$BAM (+1.19%) with extremely strong earnings. Tomorrow it's BN's turn, then there will be more information. I am very pleased with the figures, BAM is delivering what it promised.

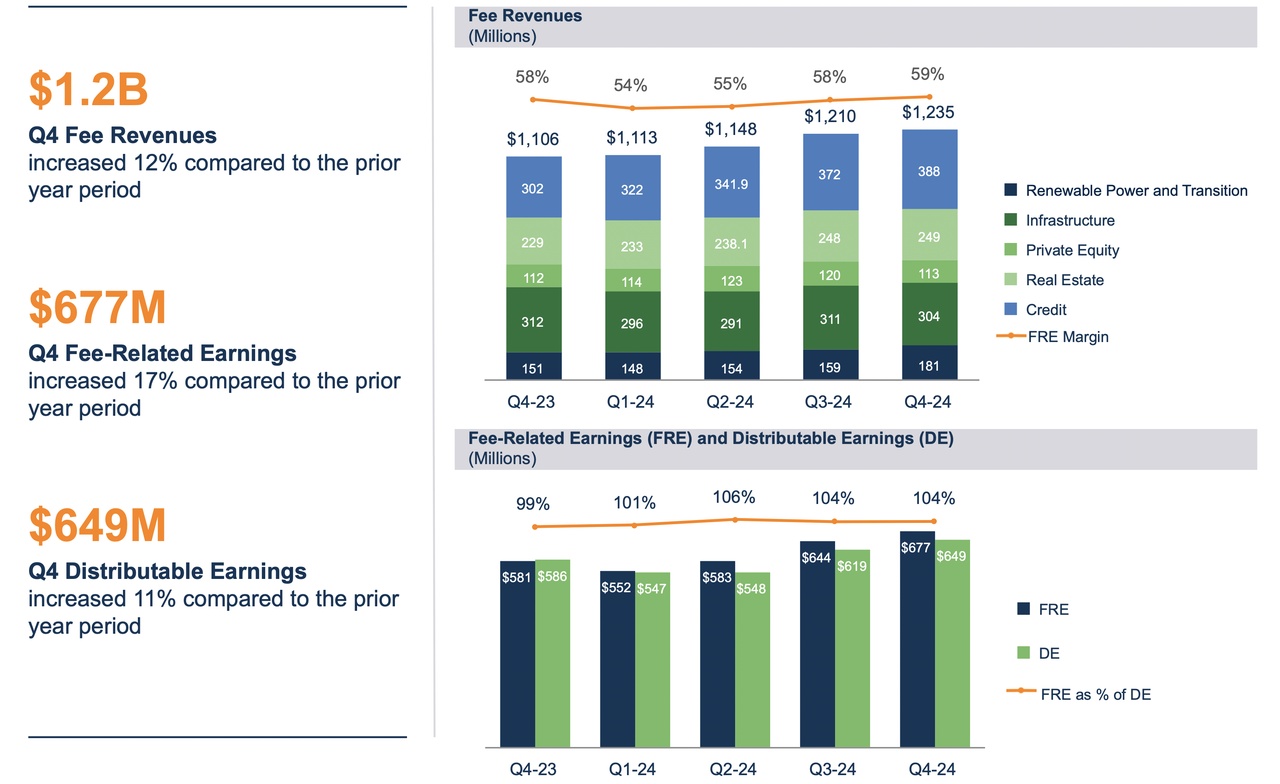

Financial results

- Fee-bearing capital (FBC) increased to USD 539 billion in the fourth quarter of 2024 (+18% year-on-year)

- Fee-related earnings reached USD 677 million (USD 0.42/share) in the quarter and USD 2.5 billion (USD 1.51/share) in the year (+17 % and +10 % respectively)

- Distributable earnings amounted to USD 649 million (USD 0.40/share) in the quarter and USD 2.4 billion (USD 1.45/share) in the year (+11 % and +5 % respectively).

Fundraising

- USD 29 billion raised in the fourth quarter and USD 137 billion for the year as a whole.

- Renewable energies: USD 4.2 billion (incl. USD 3.5 billion for global transformation fund).

- Infrastructure: USD 2.5 billion (strongest quarter in two years).

- Private equity: USD 1.8 billion, including USD 1.0 billion for Middle East funds.

- Real Estate: USD 700 million, including USD 500 million for flagship funds.

- Lending business: USD 20 billion, including USD 9.2 billion via Oaktree funds.

Investments and disposals

- Investments: USD 16 billion per quarter, USD 48 billion per year.

- Renewable energies: USD 4.5 billion (including USD 3.2 billion for Neoen acquisition).

- Real estate: USD 2.4 billion (e.g. US rental apartments & European logistics REITs).

- Lending business: USD 7.7 billion.

- Disposals: USD 9 bn per quarter, USD 30 bn per year.

- Renewable energies: USD 1.4 billion (including the sale of Saeta Yield).

- Real estate: USD 1.8 billion (e.g. sale of British shopping centers).

- Private equity: Clarios refinancing with USD 4.5 billion payout.

Strategic transactions & dividends

- BAM acquired 73 % of BN's stake in the asset management business and now holds 100 %. BN now holds BAM shares to further simplify the corporate structure.

- Quarterly dividend: USD 0.4375/share (+15%), payable on March 31, 2025.