S&P 500 posts weekly gain thanks to strong quarterly figures and the start of the Trump presidency

The Standard & Poor's 500 index rose 1.7% this week, helped by better-than-expected quarterly results and optimism that the Trump administration will cut taxes and regulations.

The market index ended Friday's session at 6,101.24 points. It reached a new record high of 6,128.18 points during the day on Friday, but closed just below Thursday's record close of 6,118.71 points. The S&P 500 is now up 3.7% in January and is 25% higher than a year ago.

The week only had four trading days as the US stock market was closed on Monday for Martin Luther King Jr. Day.

Monday also saw the inauguration, which marked the start of President Donald Trump's second term. Investors are hoping that the newly sworn-in president will implement his plans to cut taxes and regulations.

Sentiment was also boosted by better-than-expected quarterly results from companies such as GE Aerospace (GE), Union Pacific (UNP) and Netflix (NFLX).

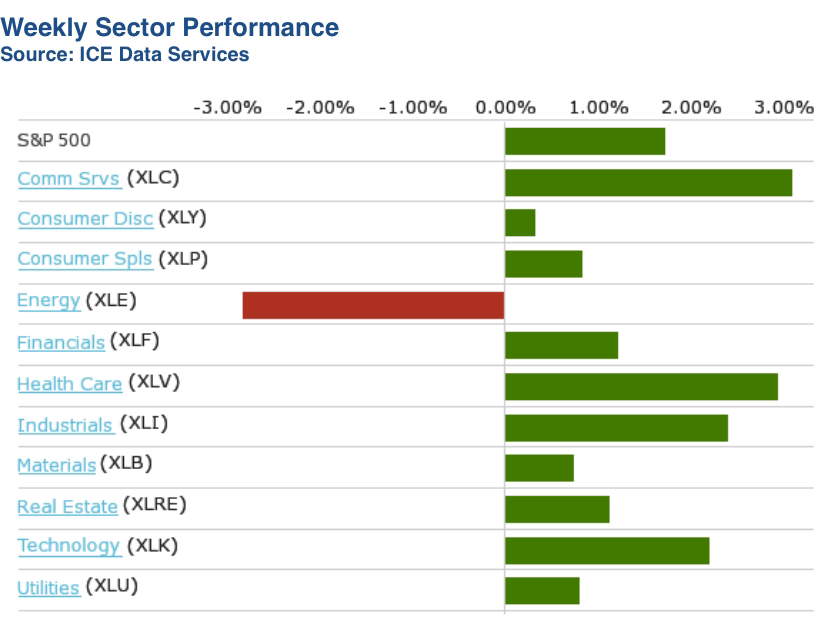

By sector:

- Communication services recorded the largest percentage increase of the week with a rise of 4%, followed by a rise of 2.9% in healthcare and an increase of 2.4 % in industry.

Netflix was the top performer in communication services, with a weekly increase of 14%. The company exceeded expectations with its Q4 results and revenues, adding 18.9 million new subscribers worldwide, almost twice as many as forecast. Netflix also issued above-consensus guidance for Q1.

In healthcare, shares of Moderna (MRNA) surged 22% after the vaccine maker was awarded $590 million from the U.S. Department of Health and Human Services to develop mRNA-based flu vaccines. Moderna also announced that it had received an order to supply its COVID-19 vaccine to the European Union, Norway and North Macedonia.

Shares of GE Aerospace led the gainers in the industrials sector, rising 7.6% after the company reported adjusted earnings per share and revenue for the fourth quarter that beat analysts' average estimates. The upper range of the earnings forecast for 2025 also exceeded the analysts' consensus estimate.

Energy was the only loser of the week and fell by 2.9% as a result of a decline in crude oil prices. Shares of Halliburton (HAL) fell 7% as the company's adjusted earnings per share beat analysts' consensus estimates by just one cent, while revenue slightly missed expectations.

Outlook for next week:

The corporate earnings calendar includes AT&T (T), Boeing (BA), Starbucks (SBUX), Microsoft (MSFT), Meta Platforms (META), Tesla (TSLA), International Business Machines (IBM), Apple (AAPL), Visa (V), Mastercard (MA), Caterpillar (CAT), United Parcel Service (UPS), Exxon Mobil (XOM), AbbVie (ABBV) and Chevron (CVX).

Economic data includes December new and pending home sales, Q1 GDP and the December personal consumption expenditures (PCE) price index. In addition, the Federal Open Market Committee of the US Federal Reserve will hold its first meeting in 2025.