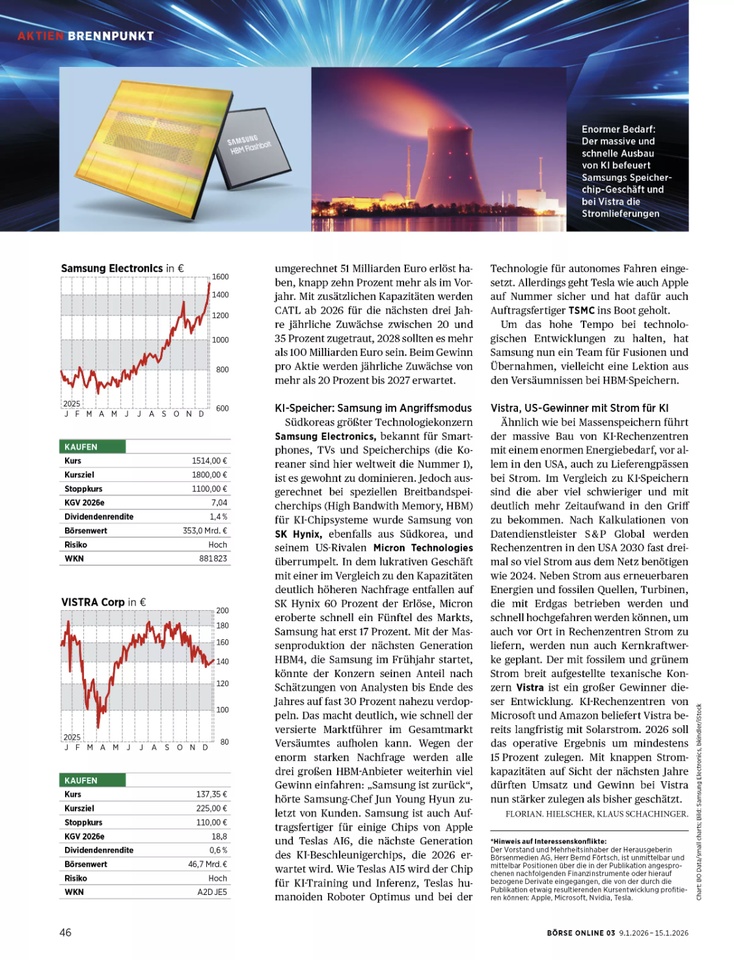

The massive expansion of data centers is leading to a sharp rise in electricity demand, particularly in the USA.

According to S&P Global, data centers there will require almost three times as much electricity by 2030 as in 2024. In addition to renewable energies and fossil sources, flexible gas-fired power plants and, in future, nuclear power will also gain in importance. ----> $NUKL (+1.82%)

Vistra is benefiting from this development in particular, as it is broadly positioned and has long-term contracts with Microsoft and Amazon, among others.

Operating profit is expected to increase by at least 15% in 2026. Revenue and profit are likely to grow faster than previously expected over the next few years.

Copied for better readability:

"Vistra, US winner with electricity for AI Similar to mass storage, the massive construction of AI data centers with enormous energy requirements, especially in the USA, is also leading to supply bottlenecks for electricity. Compared to AI storage systems, however, these are much more difficult and much more time-consuming to get under control. According to calculations by data service provider S&P Global, data centers in the USA will require almost three times as much electricity from the grid in 2030 as they will in 2024. In addition to electricity from renewable energies and fossil sources, turbines that run on natural gas and can be ramped up quickly to supply electricity to data centers on site, nuclear power plants are now also being planned. The Texan company Vistra, which is broadly positioned with fossil and green electricity, is a big winner in this development. Vistra is already supplying Microsoft and Amazon's AI data centers with solar power on a long-term basis. By 2026

operating result is expected to increase by at least 15 percent. With electricity capacities in short supply over the next few years, Vistra's turnover and profit are likely to

should now grow more strongly than previously estimated."

Analyst rating 👇

.

.

.

.

Source: Börse Online