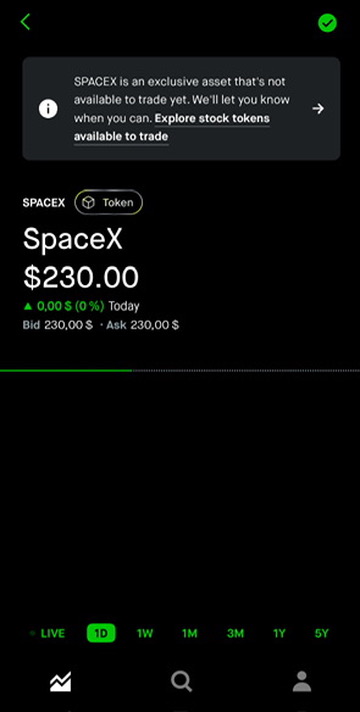

I find access to private companies particularly interesting. However, it is questionable when this will be rolled out on a larger scale and how extensive the access will be... According to the CEO, more will happen in the next few months.

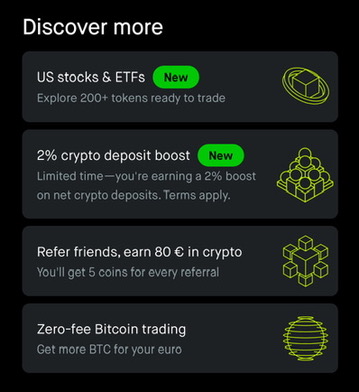

There will also be at the beginning:

- Access to popular US stocks and ETFs (>200 tokens so far, more coming soon), tokens also allow access to dividends

- 24-hour trading 5 days a week (probably 7 days a week in the coming months, as with crypto)

- No trading fees, only a 0.1% fee for currency conversion to USD

- Minimal spreads, even outside core trading hours

- Staking on ETH and SOL

- Perpetual futures (coming soon)

- Transfer your cryptos to Robinhood and get 2% bonus payment (unlimited, but only until July 7, 2025)

- Simple user interface and fast app speed

Trade Republic, Scalable & Co. should dress warmly in the coming months / years...

Have you downloaded the new Robinhood app (for Europe) yet?