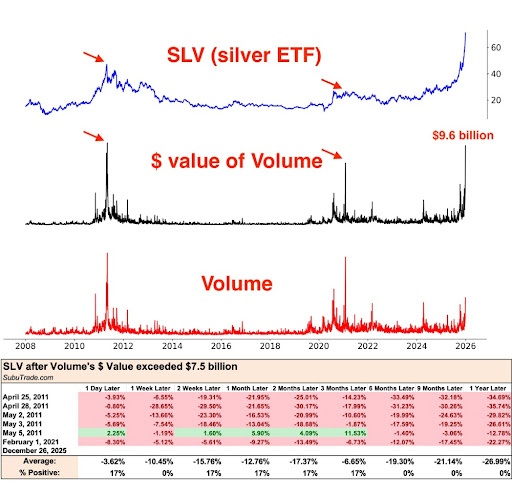

$SLV (+5.75%) has now reached the same level as in 2011 and 2021 if you look at the volume, which historically indicates overheating. Statistically, the probability of falling prices over a period of 1-12 months after such a volume peak is almost 100%. The average setback after one year was historically -26.99%.

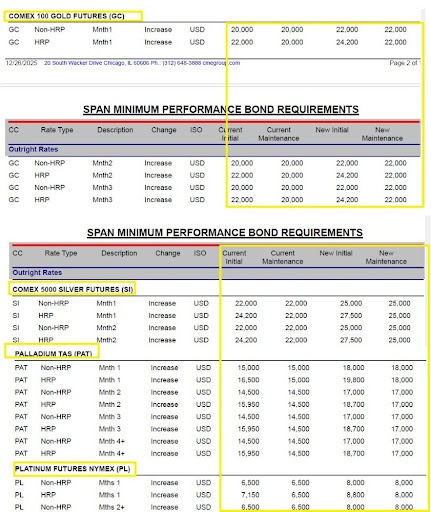

In addition, the CME has carried out margin increases. This was yesterday (26.12) and means that margins for silver futures are being increased, 14% to be exact. This usually leads to deleveraging, traders have to either immediately cash in their highly leveraged positions or sell their positions. Paper money goes!

In short, we are very likely to see a drop in price next week, which does not necessarily mean that silver has ended its bull trend, quite the opposite. If you look at the 2011 silver rally, you will see that the rise to almost 50$ was primarily speculative. Investors fled into metals due to the euro crisis and US debt concerns. The sell-off came when the COMEX raised margins by 30 and forced selling. And 2021 was a short thing when $REDDIT (-0%) User tried to bring banks to their knees. 2025 looks different. We are currently in the 5th consecutive year of a structural deficit. Around 59% of demand today comes from industry. The solar industry in particular is a huge consumer and is estimated to consume over 195 million ounces in 2025. These buyers will have to buy silver, no matter what the price, to maintain their production. Another sign of a real shortage is the increased rates for leasing silver (7%), which shows that there is hardly any physical silver available in the warehouses. This means short term we are seeing a sell off, but long term I am still bullish!