$MBB (+2.14%) or $VH2 (+0.93%)

Hello my dears,

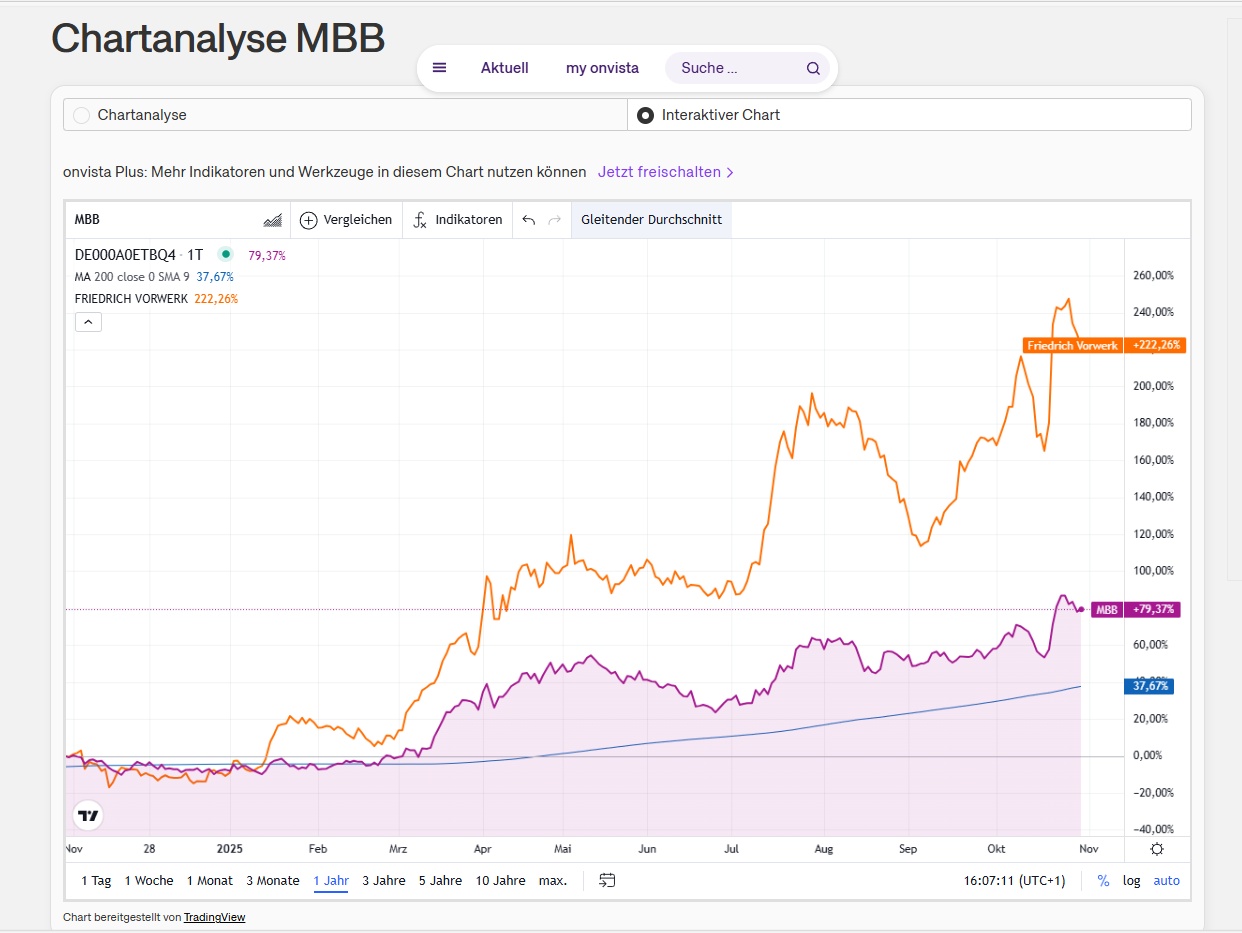

somehow the Friedrich Vorwerk share has run away from me with an annual performance of + 222 %.

Now I have noticed that the major shareholder MBB is lagging behind with an annual performance of + 79 %. (see comparison chart )

My thinking is that MBB should benefit from Vorwerk's good order situation. And it might not be a bad idea to get in before the figures in November.

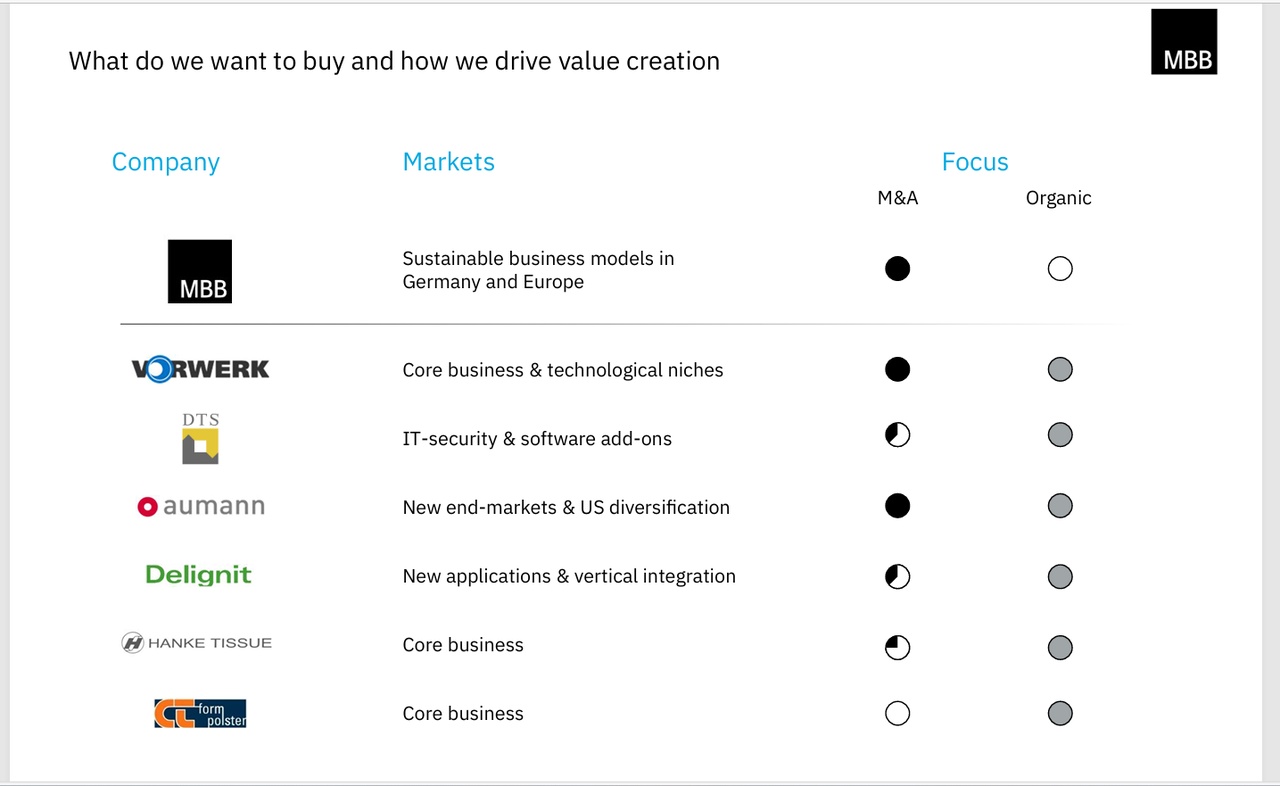

I also find the 80 % stake in DTS IT (cyber security) with sales of €99m in 2024 very exciting.

Would you like to share your assessment in the comments?

@All-in-or-nothing

@SAUgut777

@EpsEra

@Hotte1909

@topicswithhead

@Klein-Anleger1 etc.

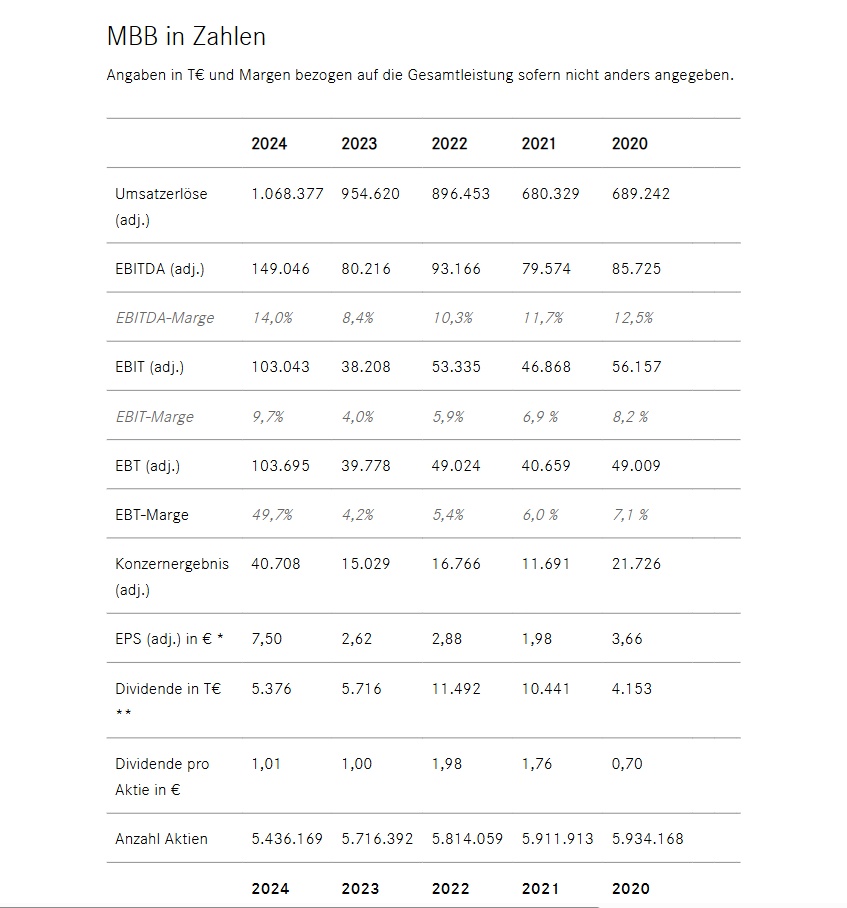

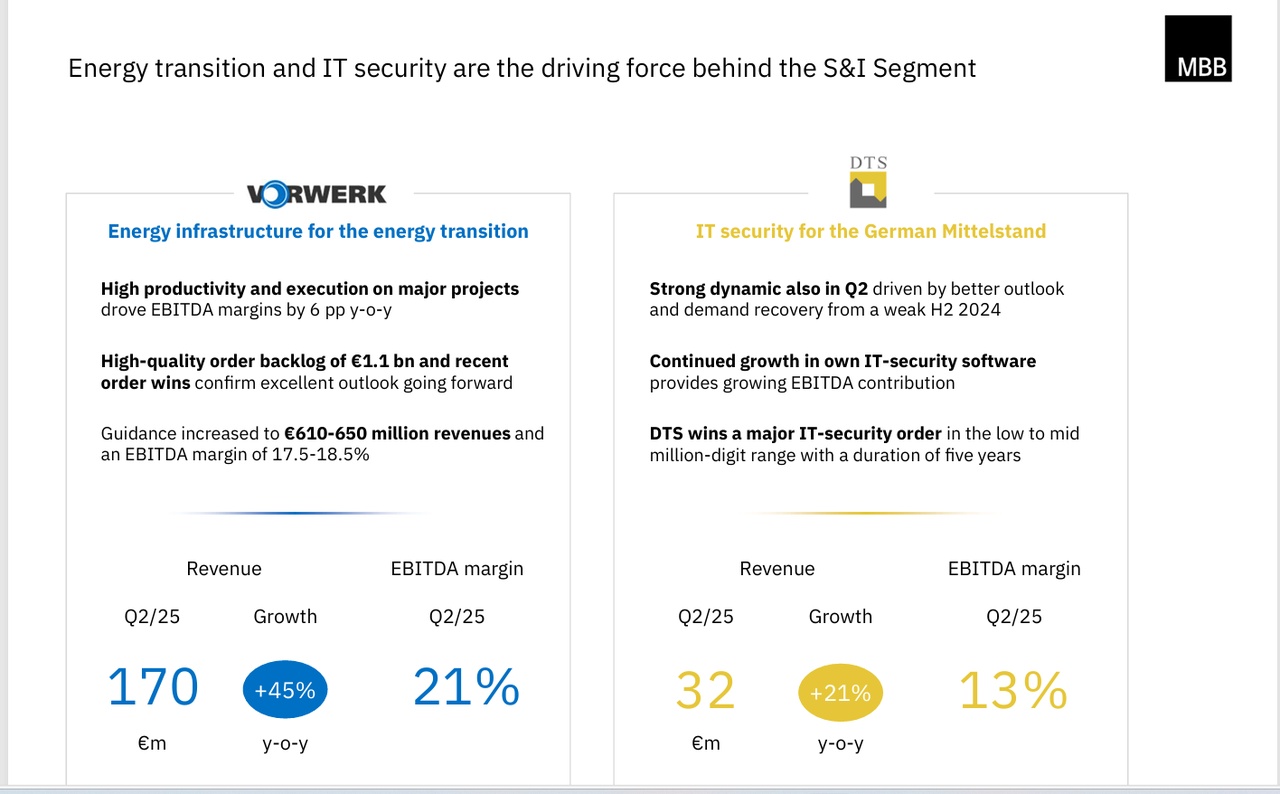

With an increase of 286 percent since the beginning of the year, Friedrich Vorwerk is the strongest stock among all Dax, MDax and SDax shares. The plant engineering company for energy infrastructure raised its forecast again the previous day. The MBB investment group, which holds a good half of Friedrich Vorwerk's share capital, benefited from this and also raised its annual targets on Tuesday.

MBB: The 50% stake in Friedrich Vorwerk covers the entire value. Why Oddo BHF analysts rightly see room up to 235 euros!

On October 22, 2025, Friedrich Vorwerk's share price rose by a further 4% to 104 euros. Metzler raised its target to EUR 116 and expects increasing sales momentum in the coming years. This would be good for MBB because the company is being consolidated. This would also increase the sales momentum of the investment company.

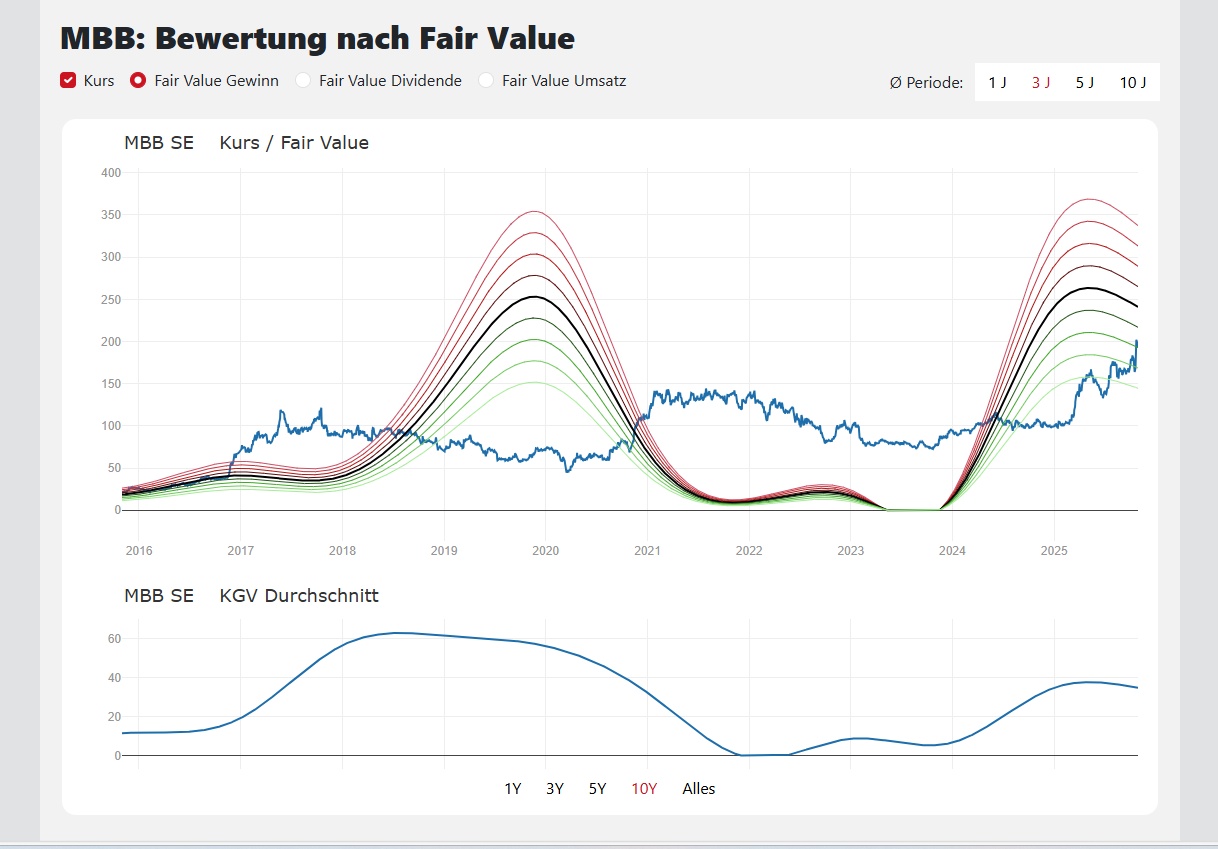

The MBB share (i) still has upside potential. On October 22, 2025, Oddo BHF analysts raised their target price to €235. Where does the potential come from? Because the intrinsic value of MBB is significantly higher than the current valuation despite a typical holding discount. The calculation:

The Friedrich Vorwerk stake is worth €1.05 billion. Added to this is €317.6 million in net cash in the holding company. The listed Aumann (i) is worth a further €80 million. These three assets alone add up to just under €1.44 billion or €265 per MBB share. However, MBB is only valued at €1.032bn with 5.436m shares. This already shows the large discrepancy, which is increasing further because the cybersecurity pearl DTS (annual turnover of around €100m) is still completely unconsidered.

The Metzler analysts' assumption of accelerated sales growth at Friedrich Vorwerk is also positive for MBB's prospects in the coming years. In the TraderFox model portfolio, we are now 100% up on MBB since our entry at EUR 94.

MBB paid a rising basic dividend 15 times in a row in 2025. According to a recent report by Handelsblatt, only 10 out of around 600 German listed companies have paid their shareholders an uninterrupted dividend increase for more than 10 years. Only 2 German companies have increased their dividends for longer than MBB.

Since MBB's IPO 19 years ago, the company has never lowered its dividend. Only 13 listed companies in Germany have not lowered their dividends over a longer period of time.

TÖCHTER

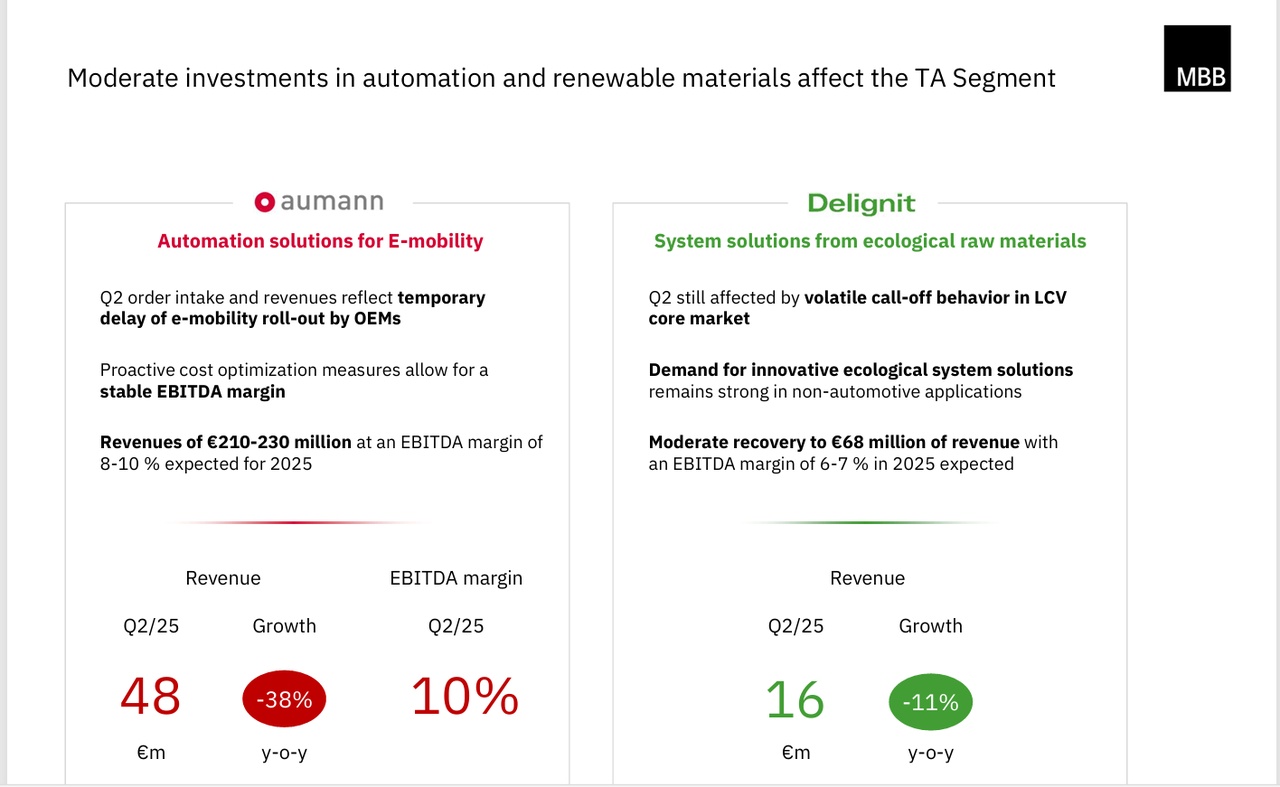

Aumann @EpsEra

Aumann is a leading global supplier of innovative special machines and automated production lines with a focus on e-mobility.

The company combines innovative winding technology for the highly efficient production of electric motors with decades of automation experience. In the field of battery systems, Aumann offers a broad product portfolio ranging from solutions for battery module and battery pack assembly to coating systems for electrode production. For fuel cell production, Aumann offers innovative solutions along the entire value chain - from coating and stacking to final assembly.

Friedrich Vorwerk

Friedrich Vorwerk is a leading supplier in the field of pipeline and plant construction for gas, electricity and hydrogen applications. The company is benefiting from the increasing need for investment in the German energy infrastructure.

At the end of 2019, Friedrich Vorwerk acquired 100% of the shares in Bohlen & Doyen Bau GmbH and Bohlen & Doyen Service & Anlagentechnik GmbH. Together with Bohlen & Doyen, Friedrich Vorwerk plans to further increase its growth in the field of pipeline, cable and plant construction for gas and electricity grids.

In 2021, Friedrich Vorwerk ventured onto the stock exchange and laid the foundation for further extraordinary growth with this IPO.

DTS IT

DTS is one of the leading German providers of cyber security solutions for IT infrastructure, on premise, hybrid or from the cloud.

Delignit

Delignit is the leading German provider of ecological, hardwood-based materials and system solutions for the automotive, rail and security industries.

Hanke Tissue. @Charmin

Hanke Tissue is a leading tissue producer in Poland, whose value chain includes the production of tissue parent rolls on its own paper machines, conversion into end products such as napkins, handkerchiefs and kitchen rolls, logistics as well as the design, marketing and distribution of these products. The company is the market leader in printed napkins. The products are mainly sold in Europe.

CT Formpolster

CT Formpolster is a leading supplier of mattresses for online retailers. As a one-stop store, the company's services range from in-house development and foam production to manufacturing, packaging and drop shipping of products to the end customer.

Family business

Gert-Maria Freimuth (Deputy Chairman of the Board of Directors) and Dr. Christof Nesemeier (Executive Chairman) founded the company in 1995 and hold the majority of the share capital for the long term. We are convinced that personal commitment and continuity in management are key cornerstones of MBB's success and provide the company with reliability and identity.

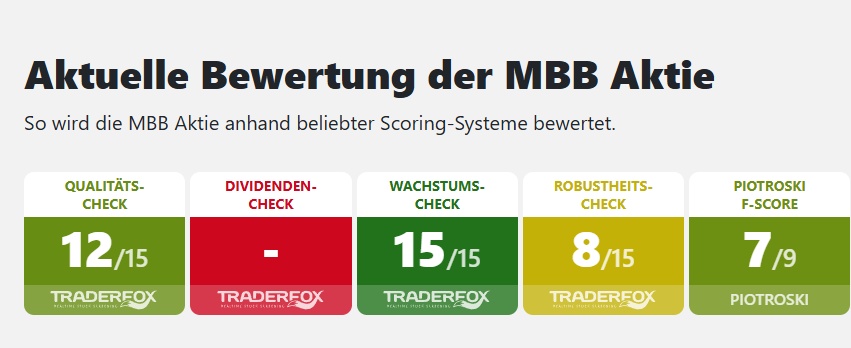

Original-Research: MBB SE (from Quirin Privatbank Capital Markets): Buy

Original-Research: MBB SE (von Quirin Privatbank Kapitalmarktgeschäft): Buy

(TOLLE ROBUST QUALITY STOCK) perhaps something for star investors @Simpson