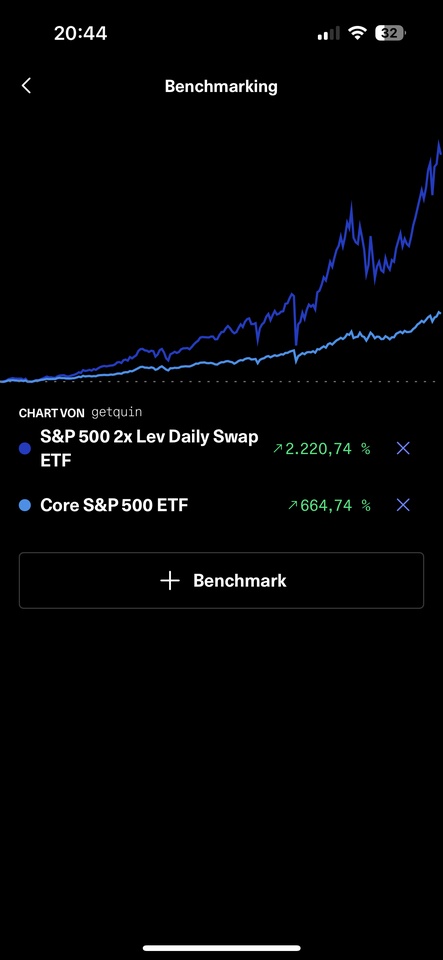

Hi guys I have a question regarding an ETF. Please no unnecessary comments but factual information and criticism. I am still learning and of course have to question some things and there are some people here with experience and good knowledge :). So I invest monthly in the $CSPX (+0.58%) and I recently heard about this one $DBPG (+1.24%) . Double the return for the same risk? I mean I'm betting on the S&P going up in the long run anyway so what's the catch? Why not switch from the normal S&P? There is also a clear difference in the benchmark.