Hello friends from the community,

I started today's company presentation with Johann Wolfgang von Goethe.

Because sometimes we don't even know what great market leaders we have in our own country.

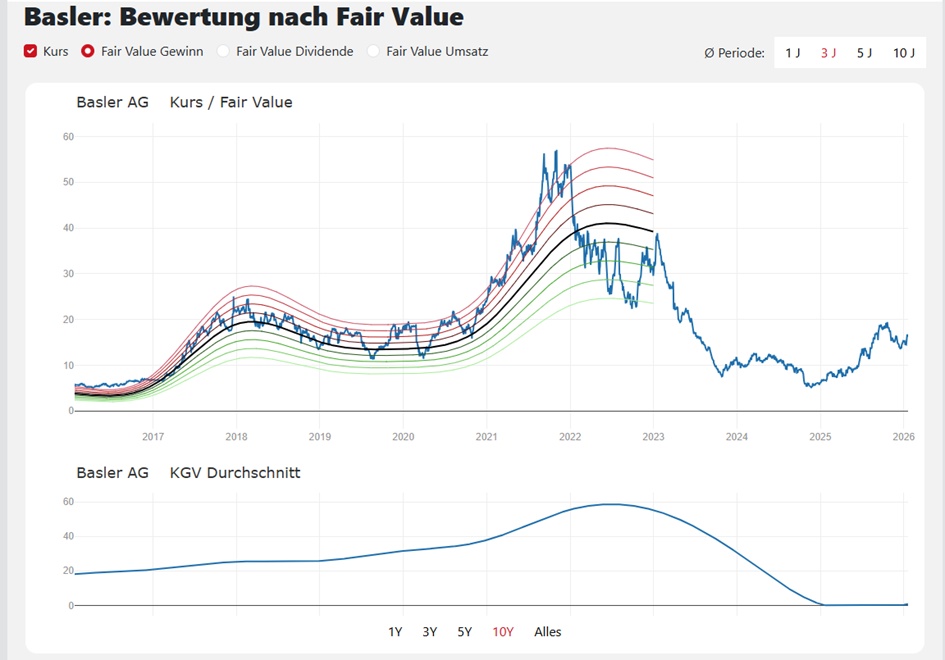

Looking at the chart, today's market leader is more of a fallen angel. It's actually unusual for me to present such a share to you.

Why am I doing it anyway?

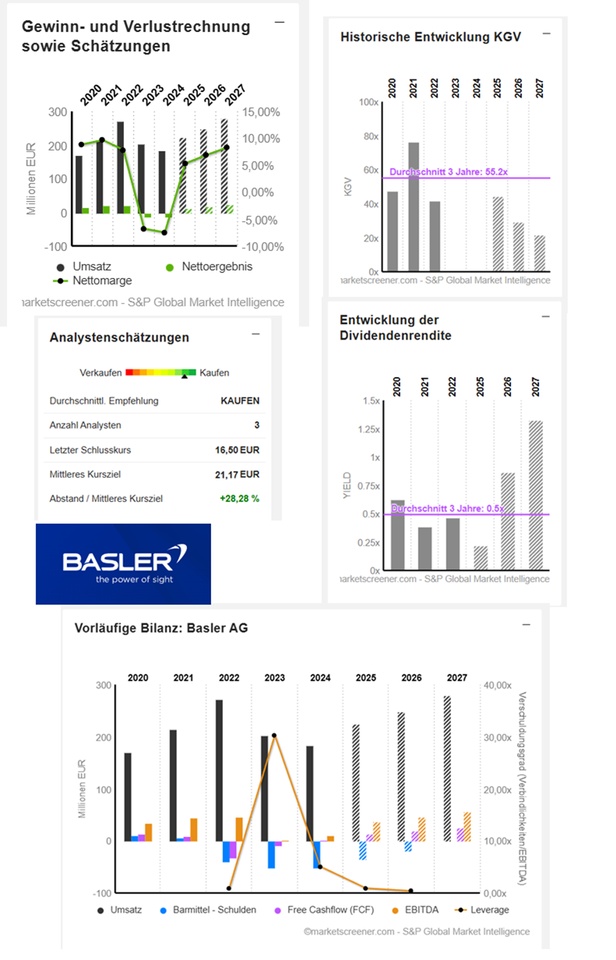

Because when looking at the fundamental figures, I noticed how the company has managed to become profitable again. And I didn't want to withhold the company from you because of the growth that still lies ahead.

Because the future and growth technologies play right into the cards here.

Drones, humanoid industrial robots, modern surveillance systems, medical research, AI systems, etc., are nothing without eyes 👀. And could not provide us with important information without them.

And this is where the market leader Basler $BSL (-0.88%) comes into play.

Ladies and gentlemen, I hope to hear lots of opinions in the comments.

Do you see potential and future fantasy here? Perhaps a hidden pearl of growth?

Please let's discuss.

Have fun with the company presentation

Basler AG is a Germany-based manufacturer of industrial cameras for a wide range of applications. The product portfolio includes area scan cameras for traffic monitoring, factory automation or retail, line scan cameras for quality assurance and sorting processes that inspect images line by line and not as a whole, network cameras, three-dimensional (3D) cameras for applications in the field of logistics as well as industrial image processing, imaging and inspection and PowerPack microscopy devices. The company also offers related software and components, including lenses, lens adapters and cables. The company operates through subsidiaries and representative offices in Europe, the United States and Asia.

Number of employees: 814

Technology leader with vision

From industrial camera pioneer to vision specialist of the robotics era - Basler AG, based in Ahrensburg near Hamburg, has been one of the leading international suppliers of industrial image processing technology for decades. The name Basler has long been synonymous with quality, precision and innovation.

Basler ignites the turbo: Chart breakout and insider purchase from the new CEO inspire!

Basler ignites the turbo: Chart breakout and insider purchase from the new CEO inspire! Basler's cameras provide the eyes for modern industry. The product portfolio ranges from 127-megapixel cameras to SWIR technologies that can see through plastic, which is essential for semiconductor manufacturing and robotics. In the first nine months of 2025, sales rose by 23% to EUR 168 million, while incoming orders increased by 29% to just under EUR 172 million. The net result soared from -6.7 million euros to 11.1 million euros.

Basler AG has fundamentally changed from a pure component manufacturer for industrial cameras to a comprehensive solution provider in the field of computer vision. While the core business was traditionally the production of robust cameras for factory automation, the Group now addresses the entire image processing value chain. A central element of value creation is now software expertise, in particular through the "pylon Camera Software Suite", which enables seamless integration of hardware into customer applications. Instead of laboriously integrating individual parts, customers from sectors such as medicine, logistics or robotics receive complete, coordinated systems, which strengthens customer loyalty and secures margins in the long term against the pure price war for hardware components.

The turn of the year 2025/2026 marks a historic turning point in the management of Basler AG. On January 1, 2026, Hardy Mehl replaced the long-standing CEO Dr. Dietmar Ley, who had shaped the company for over 25 years. At the same time, Dr. Kai Jens Ströder took over as the new CTO to ensure innovative strength in the areas of product creation and technological development. The capital markets see this planned handover as a signal of continuity and strategic renewal at the same time.

Both the outgoing CEO and the new CEO Hardy Mehl made several share purchases. In the period between December 18, 2025 and January 13, 2026, insider purchases were reported at unit prices of between EUR 13.70 and EUR 14.53 per share for a total of EUR 275,872. These insider purchases send a strong signal to shareholders that the management is convinced of the company's intrinsic strength and future value development despite a persistently subdued market environment. AI and advancing automation outside the traditional factory halls are likely to remain growth drivers.

Image-guided robotics

Smart robots with the power of sight: more capabilities and flexibility for a wide range of applications

Robots carry out tasks that are difficult or impossible for humans to perform. Computer vision gives robots "eyesight" and opens up almost unlimited application possibilities. Computer vision makes robots more flexible and helps to expand areas of application.

- Fast integration through compatibility

Compatible with ABB, KUKA, FANUC, Universal Robots and many well-known brands in robotics.

Industry 4.0 and automation

Optimization of production processes for the factory of tomorrow

Basler vision systems are used worldwide in automation processes for a wide range of industrial sectors, for example to increase the efficiency of production processes. Applications range from electronics and semiconductor inspection, robotics and food inspection to mail sorting and print image inspection.

Image processing in battery cell production

Machine vision ensures quality assurance

In the production of battery cells, high quality in all process steps and thus the reduction of material waste are crucial. Digital image processing opens up possibilities for reliably detecting even the smallest defects. Basler's solutions help to produce high-quality and safe battery cells to meet the challenges of electromobility.

Electronics inspection

Consistent quality - for every circuit board, every panel and every device.

Precision and speed are crucial in electronics production. This applies from PCB production to the assembly of display panels and the manufacture of complex electronic components. The demands for miniaturization, higher performance and tighter tolerances continue to increase. Basler's machine vision solutions help industrial partners to develop reliable, high-quality inspection systems. These systems are specifically designed to meet the growing demands of the electronics industry.

Warehouse automation

Faster, smarter and more efficient logistics with vision solutions

Automation with vision solutions in intralogistics creates efficient and cost-effective processes from goods receipt to delivery. Basler's vision solutions in warehouse automation are reliable and user-friendly with an unbeatable price-performance ratio.

Image processing in Medical & Life Sciences

First-class vision solutions for demanding applications

Digital image acquisition and processing opens up numerous possibilities for researching, analyzing and diagnosing diseases as well as in the manufacturing process of medical products. Basler's customized products and solutions guarantee exceptional reliability and the best image quality.

- Best image quality and color reproduction

Basler cameras produce excellent images - fully automatically or individually adjusted

Industry solutions

Whether Industry 4.0 solutions, automated manufacturing processes or applications in Medical & Life Sciences: Numerous industries rely on imaging from Basler in a wide variety of applications.

- Medical & Life Sciences

- Smart City

- Traffic, transportation, infrastructure

- Agriculture

- Robotics

- Automated retail systems

- Automotive

- Printing industry

- Electronics

- Factory automation

- IoT, IIoT & Industry 4.0

- Warehouse automation

- Food & beverage industry

- Microscopy

- Pharmaceuticals

- Sports & Entertainment

EUR in millions

Estimates

Year Turnover Change

2024 183,7 -9,55 %

2025 224,6 22,27 %

2026 248 10,4 %

2027 279,3 12,61 %

Year EBIT Change

2024 -9,784 55,33 %

2025 18,6 290,11 %

2026 25,37 36,38 %

2027 33,57 32,33 %

Year Net result Change

2024 -13,77 0,3 %

2025 11,97 186,93 %

2026 17,03 42,34 %

2027 23,07 35,42 %

Year Net debt Leverage ratio

2024 50,8 5,08x

2025 34,4 0,92x

2026 18,5 0,4x

2027 -0,37

Year Free cash flow Change CAPEX

2024 1,4 115,22 % 9,807

2025 14,3 921,43 % 14

2026 20,13 40,79 % 19,55

2027 24,87 23,51 % 22,35

Year EBIT margin ROE

2024 -5,33 % -10,45 %

2025 8,28 % 10 %

2026 10,23 % 11,7 %

2027 12,02 % 14,25 %

Year Earnings per share P/E ratio PEG

2024 -0,45 -13,6x

2025 0.37 44.6x -0x

2026 0.56 29.5x 0.6x

2027 0.7533 21.9x 0.6x

Year Dividend Yield

2024

2025 0,0367 0,22 %

2026 0,1433 0,87 %

2027 0,22 1,33 %

Market value 507.3

Number of shares (in thousands) 30,748

Date of publication 28.03.2025

Performance

Current year + 4.71 %

1 year +140.54 %

5 years - 45.51 %

10 years + 200.56 %

15 years + 1,151.56 %

( PS. @EpsEra I hope you are doing well. Maybe also interesting for you)