My dears, since I didn't get everything into one post at getquin.

Here is part 2

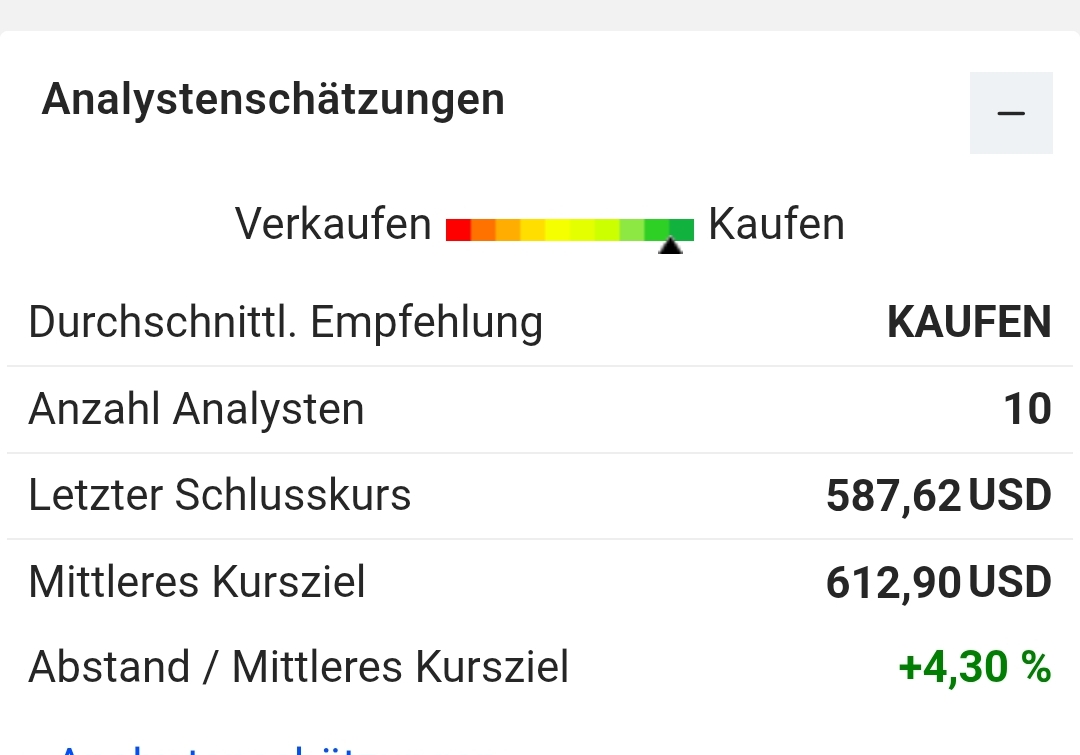

Multiples: (USD in millions, source MarketScreener )

Market value 27,533

2025 2026 2027

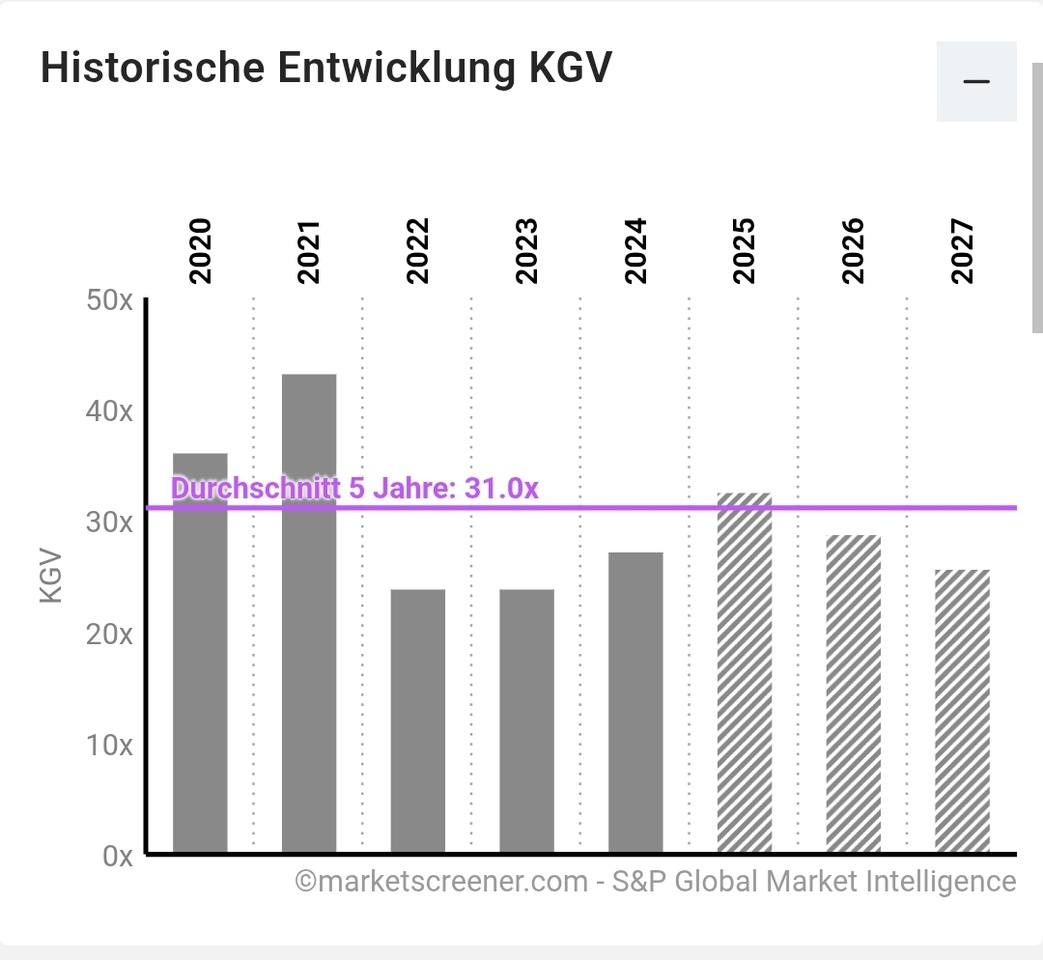

KGV 32.6 28.8 25.7

Earnings per share 18 20.38 22.87

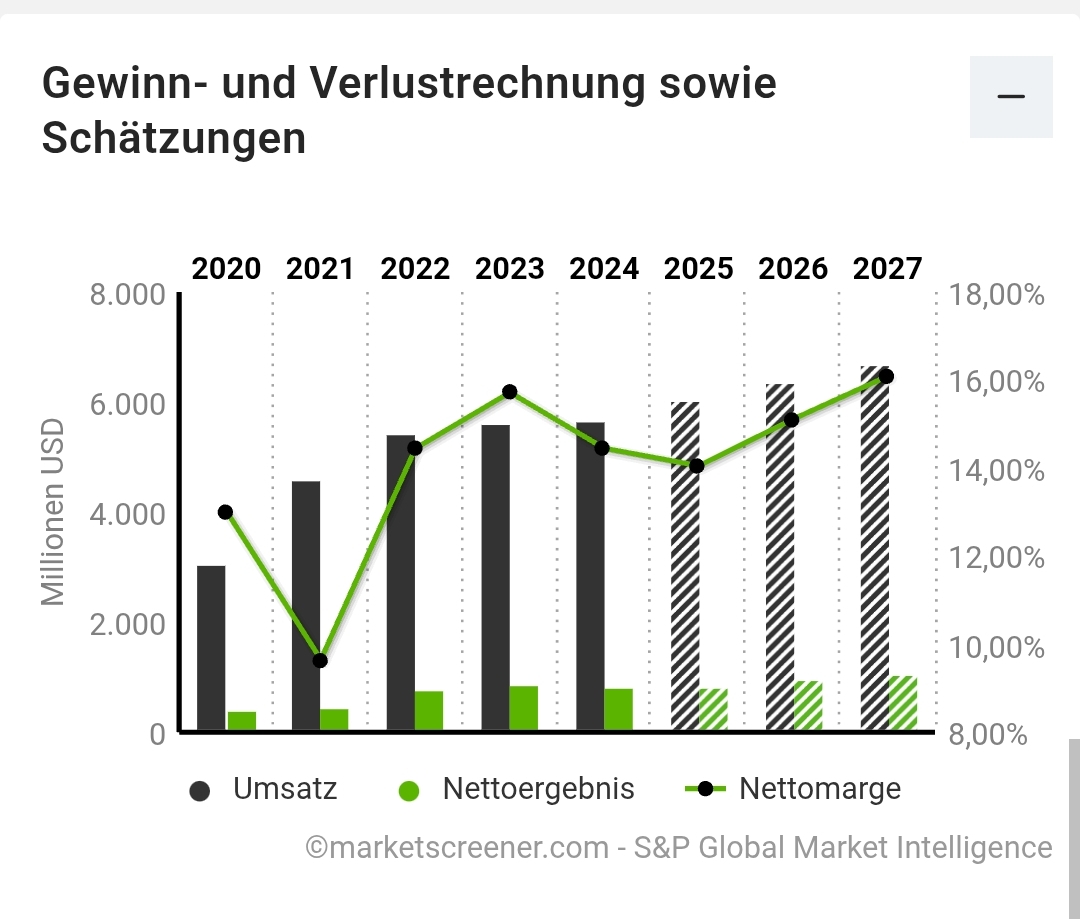

Turnover 6,067 6,389 6,719

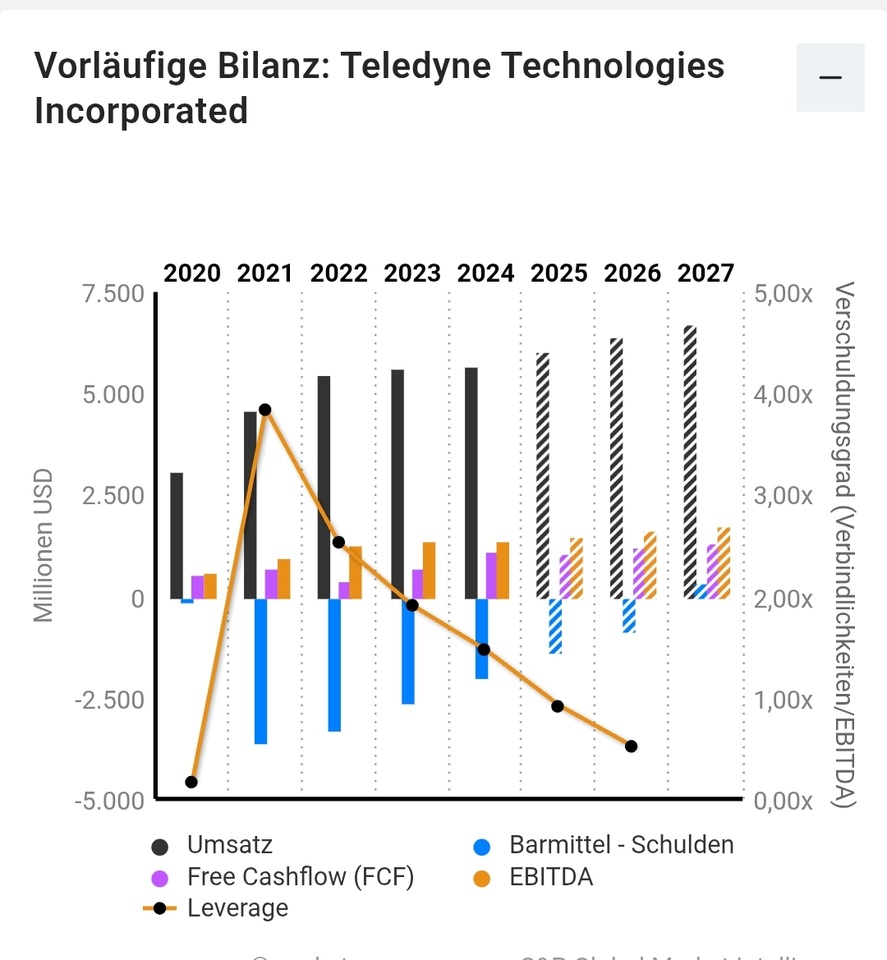

EBITDA 1,490 1,620 1,731

Net result 852.5 965.6 1,081.0

Net debt 1,374.0 842.8 -333.1

CAPEX 111.5 117.9 125.4

Free cash flow 1,083 1,200 1,309

EBITDA MARGIN % 24.56% 25.35% 25.76%

EBIT MARGIN % 17.72% 19.13% 20.41%

ROE 9.82% 10.02% 10.05%

Number of shares 46,888 46,888 46,888

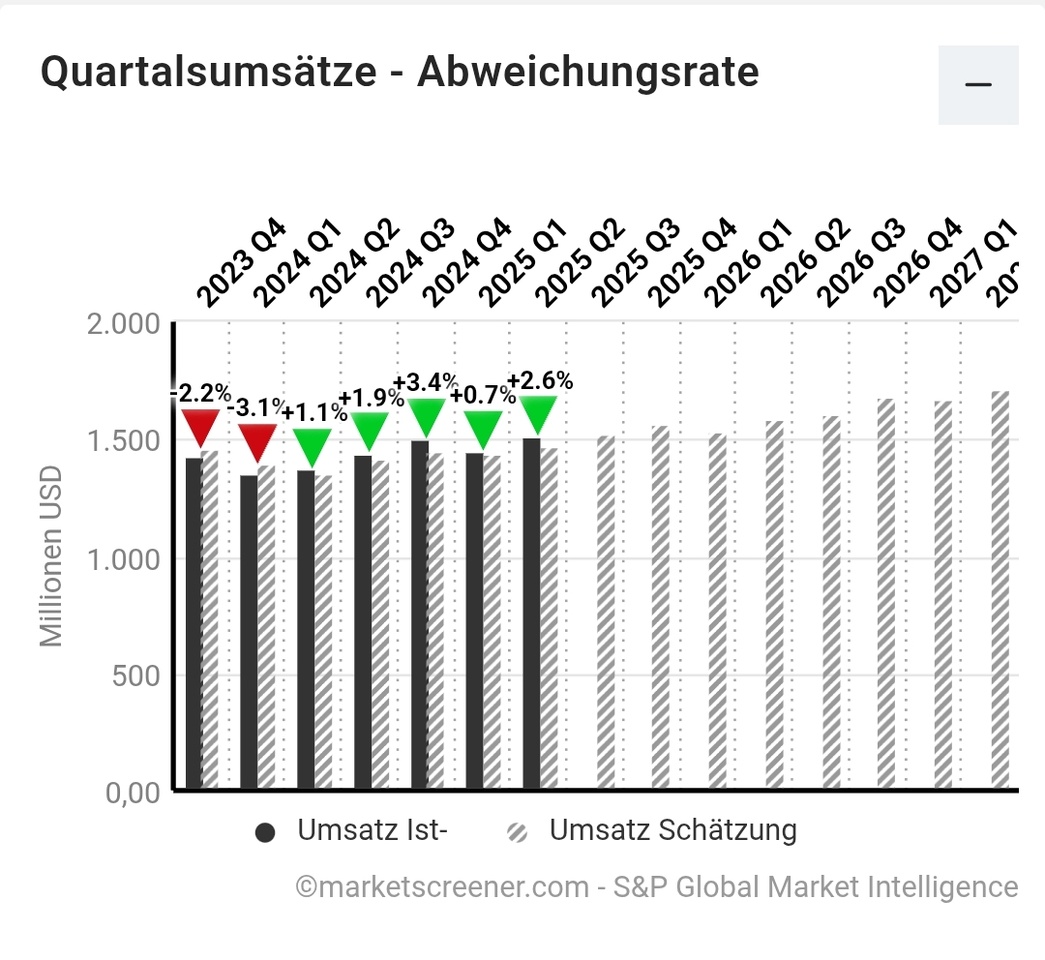

My dears, I think the estimates are very conservative. And as the chart shows, the estimates were exceeded in the last earnings.

I like the fact that important multiples can be increased, and thus the P/E ratio decreases.