After 60% drawdown at the most favorable level for >10 years

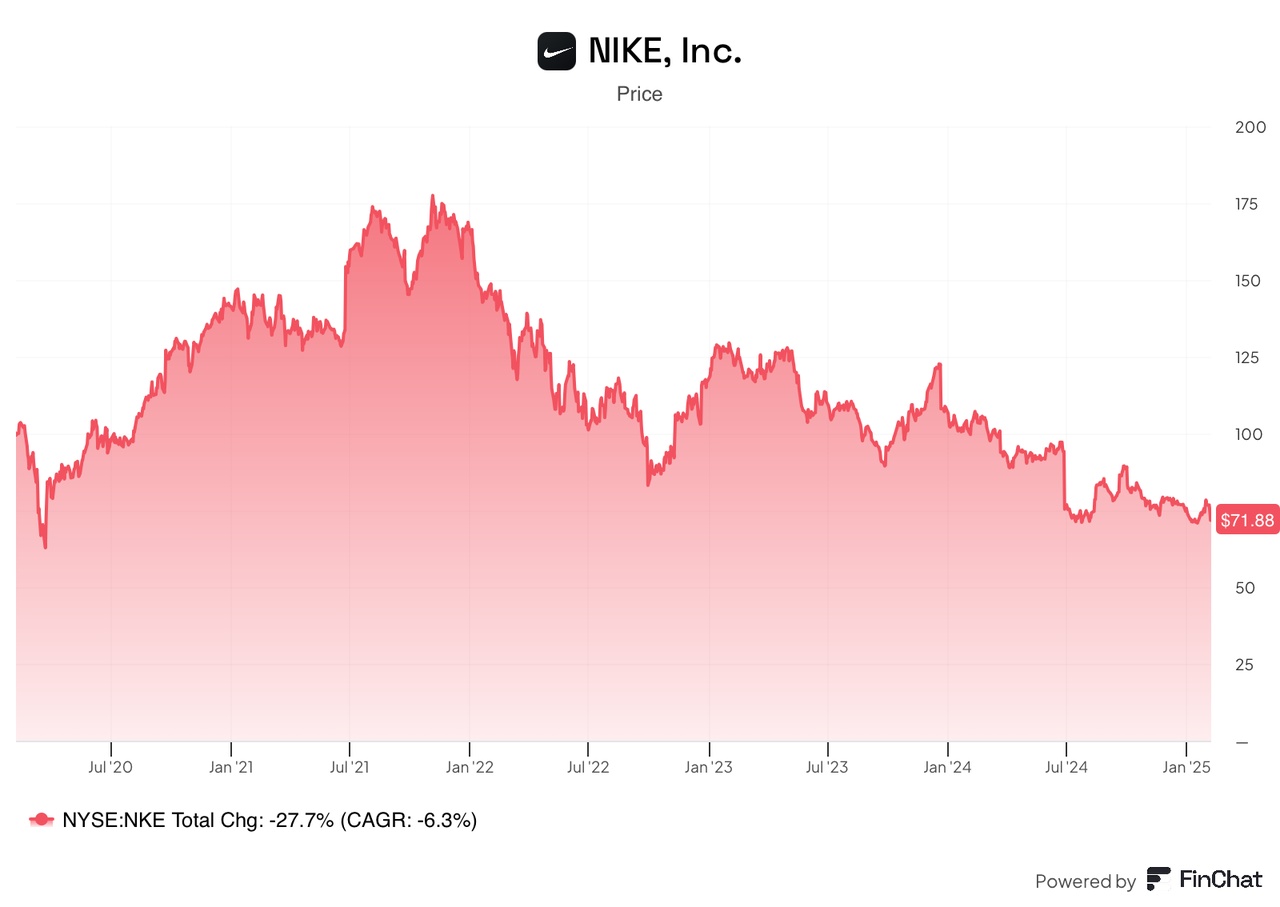

The Nike share $NKE (+0.73%) has suffered heavily in recent years. Since the all-time high of $177 US dollars in November 2021, the share price has more than halved and is currently trading at around $72 (see chart below).

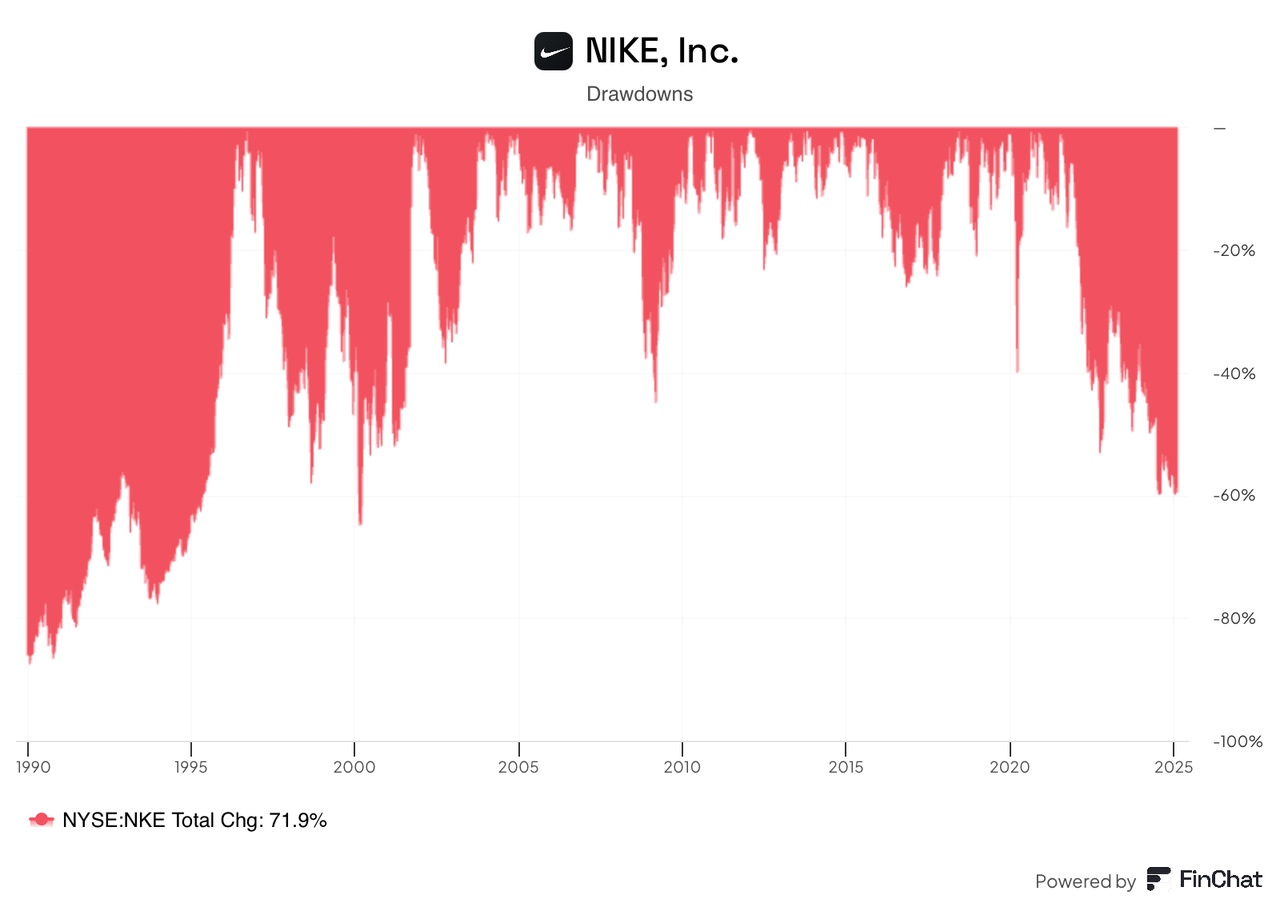

At around 60%, this is the sharpest fall in the share price in 25 yearsas can be seen in the drawdown chart (see below). This shows the sharpest declines in the share price from an all-time high over time. The share price is therefore where it was 6 years ago - quite sobering for investors.

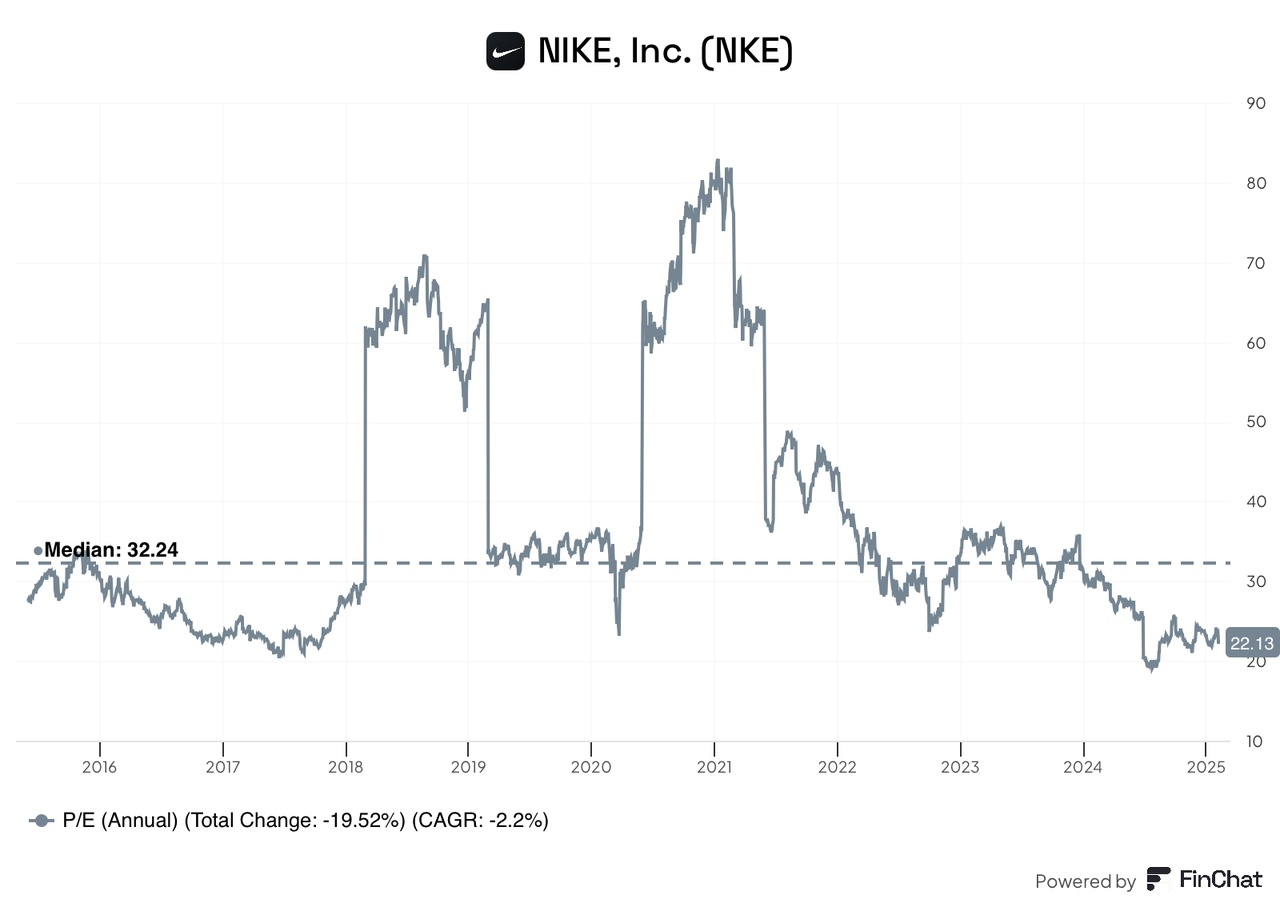

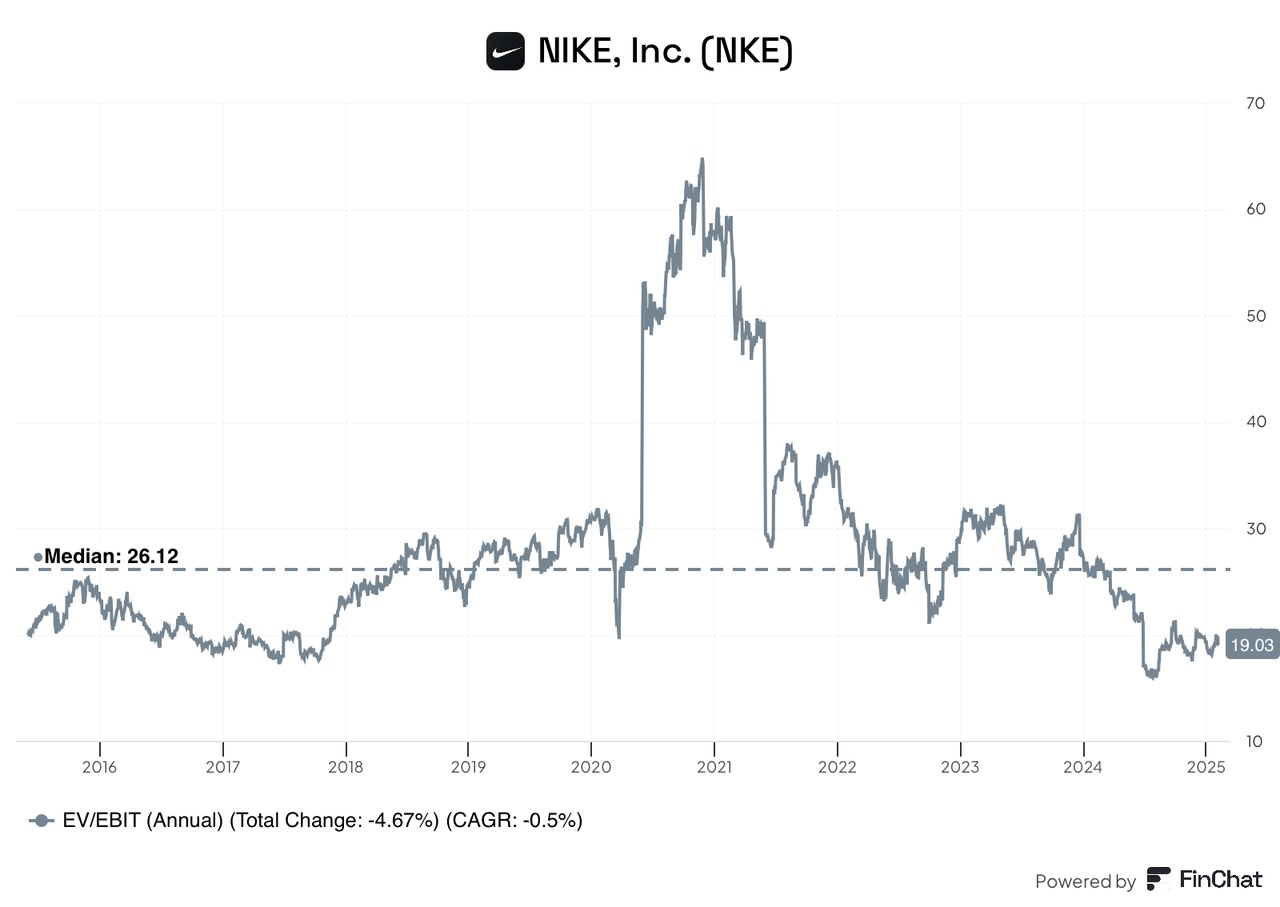

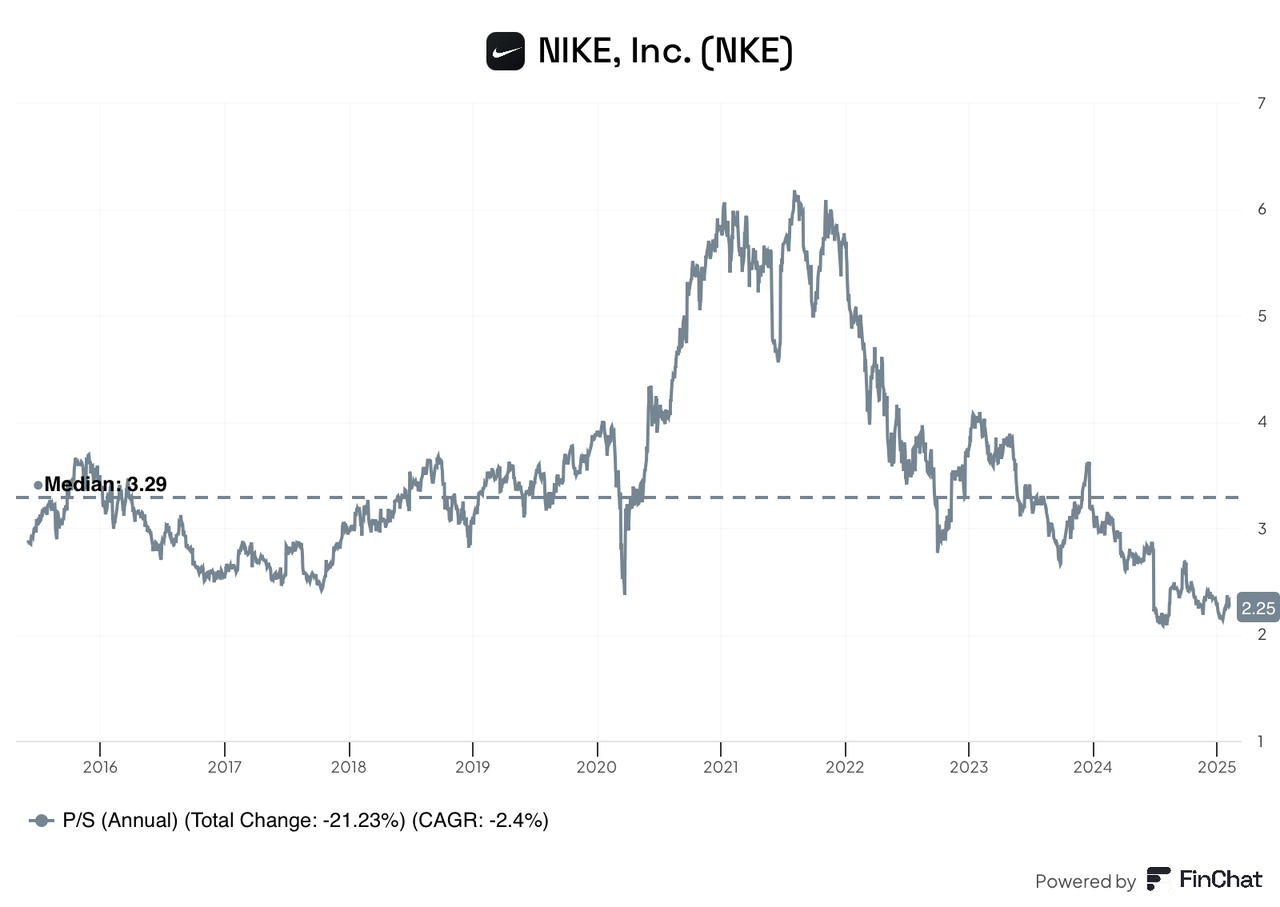

On the basis of traditional key figures, Nike $NKE (+0.73%) thus valued more favorably than it has been for a long time:

- The price/earnings ratio (P/E ratio) for the last 12 months is currently 22.1x and therefore below the median of the last 10 years (32.2x).

- The ratio of enterprise value to operating profit (EV/EBIT) shows a similar picture.

- Nike also looks more attractive than it has for a long time on the basis of the price/sales ratio (P/S ratio).

Current situation: Why is the share under pressure?

In retrospect, the decline in the share price is due to a combination of several factors:

- Strategic missteps in distribution: Under the leadership of CEO John Donahoe (2020-24), Nike shifted $NKE (+0.73%) shifted its focus to direct-to-consumer (DTC) sales while reducing partnerships with traditional retailers, e.g. Footlocker. This strategy led to tensions with Nike's long-standing retail partners and allowed competitors to take space on store shelves and gain market share.

- Growing competition: New entrants such as Hoka and On Running have gained popularity and market share with innovative products and modern designs, increasing competitive pressure on Nike $NKE (+0.73%) increased.

- Product and innovation deficits: Nike $NKE (+0.73%) has increasingly focused on new editions of classic models in recent years instead of introducing innovative new products. This led to a saturation of the market with retro products and left room for competitors who could score points with fresh designs and technologies.

- Damage to image due to supplier scandals: Ongoing allegations of child labor, forced labor and poor working conditions in Asian production facilities have damaged Nike's brand image. Consumers could increasingly turn away from Nike in the long term $NKE (+0.73%) away from Nike in the long term, which will impact growth potential and investor confidence.

- Macroeconomic challenges: Global economic uncertainties, e.g. inflation and fluctuating consumer spending, have negatively impacted Nike's sales $NKE (+0.73%) in key sales markets such as China.

New leadership, new opportunities?

Nike responded to the sharp decline in the share price $NKE (+0.73%) with a change of leadership in October 2024. Elliott Hill was appointed new CEO and brings 32 years of experience in the company with the company. He once started as an intern at Nike $NKE (+0.73%) , made a stellar career and is now returning as a beacon of hope after leaving the company in 2020.

His turnaround plan envisages the following:

- A return to sport: Hill emphasizes that Nike $NKE (+0.73%) has lost its obsession with sport and plans to put sport and athletes back at the center of all decisions.

- Strengthening product innovation: Nike $NKE (+0.73%) wants to renew its product range with a focus on athletic performance, drawing on the daily experiences of athletes to drive innovation, design and product development.

- Intensifying marketing: The company plans to invest more in creative marketing campaigns that highlight athletes and sporting events to re-present the brand in a more authentic way.

- Strengthening local teams and sales markets: Nike $NKE (+0.73%) plans to specifically strengthen its teams in key countries and cities and give them more freedom to make decisions. This should ensure that Nike $NKE (+0.73%) can respond better to local needs and act faster in key markets.

- Optimization of sales channels: On the one hand, the company's own direct sales (primarily via digital channels) are to be further expanded and raised to a premium level. Discount campaigns will only be used in a targeted manner. At the same time, close cooperation with key retailers remains a central component of the strategy, which was previously de-prioritized.

These measures are intended to regain the trust of investors and put Nike $NKE (+0.73%) back on course for growth in the long term.

Market reaction and possible potential for investors

The reaction of investors to the change in leadership was restrained. Nike $NKE (+0.73%) already announced that in the next two quarters until summer 2025 even worse results are to be expected. Restructuring is often accompanied by short-term declines in sales and profits before an improvement is seen in the long term. Many investors are cautious, as it is unclear how quickly Nike can $NKE (+0.73%) can take on the competition and regain its former strength.

Added to this is the current uncertainty surrounding the US tariffs. These could affect both supply and demand for Nike products. Nike $NKE (+0.73%) is not only dependent on imports from China, e.g. for fabrics, but the country is also one of the company's largest consumer markets.

Despite the current challenges, there are several factors that point to a sustained recovery for the company. Nike remains one of the strongest sports brands in the world, and the company has a number of unique advantages:

- Three of the world's most recognizable brands: Nike, Jordan and Converse have cult status and are deeply rooted in the sports and lifestyle world.

- Unbeatable network of athletes, teams and leagues: Nike $NKE (+0.73%) dominates top-level sport - from LeBron James to Kylian Mbappé, from the NBA to the Champions League. This reach strengthens brand loyalty and global visibility.

- Broad product range for all price segments: From affordable casual shoes to premium high-performance products, Nike offers products for every budget - an important aspect in difficult economic times.

- Global presence: Nike $NKE (+0.73%) is a true powerhouse in international retail with a highly optimized supply chain and distribution in almost every market in the world.

- Integrated multi-channel ecosystem: Nike $NKE (+0.73%) can serve different target groups and customer preferences via its own stores, direct online sales and the reinvigorated wholesale business.

- Long-standing relationships with top suppliers and manufacturers: Stable partnerships ensure efficiency in production and help Nike control costs.

- Team of motivated, talented employees: Nike $NKE (+0.73%) is known for its strong corporate culture and its ability to attract top talent in design, marketing and sports technology.

These factors form the foundation for a potential comeback. If the strategy is successfully implemented, Nike shares could see significantly higher prices again in the long term.

Here is a possible sample calculation to derive the share price potential until mid-2028 or 2029:

- Annual sales: $55 bn (today: $49.0 bn, but the next two quarters will be significantly weaker)

- Net profit margin: 13% (today: 10%)

- Net profit: $7.2 bn (today: $4.9 bn)

- Number of shares outstanding: 1.4 bn (today: 1.5 bn)

- Earnings per share: $5.1 (today: $3.2)

- Price/earnings ratio (P/E): 30x (comparable to the median level of the last 10 years)

- Share price: $154 (today: $72)

In other words: Should Nike $NKE (+0.73%) manages to exceed the old sales records from 2023/24 by 5-10% by mid-2028/29 and return to its record level of profitability, then a doubling of the share price would be conceivable.

Is it worth getting in?

The Nike share is at a crossroads. crossroads. The sharp fall in the share price in recent years reflects the challenges the company has faced: poor strategic decisions and increased competition. This has led to stagnating and now declining sales over the last six quarters. Profits have also mostly fallen short of expectations. Poor financial results are expected to continue in the next two quarters - sales and profits are expected to fall further. But with Elliott Hill as the new CEO and a reorientation towards a focus on sport and athletes, innovation and a new sales strategy, Nike could regain its former strength in the long term.

Pro: What speaks for an investment

✅ Global brand strength: Nike $NKE (+0.73%) is one of the top 25 brands worldwide (Link) - it is a cult brand with enormous reach.

✅ Dominant sports network: Collaboration with top athletes, teams and leagues ensures market presence.

✅ Innovative strength: Strong product development and patented technologies such as Nike Air and Flyknit, although these have fallen somewhat behind in recent years and need to be brought back to life.

✅ Broad product range: Offerings for all price segments ensure crisis resilience.

✅ Optimized sales strategy: Return to increased cooperation with retailers for better market penetration and positioning direct sales as a premium offering without major discount campaigns.

✅ Smart Money: Bill Ackman - one of the most high-profile hedge fund managers in the world - added the share to his portfolio between July and September 2024 and increased it significantly between October and December 2024. It now accounts for 11% of his portfolio (Link). As quickly as these professional investors appear, they can also disappear again - but their presence can still be seen as a positive signal.

✅ Insider purchases: Two higher-ranking employees at the company have bought Nike stock themselves in the last six months (1x June '24 at $77, 1x Dec '24 at $77, Link). The purchases were manageable in total (less than $250,000 each), but it is still a positive sign because the employees seem to believe in the future of the company.

✅ Attractive valuation: Based on traditional valuation ratios, the share shows the most favorable valuation in at least 10 years.

✅ Dividend: Nike has increased its dividend for 24 consecutive years, which is regularly distributed to shareholders. Based on the current share price, the dividend yield is 2.2%, which is comparable to an overnight interest rate.

✅ Turnaround opportunity: If the company were to increase sales to $55 bn, for example, and improve profitability to record levels, a doubling of the share price to $160 by 2028/29 would be conceivable.

Cons: Risks you need to be aware of

❌ Recovery takes time: No turnaround to be expected in the short term. At least the next two quarters until summer 2025 will be poor - this has already been announced. After that, it is unclear whether and when Nike $NKE (+0.73%) will achieve a turnaround that holds out the prospect of positive financial figures. The dry spell could therefore continue for a few more quarters.

❌ Competition is growing: Low barriers to entry and increasing democratization of production are enabling other and smaller companies to enter the market. Brands such as Adidas, New Balance, On Running and Hoka are stealing market share from Nike. In addition, by neglecting its retail partners, Nike has recklessly given away sales space that is now available to other brands - it is questionable whether and how quickly this can be regained.

❌ Buying behavior is changing: Consumers are no longer just spoiled for choice between the two heavyweights Adidas and Nike $NKE (+0.73%) - there are now dozens of mass and niche suppliers available that are better able to capture the zeitgeist of important consumers through social media and inspiring content than Nike. There may have been a lasting shift here, with consumers preferring smaller and less well-known brands that better serve today's customer preferences.

❌ Market uncertainties: US tariffs on Chinese goods could weigh on production and demand and put further downward pressure on the share.

❌ Macroeconomic risks: Rising inflation, weak purchasing power and geopolitical uncertainties could slow down growth.

My conclusion

The risk-reward ratio with Nike $NKE (+0.73%) is attractiveThe share is currently valued more favorably than it has been for a long time and could be an interesting opportunity for long-term investors - but patience is required. The next 12 to 18 months will be crucial to see whether the new strategy works or whether the company will continue to go downhill. Anyone who believes in the turnaround could build up an initial position or buy in if there are further setbacks. In the meantime, investors can console themselves with a regular dividend.