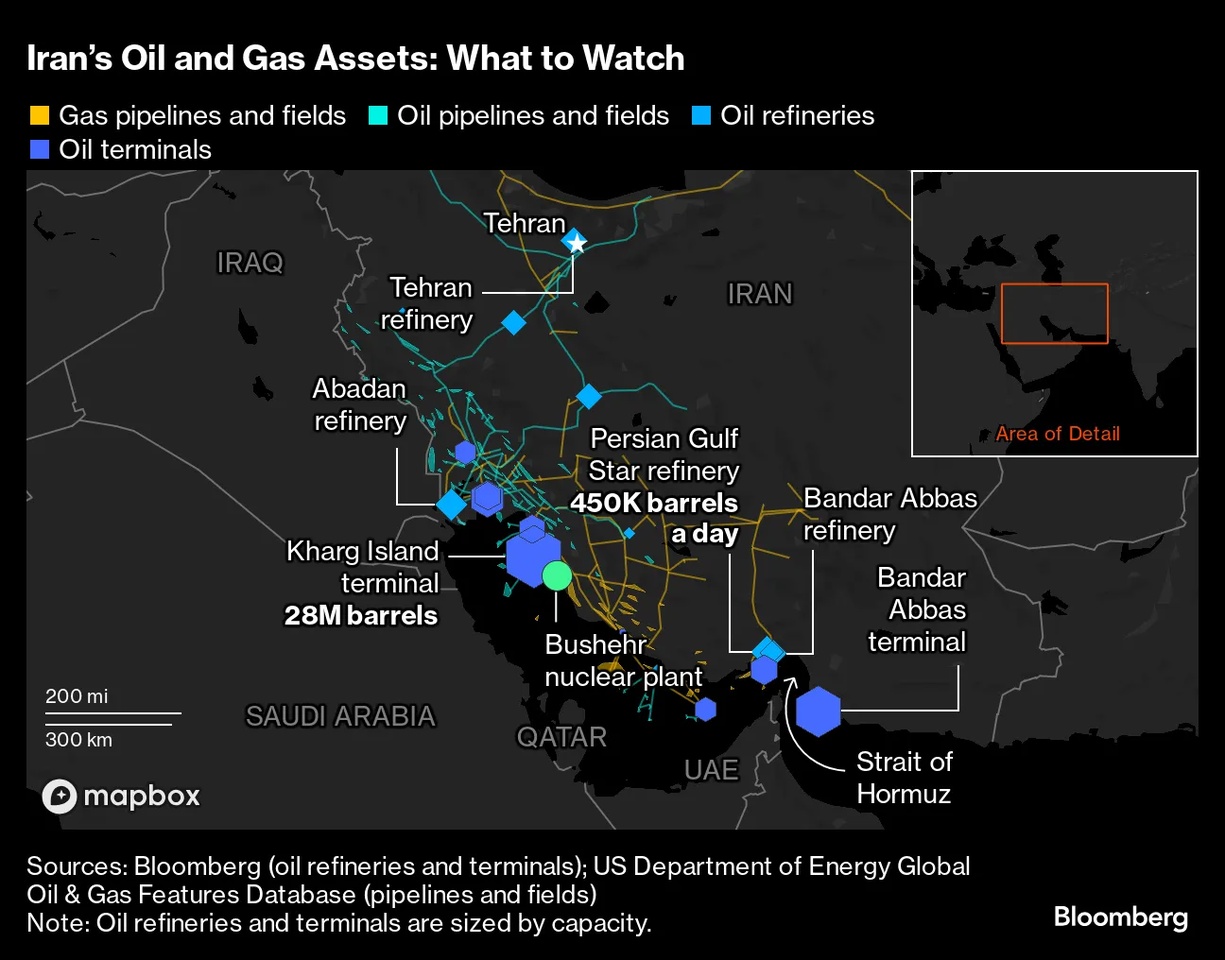

III: Oil infrastructure

Another point responsible for price spikes would be the threat to the oil infrastructure in the Middle East. Should there be attacks on production facilities, pipelines or oil ports, large quantities of oil could disappear from the market in the short term. Targeted attacks on Iranian facilities alone could result in a loss of 1.7 million barrels per day of exports, enough to tip the market from surplus to deficit and drive prices to USD 80 or more. Even more serious, of course, would be attacks or blockades affecting the Strait of Hormuz, but this is unlikely as mentioned above.

𝖪𝗋𝗂𝗍𝗂𝗌𝖼𝗁𝖾 𝖤𝗇𝖾𝗋𝗀𝗂𝖾𝗂𝗇𝖿𝗋𝖺𝗌𝗍𝗋𝗎𝗄𝗍𝗎𝗋 𝗂𝗆 𝖯𝖾𝗋𝗌𝗂𝗌𝖼𝗁𝖾𝗇 𝖦𝗈𝗅𝖿, 𝖽𝖺𝗋𝗎𝗇𝗍𝖾𝗋 Ö𝗅𝗋𝖺𝖿𝖿𝗂𝗇𝖾𝗋𝗂𝖾𝗇 (𝗐𝗂𝖾 𝖠𝖻𝖺𝖽𝖺𝗇 𝗎𝗇𝖽 𝖡𝖺𝗇𝖽𝖺𝗋 𝖠𝖻𝖻𝖺𝗌), 𝖲𝖼𝗁𝗅ü𝗌𝗌𝖾𝗅𝗍𝖾𝗋𝗆𝗂𝗇𝖺𝗅𝗌 (𝖪𝗁𝖺𝗋𝗀 𝖨𝗌𝗅𝖺𝗇𝖽 𝗆𝗂𝗍 28 𝖬𝗂𝗈. 𝖡𝖺𝗋𝗋𝖾𝗅 𝖫𝖺𝗀𝖾𝗋𝗄𝖺𝗉𝖺𝗓𝗂𝗍ä𝗍) 𝗎𝗇𝖽 𝖯𝗂𝗉𝖾𝗅𝗂𝗇𝖾𝗌. 𝖠𝗅𝗅𝖾 𝖠𝗇𝗅𝖺𝗀𝖾𝗇 𝗅𝗂𝖾𝗀𝖾𝗇 𝗇𝖺𝗁𝖾 𝖽𝖾𝗋 𝗌𝗍𝗋𝖺𝗍𝖾𝗀𝗂𝗌𝖼𝗁𝖾𝗇 𝖲𝗍𝗋𝖺ß𝖾 𝗏𝗈𝗇 𝖧𝗈𝗋𝗆𝗎𝗓 - 𝗂𝗁𝗋𝖾𝗋 𝖵𝖾𝗋𝗐𝗎𝗇𝖽𝖻𝖺𝗋𝗄𝖾𝗂𝗍 𝗆𝖺𝖼𝗁𝗍 𝗌𝗂𝖾 𝗓𝗎 𝗉𝗈𝗍𝖾𝗇𝗓𝗂𝖾𝗅𝗅𝖾𝗇 𝖹𝗂𝖾𝗅𝖾𝗇 𝖻𝖾𝗂 𝗆𝗂𝗅𝗂𝗍ä𝗋𝗂𝗌𝖼𝗁𝖾𝗇 𝖤𝗌𝗄𝖺𝗅𝖺𝗍𝗂𝗈𝗇𝖾𝗇.

IV: Oil in connection with CPI data

In principle, an increase in the price of oil has a direct and indirect effect on inflation. economists estimate that a 10 percent increase in the price of oil increases consumer prices by around 0.4% in the following year. This means that if the oil price rises from USD 80 to USD 88 per barrel, inflation in Europe or the USA could be almost 0.5% higher next year than it would otherwise be. This would not necessarily play into his hands, for example, the last thing he needs is high CPI data.

V: Scenarios for this conflict

A. Regional conflict (probability 70-80%*)

If the conflict remains limited to Israel and Iran, I expect a stabilization at the level of USD 75-80 per barrel. Iran's production and export volumes (around 1.5-1.7 million barrels/day) could be at least partially offset by other producers, as mentioned above.

B. Expansion to the Gulf region (probability 15-25%* )

Should the conflict spread to other countries in the Persian Gulf or targeted attacks on production facilities occur, prices could rise further. One can assume 90-100 US dollars per barrel. Even a partial escalation of the conflict could lead to production losses or transportation delays. Such a price rise would fuel inflation worldwide, increase transportation and production costs and tend to slow down economic growth. The stock markets would come under more pressure and central banks could be forced to keep interest rates high or even raise them again. This would not play into Trump's hands, for example, so he will try to keep the conflict regional if he can.

C. Blockade of the Strait of Hormuz (probability 1-5%*)

The blockade of the Strait of Hormuz is considered a nightmare scenario for the markets. This could lead to a doubling of oil prices within a few hours, with forecasts of USD 100 to 130 per barrel. Every day, 20-21 million barrels of crude oil are shipped via the Strait, i.e. around 20% of global consumption and around a quarter of the global LNG trade. A blockade would therefore suddenly remove a fifth of the global oil supply from the market. Refineries in Asia and Europe would be forced to fall back on emergency reserves. The stock markets would plummet and freight rates for tankers would also explode

*𝖬𝖾𝗂𝗇𝖾𝖾 𝖠𝗇𝗀𝖺𝖻𝖾𝗇