- My thoughts on Zeta

Due to the rare combination of rapid growth, improved margins and attractive valuation, I have $ZETA (-11.1%) in my portfolio.

ZETA's 36% year-over-year revenue growth, strong gross margins and recurring revenue-based model set it apart from the competition and offer significant upside potential in both acquisition and standalone business models.

Compared to industry peers, the company trades at a much lower multiple despite faster growth and I estimate it offers upside potential of 50-100% over the next 24 months.

- Highlights of the 1st quarter results

36% year-on-year sales growth

Gross margin of 60.9

548 customers spending over $100,000 per year

5-6 customers with a value of over USD 100 million

GAAP operating margin of -6.1 % (compared to -18.4 % in the previous year)

USD 364 million in cash and USD 195 million in debt

- Risks

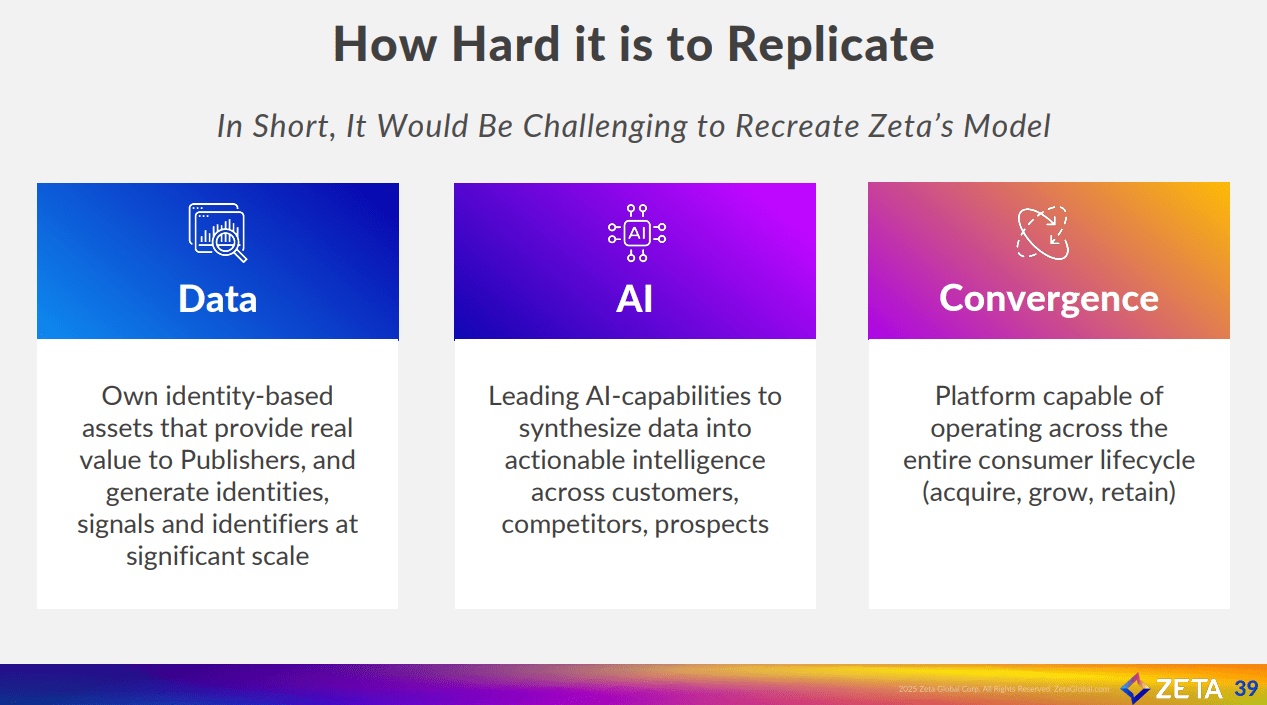

While I remain optimistic about Zeta's long-term potential, there are some important risks to be aware of. A primary concern is the changing regulatory landscape around data privacy, which adds significant complexity to the marketing industry. Although proprietary data assets are a competitive advantage today, future restrictions on data collection, identity resolution or customer tracking could impact the company's ability to deliver personalized, high ROI marketing that ZETA is known for.

Another aspect is the general macroeconomic backdrop. If the current period of restrained marketing spend continues or worsens into a full-blown downturn, brands may be forced to cut their advertising budgets more. Although I believe this is a valid risk, it has been discussed with ZETA for years and so far there is no indication that it will actually materialize as the ROIs ZETA has achieved make it more than worthwhile for companies to continue investing. Of course, we could be heading for an even deeper recession.

- Fundamentals

Unlike many growth companies, ZETA is growing at these rates without sacrificing margins or profitability. With rising EBITDA margins, ZETA has now been EBITDA profitable for three consecutive quarters.

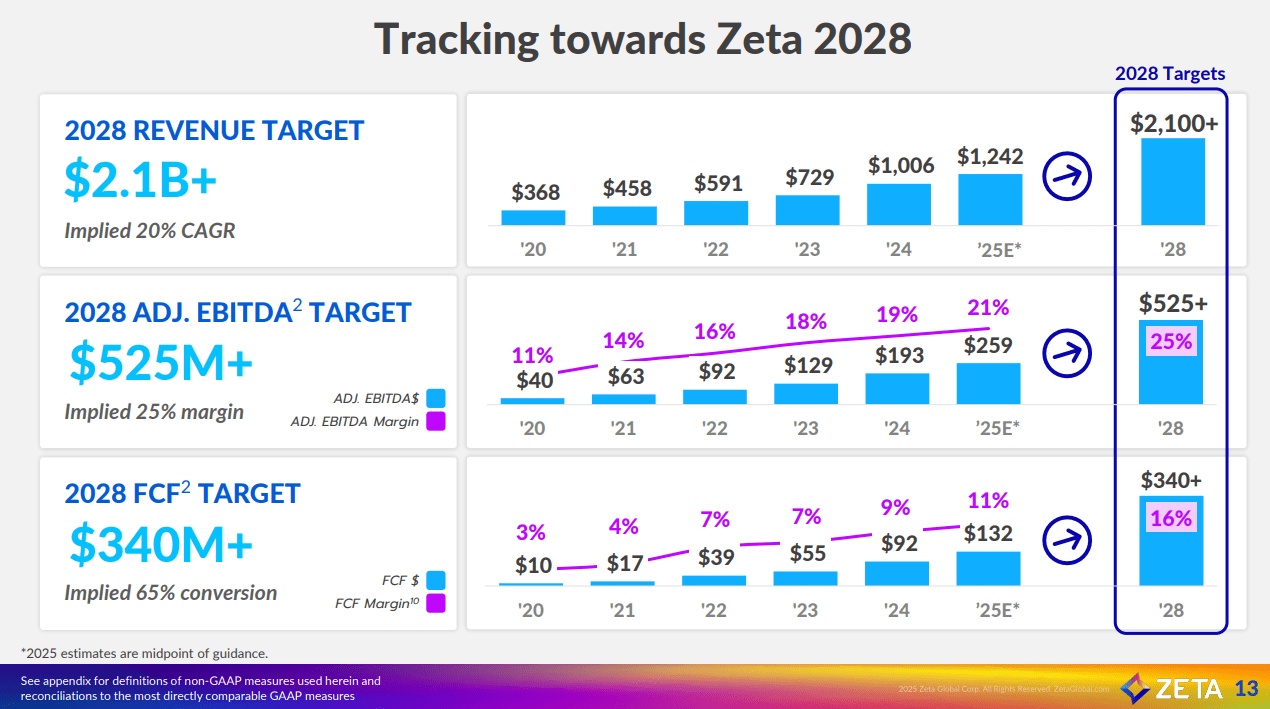

There are only a handful of companies in the market that are built from the ground up as technology companies and therefore naturally become more profitable as they grow in size. This basket of companies includes insurtech companies like ROOT and LMND , lending companies like SOFI and UPST and healthcare platforms like HIMS. I think ZETA can compete with these types of companies, but only in the marketing niche, an extremely lucrative industry to be competitive in. Grand View Research estimates that MarTech will grow by an average of 20% annually until 2030, and Zeta is undoubtedly one of the leading players in this sector. It therefore seems possible that the growth rate will remain very high (at least in the mid-teens) until 2030, while at the same time profitability will improve massively.

- Longer-term valuation

If we assume that ZETA is not bought out in the next 12-24 months, I think the long-term potential is even greater if the company gets a deserved re-rating in line with other software companies with similar fundamentals. ZETA's closest competitors are probably ADBE , CRM and HUBS , of which ZETA has by far the lowest valuation from an EV/EBITDA and EV/Sales perspective and at the same time has by far the highest sales growth rates.

With revenue estimates of $1.4bn for FY26 (assuming ZETA achieved management estimates of $1.2bn in FY25), a 5x revenue multiple (still lower than any of the peers listed above) gives a market capitalization of $7bn, offering 100% upside from current levels.

Companies with large upside potential like ZETA generally have a lot of risk and/or profitability issues in my opinion, but with ZETA I think the downside risk is much lower.

- What does Zeta do anyway?

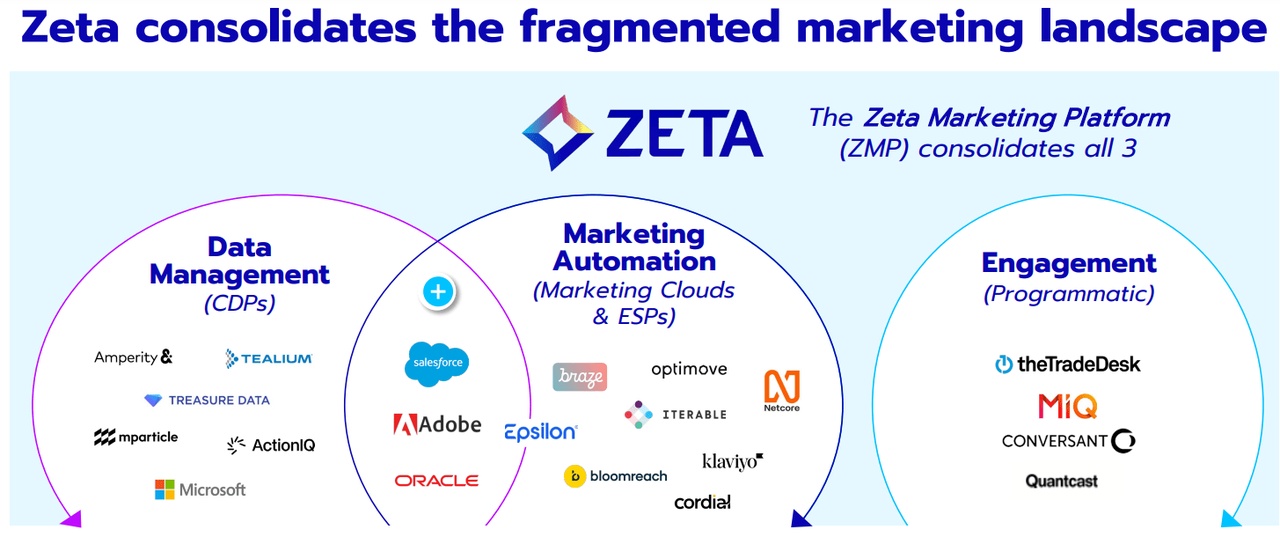

Zeta Global is a global marketing technology company that provides a platform for data-driven omnichannel marketing. They use Artificial Intelligence (AI) to create, nurture and monetize customer relationships. The company offers solutions for various industries, including retail, healthcare and financial services.

Zeta Global's core expertise lies in analyzing billions of data points to predict customer intent and enable personalized marketing campaigns. They offer a range of products and services, such as a Customer Data Platform (CDP), a messaging platform and a DSP for paid media.

Zeta Global was founded in 2007 and is headquartered in New York.

In summary, Zeta Global is a technology company that specializes in data-driven marketing and customer relationship management. They use AI to help companies optimize their marketing strategies and achieve better results.

Source: https://zetaglobal.com/