$COST (+0.45%)

$HD (+0.59%)

$ADP (+0.07%)

$MMC (+0.37%)

$SHW (+0.39%)

$CTAS (+0.37%)

$RACE (+2.2%)

$ZTS (+0.58%)

$PAYX (+0.22%)

$TSCO (+0.02%)

$TPL (+0.54%)

$WSO (+0.37%)

$DPZ (-0.05%)

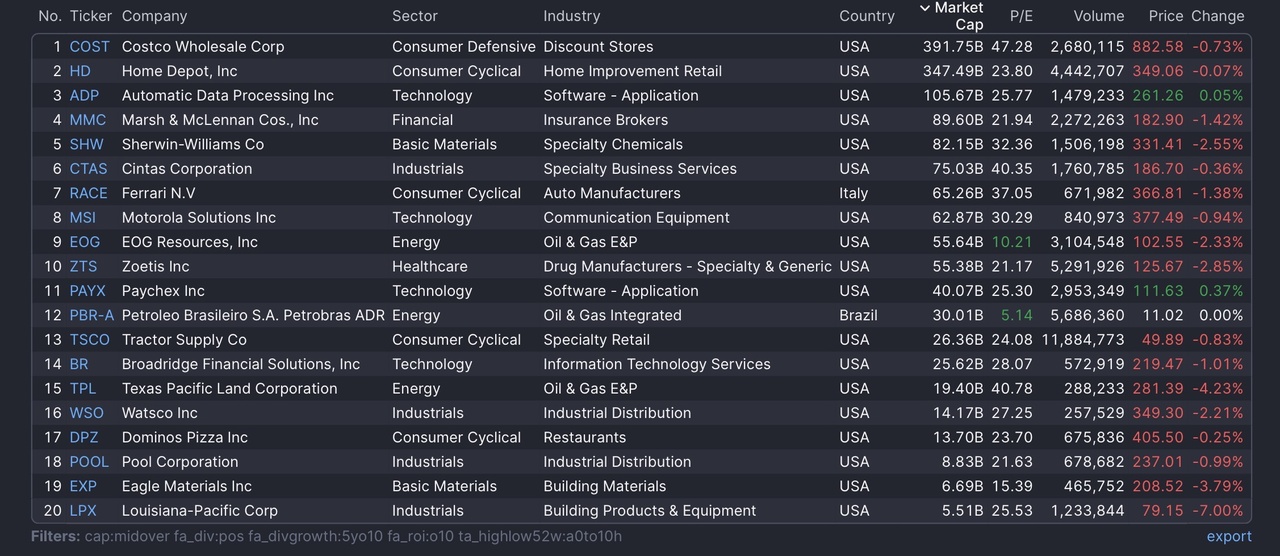

Is it Black Friday again?

Quality companies pop up in my weekly screenings from time to time. Admittedly, they are designed for this. Recently, however, the number has been increasing.

Filters:

- Marketcap > 2 billion $

- ROIC > 10%

- 52W Low: 0-10% above

- Dividend Growth: 5Y over 10%

It seems that outstanding companies with proven business models, strong and in some cases very predictable cash flows, high returns on capital and little or no debt are going out of fashion.

Is the AI narrative driving this development? Are the companies simply too boring? Do they not promise sufficient returns compared to the hype stocks? Is it perhaps the phenomenon of the quality anomaly or are the companies really all doomed?

Who knows for sure.

What I do know is that I know nothing!

I humbly look at the market and gratefully accept what it offers me, and right now I see quality companies on sale.

How do you see what the market is offering? Which company do we buy first? Do we buy at all or do we continue to exercise patience?

Let me know and write it in the comments as added value for everyone!

Link to the screening