After years of under-performance, VLCC (Very Large Crude Carrier) rates could finally rebound in 2025, driven by a mix of geopolitical turmoil, sweeping sanctions, and tight fleet growth.

The Biden administration’s recent sanctions target over 100 Russian tankers and key energy players like Gazprom Neft. These measures aim to cut Russia’s oil revenue as its exports to major buyers like India and China face severe disruptions.

⚠️ At the same time, China’s Shandong Port has banned U.S.-sanctioned tankers, forcing VLCCs to divert to alternative routes like Singapore. Russian crude exports are also falling, partly due to infrastructure damage and under investment, tightening supply and boosting demand for unsanctioned shipping.

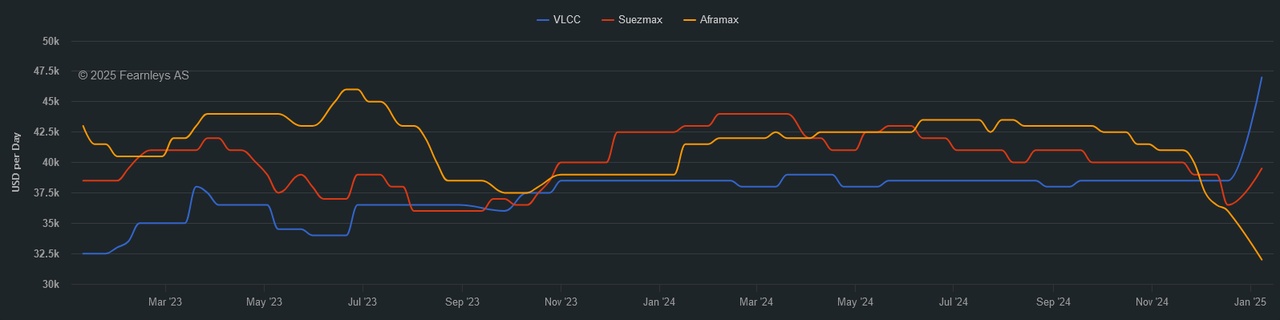

1 Year T/C Crude

However, Chinese demand remains a critical factor. Unipec, the world’s largest crude charterer, reported a 6-year low in volumes last year, with crude imports down 4%. If China’s demand doesn’t rebound, it could offset the positive impact of sanctions.

⛽ Supply vs. Demand: On the supply side, just five new VLCCs are set to join the fleet in 2025. Meanwhile, global oil prices recently spiked 3% to $80 a barrel as traders brace for potential disruptions. New production from the U.S., Brazil, and the Middle East could help stabilize the market.

🚨 What’s Next?

The interplay between sanctions, China’s demand, and tight fleet growth sets the stage for a complex and unpredictable 2025. Investors in shipping and energy need to monitor these dynamics closely.

💬 Let's connect !

What’s your outlook on the coming year for tankers and the broader impact of sanctions?

Share your insights in the comments, and don’t forget to like and share this post 📰 !

$FRO (-1.8%)

$NAT (+0.8%)

$TRMD A (+1.27%)

$STNG (-2.4%)

$OET (-0.47%)

$HAFNI (-0.41%)

$DHT (-0.38%)

$TNK (+0%)

$ASC (-0.62%)

$INSW (-1.32%)