Gold as a hedge against inflation?

Over the past few weeks, I have been intensively researching the topic of gold as a hedge against inflation. I have come across many charts, articles and historical developments and videos that show a differentiated picture. It is often claimed that gold outperforms inflation in around 90% of cases. This is not statistically wrong, but does this automatically mean that it is a good inflation hedge?

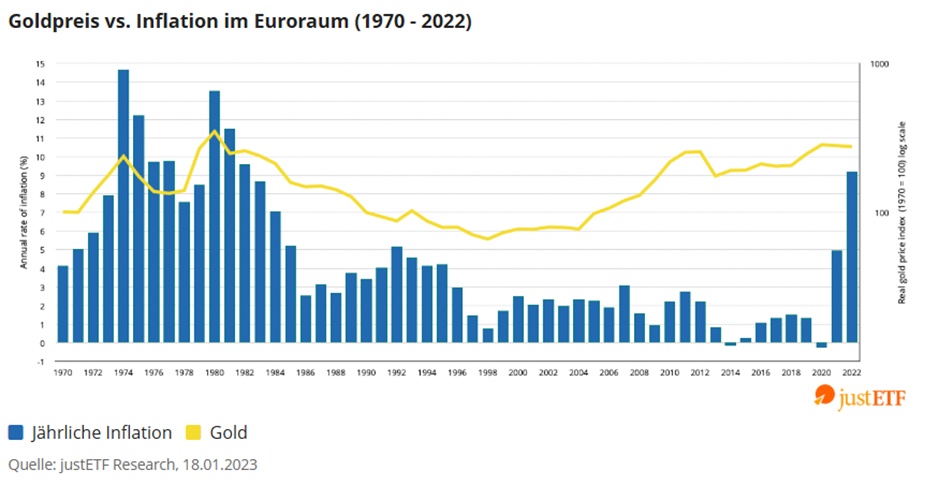

This chart shows that gold has outperformed inflation over the long term from around 1982. However, the trend was not uniform. The gold price fell steadily from 1980 until the turn of the millennium. From then on, it went sideways until the 2008 financial crisis, with a slight increase from 2006. After the 2008 financial crisis, the price of gold rose sharply. In 2014, political events such as the annexation of Crimea led to another decline. In the years that followed, the gold price tended to move sideways, rising slightly. The period from 2020 is particularly striking. Inflation rose sharply and gold was able to keep pace, but at times almost caught up.

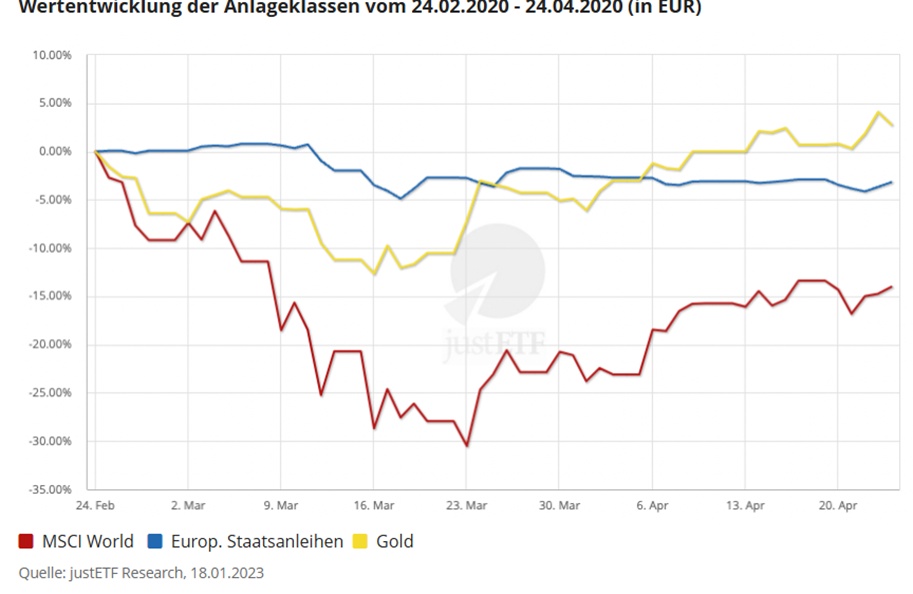

This shows: Gold does not always react immediately to inflation. In times of crisis, it can offer a certain degree of protection, but it is not a guarantee. Even during the coronavirus pandemic, gold outperformed many indices in the short term - but often underperformed in calmer market phases with low inflation.

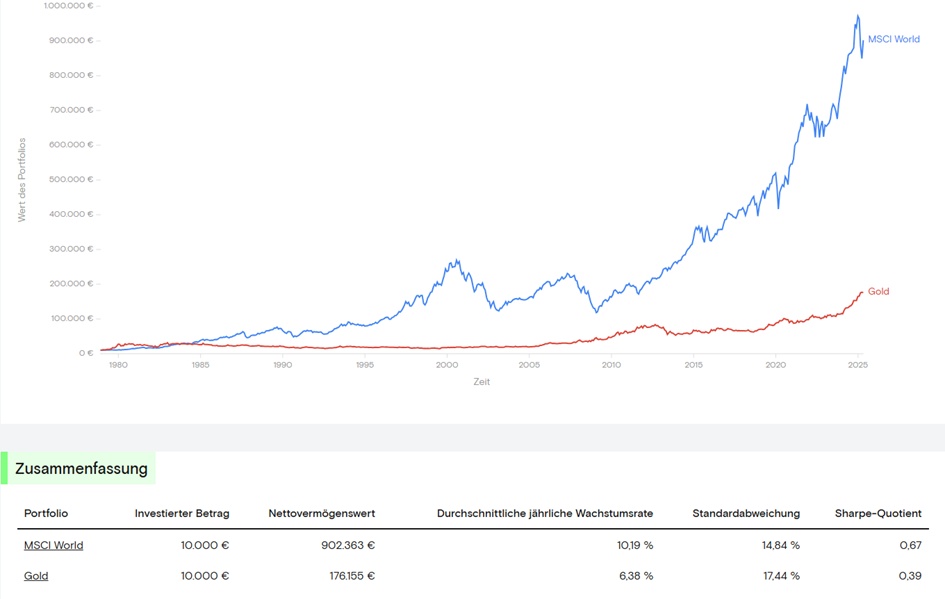

A look at the average return confirms this. Gold returns around 6.38% per year in the long term. The MSCI World achieved around 10.19 % over the same period. This means that, on average, gold yields just under 4 % less per year. This is not insignificant, especially if you want to build up assets over the long term.

Of course, there are arguments in favor of gold. Its value has been stable for centuries and it has survived wars, currency crises and economic upheavals. It is not a product with counterparty risk, is physically tangible and makes perfect sense in extreme scenarios. But gold also has weaknesses. It fluctuates in price, is not immune to losses, does not generate an ongoing income and, as a commodity traded in US dollars, is subject to additional currency risks for European investors.

If you look at all this soberly, the following conclusion remains in my view: gold can help to stabilize a portfolio, especially as an addition in turbulent phases. But it is not the reliable inflation hedge that it is often portrayed as. Investors who rely exclusively on gold often miss out on returns in stable times, and even in crises there is no guarantee that gold will actually provide protection.

Gold can therefore be useful, but more as a supplement. Not as the sole hedge against inflation.

Thanks for reading. I am always grateful for feedback.