Hello my dears,

Camurus has just arrived.

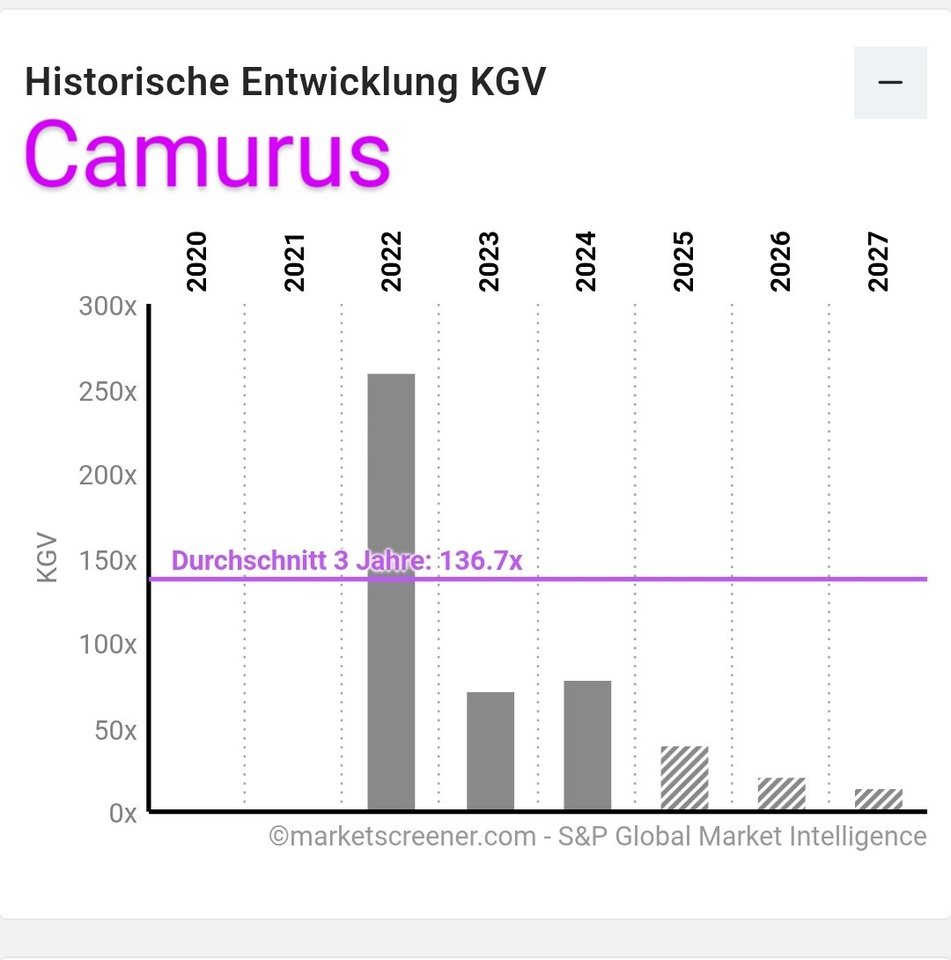

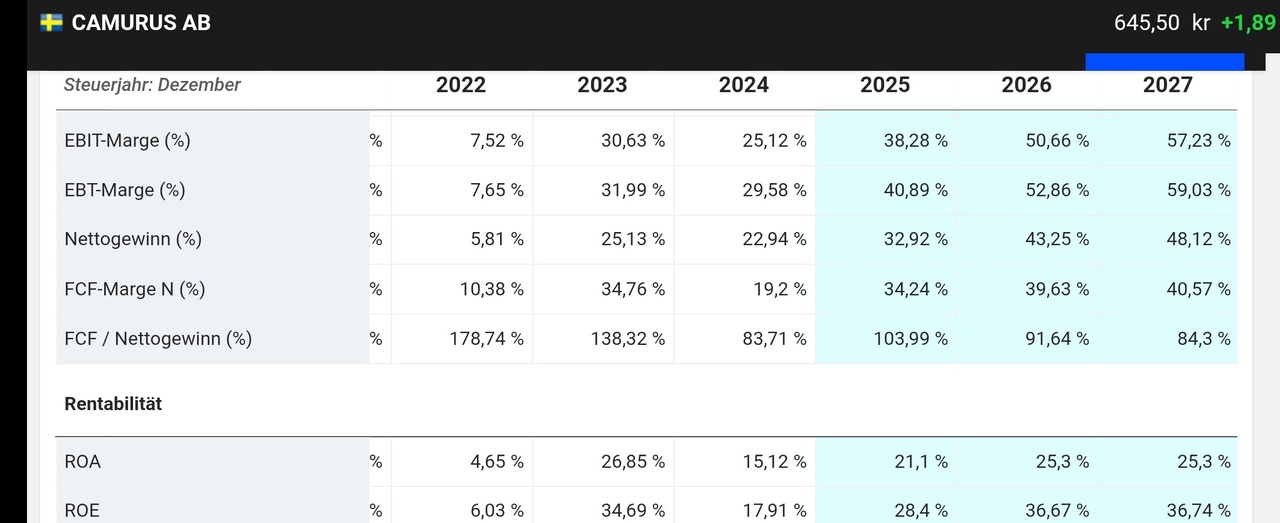

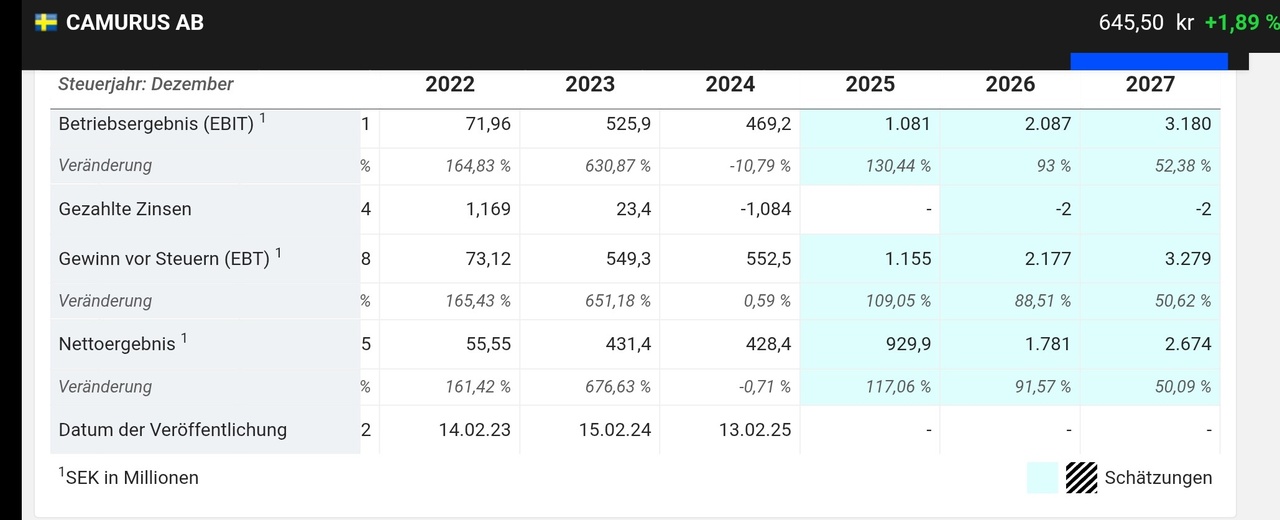

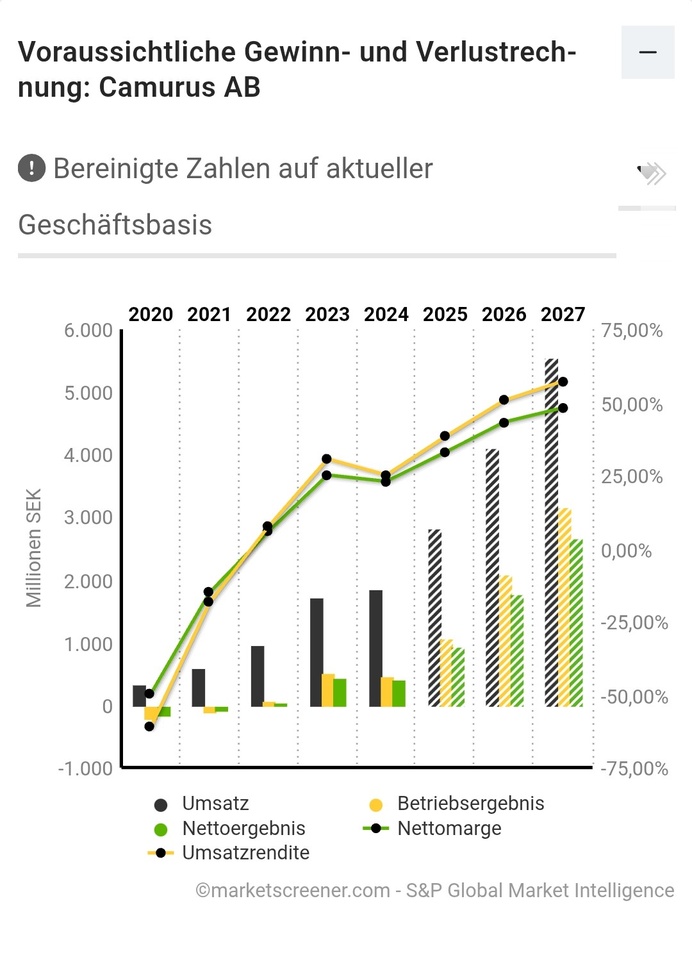

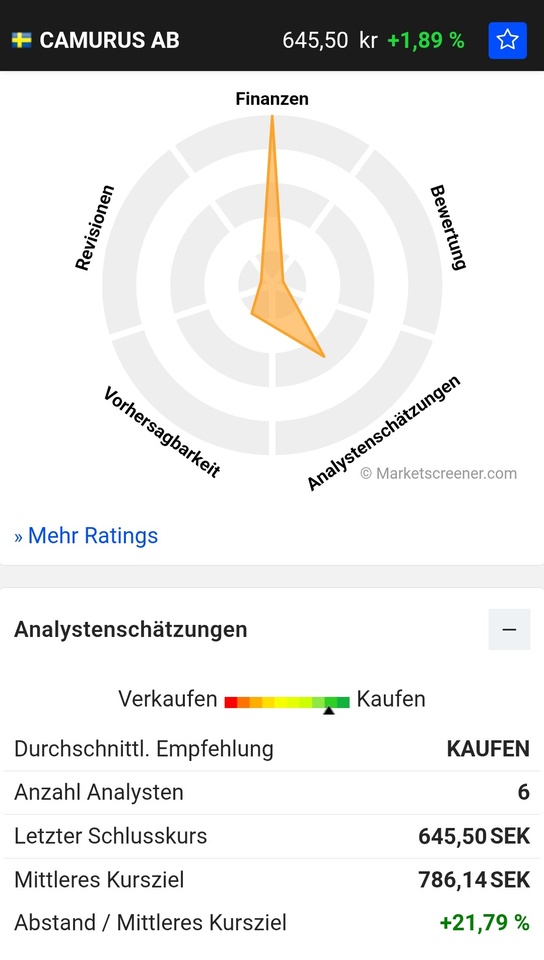

I was thrilled to see that profits have doubled. And that the already good EbiT margin can be increased by a further 10%. As a result, the P/E ratio has halved and the PEG is a good 0.50.

Today's breakout from the prolonged sideways movement has encouraged me to buy.

https://aktie.traderfox.com/visualizations/SE0007692850/EI/camurus-ab

What does Camurus do?

Camurus is a biopharmaceutical company based in Sweden. The company specializes in the development and marketing of pharmaceuticals based on proprietary formulation technologies.

Camurus focuses on the treatment of chronic diseases and addictions. The company's approach is to develop longer-acting drug formulations in order to improve patient compliance and reduce the number of doses.

Camurus offers a range of products in various therapeutic areas, including pain management, oncology and endocrinology. The company strives to provide solutions that improve patients' quality of life and optimize clinical outcomes.

On June 3, 2025, the Swedish biopharmaceutical company Camurus and the US pharmaceutical group Eli Lilly announced a comprehensive collaboration and license agreement. The aim of this partnership is the development and global commercialization of long-acting incretin therapeutics.

Camurus Q2 2025: Record sales and profit with expansion of the product portfolio/s