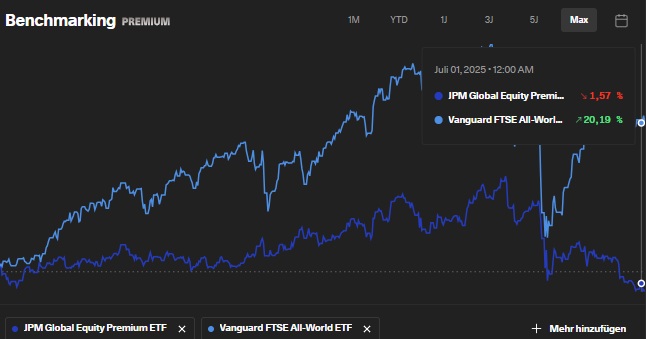

Why is the JPMorgan ETF underperforming? $JEGP (-0.3%)

$VWRL (-1.12%)

Covered call strategy limits price gains:

- The ETF cannot fully participate in strongly rising markets as the option premiums cap the price gains.

Defensive structure in a falling market does not help here:

- The decline in March/April was sharp - apparently the option strategy was also unable to cushion the losses. cushion the losses.

Dividends are not visibly taken into account:

The real effect on earnings (e.g. through distributions) could be higher, but is not fully not fully priced into the share price priced into the share price.