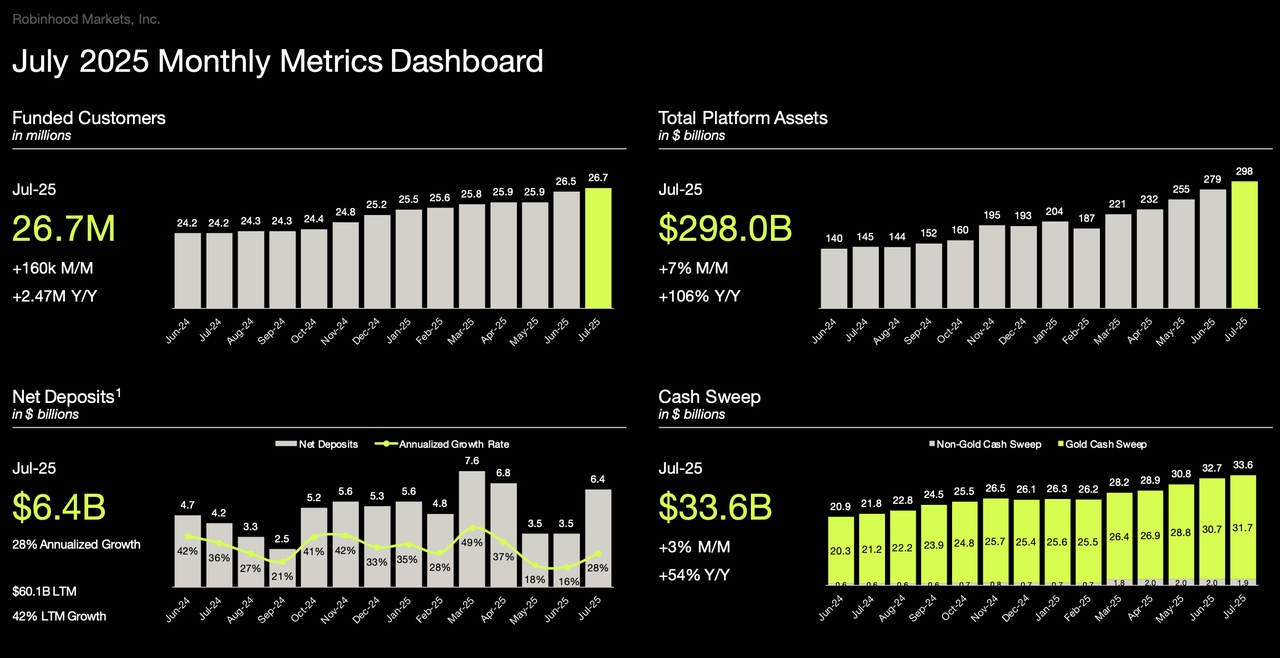

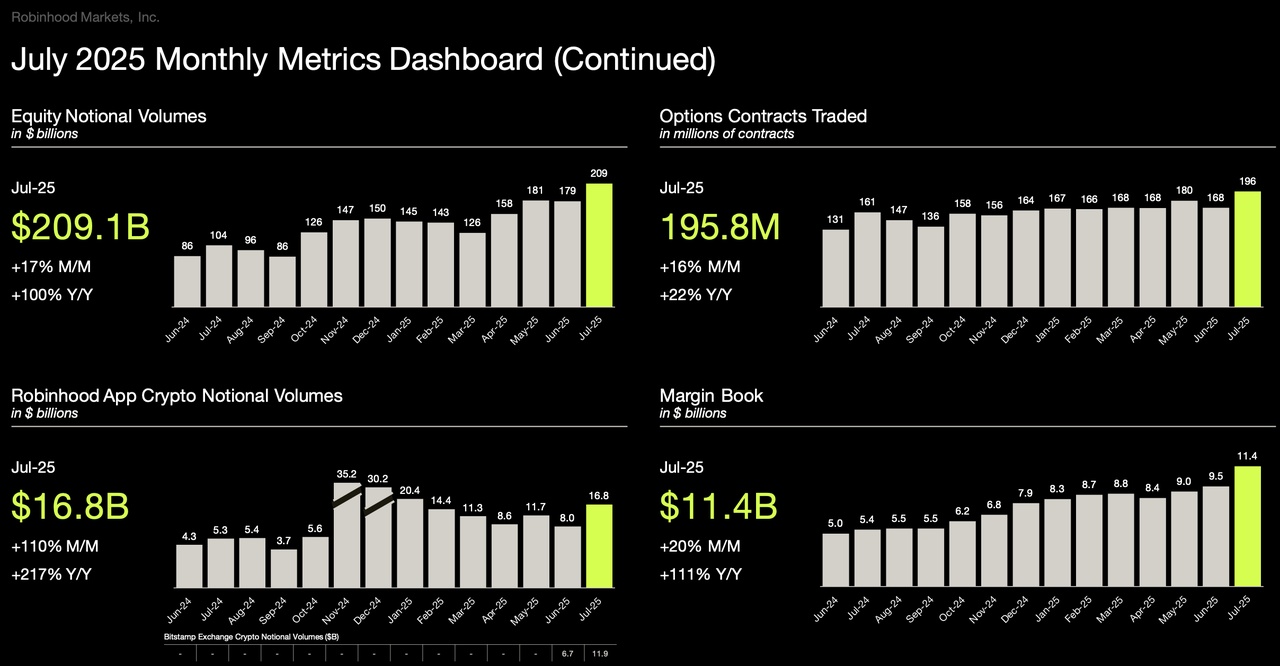

$HOOD (-0.84%) publishes (voluntary) monthly updates. The report for July was published today and is convincing across the board. High trading volumes as a result of increased volatility played $HOOD (-0.84%) into the cards.

Total platform assets now stand at $298 B, which corresponds to an increase of 108% compared to the previous year.

This rapid growth is also reflected in the share price. YTD is $HOOD (-0.84%) up 142% for euro investors, and even higher in USD. A P/E ratio of 55 also indicates a high valuation. However, it is well known that the P/E ratio is not the best valuation indicator for growth stocks.

$HOOD (-0.84%) According to my investment thesis, the US economy will be a major beneficiary of the largest wealth transfer ever in the USA in the coming years, when trillions of USD will be passed on to the next generation. A short to medium term catalyst could be the inclusion in the S&P 500 in September when the next rebalancing takes place.

Are you invested or are you considering $HOOD (-0.84%) in your portfolio?