𝑮𝒆𝒇𝒂𝒉𝒓𝒆𝒏 𝒗𝒐𝒏 𝑮𝒆𝒘𝒊𝒏𝒏𝒆𝒊𝒏𝒃𝒓ü𝒄𝒉𝒆𝒏 𝒖𝒏𝒅 𝒘𝒊𝒆 𝒊𝒉𝒓 𝒅𝒊𝒆𝒔𝒆 𝒇𝒓ü𝒉𝒛𝒆𝒊𝒕𝒊𝒈 𝒂𝒃𝒔𝒄𝒉ä𝒕𝒛𝒆𝒏 𝒌ö𝒏𝒏𝒕!

Especially in the current environment, it is important to understand what stagnating or even declining economic growth can mean for companies. Of course, valuations are being adjusted and slumps in sales and profits can be the result. The consequences are falling share prices!

Fundamental analysis has therefore become all the more important. I therefore refer you first of all to my analysis of key figures, which provides you with important tools:

https://app.getquin.com/activity/XcuRrJwmyP

But what is this IAS 36 all about?

Most listed European groups prepare their accounts in accordance with IFRS. IFRS requires assets to be measured on the basis of an annual impairment test. The precise rules on impairment are set out in IAS 36 (an IFRS standard). This IAS 36 is very essential and allows you to classify future events at an early stage. I would therefore like to explain to you as briefly as possible and in an understandable way what consequences these regulations can have for us private shareholders!

𝗜. 𝗜𝗔𝗦 𝟯𝟲 𝗶𝗻 𝗞ü𝗿𝘇𝗲

IAS 36 is a component of the IFRS regulations according to which most groups in Europe prepare their accounts. IAS = International Accounting Standard. For you, however, the standard in this context should also mean IAS = "I'm screwed". Because if this standard "IAS 36" is applied, this always means a correction of the profit and thus possibly also of the share price (depending on the size)!

Core statement of IAS 36: "Assets within the scope of application (in particular intangible assets and property, plant and equipment) shall be assessed at each balance sheet date for indications of impairment. If there are any such indications, an impairment test must be carried out." [1] Even in the case of exceptional triggering events during the year, this also requires an additional test during the year (IAS 36.12).

A company must therefore analyze possible indications of impairment of an asset at least at each reporting date. IAS 36 contains a list of external and internal indicators of possible impairment. A mandatory annual review is prescribed for intangible assets with an indefinite useful life, intangible assets not yet available for use and goodwill (IAS 36.10 and

IAS 36.90). [2]

The analogous provisions for accounting in accordance with US accounting standards (US GAAP) are contained in the standards ASC 350 Intangibles - Goodwill and Other and ASC 360 Property, Plant and Equipment. [2]

IAS 36 is to be applied in particular to the following assets.

- Land

- Buildings

- Investment assets measured at acquisition or production cost

- Intangible assets

- Goodwill

- Investments in subsidiaries and joint ventures.

It is therefore necessary to assess annually whether an impairment is necessary for all these balance sheet values and thus whether a write-down is necessary, which is reflected in the profit!

𝗜𝗜. 𝗜𝗔𝗦 𝟯𝟲 𝗕𝗲𝗶𝘀𝗽𝗶𝗲𝗹𝗲 𝘂𝗻𝗱 𝗔𝗻𝗵𝗮𝗹𝘁𝘀𝗽𝘂𝗻𝗸𝘁𝗲 𝗳ü𝗿 𝗣𝗿𝗶𝘃𝗮𝘁𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝗲𝗻

But how exactly can I imagine this? How can we succinctly recognize when there is a risk of impairment without carrying out an impairment test for each asset ourselves, for which we often simply lack the data? After all, such an impairment would possibly result in a drop in profits, which would be reflected in the share price!

a) Market capitalization as the first indicator of impairment

Only a little information is actually required for this:

1) Market capitalization (number of shares x share price)

2) Equity of the Group, taken from the annual report

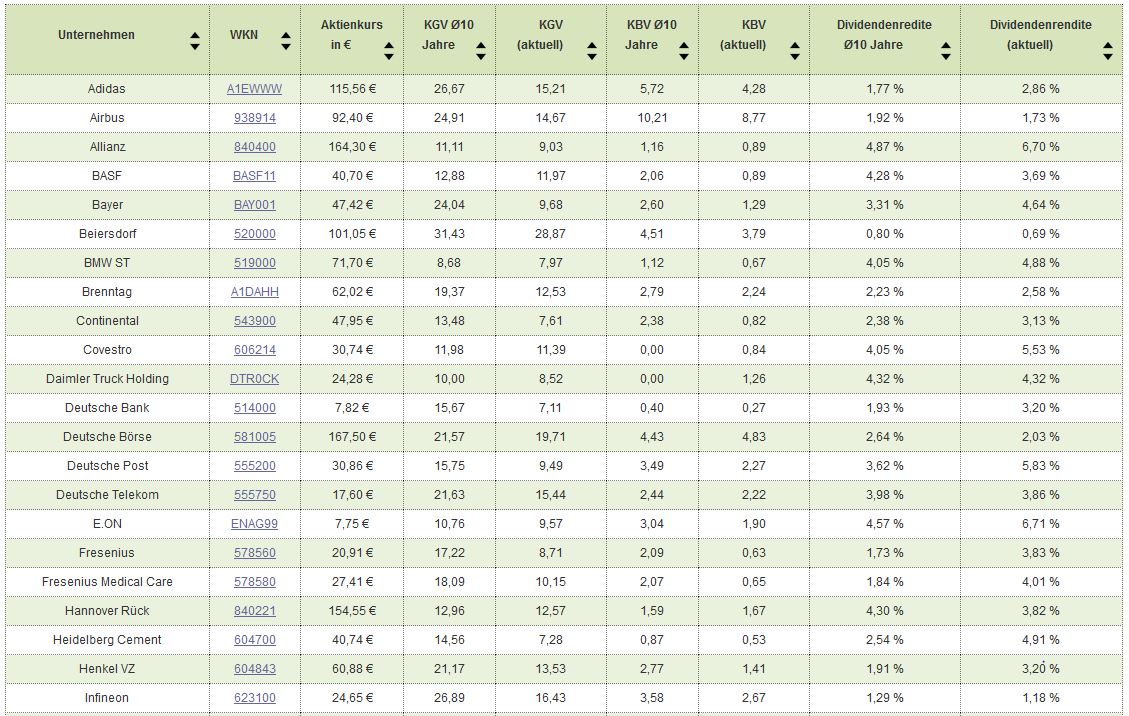

These two points may sound familiar to you, as it is precisely these parameters that we also need to determine the P/B ratio (price-to-book ratio).

If this ratio is less than 1, this does not immediately mean that the company is valued favorably. It also gives us an indication of whether there is a risk of impairment, according to which assets must be written down in accordance with IAS 36. This is because a ratio of less than 1 indicates that the book values are higher than the actual value on the stock exchange. Only if the stock exchange or the market overlooks parameters does this justify a favorable time to buy.

The core statement from IFRS (and also US GAAP) is that the financial statements must present the net assets, financial position, results of operations and cash flows of a company in accordance with the actual circumstances [1]. This is referred to as the "true and fair view" concept. Many assets must therefore always be valued (e.g. using the DCF model). This means that pure market capitalization or the P/B ratio also gives us initial indications that need to be assessed.

Of course, a low P/B ratio does not immediately mean impairment risk.

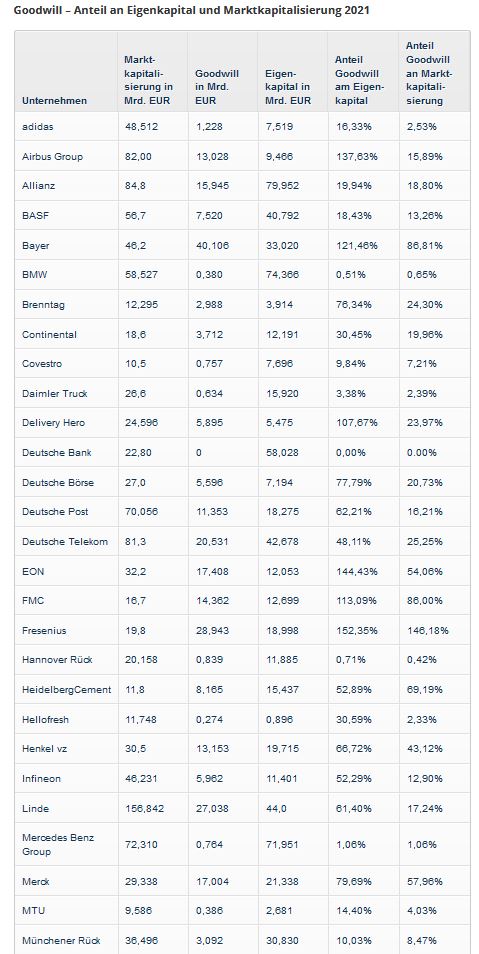

If you are interested in studies in this area, I can recommend the following. Here, stocks from the DAX, MDAX, SDAX and TecDAX were analyzed on the basis of market capitalization and equity in connection with possible impairment risks. Perhaps this will give you a better understanding of what I mean.

b) Goodwill

Investments in subsidiaries are not included in the consolidated financial statements that we analyze (keyword "capital consolidation" - if you want to know why). What we see in the consolidated report is the so-called goodwill. In short, goodwill is the additional value that I am prepared to pay for another company - and therefore exceeds the value of the book value of equity - because I believe that the company will be worth more in the future than what is on the books. This "premium" must be recognized in the balance sheet. The counterpart is the so-called badwill. Goodwill can be found under intangible assets in the balance sheet.

So if a group has a very high proportion of goodwill on its balance sheet due to many company acquisitions, you must take this into account in your analysis! A high proportion of goodwill also means a high risk of extraordinary write-downs in times of recession, which have a 100% impact on profits! Impairment in accordance with IAS 36 would be the result.

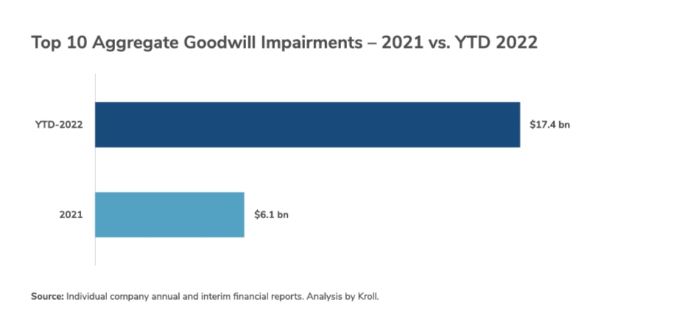

Goodwill impairments have already more than doubled in 2022, as the following study shows, which analyzed US companies ("US based companies"). The study cites many reasons, including the decline in market capitalization (see my comments under point a), lower operating profits and a reduction in the workforce.

Further examples based on recent news, including Canopy Growth:

For more details on goodwill, please refer to the following article and a picture attached:

https://app.getquin.com/activity/ymidZwhlTk

I also link to an analysis by AMD in the comments. The goodwill is also briefly discussed there. It becomes relevant here from minute 11.

c) Further examples

Other assets that can be valued using a DCF model and can therefore be subject to impairment in accordance with IAS 36 (list is not exhaustive and reflects our own thinking):

-leased properties - rent as the basis of cash flow for DCF (property, plant and equipment on the balance sheet)

-Parking garages - parking fees as the basis of the cash flow for DCF (property, plant and equipment in the balance sheet)

-Patents, rights for products - cash flow from product sales as the basis of the cash flow for DCF (intangible assets in the balance sheet)

In the same way, a dilapidated building in need of renovation or simply a building destroyed by external influences (environmental disasters, hurricanes, etc.) would be reason enough to write it off in accordance with IAS 36. Such "ad hoc" events are referred to as "triggering events", which also lead to impairments during the year.

d) Indications in accordance with IAS 36

IAS 36 lists various indications that may lead to impairment:

External sources of information:

- the fair value of an asset has decreased significantly during the period under review compared to its

normal use (IAS 36.12 a));

- (already occurred or soon to occur) significant changes in the technical, market, economic or legal

market, economic or legal environment of the company (IAS 36.12 b));

- Increase in the market interest rates and yields to be used as a basis for discounting cash flows as part of the impairment test (IAS 36.12 c)); --> Very relevant in the current environment of rising interest rates!

- For listed companies, the market capitalization (number of shares in circulation

shares outstanding x price per share) is less than the net assets (at book value)

(IAS 36.12 d)). -->see point a)

Internal sources of information:

- Substantial evidence of obsolescence or physical damage to an asset (IAS 36.12 e)

asset (IAS 36.12 e));

- significant changes with adverse consequences for the company and the associated asset (goodwill) (IAS 36.12 f));

- indications from internal reporting that suggest a worse (than expected) economic performance (IAS 36.12 g)).

𝗜𝗜𝗜. 𝗦𝗰𝗵𝗹𝘂𝘀𝘀𝘄𝗼𝗿𝘁

In short, periods of recession and extraordinary events, such as the coronavirus pandemic or environmental disasters, are phases that can lead to significant impairment tests! Some of these we cannot foresee. Others, however, such as upcoming events in the course of a recession, we can! You do not need to understand IAS 36 in detail. However, you should know and be able to classify the consequences!

Oh yes...sorry for the nerdy meme...🌝

Sources:

[1] IFRS Visuell - The IFRS in structured overviews, 7th edition

[2] https://www.firicon.de/ias-36-wertminderung-von-vermoegenswerten-impairment-test.html

Further sources:

Goodwill ratios DAX companies: https://www.brokervergleich.de/wissen/expertisen/goodwill-bei-dax-unternehmen/

KBV DAX: https://www.boersengefluester.de/10-jahres-durchschnitt-kgv-kbv-dividendenrendite/