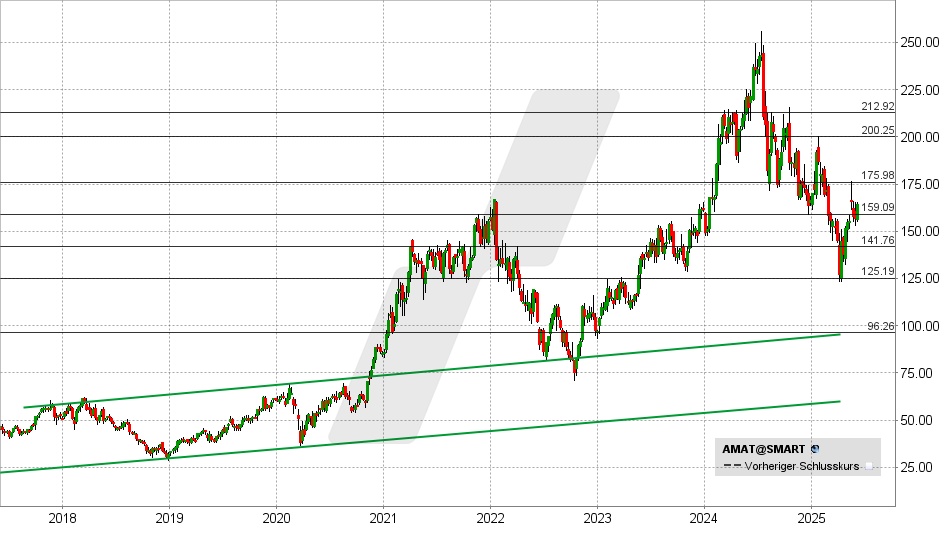

Applied Materials share: Chart from 16.05.2025, price: USD 163.93 - symbol: AMAT | Source: TWS

From a technical perspective, the price reaction to the figures to date is of secondary importance. However, if the share price falls below USD 159, there will be a Verkaufssignal with possible price targets at USD 153 and 142

Expectations exceeded, share price falls

The company is strongly positioned in technological disruptions such as gate-all-around, backside power delivery, 3D DRAM, advanced packaging and silicon photonics, which creates long-term growth opportunities. The new SIM³ Magnum Etch platform has generated over USD 1.2 billion in sales since its market launch in February 2024. The e-beam technology for process control recorded record revenue.

For the third quarter, sales of USD 6.7 - 7.7 billion and earnings of USD 2.15 - 2.55 per share are expected. Applied Materials usually delivers results at the upper end of its own forecasts.

Consensus estimates to date have been for sales of USD 7.20 billion and earnings of USD 2.32 per share.

In the current financial year, earnings are expected to rise by 9% to USD 9.44 per share. After achieving growth of 12% and 14% in the first two quarters, this is plausible to conservative.

Applied Materials is trading pre-market at USD 163.93 and thus has a forward P/E of 17.4