The dry bulk market is navigating significant challenges as we move through Week 4 of 2025. A mix of factors, from high coal inventories to a strong US dollar, is shaping the outlook for the year, with minimal demand growth anticipated. Let's break down the key developments.

💡 Demand Growth Forecast: Flat in 2025

Fearnleys projects zero demand growth for dry bulk shipping in 2025. Economic conditions are a key driver of this forecast, with the strong US dollar, high interest rates, and delayed effects of China’s economic stimulus measures weighing on demand. Manufacturing activity has underperformed compared to services, indicating a weaker global economy. As a result, the market faces significant headwinds, particularly in the Pacific markets.

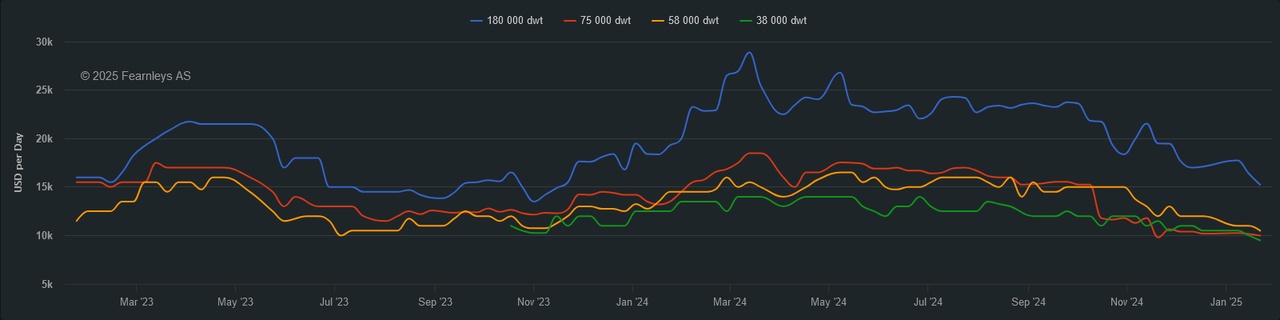

1 Year T/C Dry Bulk

📉 Impact of Coal Inventories on the Pacific

One of the major bearish factors is the high coal inventories in China, a consequence of energy security policies that have been in place since 2021. Coal stocks are at elevated levels, limiting China’s need for further imports, which is particularly problematic for Pacific markets. As coal demand stagnates, analysts are forecasting a drop in China’s coal imports, further depressing rates in these key trade routes.

💰 US Dollar and Financing Growth

The US dollar continues to play a pivotal role in limiting growth. A 5% rise in the dollar index in 2024 is expected to result in zero growth in dry bulk shipment volumes in 2025. Additionally, Chinese financing growth has slowed, signaling continued challenges for demand recovery. The lag between Chinese stimulus measures and their actual impact on the market could stretch into 2026, keeping the outlook uncertain for the immediate future.

🚢 Fleet Growth Outpaces Demand

While demand remains flat, the global bulker fleet is projected to grow by 3% in 2025. The fleet will see the most significant growth in the Supramax/Ultramax segment (+5%), followed by Handysize and Panamax segments (+3%). The Capesize fleet will see the smallest increase at 1.8%, which could contribute to continued rate pressure as supply outpaces demand.

🔮 China’s Stimulus and Iron Ore Demand

In the long term, the stimulus measures announced by China, targeting industries such as steel, nonferrous metals, and building materials, may have a positive effect on the dry bulk market. Iron ore futures show slight positivity (+0.2%), and while iron ore imports to China are expected to remain flat, there is a possibility for stronger demand later in the year as the stimulus takes hold. Forward Freight Agreements (FFAs) remain cautious, signaling skepticism about a rapid recovery.

⚖️ Uneven Commodity Flow Shifts

The dry bulk market may experience shifts in commodity flows throughout 2025. Steel and iron ore shipments into China are expected to be relatively flat, but any disruption in the flow of these commodities could trigger periods of stronger demand for transportation, creating opportunities for freight recovery.

🌍 Minimal Impact of Potential Tariffs

Tariff concerns are afoot, with potential U.S. tariffs on Mexico, Canada, and China. However, the dry bulk sector is minimally exposed to China-U.S. trade routes, meaning tariffs are unlikely to have a major impact on the sector. The broader market will likely continue to face challenges from geopolitical tensions and global economic shifts.

🚢 The Dry Bulk Market’s Road Ahead

With the global bulker fleet expanding faster than demand, rates for Panamax, Supramax, and Handysize vessels are expected to stay under pressure, especially given the lack of strong demand growth. Meanwhile, Capesize rates are expected to hover around $15,000/day, marking a year of mixed performance in the dry bulk sector.

As 2025 progresses, opportunities for freight recovery may arise, particularly with shifts in commodity demand and China’s stimulus policies. However, the market remains cautious as the slow pace of recovery and high inventories continue to weigh heavily on rates.

💬 Let’s Connect!

What’s your take on the dry bulk market heading into 2025? Share your thoughts in the comments, and don't forget to like and share this update! 🚢