$CSPX (-1.21%)

$SPY (-1.06%)

$CSNDX (-2.38%)

$IWDA (-1.04%)

$ISAC (-0.88%)

$WSML (-1.22%)

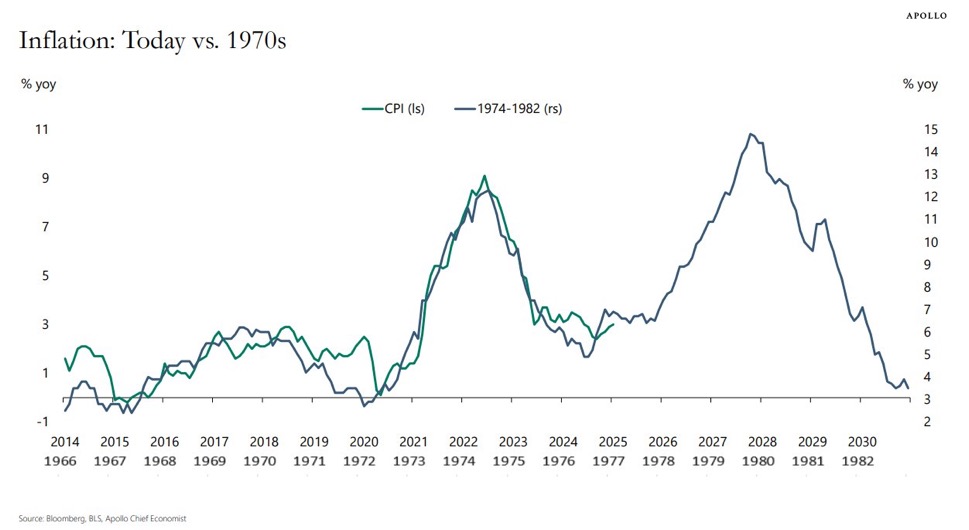

found an interesting comparison, I wonder if that's the case ? 🧐🤔

I don't think so, what do you think?

Otherwise it could get pretty uncomfortable 😬

$CSPX (-1.21%)

$SPY (-1.06%)

$CSNDX (-2.38%)

$IWDA (-1.04%)

$ISAC (-0.88%)

$WSML (-1.22%)

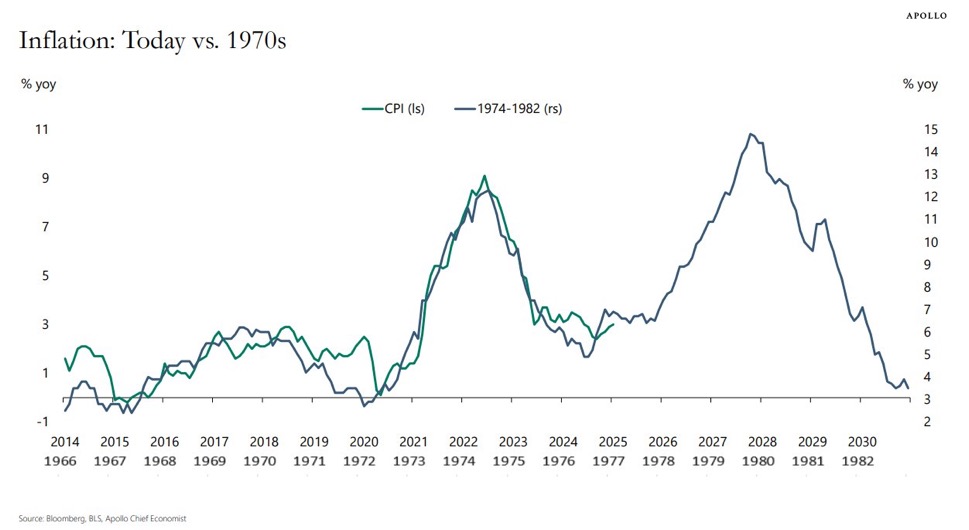

found an interesting comparison, I wonder if that's the case ? 🧐🤔

I don't think so, what do you think?

Otherwise it could get pretty uncomfortable 😬