$MMK (-0.18%) Mayr-Melnhof Karton AG - a turnaround candidate for 2025🧐

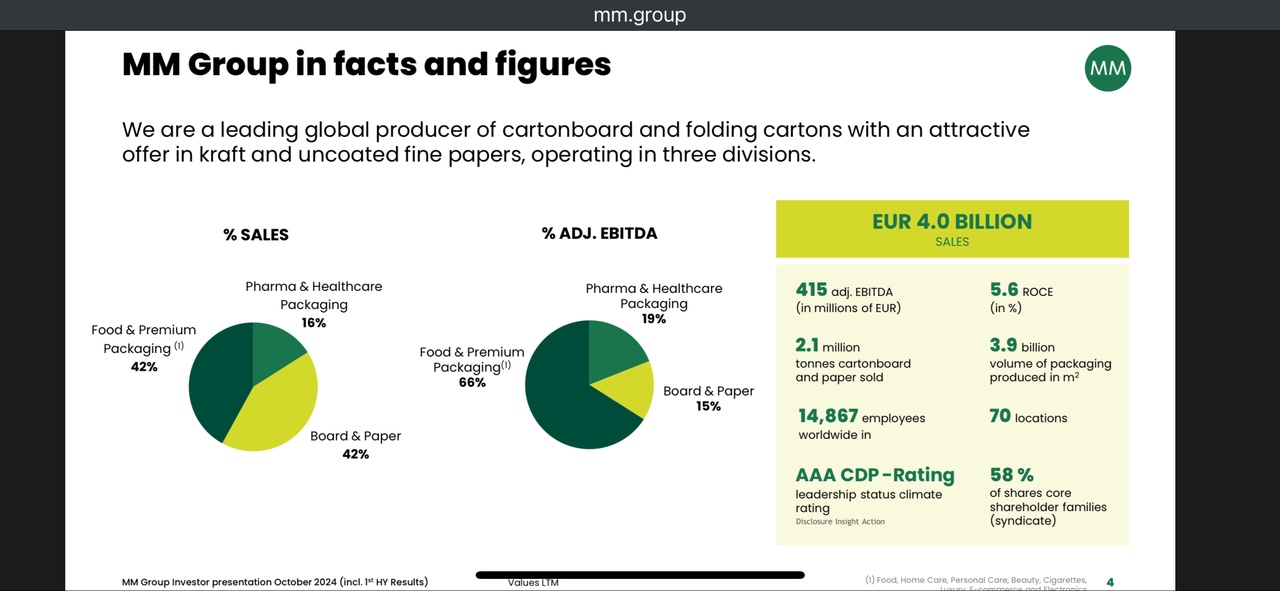

The divisions are divided into 3 areas:

- Board & Paper

- Food & Premium Packaging

- Pharma and Healthcare Packaging

Due to weakening demand and oversupply on the market, the $MMK (-0.18%) was recently hit hard, which is also reflected in the chart.

We saw the current price level around 10 years ago. In 2013 and 2014 it was already support, and before that in 2011 and 2007 it was resistance. Has the bottom been reached or will the slide continue?

The Q3 figures will be published shortly on 7 Nov ☝🏻

And what about the outlook?

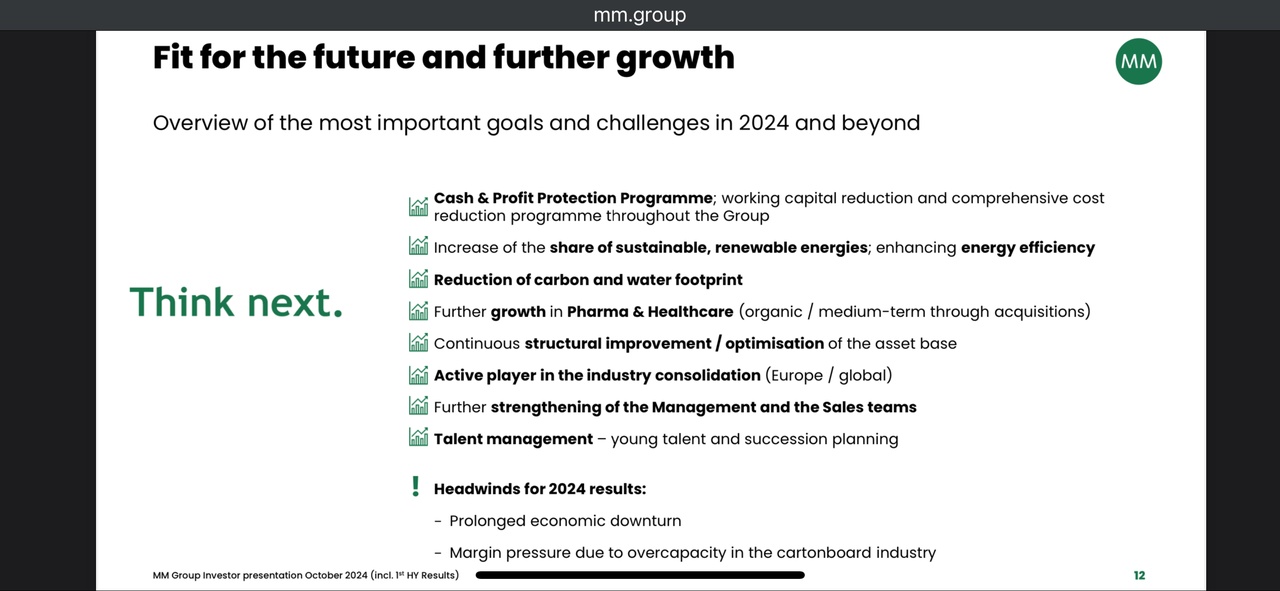

Demand on the market is still subdued and the oversupply has not yet been reduced. What seems interesting is the good long-term customer base. Ultimately, the prospects of $MMK (-0.18%) can also be derived from the prospects of its key accounts.

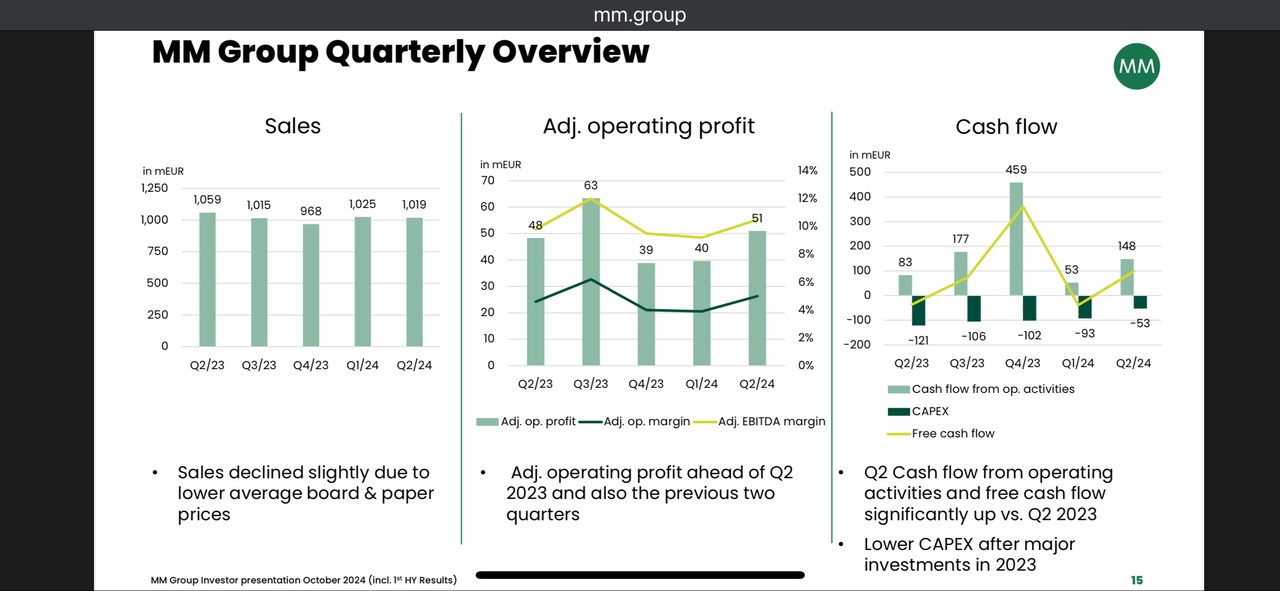

In addition to the solid customer base, the ongoing Cash & Profit Protection Program also appears to be bearing fruit. Cash flow has already improved significantly and should also have an impact on earnings in 2025.

My conclusion:

$MMK (-0.18%) The company has been added to my watchlist. I can well imagine entering the stock soon with an initial small position and then seeing whether the market believes in a turnaround in the same way. If it turns upwards again, the position can be expanded with further tranches.

Do you know Mayr-Melnhof Karton? Do you already have it in your portfolio?

@7Trader

@BamBamInvest

@Smudeo

@Goldmarie

@Petzi-Port

You can find more information here https://mm.group/wp-content/uploads/MM-Group-investor-presentation-Oct-2024-1.pdf