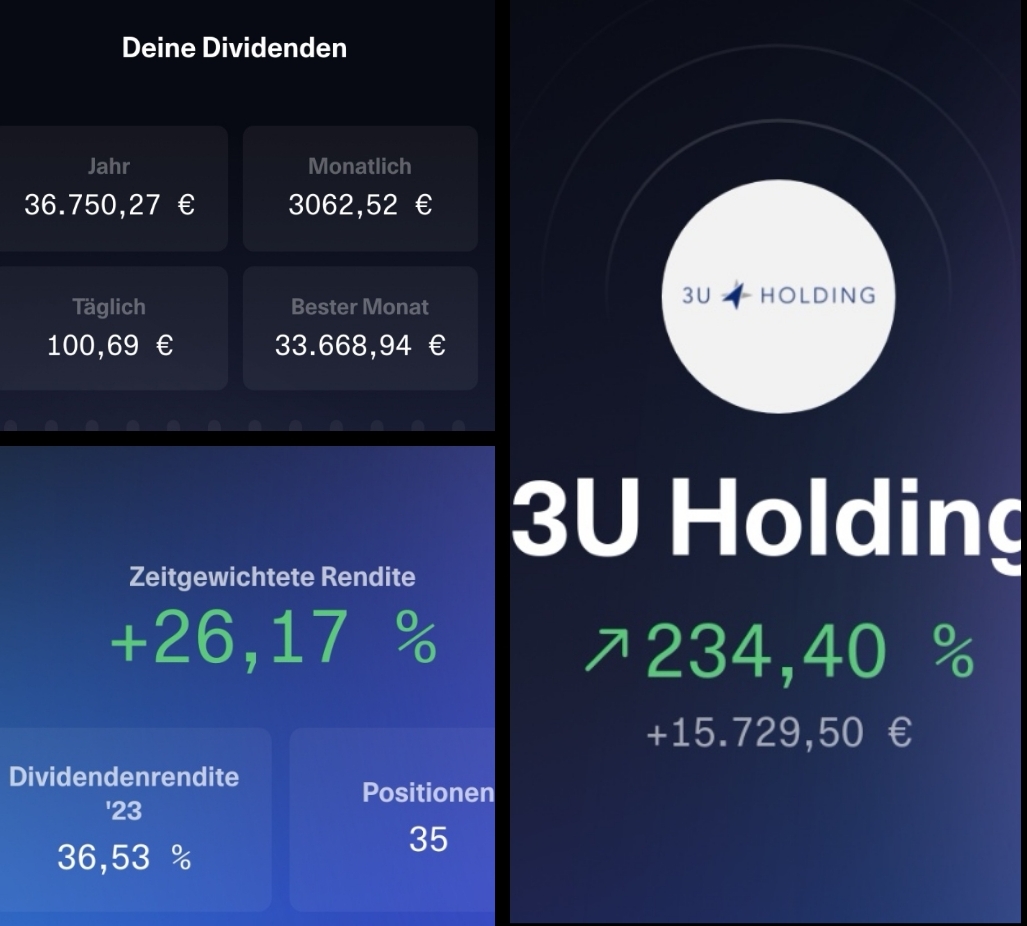

Dear community, unfortunately I can't manage to add multiple photos (maybe too old 🤷🏻♀️), hence 3in1... I tested this new feature a while ago, it's not that meaningful for me now, because no, I don't have a 'dividend portfolio' (although it's decent, but more as a side effect), but rather my own mix of really everything that doesn't correspond to any 'strategy'.

My personal bestseller this year is actually $UUU (+0%) ... A much 'hated' share, so I'll just share that now. I bought shares of this in 2009 for around €4000... I had just been paid out money (because someone drove my car to a total loss) and shortly afterwards I stumbled across the founding of 3U-Solar, looked into the company and thought I'd get in (for €0.38 per share, without dividends at the time), 11,000 shares in total.

This May, as I think everyone knows, there was a one-off 'super dividend' of €3.20, the rally started from the announcement in the spring and I was really amazed at how many people, including here, bought quickly because of the dividend. I don't recommend that. I also briefly considered selling at the peak of the run (i.e. shortly before the dividend), but decided against it, I felt somehow ungrateful 😅