My dears,

after evaluating the great comments under my post

" Do you want more? ",

I have noticed that Ameresco $AMRC (+1.43%) has met with a lot of interest.

And Liebe @TomTurboInvest immediately did a chart analysis for us.

With the result that €45 is a good entry price. (no investment advice).

So I got down to work and took a quick look at the company. Due to the great key figures, I immediately picked out the estimates over 5 years.

My conclusion is

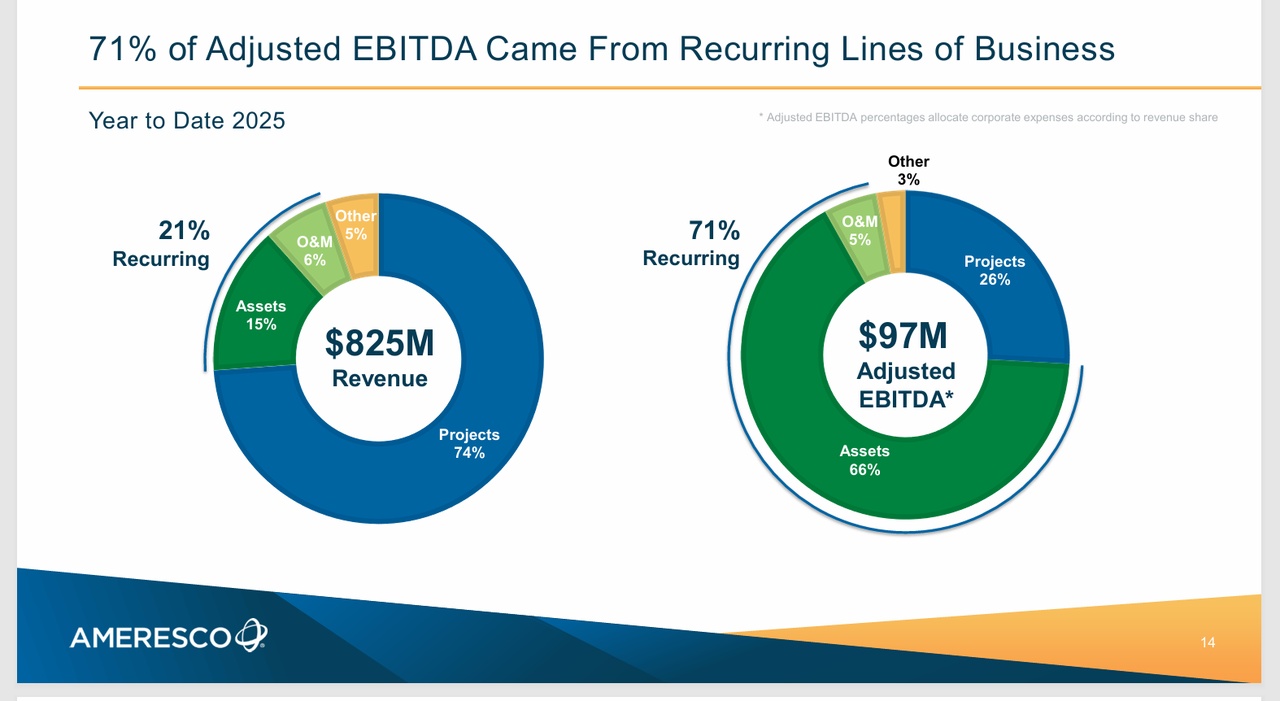

Nice steady growth over 5 years, in sales, profit and EbiT margin.

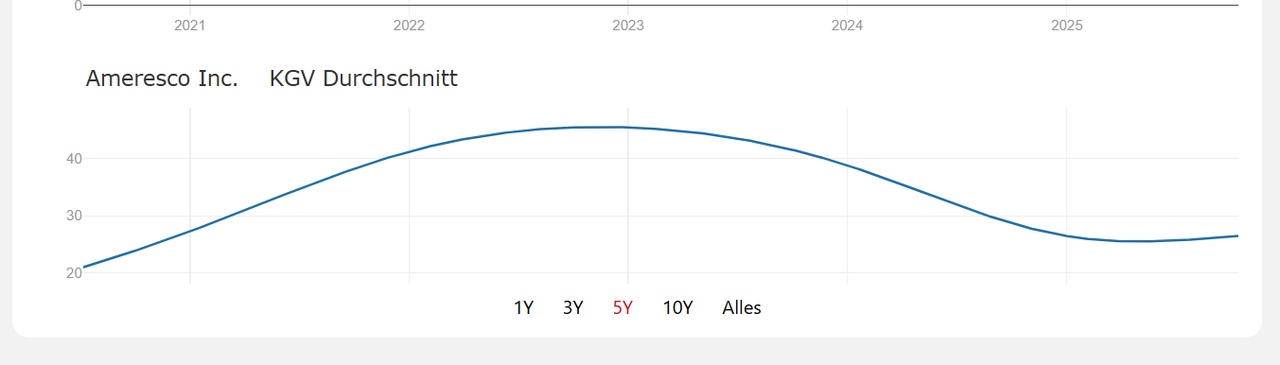

This reduces the P/E ratio. And I think the share is a great value stock. And it's interesting because energy demand will continue to rise over the next few years. Which means that saving and storing energy will become increasingly important.

Please let me know in the comments whether you think the share is also suitable for a long-term investment?

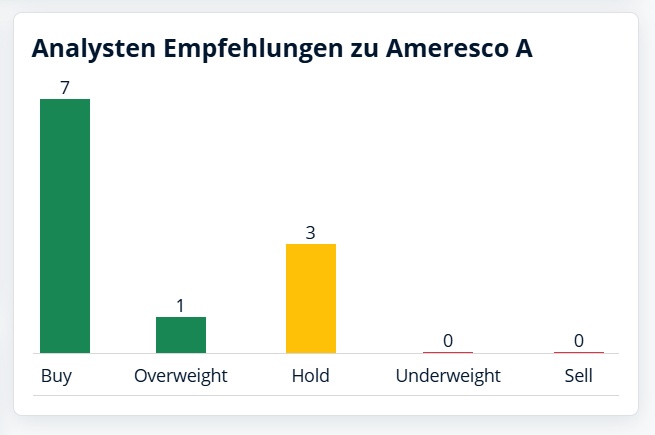

Estimates* for Ameresco A (fiscal year end: December 31)

Year Earnings growth

2025 -28,50 %

2026 +30,72 %

2027 +81,00 %

Year

Sales revenue in € million

2025 1.908,76

2026 2.082,59

2027 2.315,21

2028 2.513,50

2029 2.691,20

Year

Profit/share

2025 0,81

2026 1,13

2027 1,73

2028 1,80

2029 2,37

Year

P/E RATIO

2025 49,72

2026 35,64

2027 23,29

2028 22,42

2029 17,03

Year

EBIT in € million

2025 120,94

2026 151,16

2027 188,64

2028 241,80

2029 284,20

Year

EBITDA in € million

2025 234,33

2026 274,97

2027 337,40

2028 379,40

2029 436,20

Year

Profit in € million

2025 41,90

2026 55,43

2027 77,89

2028 100,00

2029 127,70

Year

Profit (before taxes) in € million

2025 36,32

2026 54,30

2027 73,25

2028 112,00

-

Year

Profit/share (reported)

2025 0,76

2026 1,06

2027 1,54

2028 1,82

2029 2,37

Year

Free cash flow in € million

2025 146,73

2026 211,80

2027 196,60

2028 250,00

-

Year

EBIT margin

2025 6,28 %

2026 7,24 %

2027 7,95 %

2028 8,72%

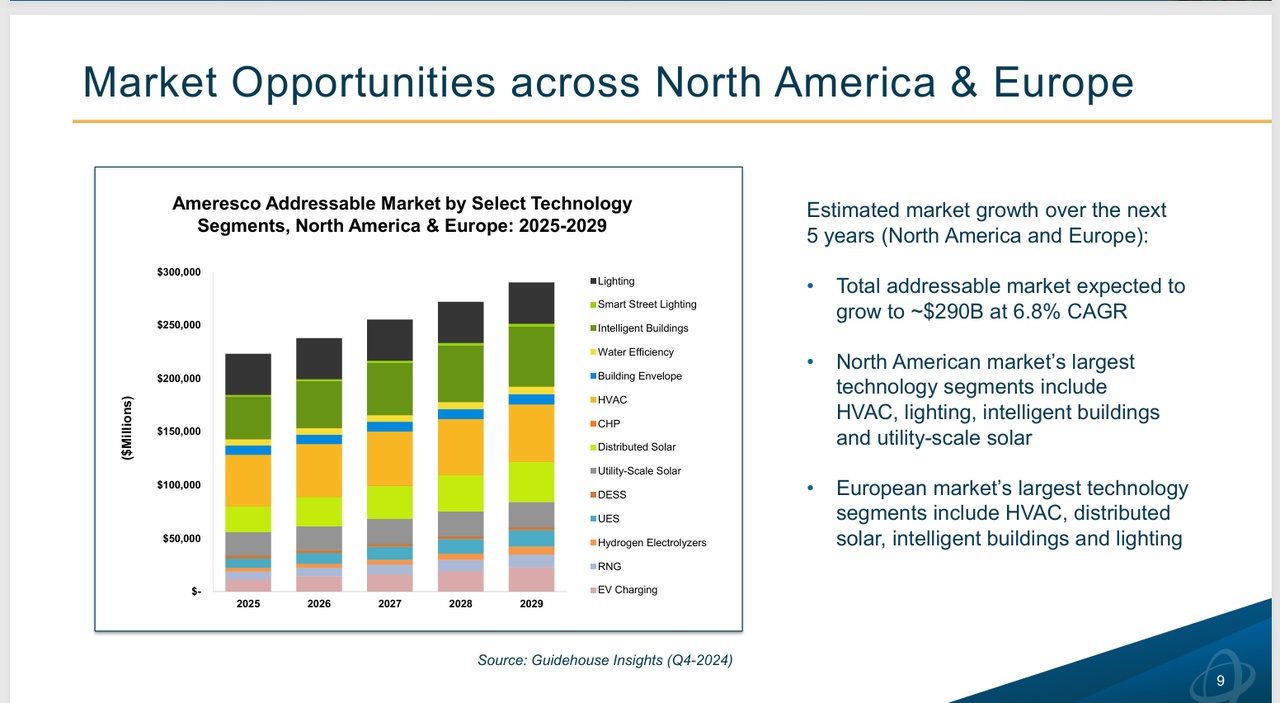

Donald Trump is signaling a willingness to talk to the Democrats in order to avert and shorten the current government shutdown. This could create positive sentiment. The "Industrials" sector is performing very robustly in this environment. We turn our attention to Ameresco, the frontrunner in the Engineering & Construction sector. Where does the strong monthly rise of over 56 % come from? Ameresco is a full-service provider of energy solutions to reduce costs Largest order backlog of USD 5.1 billion thanks to numerous major projects .

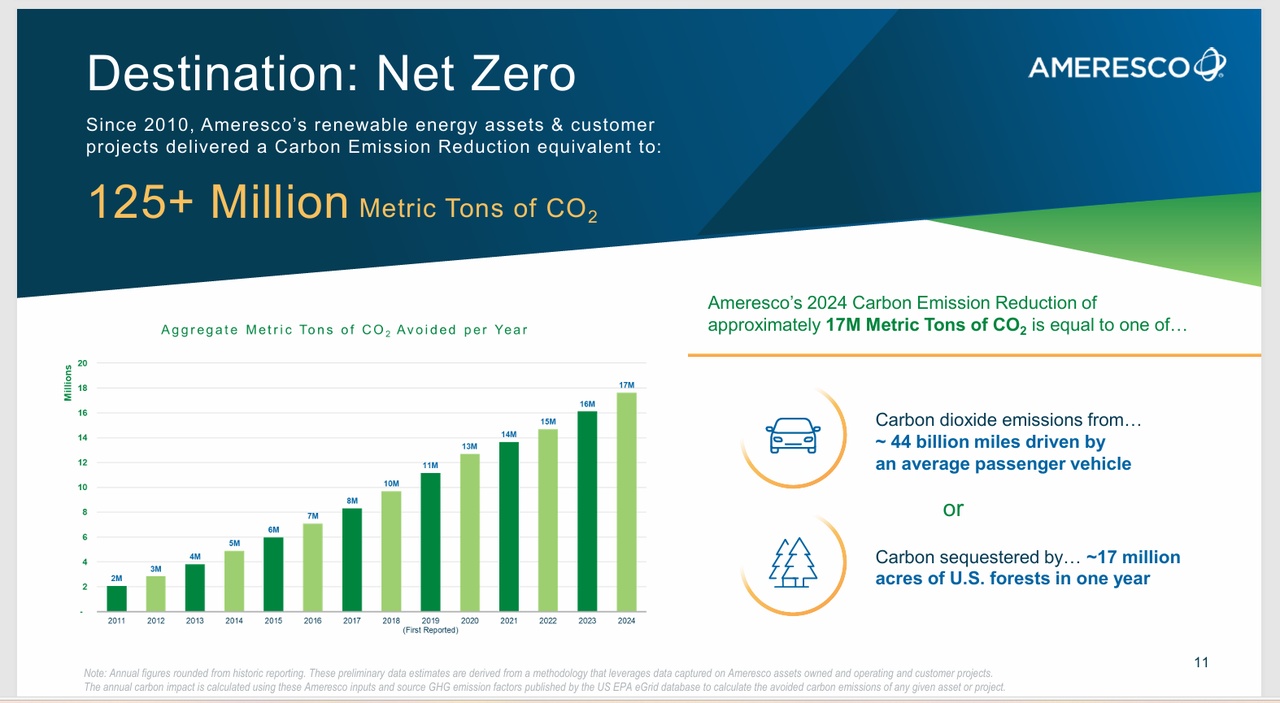

Ameresco, Inc. (NYSE:AMRC) is a leading energy solutions provider that helps customers reduce costs, increase resilience and decarbonize to net zero as part of the global energy transition. Our comprehensive portfolio includes the implementation of smart energy efficiency solutions, die Modernisierung der Infrastruktur as well as the development, construction and operation dezentraler Energieressourcen.

As a trusted full-service partner, Ameresco leads the way by reducing energy consumption and providing energy infrastructure solutions for Bundes-state and local governments, Versorgungsunternehmenhealthcare and education facilities, housing authorities and gewerbliche und industrielle Kunden housing authorities. We offer local expertise in the US, Canada, UK and Europe.

Ameresco (AMRC) surprises with strong quarter - share price shoots up 16.3% after figures! With a clear jump in earnings and sales, US energy services provider Ameresco significantly exceeded analysts' expectations in the second quarter of 2025. The specialist for renewable energy solutions increased its revenue by 7.8% year-on-year to USD 472.3 million, exceeding forecasts by a whopping 13%. Adjusted earnings per share (EPS) were also impressive at USD 0.27 - well above analysts' estimates.

Order situation: