Memestock time = Milestone time?

300k

reached 🚀🚀🚀🚀

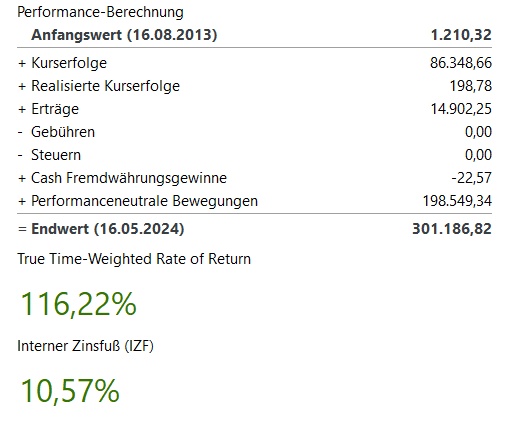

Shares like Gamestop $GME (-4.08%) or AMC $AMC (-1.63%) make the headlines again, my portfolio reaches the next milestone of €300,000.

After hitting €100,000 in November 2020, I reached €200,000 last year in April 2023.

13 months later, in May 2024, the €300,000 mark has already been reached.

The €300,000 was actually my target for the end of 2024, which has now already been reached in May.

However, I am curious to see how things will continue in the medium term. The memestock hype could also symbolize a high again for the time being. If you can make money with anything and everyone joins in, it's usually already too late for the big profits on the stock market.

Detailed calculation since August 2013: