If you can't see the target, you can't hit it.

Unknown

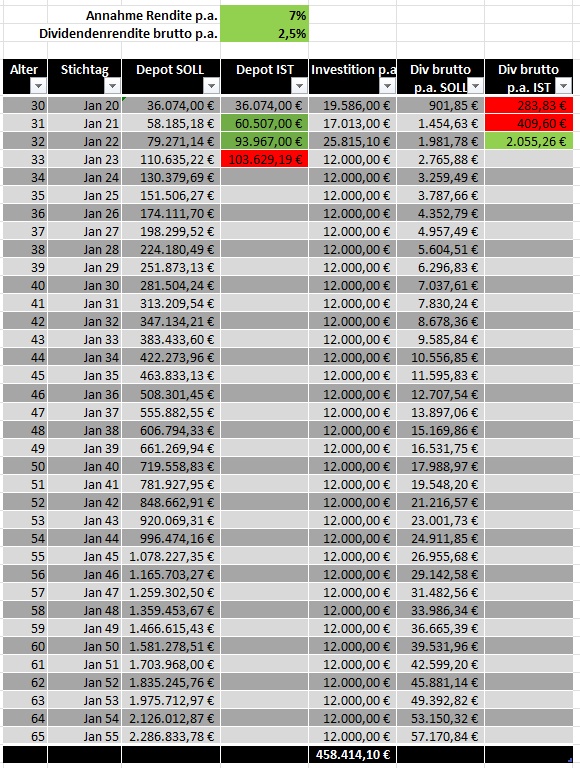

As I wrote yesterday in #Jahresbericht 2022 from #Howsyshaussehedge yesterday, I measure myself against the annual goals I set myself. I follow the KISS principle: keep it simple, stupid. I have created a small Excel spreadsheet to set my annual financial goals, which is not rocket science. You can certainly take a highly scientific approach, but I prefer to keep it simple.

Calculation of the annual target value

Since the coronavirus crash in 2020, I have set myself financial targets for my investment in the stock market. I assume an average annual return of 7% on my portfolio value. Together with the previous year's investment, this results in the target value of the portfolio at the start of the following year. I add the investment at this point. Interest on the investment in the current year is not yet calculated at this point.

The investment for the current year is entered in the "Investment p.a." column. The figures for this come from the Portfolio Performance program. I am trying to invest €1,000 per month. I'm not sure whether I'll be able to maintain this savings rate in the future. As I'm starting a new job this year, which initially involves a loss of salary, the savings rate could well suffer at this point. However, the advantage is that I "only" have to put an average of €850 a month into the system. The remaining €150 comes from my dividend payments.

I am aiming for an annual dividend yield of 2.5%, which in my opinion is a very healthy assumption. My portfolio contains high dividend stocks as well as dividend growth stocks. I therefore assume that the dividend yield will increase in my favor in the future. However, I conservatively expect the 2.5% p.a. in the long term. I then compare the target value of the annual gross dividend with the actual value actually received. This in turn comes from the Portfolio Performance program.

Current situation

This year, I missed my target value at the start of 2023 by €7,006.03. In order to make the delta between this year's actual value and next year's target value disappear, my portfolio would have to grow by € 26,750.50, taking into account my investments of € 12,000 during the year. If you take into account that I am only adding the investment from the current year, i.e. assuming that it does not earn interest, my portfolio must "earn" €14,750.50. This corresponds to a return of 14.23%. Sporty, but possible at the end of the bear market and a corresponding recovery.

Book profits or rather losses, what counts is the cash flow! The gross dividend actually received was cause for celebration. I was able to exceed my target value by €73.48. According to the Divvydiary app, I should just reach my gross target of € 2,765.88 this year. However, you need to know that the app only uses the current portfolio balance for the calculation. Future investments and the resulting dynamization as well as dividend increases or reductions are not (yet) known to the app.

Why the gross dividend? Because I don't know how future income from investments will be taxed. In order to achieve the best possible comparability across decades, I choose dividends before tax in my table here. Normally, I always use the net value for the dividend figures, after all, only what ultimately arrives in my account counts.

Target value for retirement

The quality of our goals determines the quality of our future.

Josef Schmidt

Why am I doing all this? Why am I investing? Why am I doing without in the here and now? To have a really good time in old age, of course! Or to avoid having to exchange my lifetime for money for eternity. I don't really expect anything from my pension. It's up to the shareholder!

If I continue my table until the age of 65, I will receive a portfolio value of €2,286,833.78. Wow! Considering a 2.5% dividend yield, this portfolio should yield a dividend of €57,170.84 before tax. If you deduct the currently (!!!) applicable capital gains tax rate (+ solidarity surcharge, 26.37%), you get €42,094.89. This means you can live on €3,507.91 per month. If you take inflation into account (conservative assumption 3% p.a.), you will still have a monthly purchasing power of €1,361.90 in 32 years. That means a loss in purchasing power of 61.17%! Not so wow anymore.

At this point, you could throw in the towel in disbelief. But since I'm more of an optimist than a pessimist, I say to myself: step on the gas! Put as much money to work as possible, especially in the early years of the portfolio, so that compound interest kicks in. As I have not been able to influence the returns on the stock market in the long term so far, the only other option I have is to increase the dividend yield. However, as described above, I assume that this will develop independently in my favor. The final quote fits quite well at this point:

Anyone who achieves all their goals has probably set them too low.

Herbert von Karajan

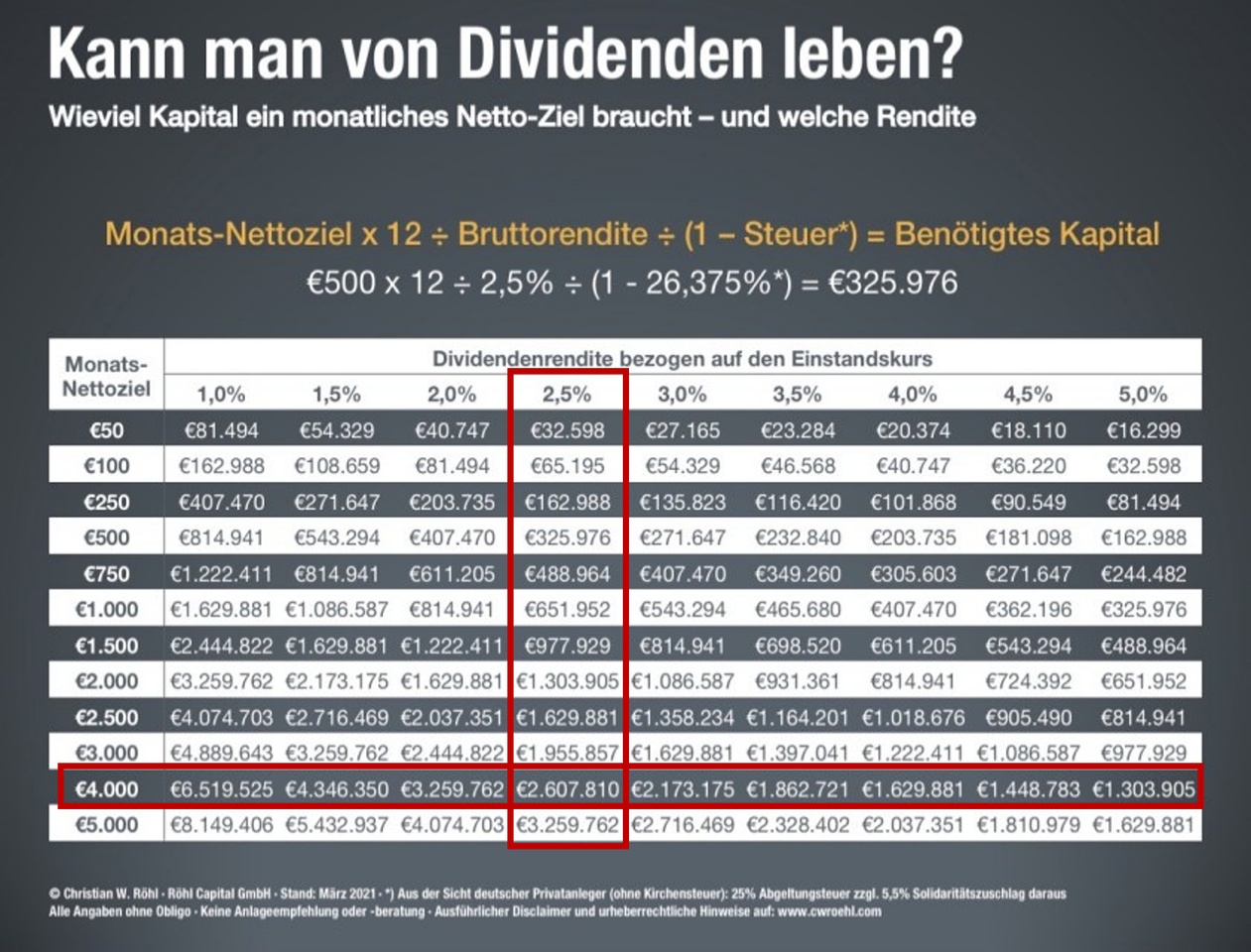

I use CW Röhl's table to quickly estimate the possible income from dividends. Source:

https://twitter.com/cwroehl/status/1484509586698735622