Here is my portfolio, in which I have entered the sales as purchases.

Briefly: What profits/losses have I lost since selling position XY?

Background information: I have been saving the $IWDA (-0.48%) + $CSPX (-0.64%) and a little $BTC (-1.34%) - now only due to the size $HMWO (-0.45%) - and from the beginning of 2020 to mid-2024 the 76 individual shares were also included.

Well, it actually looks quite good, why didn't you switch completely to individual stocks, you have some nice stocks in there? 1.9% dividend yield with 80% TTWROR

Quite simply: I'm not interested in the hassle - it's just too stressful for me

.

.

.

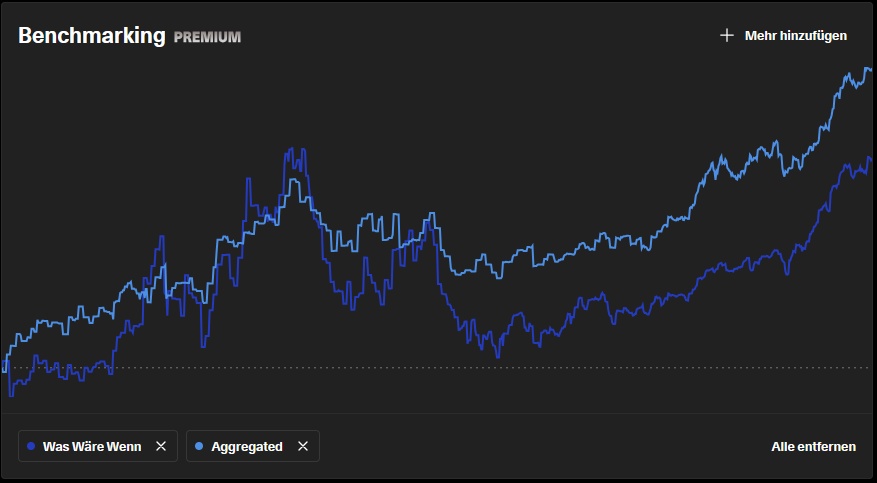

Here's a comparison of the "what-if" portfolio with the actual portfolio:

.

Now have fun browsing. Maybe one or the other will find a Tenbagger.

.

.

.

.

Oh yes, exactly. Thank you @DonkeyInvestorthat was quite a task to grasp the whole thing, but I wanted to see it.