- values Chime at around 11.6 billion dollars on a fully diluted basis

- Chime was valued at 25 billion dollars in the last major financing round

- Chine generates the majority of its revenue from interchange fees

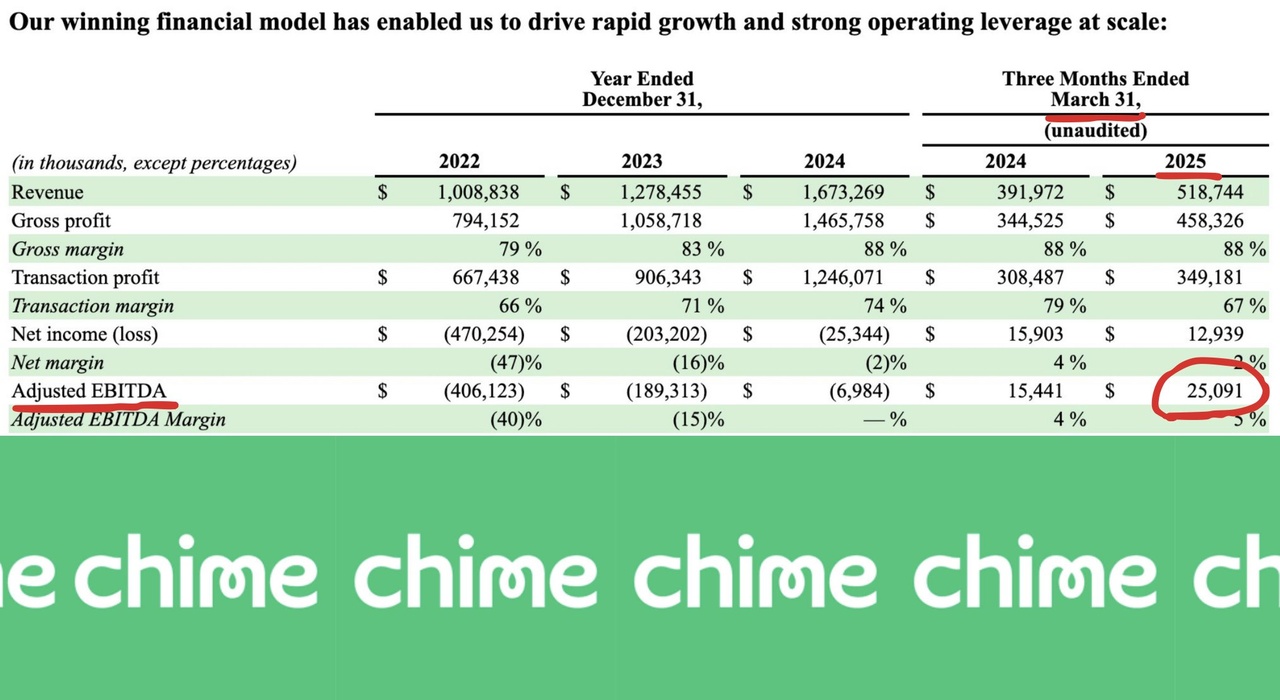

Chime $CHYM goes public with a valuation of 11 billion US dollars, a turnover of 1.7 billion US dollars and a negative net profit of (-) 25 million US dollars.

$SOFI (+2.85%) In contrast, Chime achieved sales of USD 2.7 billion and a net profit of USD 500 million in 2024, but was only valued at USD 16 billion.

$CHYM does not have a banking license or is not a bank, that is correct, so a comparison only makes limited sense, but:

Chime $CHYM uses Galileo from $SOFI (+2.85%) .

A brief explanation: Galileo is a fintech platform that provides APIs and services that can be used by $CHYM and other fintech companies (e.g. also $HOOD (+4.02%) ) to offer financial services such as debit cards, loans and transactions. Chime uses these APIs to develop and offer its own financial products and services.

-> I just want to point out the potential here if other banks want to modernize their technologies.

The financial technology company Chime announced on Wednesday that it had raised 864 million dollars in its IPO after shares were offered at a price of 27 dollars each.

The company had priced the offering between 24 and 26 dollars per share.

The IPO values Chime at approximately $11.6 billion on a fully diluted basis.

Chime's IPO is one of the largest in recent years for a US financial technology company. It follows a period in which valuations were reset from the highs reached in the wake of the coronavirus pandemic, which drove up investment in fintech and e-commerce companies.

Chime was founded in 2012 by Chris Britt, former managing director of $V (+0.08%) and Ryan King, former employee of $CMCSA (-0.16%) and offers its services through partnerships with brick-and-mortar banks. Products include branded current accounts and user-friendly features such as fee-free overdrafts.

Investors in Chime, which was valued at 25 billion US dollars in its last major funding round in 2021, include Yuri Milner's DST Global, private equity firm General Atlantic and investment firm ICONIQ.

Chime is scheduled to begin trading on the Nasdaq Global Select Market on Thursday (June 12) under the symbol "CHYM".

The IPO follows a strong market debut by stablecoin issuer Circle at the beginning of June, which gave new momentum to the US IPO market, which has been dampened by the Trump administration's tariff policy.

Chime's IPO had been expected at the beginning of the year, but was postponed after Trump's announcement of tariffs on "Liberation Day" sent the financial markets into turmoil.

The recent upturn in listings has encouraged more companies to revisit their plans, with June proving to be an important window as companies seek to capitalize on the relatively stable market conditions ahead of the traditional summer lull.

As of March 31, Chime had 8.6 million active members. According to the IPO prospectus, the company generated an average revenue per active member of $251 in the first quarter.

Members conducted an average of 54 transactions per month, 75 percent of which were purchase transactions with Chime-branded cards.

The company generates the majority of its revenue from interchange fees - a portion of the transaction fees paid by merchants to payment networks such as Visa when a customer uses a Chime debit or credit card.

Chime's net loss narrowed to 39 cents per share for the year ended Dec. 31, down from $3.22 in 2023 and $8.12 in 2022.